Tokenized real estate is rapidly redefining how investors approach property markets, challenging the conventions of traditional finance with blockchain-powered innovation. As we move into 2025, the debate around tokenized real estate vs traditional finance is more relevant than ever, especially as new investor trends highlight the growing appetite for speed, liquidity, and transparency in property investment.

Speed: From Months to Minutes

In the traditional real estate world, buying or selling property is a marathon. Transactions typically involve a labyrinth of intermediaries – brokers, lawyers, banks – each adding layers of paperwork and delays. Closing times routinely stretch from weeks to several months. This friction has long been accepted as the cost of doing business in an industry built on trust and verification.

Tokenization upends this paradigm by leveraging smart contracts on blockchain platforms to automate and accelerate every stage of the transaction process. With tokenized real estate, ownership rights are encoded into digital tokens that can be transferred almost instantly between parties. What once took months now takes minutes. The efficiencies gained by removing middlemen are not just theoretical; platforms are demonstrating that settlement times can be reduced dramatically without sacrificing due diligence or compliance. For a deeper dive into why this shift matters for investors, see insights from Shamla Tech.

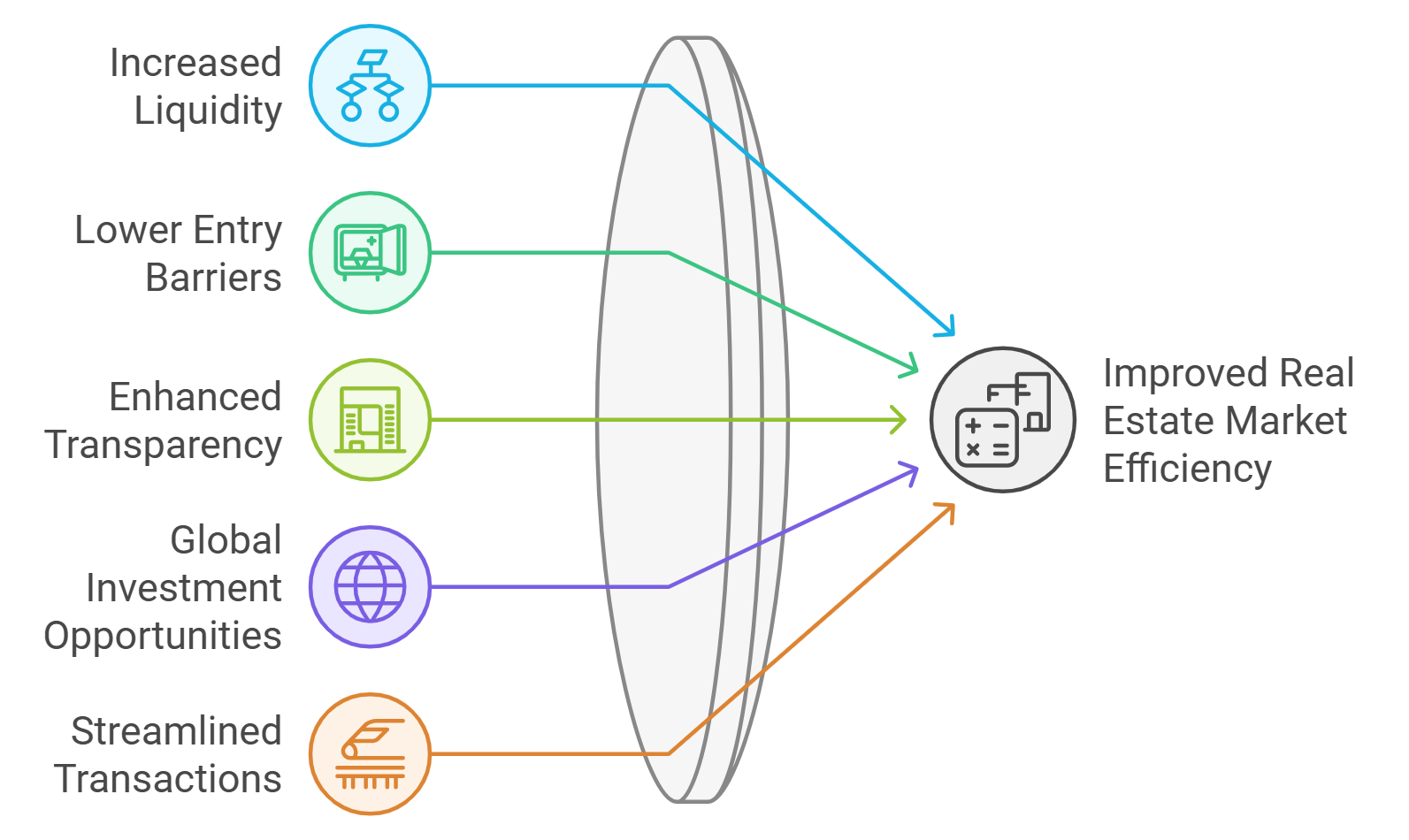

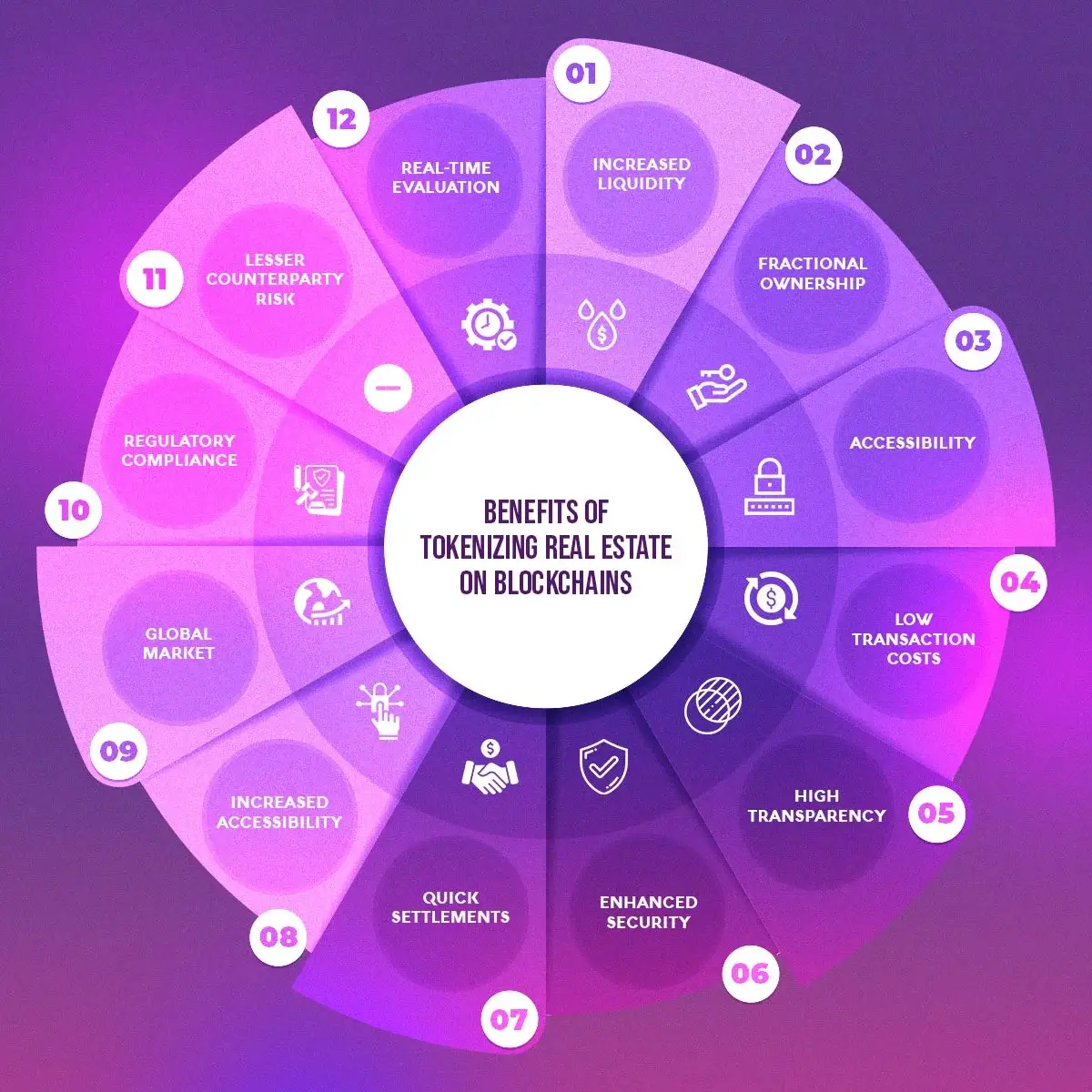

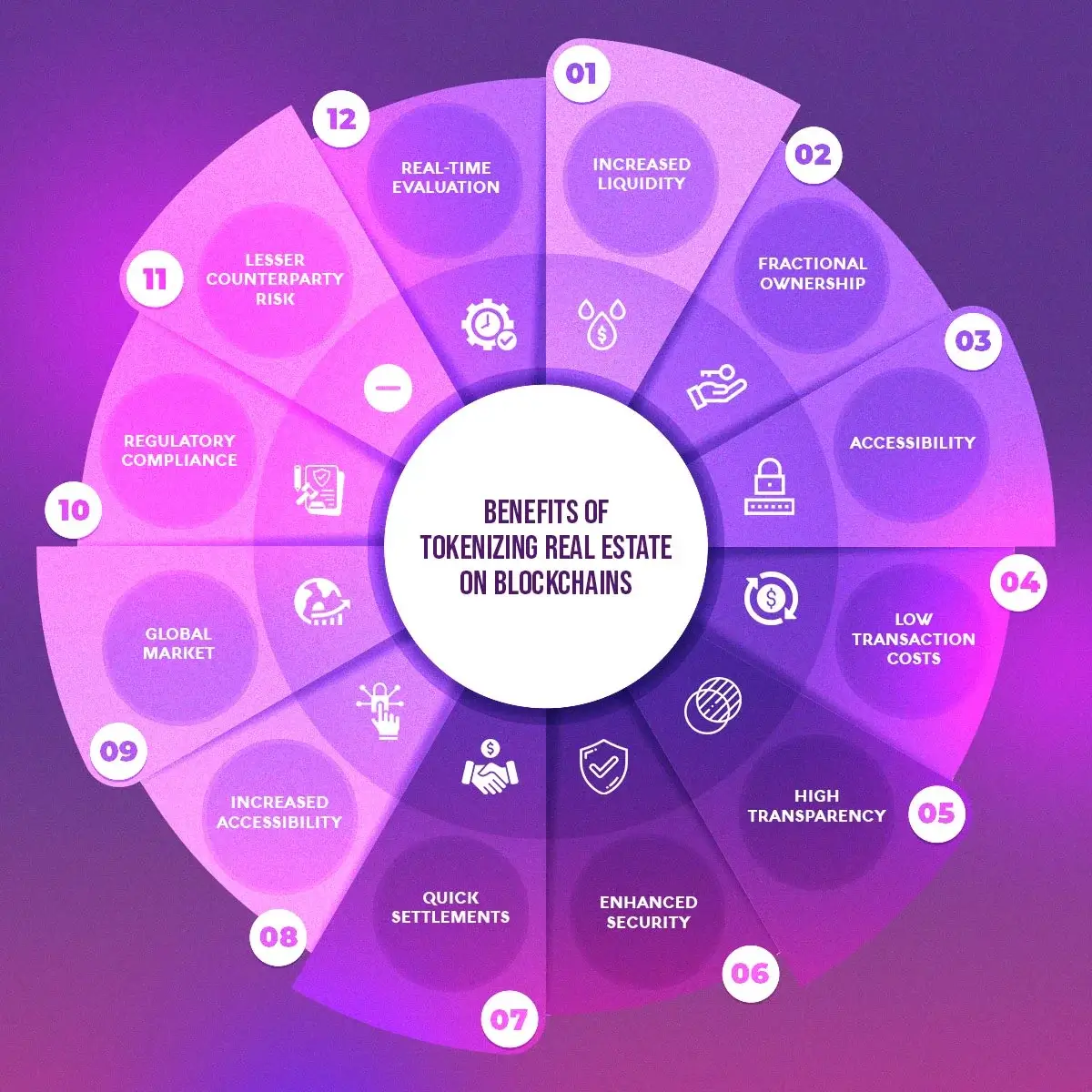

Liquidity: Unlocking Capital with Fractional Ownership

Liquidity has always been the Achilles’ heel of direct real estate investment. Properties are high-value assets that traditionally require significant capital outlays and can take months or years to sell in full. Investors seeking to exit an investment quickly often face steep discounts or drawn-out sale processes.

The tokenization model addresses this challenge head-on through fractional ownership. By dividing a property into hundreds or thousands of tokens, investors can buy or sell small portions on secondary markets with unprecedented ease. This granular approach transforms illiquid assets into tradable instruments – a game-changer for those who value flexibility and rapid access to capital.

Key Benefits of Property Token Liquidity for Modern Investors

-

Fractional Ownership Lowers Barriers: Platforms like Smartlands and Brickblock allow investors to purchase small fractions of high-value properties, making real estate accessible with minimum investments as low as $1,000.

-

Faster Access to Capital: Tokenized assets can be liquidated quickly on secondary markets, providing investors with rapid access to funds—often within minutes—compared to the months-long process of selling traditional property.

-

Global Market Participation: Tokenization opens up real estate investment to a global pool of investors, as seen on platforms like Propy, increasing liquidity and market depth beyond local buyers.

-

Transparent Transaction Records: Blockchain-based platforms such as Blockimmo provide immutable, transparent records of all token trades and ownership changes, building trust and reducing fraud risk.

This increased liquidity is not just theoretical; platforms like Primior have documented how trading tokenized assets on secondary markets offers greater convenience compared to traditional methods (Primior’s analysis). The result is a more dynamic market where investors can react swiftly to changing conditions without being locked into long holding periods.

Transparency: Blockchain’s Immutable Ledger Advantage

The final pillar distinguishing tokenized real estate from its traditional counterpart is transparency. In legacy systems, records of ownership and transaction history are often fragmented across different agencies and institutions. Accessing these records can be cumbersome – sometimes even impossible without costly legal intervention.

Blockchain technology changes this equation entirely by providing an immutable ledger where every transaction and change in ownership is recorded in real time. For investors, this means unparalleled clarity regarding their holdings and the history of any asset they’re considering purchasing. The risk of fraud diminishes significantly when all parties have access to an open and verifiable record.

This level of transparency not only builds trust but also streamlines compliance checks for regulators and auditors alike (Shamla Tech). As regulatory frameworks evolve alongside these technologies, expect transparency standards in tokenized markets to continue outpacing those found in conventional finance.

Yet, even as these advantages reshape the investment landscape, tokenized real estate is not without its growing pains. The regulatory environment remains fluid, with compliance requirements that differ across jurisdictions and continue to evolve. Secondary market liquidity, while improved over traditional models, still depends on the development of robust, reputable exchanges where property tokens can be traded efficiently and securely.

Another critical factor is accessibility. Traditional real estate investments have long been the preserve of high-net-worth individuals or institutional players due to high minimum investment thresholds and complex legal structures. Tokenization dramatically lowers these barriers: minimums can fall to as little as $1,000, opening doors for a broader spectrum of investors who previously could not participate in prime property markets. This democratization is already reshaping investor demographics and strategies (EY).

Comparing Tokenized Real Estate with REITs

It’s worth noting that tokenized real estate shares some similarities with Real Estate Investment Trusts (REITs), particularly around fractional ownership and simplified access. However, there are key differences:

Tokenized Property vs. Traditional REITs: Key Comparison Points

-

Transaction Speed: Tokenized property investments leverage blockchain and smart contracts to enable near-instant settlement, often reducing transaction times from months to minutes. In contrast, traditional REITs and direct real estate deals involve lengthy processes with multiple intermediaries.

-

Liquidity: Tokenized real estate enables fractional ownership and trading of property tokens on secondary markets, offering higher liquidity and easier entry/exit for investors. Traditional REITs are traded on stock exchanges and are more liquid than direct real estate, but may still face trading restrictions and market hours.

-

Transparency: Blockchain-based property tokens provide an immutable, transparent ledger of all transactions and ownership changes, reducing fraud risk. Traditional REITs offer some transparency via regulatory filings, but lack the real-time, granular visibility of blockchain records.

-

Accessibility & Minimum Investment: Tokenization lowers barriers to entry, with minimum investments as low as $1,000 on some platforms. Traditional REITs also offer relatively low minimums compared to direct property ownership, but tokenized platforms may provide even greater accessibility and global reach.

-

Regulatory Environment: Traditional REITs operate within well-established regulatory frameworks, offering investor protections and clear compliance standards. Tokenized property investments face evolving regulations and potential legal uncertainties, which can impact investor confidence and platform adoption.

While REITs offer liquidity via public markets and professional management, they lack the direct ownership transparency and programmable features enabled by blockchain technology. Tokenization allows investors to hold actual digital representations of specific properties rather than shares in a company that owns a portfolio of assets. This subtle but important distinction gives investors greater control and insight into their holdings.

Challenges Ahead, and the Road to Maturity

The path forward for property tokenization will hinge on several factors: standardization of legal frameworks, maturation of secondary trading venues, and continued education for both investors and issuers. As more platforms adopt best practices around security, compliance, and investor protection, confidence in this new asset class will deepen.

The momentum behind blockchain transparency in real estate, enhanced property token liquidity, and lower entry barriers is already shifting capital flows globally. Early adopters are not just seeking returns, they’re demanding a fundamentally better investment experience built on speed, flexibility, and trust.

Balance is the key to lasting wealth, even as we embrace new paradigms like tokenized assets.