Imagine unlocking access to premium real estate around the globe, all from your smartphone and with as little capital as you want to commit. That’s the promise of a Property Token Offering (PTO), where bricks-and-mortar assets meet blockchain innovation. PTOs are shaking up legacy property investing, letting anyone participate in high-value markets through fractional ownership. But before you can launch your own tokenized property investment, you’ll need to navigate a landscape of legal, technical, and practical requirements.

What is a Property Token Offering (PTO) and Why Does It Matter?

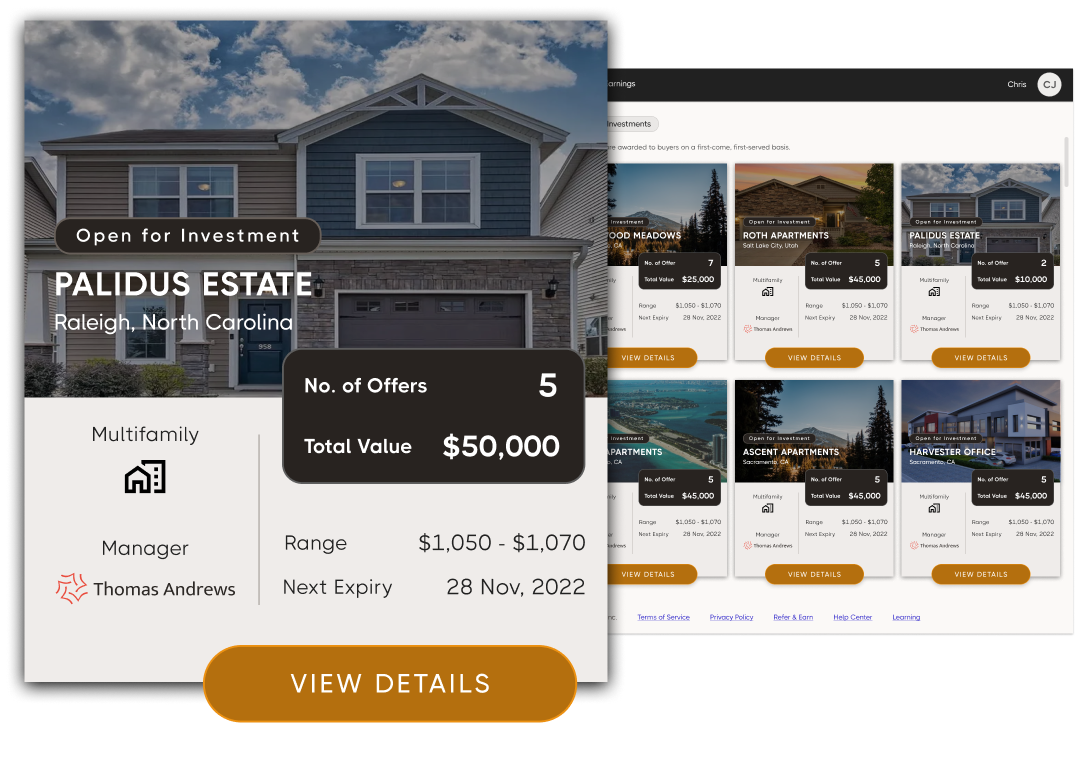

A PTO converts real estate assets into digital tokens on the blockchain. Each token represents fractional ownership in a property or portfolio, giving investors exposure to rental yields or appreciation without the traditional barriers of hefty down payments or geographic limits. Platforms like Mey Network have pioneered this approach, letting users secure yield-backed tokens tied directly to physical properties.

In 2025, PTOs aren’t just for crypto die-hards, they’re attracting mainstream investors who want liquidity, transparency, and global access that traditional real estate simply can’t match.

Essential Requirements for Launching Your PTO

If you’re eyeing the tokenized property market as an issuer or platform builder, preparation is everything. Here are the pillars every successful property token offering guide should cover:

Key Requirements for Launching a PTO

-

Regulatory Compliance: Adhere to securities laws, property regulations, and anti-money laundering (AML) standards in the relevant jurisdiction. This is crucial to avoid legal issues and ensure investor protection.

-

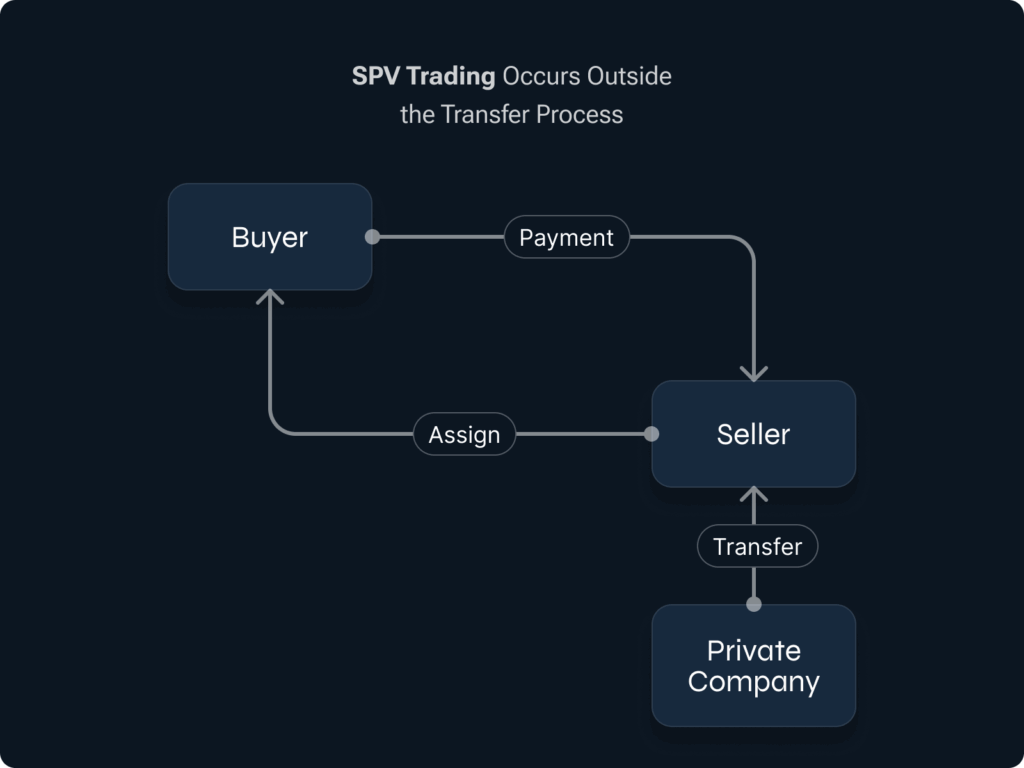

Legal Structuring: Establish a robust legal framework, often through a Special Purpose Vehicle (SPV), to manage the tokenized asset and clearly define investor rights and obligations.

-

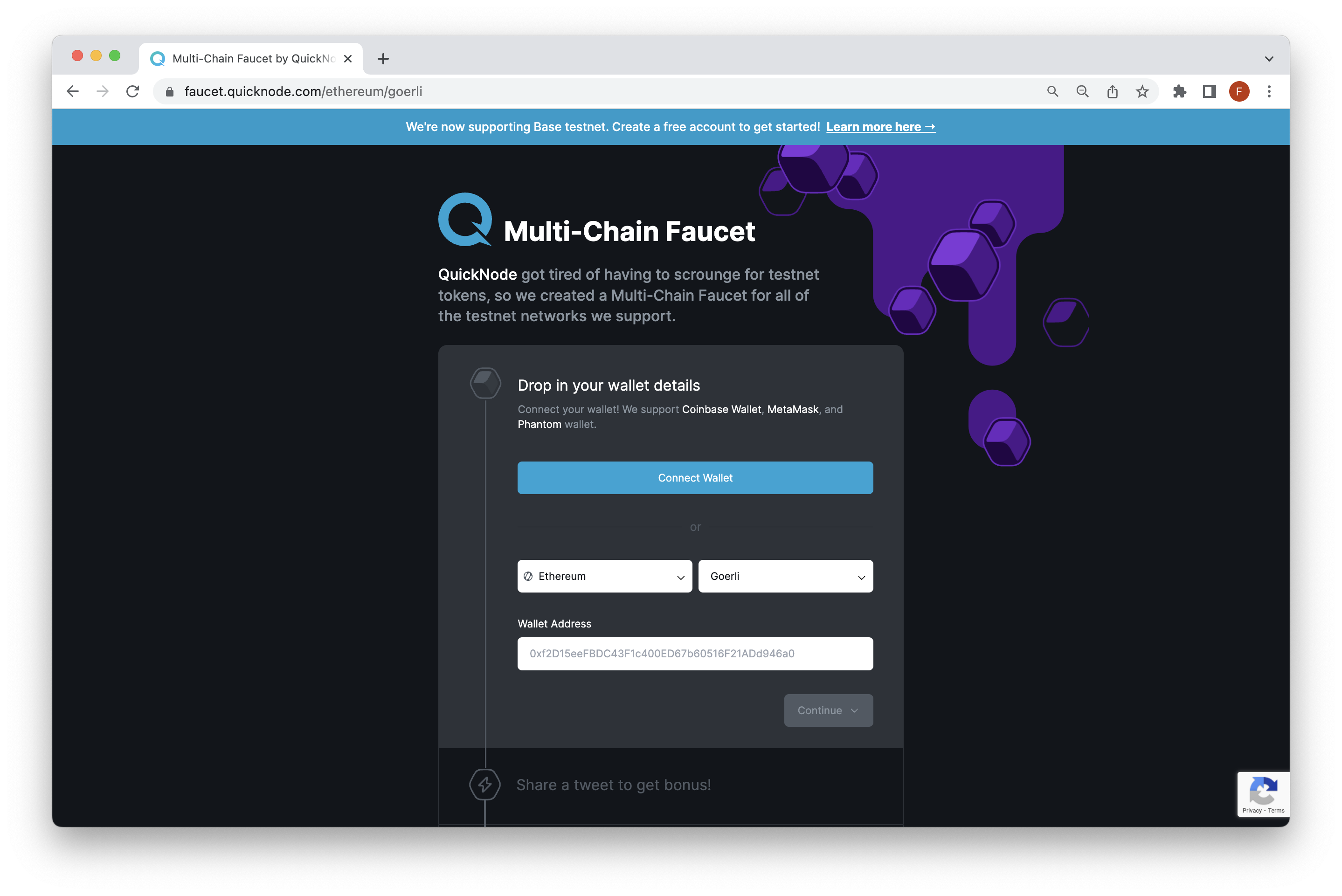

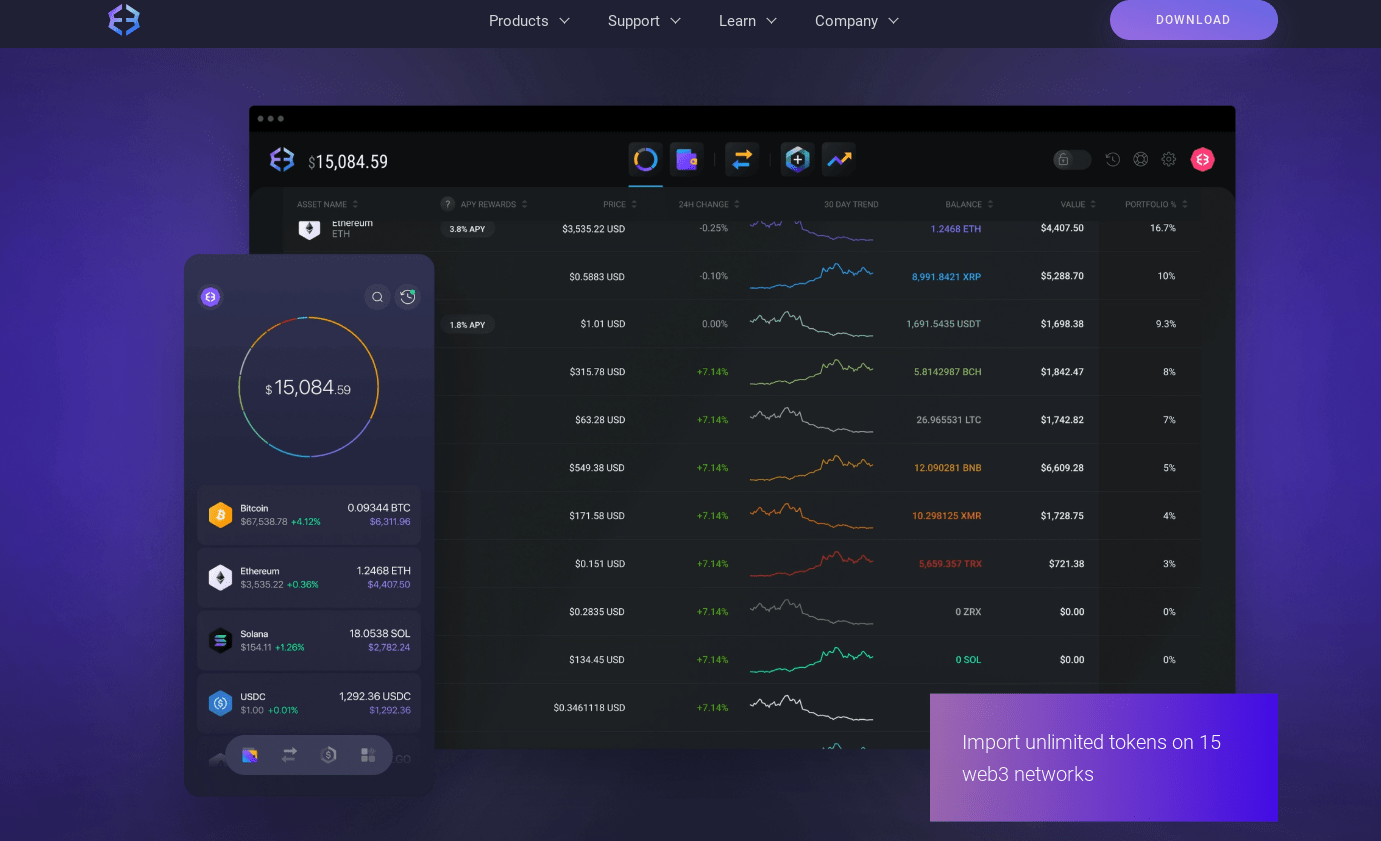

Technology Infrastructure: Develop or partner with platforms that support blockchain integration, smart contract deployment, and secure token issuance. Leading platforms include Ethereum and Polygon.

-

Asset Valuation and Due Diligence: Conduct thorough property appraisals and due diligence to ensure accurate valuation, transparency, and compliance with disclosure requirements.

-

Investor Onboarding: Implement Know Your Customer (KYC) and AML procedures to verify investor identities and maintain regulatory compliance.

Regulatory Compliance: Every jurisdiction has its own rules on securities and real estate sales. You must comply with local securities laws and anti-money laundering (AML) standards from day one. Learn more about these regulatory hurdles at bakertilly. com.

Legal Structuring: Most PTOs use a Special Purpose Vehicle (SPV) to hold the asset and issue tokens. This defines investor rights and streamlines compliance.

Technology Infrastructure: Secure smart contracts and reliable blockchain integration are non-negotiable. Whether you build your own platform or partner with an established provider, robust tech is mission-critical.

Asset Valuation and Due Diligence: Investors demand transparency. Rigorous appraisals and full disclosure of financials help build trust, and keep you on the right side of regulators.

KYC and Investor Onboarding: Know Your Customer checks aren’t just best practice, they’re required by law in most countries to prevent fraud and money laundering.

The Real Benefits: Why Investors Are Flocking to PTO Real Estate

PTOs aren’t just about novelty, they solve real pain points for both issuers and investors:

- Fractional Ownership: Buy into trophy assets with as little as $100 instead of hundreds of thousands.

- Increased Liquidity: Secondary markets allow faster entry/exit compared to traditional real estate deals.

- Transparency and Efficiency: Blockchain records every transaction immutably; smart contracts automate distributions with minimal paperwork.

- Diversification and Global Access: Cross-border investment becomes seamless, diversify across cities and continents without leaving home.

PTO Risks: What Every Issuer (and Investor) Needs to Know

No innovative investment comes without risks, especially when it’s built on emerging technology. The biggest challenges facing tokenized property investments include:

- Regulatory Uncertainty: Laws are evolving fast; today’s compliant structure could face new scrutiny tomorrow (housing. com).

- Market Volatility: Token prices don’t always track underlying property values perfectly; speculation can drive swings unconnected to fundamentals.

- Technological Risks: Smart contract bugs or security flaws can lead to catastrophic losses if not rigorously tested (webisoft. com).

- Pace of Liquidity Growth: While secondary markets exist, they’re not yet as deep or mature as stock exchanges, selling large positions quickly may be challenging (kensoninvestments. com).

- Lack of Investor Education: Many potential buyers don’t fully grasp how PTOs work or what risks they carry; education is crucial for mass adoption.

Mitigating these risks takes a blend of proactive strategy and ongoing vigilance. For example, working with legal counsel experienced in both securities and blockchain law can help you anticipate regulatory shifts before they bite. On the tech front, smart contract audits by reputable third parties are no longer optional, they’re essential for protecting both platform reputation and investor funds.

Step-by-Step: Launching Your Property Token Offering

Launching a PTO isn’t just about minting tokens and hoping for the best. Here’s a streamlined roadmap:

- Pinpoint the Right Asset: Not every property is ideal for tokenization. Focus on assets with clear documentation, high rental yields, or strong appreciation potential. Highlight what makes your property stand out, prime location? Unique amenities?

- Structure Legally from Day One: Set up your SPV or relevant legal entity early. This defines how revenue flows to token holders and what rights they have.

- Choose Your Tech Stack Wisely: Decide whether to build your own platform or partner with an established provider like Mey Network. Prioritize user experience, security, and scalability.

- Conduct Ironclad Due Diligence: Commission independent appraisals and make all disclosures transparent to attract serious investors.

- Nail Investor Onboarding: Streamline KYC/AML processes so it’s easy for global investors to participate, without compromising compliance.

- Plan Secondary Market Access: Ensure your tokens can be traded post-issuance, even if liquidity is still building.

Best Practices for PTO Success

The most successful PTOs don’t just check boxes, they build trust through transparency and continuous engagement. Here are some proven tactics:

Best Practices for a Secure, Investor-Friendly PTO

-

Prioritize Regulatory Compliance: Work with experienced legal advisors to ensure full adherence to securities laws, AML/KYC standards, and property regulations in all relevant jurisdictions. Platforms like Securitize and tZERO offer compliance-focused tokenization solutions.

-

Implement Robust Legal Structuring: Establish a Special Purpose Vehicle (SPV) or similar legal entity to manage the tokenized asset and clearly define investor rights. Consult reputable firms such as Baker Tilly or Harris Sliwoski LLP for legal structuring expertise.

-

Leverage Proven Blockchain Platforms: Choose established blockchain infrastructure like Ethereum or Polygon for smart contract deployment, and ensure the use of secure, audited code. Consider platforms such as Mey Network for PTO-specific solutions.

-

Educate and Engage Investors: Provide clear, accessible educational materials and regular updates on property performance, token mechanics, and market risks. Platforms like HoneyBricks and RealtyBits offer investor-friendly dashboards and resources.

-

Facilitate Secondary Market Liquidity: List tokens on reputable secondary trading platforms such as tZERO or OpenFinance Network to enhance liquidity and provide exit options for investors.

If you’re new to this space, consider collaborating with partners who have prior experience launching security token offerings (STOs) in real estate (bakertilly. com). They can help you avoid pitfalls that first-timers often miss, such as underestimating ongoing reporting requirements or overpromising on liquidity timelines.

Investor Education: The Unsung Hero

No matter how robust your tech or how prime your property, education remains the key lever for adoption, and retention. Host webinars, create interactive guides, and offer clear FAQs so that even non-crypto natives feel comfortable participating in your PTO.

The future of real estate investing is undeniably digital, but it’s also collaborative. Whether you’re an issuer looking to democratize access or an investor eager for new opportunities beyond borders, understanding the requirements, benefits, and risks of PTOs is essential. As secondary markets mature and regulatory clarity improves, expect PTOs to become a mainstay in diversified portfolios worldwide.