Tokenizing commercial real estate is rapidly transforming how investors and property owners access, trade, and manage high-value assets. By breaking down traditionally illiquid properties into digital tokens on the blockchain, you can unlock global liquidity, automate compliance, and democratize access to institutional-grade real estate. But how exactly do you get from a bricks-and-mortar office tower to a globally tradable on-chain property asset?

1. Identify and Structure the Commercial Real Estate Asset for Tokenization

The journey starts with careful asset selection. Not every property is a good candidate for tokenization – you’ll want a building or portfolio with clear title, stable cash flows, and strong investment appeal. Once identified, the next step is structuring ownership in a way that’s compatible with blockchain-based trading. This often involves transferring the asset into a legal wrapper like a Special Purpose Vehicle (SPV) or Real Estate Investment Trust (REIT), which will issue tokens representing fractional ownership.

This foundational step shapes everything that follows: it determines how rights are allocated to token holders, impacts tax treatment, and sets expectations for future governance and payouts. See more about asset selection.

2. Conduct Legal Due Diligence and Ensure Regulatory Compliance

This is where things get serious – and where many projects stall if they don’t have expert guidance. Tokenizing real estate means navigating both property law and securities regulation in every jurisdiction where you intend to market your tokens. Legal due diligence includes verifying ownership, resolving liens or encumbrances, and confirming zoning or lease terms.

Equally important is regulatory compliance: will your tokens be classified as securities? What disclosures are required? Will you need to restrict sales to accredited investors? Structuring your offering correctly at this stage not only keeps regulators happy but also builds trust with future investors.

3. Select a Blockchain Platform and Develop Smart Contracts

With your asset structured and legal path mapped out, it’s time to choose the technology stack that will power your on-chain property assets. Leading platforms like Ethereum offer robust smart contract capabilities, but newer blockchains may provide lower fees or enhanced compliance features tailored for real estate.

Key Criteria for Choosing a Blockchain Platform

-

Identify and Structure the Commercial Real Estate Asset for TokenizationBegin by selecting a property with clear ownership and stable value. Structure the asset—often via a Special Purpose Vehicle (SPV) or Real Estate Investment Trust (REIT)—to facilitate legal compliance and future tokenization.

-

Conduct Legal Due Diligence and Ensure Regulatory ComplianceEngage legal experts to review property documentation and ensure all local real estate and securities regulations are met. This step may involve working with established legal advisory firms like DLA Piper or Pillsbury Winthrop Shaw Pittman.

-

Select a Blockchain Platform and Develop Smart ContractsChoose a robust, secure blockchain platform such as Ethereum, Polygon, or Polymesh that supports smart contracts and token standards (e.g., ERC-1400 for security tokens). Develop and audit smart contracts to automate ownership, compliance, and distributions.

-

Digitize Ownership by Issuing and Allocating Property TokensMint digital tokens representing fractional ownership of the asset using the chosen blockchain. Platforms like Tokeny, Securitize, or RealT can assist with compliant token issuance and allocation processes.

-

Onboard Investors and Facilitate Global Trading on Compliant MarketplacesImplement KYC/AML verification for investors and list tokens on regulated marketplaces such as tZERO, INX, or OpenFinance Network to enable global trading and liquidity.

The heart of your project is the smart contract – code that automates ownership transfers, dividend distributions, voting rights, and even regulatory compliance checks (like KYC/AML). These contracts must be meticulously developed and audited; any flaws could jeopardize investor funds or expose you to legal risk.

The Foundation for Global Trading

Once these first three steps are complete – identifying the asset, ensuring legal compliance, and deploying secure smart contracts – you’re ready to digitize ownership through token issuance and open up access to global investors. In part two of this guide we’ll walk through issuing tokens, onboarding investors with robust compliance checks, and facilitating seamless trading on regulated digital marketplaces.

4. Digitize Ownership by Issuing and Allocating Property Tokens

With your legal structure in place and smart contracts ready, you’re now set to mint digital tokens that represent fractional ownership in your commercial real estate asset. These tokens are created on your chosen blockchain platform, with each token tied to a specific share of the underlying property, think of it as digitally slicing the building into thousands of investable pieces.

The allocation process is more than just pushing a button. You’ll need to determine how many tokens will be issued (for example, 10,000 tokens for a $10 million property means each token is valued at $1,000), what rights those tokens confer (such as voting or dividend rights), and how they can be transferred or traded. This is where transparent reporting, clear documentation, and an investor-friendly dashboard make all the difference for building trust.

Once minted, these property tokens can be distributed to initial investors through a private placement or public offering, always in line with your jurisdiction’s regulatory requirements. The result: you’ve transformed a traditionally illiquid asset into a flexible, programmable on-chain investment vehicle.

5. Onboard Investors and Facilitate Global Trading on Compliant Marketplaces

The final stage is about opening the doors to global capital. Effective investor onboarding starts with robust Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, these aren’t just regulatory boxes to tick; they’re crucial for maintaining transparency and safeguarding your marketplace against fraud.

After verification, investors receive their allocated property tokens directly into their digital wallets. From here, liquidity becomes reality: compliant marketplaces and secondary exchanges allow token holders to buy or sell their stakes 24/7, often with lower friction than traditional real estate transactions. This democratizes access not only for institutional players but also for smaller investors worldwide who previously couldn’t tap into prime commercial assets.

If you want to see how this process unfolds in practice, including real-world examples of compliant trading venues, check out this comprehensive guide from Blockchain Oodles.

Why Tokenizing Commercial Real Estate Is Gaining Momentum

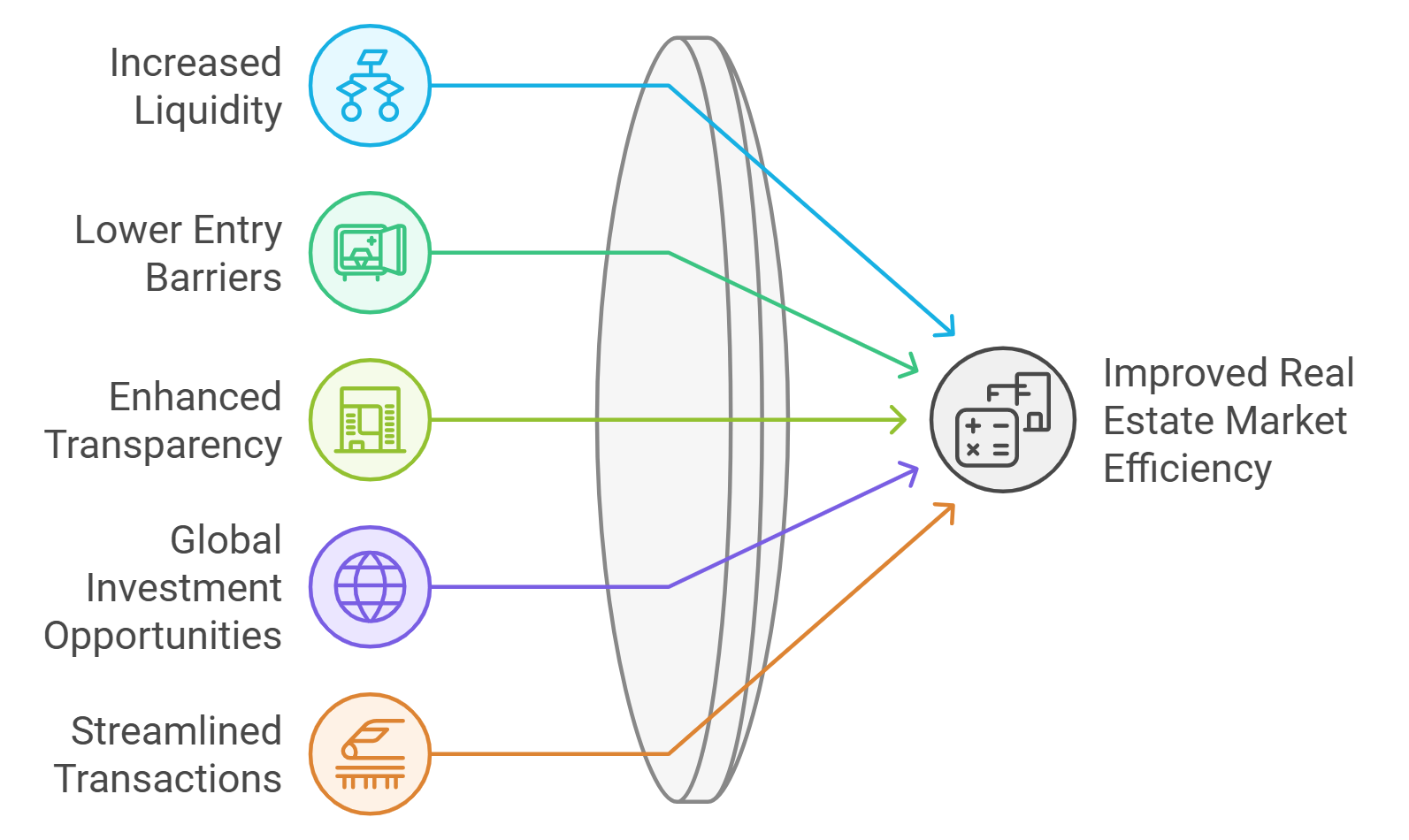

The appeal isn’t just theoretical. By following this five-step process, structuring the asset, ensuring compliance, leveraging smart contracts, issuing digital tokens, and enabling global trading, you unlock new efficiencies at every level:

- Increased liquidity: Investors can exit positions quickly via secondary markets.

- Broader access: Fractional ownership lowers barriers for global investors.

- Automated compliance: Smart contracts handle KYC/AML checks seamlessly.

- Transparent governance: All actions are recorded on-chain for auditability.

Navigating Challenges and Looking Ahead

No transformation comes without hurdles. Regulatory frameworks remain patchy across borders; tech adoption requires careful education of both issuers and investors; and not all blockchains offer equal security or scalability. But as standards emerge and success stories accumulate, the path is getting clearer, and more accessible, for everyone from institutional asset managers to first-time property investors.

If you’re considering taking your first steps toward tokenizing commercial real estate assets, or simply want to stay ahead of the curve, the time to explore this space is now. With careful planning around these five core stages, you can harness blockchain’s power to reimagine what’s possible in property investment. For more insights on structuring deals or choosing technology partners, explore our full resource archive at Tokenized Real Estate.