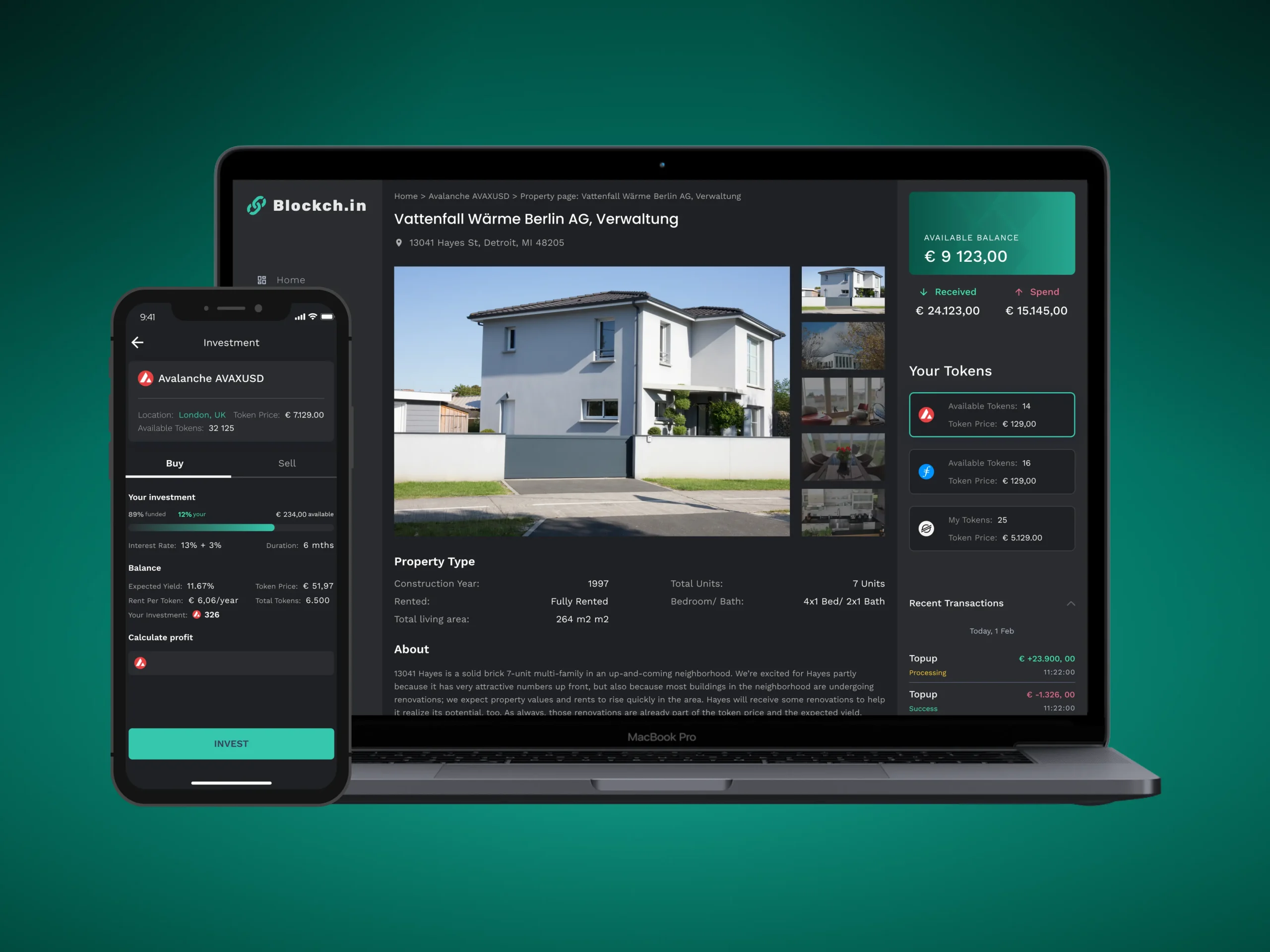

PropertyNFTs are rapidly redefining the landscape of on-chain real estate rentals, introducing a new paradigm where digital assets and physical properties converge. By leveraging blockchain technology, PropertyNFTs enable unique, verifiable ownership and automate key aspects of property management. This shift is not merely theoretical – it is already manifesting in real-world rental markets, with platforms like Firepan and Renta Network leading the charge.

![]()

Tokenization: Lowering Barriers to Entry in Real Estate Rentals

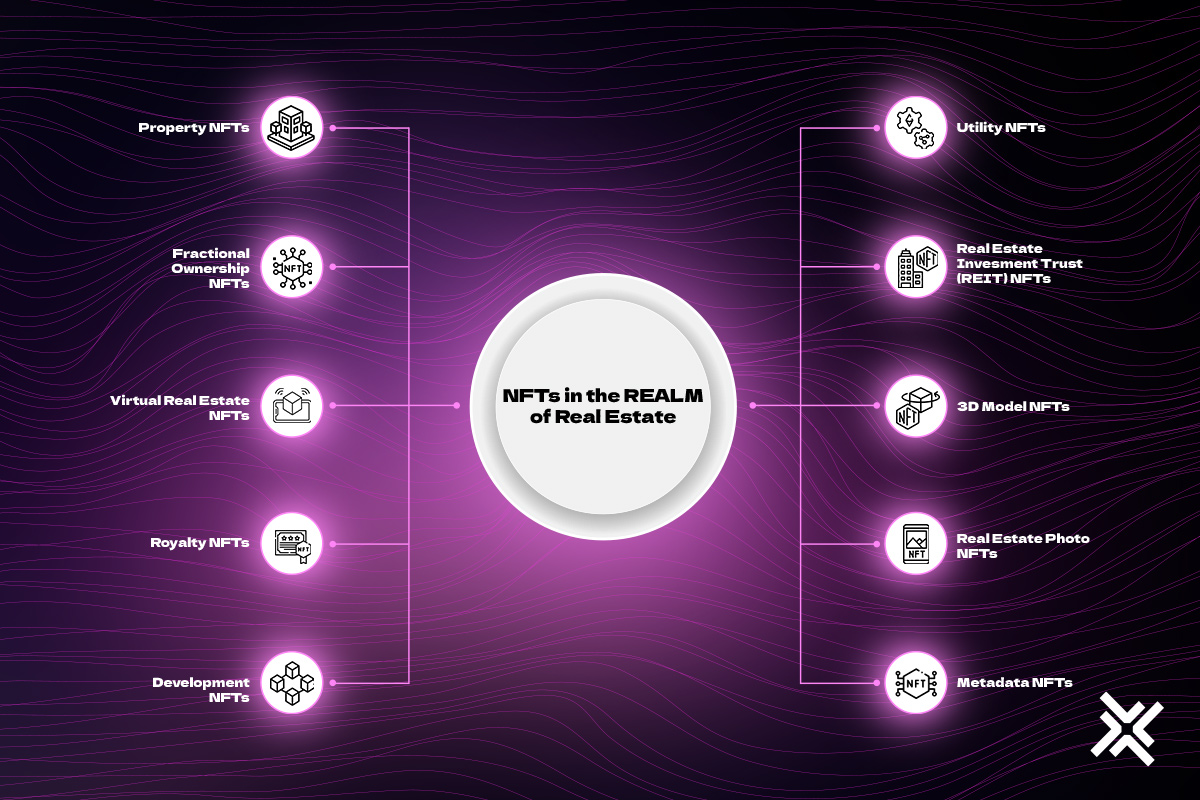

Traditional real estate investment has long been dominated by high capital requirements and complex legal structures. Tokenization disrupts this status quo by dividing property ownership into digital tokens or NFTs, which can be traded on blockchain platforms. As highlighted by Firepan, this approach facilitates fractional real estate ownership, enabling investors to purchase small shares of a property rather than acquiring entire buildings or units.

This democratization has profound implications for the rental market:

Key Benefits of Fractional Real Estate Ownership via PropertyNFTs

-

Lower Barriers to Entry for Investors: Platforms like Firepan enable fractional ownership by tokenizing physical properties, allowing individuals to invest in real estate with smaller amounts of capital than traditional methods require.

-

Increased Liquidity and Global Access: PropertyNFTs transform traditionally illiquid real estate assets into easily tradable digital tokens, granting investors worldwide the ability to buy, sell, or trade property fractions on blockchain marketplaces.

-

Automated and Transparent Rental Processes: With solutions like Renta Network, smart contracts automate rental agreements, ensuring transparent, tamper-proof transactions and reducing reliance on intermediaries.

-

Enhanced Security and Regulatory Compliance: Integrations such as Renta Network with Naoris Protocol provide advanced decentralized security features, protecting user data and ensuring compliance with local regulations.

-

Instant Settlement and Real-World Implementation: Roofstock onChain has demonstrated the practical benefits of PropertyNFTs by enabling instantaneous sale and settlement of single-family rental properties, streamlining the transaction process.

For example, Homebase’s tokenization of a $235,000 single-family rental property in South Texas on the Solana blockchain demonstrates that even modestly priced assets can now be accessed by a global pool of investors. This opens up previously illiquid markets and allows individuals to diversify their portfolios across multiple properties and locations.

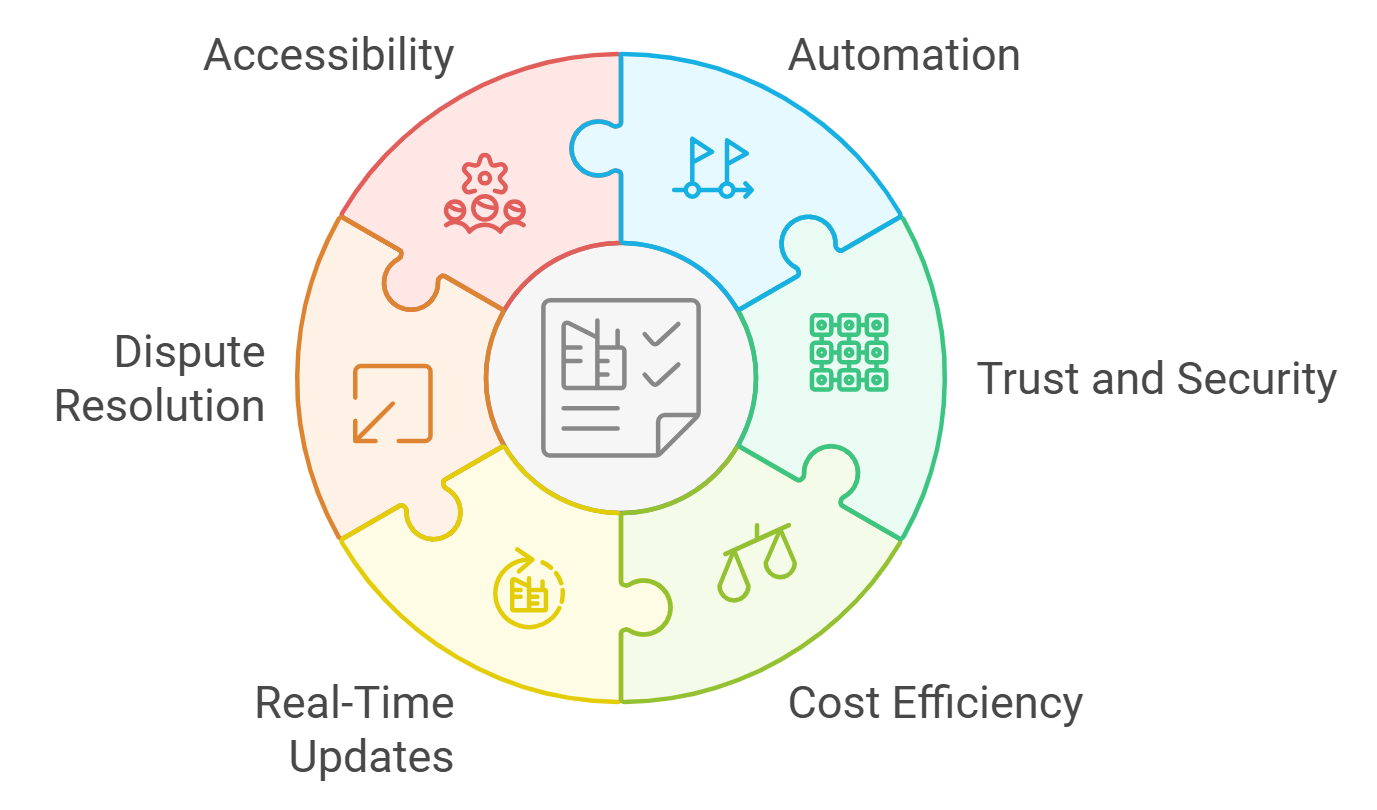

Automated Rental Agreements with Smart Contracts

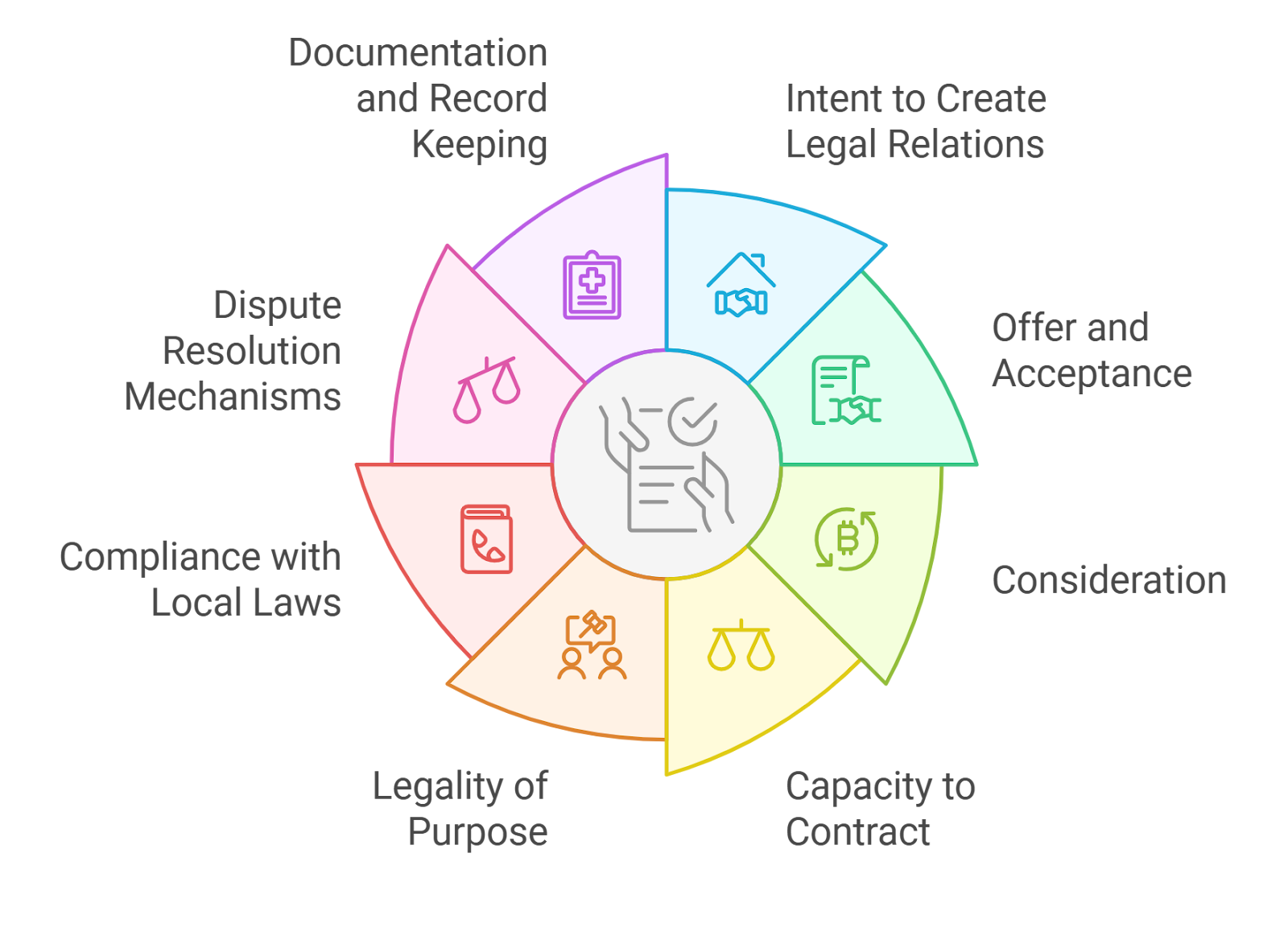

The integration of smart contracts into PropertyNFT platforms is streamlining rental operations. Platforms like Renta Network are pioneering automated on-chain agreements that eliminate intermediaries such as agents or brokers. Once terms are set within a smart contract, rent payments, deposits, and even dispute resolutions can be executed programmatically – reducing costs and minimizing human error.

This automation increases transparency for both tenants and landlords. Every transaction is immutably recorded on the blockchain, ensuring that payment histories and contract terms are accessible for audit at any time. Additionally, Renta Network’s partnership with 4EVERLAND brings decentralized storage into play, safeguarding sensitive documents against tampering or loss.

Enhanced Security and Regulatory Compliance

Security remains paramount as rental transactions move on-chain. The collaboration between Renta Network and Naoris Protocol exemplifies how advanced decentralized security measures are being woven into PropertyNFT ecosystems (source). These partnerships focus on protecting user data, securing transactions from malicious actors, and ensuring compliance with evolving local regulations – all critical factors for mainstream adoption.

The result is a system where both asset owners and renters benefit from reduced risk exposure while maintaining regulatory transparency. This balance between innovation and compliance is essential as more jurisdictions develop frameworks for blockchain-based property management.

Pioneering Real-World Implementations

Beyond theory, PropertyNFTs have been successfully deployed in live markets. Roofstock onChain’s sale of single-family homes as NFTs illustrates how instantaneous settlement can become reality (source). These transactions bypass legacy escrow systems entirely – reducing closing times from weeks to minutes while offering greater liquidity for both buyers and sellers.

Would you consider renting a home through an NFT-based platform within the next 5 years?

With PropertyNFTs making real estate rentals more transparent, secure, and accessible, platforms now offer automated agreements and fractional ownership. Do you see yourself embracing this new way to rent?

As PropertyNFTs gain traction, the rental market is witnessing a shift toward seamless, borderless participation. Investors from anywhere in the world can now co-own income-producing properties and receive proportional rental yields directly to their digital wallets. This global accessibility is not just theoretical – it is actively reshaping how capital flows into residential and commercial rentals.

Driving Efficiency in Tokenized Property Management

One of the most transformative aspects of on-chain real estate rentals is the automation of property management tasks. Through smart contracts, routine processes such as rent collection, maintenance scheduling, and compliance checks can be codified and executed autonomously. For example, if a tenant’s payment is late, a pre-set smart contract can automatically send reminders or initiate late fees, all without manual intervention.

This efficiency extends to secondary markets as well. Owners of PropertyNFTs can trade their tokens on supported exchanges, unlocking liquidity that was previously unavailable in traditional real estate. This ability to buy or sell fractions of properties means investors are no longer locked into long holding periods or cumbersome exit processes.

Challenges and Future Outlook

Despite rapid progress, several challenges remain for mainstream adoption of tokenized property rentals. Regulatory uncertainty is still a significant hurdle; different jurisdictions interpret digital property rights and smart contracts in varying ways. Platforms must invest heavily in compliance infrastructure to ensure adherence to local laws while maintaining the benefits of decentralization.

Another key consideration is user experience. While blockchain-native investors may be comfortable with wallet management and interacting with smart contracts, mass-market tenants will expect frictionless onboarding and support. Continued innovation in user interface design will be critical for expanding adoption beyond early adopters.

Key Takeaways for Investors and Landlords

Top Strategies for Leveraging PropertyNFTs in Rentals

-

Utilize Tokenization Platforms for Fractional Ownership: Platforms like Firepan enable property owners to tokenize real estate, allowing for fractional ownership. This lowers investment barriers and provides global access to rental properties.

-

Automate Rental Agreements with Smart Contracts: Renta Network leverages PropertyNFTs and smart contracts to automate rental processes, eliminating intermediaries and ensuring secure, transparent transactions.

-

Enhance Security and Compliance with Decentralized Protocols: Integrate advanced security features by partnering with solutions like Naoris Protocol, which provides decentralized cybersecurity and compliance tools for on-chain property rentals.

-

Leverage Real-World Implementations for Instant Transactions: Platforms such as Roofstock onChain have demonstrated the practical use of PropertyNFTs by facilitating instantaneous sale and settlement of single-family rental properties.

-

Adopt Decentralized Storage for Rental Data: Integrate decentralized storage solutions like 4EVERLAND with PropertyNFT platforms to securely store rental agreements and property data, enhancing transparency and resilience.

For forward-thinking investors and landlords, now is an opportune time to explore this evolving ecosystem. Platforms like Firepan and Renta Network have demonstrated that secure, automated rental income streams are possible through blockchain technology (Firepan). As more case studies emerge – such as Homebase’s $235,000 tokenized rental property on Solana – expect further validation of these models across diverse asset classes.

The convergence of tokenization, automation, security enhancements, and regulatory progress signals a new era for the blockchain rental market. With each successful implementation, PropertyNFTs move closer to becoming the standard for efficient, transparent, and globally accessible real estate rentals.