Fractional real estate tokenization is rapidly reshaping how investors access and own property. By leveraging blockchain technology, it’s now possible for individuals to hold a digital, on-chain stake in high-value assets that were once reserved for institutional players or ultra-high-net-worth individuals. Let’s break down exactly how this works using a real-world scenario: a $1 million property.

Breaking Down the $1 Million Property Tokenization

Imagine a prime property valued at $1,000,000. Traditionally, acquiring such an asset would require significant capital or complex syndication. With tokenization, however, the process becomes more accessible and transparent:

Step-by-Step: Tokenizing a $1 Million Property

-

1. Property Valuation & Legal Structuring: The property is professionally valued at $1 million. A legal entity—typically a Limited Liability Company (LLC)—is created to hold the property, ensuring clear ownership and regulatory compliance.

-

2. Token Creation on Blockchain: The LLC’s ownership is divided into digital tokens. For example, 1 million tokens are minted on a blockchain platform (such as Ethereum), with each token representing 0.0001% ownership, valued at $1 per token.

-

3. Regulatory Compliance & Smart Contracts: Smart contracts are deployed to automate transactions, enforce ownership rights, and manage income distributions. Compliance with regulations (such as SEC guidelines in the U.S.) is ensured throughout the process.

-

4. Token Offering to Investors: Tokens are offered to investors via a secure digital platform. Investors can purchase any number of tokens, gaining a fractional ownership stake in the property with a low minimum investment.

-

5. Income Distribution & Secondary Trading: Investors receive a proportional share of rental income and property appreciation. Tokens can be traded on secondary markets (such as tZERO), providing liquidity not typically found in traditional real estate investments.

-

6. Real-World Example – St. Regis Aspen Resort: In 2018, the St. Regis Aspen Resort tokenized 18.9% of its equity, issuing 18 million Aspen Coins on Ethereum, each valued at $1. Accredited investors gained fractional ownership, income rights, and the ability to trade tokens, all under SEC-compliant structures.

1. Property Valuation and Legal Structuring: The first step is to have the property professionally appraised at $1,000,000. Typically, a legal entity such as an LLC is created to hold the title to the asset. This structure ensures clear delineation between the physical asset and its digital representation.

2. Token Creation: Next, the ownership of that LLC (and thus the property) is divided into digital tokens using blockchain smart contracts. For example, 1 million tokens can be minted – each one representing precisely $1 worth of ownership or 0.0001% of the total equity.

3. Offering Tokens to Investors: These tokens are then offered on a secure digital platform specializing in on-chain real estate investment opportunities. Investors can purchase as many tokens as they wish, whether it’s 10 ($10), 10,000 ($10,000), or any other amount, giving them direct exposure to both rental income and appreciation potential.

The Role of Smart Contracts and Blockchain in Property Ownership

The backbone of fractional real estate tokenization is smart contract real estate. Smart contracts automate everything from distribution of rental income to recording changes in ownership. This means every token transaction is immutably recorded on-chain, offering unmatched transparency compared to traditional paper deeds or spreadsheets.

This technology also allows for programmable compliance features such as KYC/AML checks and investor whitelisting directly within the smart contract code. As a result, each transaction aligns with regulatory standards while reducing manual intervention and settlement times.

A Real-World Example: St. Regis Aspen Resort

The St. Regis Aspen Resort illustrates how large-scale assets can be fractionally owned through tokenization:

- Tokenization Details: In 2018, approximately 18.9% of this luxury Colorado resort was tokenized into 18 million “Aspen Coins” on Ethereum, each valued at $1.

- Investor Access: Accredited investors could buy these tokens (subject to minimum purchase requirements), gaining rights to future rental income streams and appreciation upside.

- Regulatory Compliance: The offering was structured under SEC guidelines for security tokens, setting an early precedent for compliant blockchain property ownership.

Main Benefits for Investors

Key Advantages of Fractional Real Estate Tokens

-

Increased Accessibility: Fractional real estate tokens lower the capital required to invest in high-value properties, enabling more investors to participate in the real estate market with smaller amounts.

-

Enhanced Liquidity: Unlike traditional real estate, tokens can be traded on secondary markets, allowing investors to buy and sell their shares more easily and exit positions with greater flexibility.

-

Transparency and Security: Blockchain technology ensures all transactions and ownership records are immutably stored, providing a transparent and secure investment environment.

-

Portfolio Diversification: Investors can diversify their holdings by purchasing fractional tokens in multiple properties across different locations and asset types, reducing risk and increasing potential returns.

-

Efficient Income Distribution: Smart contracts automate the distribution of rental income and profits, ensuring timely and accurate payments to token holders without manual intervention.

-

Global Investment Opportunities: Tokenization platforms enable cross-border participation, allowing investors from around the world to access real estate markets previously limited by geography and regulation.

This model unlocks several important benefits for modern investors:

- Diversification: Easily spread capital across multiple properties or even global markets by owning fractions instead of whole assets.

- Liquidity: Trade your tokens on secondary markets if you need access to cash, something rarely possible with traditional brick-and-mortar investments.

- Simplicity and Transparency: Thanks to blockchain records and automated smart contracts, every transaction is auditable and efficient.

Beyond these advantages, the emergence of property token rewards is adding a new dimension to on-chain real estate investment. Some platforms now offer loyalty or staking rewards to token holders, further increasing the appeal of holding fractionalized property tokens. These incentives can range from increased yields to early access for future offerings, creating a dynamic ecosystem around blockchain property ownership.

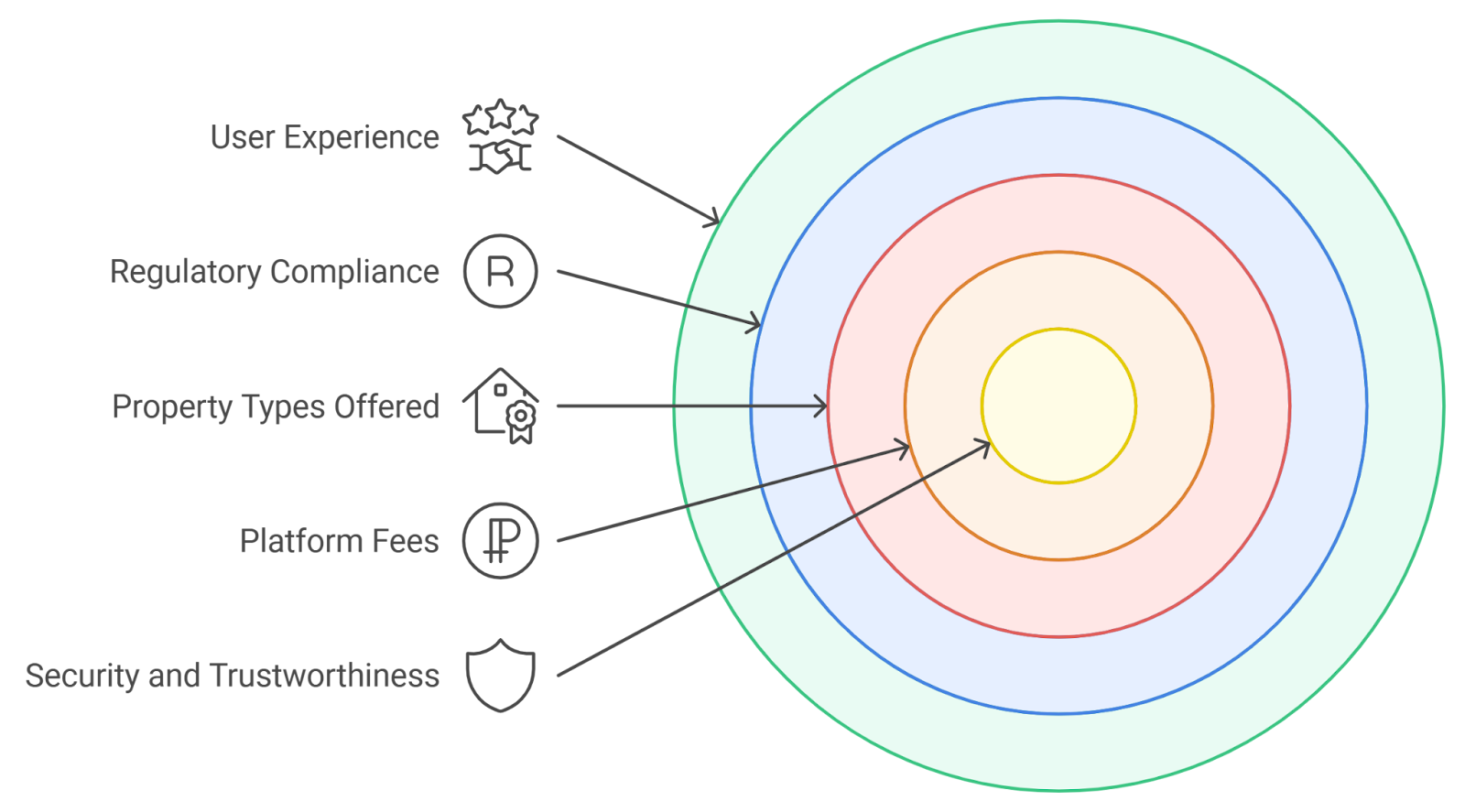

Key Considerations Before Investing in Tokenized Real Estate

While the benefits are compelling, it’s important for investors to weigh several factors before diving in:

Essential Due Diligence Steps for Tokenized Real Estate

-

Verify the Legal Structure and Ownership: Confirm that the property is held by a legitimate legal entity (such as an LLC) and that token holders have clearly defined rights. Review official documents and ensure regulatory compliance, as seen in the St. Regis Aspen Resort tokenization, which followed SEC guidelines.

-

Assess the Tokenization Platform’s Reputation: Research the platform facilitating the token offering. Established platforms like Republic, RealT, and Blocksquare have a track record of compliant, secure real estate tokenizations.

-

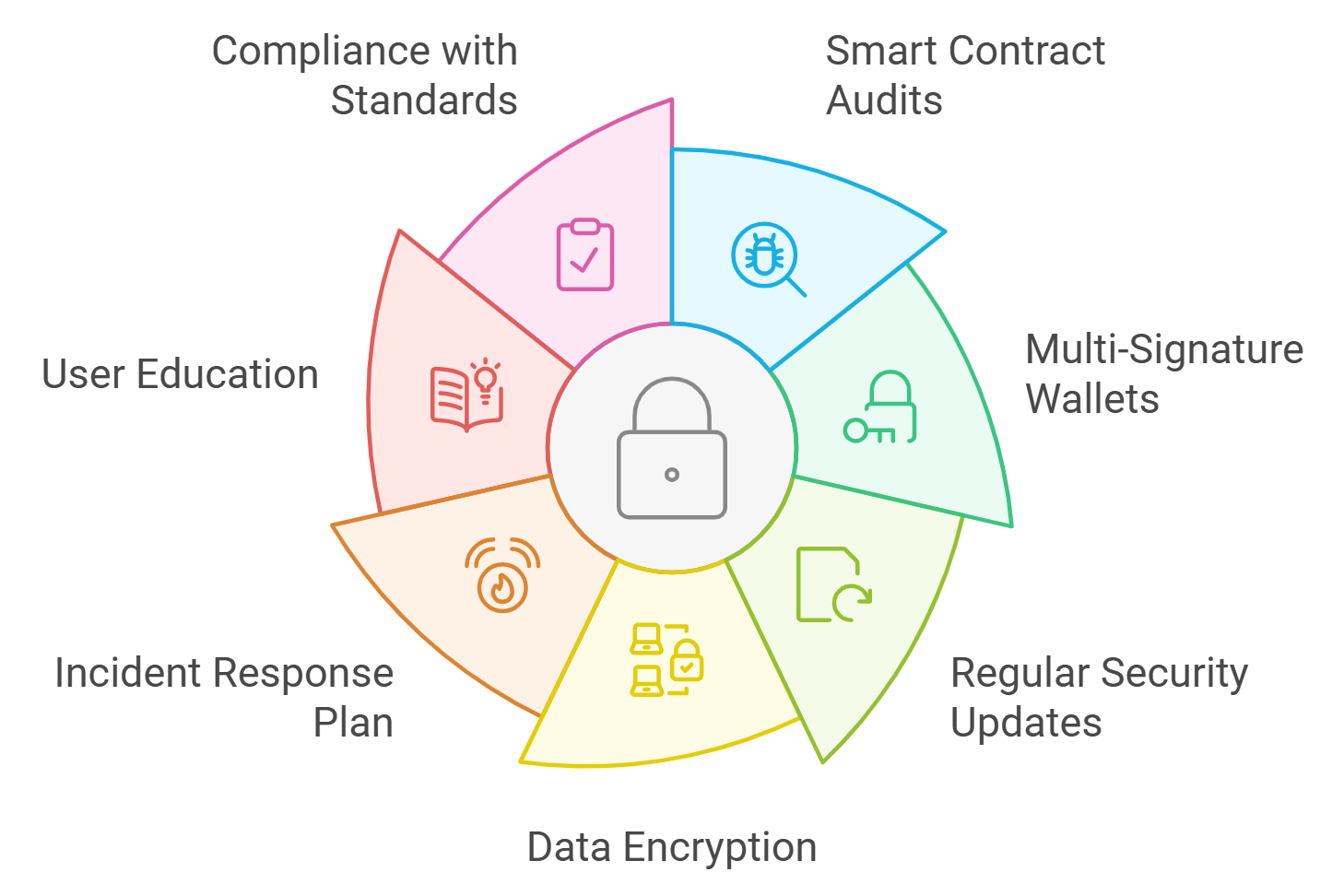

Review Smart Contract Security: Ensure that the smart contracts governing token issuance and management have undergone third-party audits. Look for published audit reports or security certifications from reputable firms.

-

Understand Income Distribution and Exit Options: Examine how rental income and property appreciation are distributed to token holders. Check if tokens can be traded on secondary markets for liquidity, as with the Aspen Coin example.

-

Evaluate Regulatory Compliance and Investor Protections: Confirm the offering complies with local securities regulations and offers adequate investor protections. Look for SEC filings or equivalent regulatory disclosures, especially for U.S.-based assets.

-

Analyze Underlying Property Fundamentals: Conduct due diligence on the property itself—location, valuation, occupancy rates, and potential for appreciation. Request third-party appraisals and inspect financial statements.

-

Check Platform’s Technological Infrastructure: Investigate the blockchain technology used (e.g., Ethereum) and the platform’s uptime, security protocols, and user support. Reliable infrastructure is vital for safe token ownership and trading.

- Regulatory Environment: Ensure that the platform and offering comply with local securities laws and investor protections. Regulatory clarity is improving, but global standards remain fragmented.

- Platform Security: Evaluate the technical robustness of the smart contract infrastructure and the reputation of the platform operator. Look for independent audits and transparent reporting.

- Market Liquidity: While secondary trading is a core promise of tokenization, actual liquidity can vary widely depending on market adoption and platform integration.

- Property Fundamentals: Don’t overlook traditional real estate due diligence, location, tenant quality, lease terms, and market trends all remain critical drivers of long-term returns.

How Rental Income Flows to Token Holders

A central value proposition of fractional real estate tokenization is direct participation in cash flows. When tenants pay rent on a tokenized property, smart contracts can automate proportional distribution to each token holder’s wallet. This process replaces legacy manual accounting with near-instant settlements and clear audit trails, making tokenized real estate rental income more transparent and efficient than ever before.

This programmable income distribution also opens up innovative models such as real-time streaming payments or compound staking rewards for longer-term holders. The result: an evolving landscape where investors have more control over both their capital and cash flow timing.

The Future Outlook: From Single Assets to Global Portfolios

The $1 million property example illustrates just one use case among many emerging across the globe. As legal frameworks mature and interoperability between platforms improves, expect to see increased cross-border investment opportunities and bundled portfolios, enabling true diversification across cities, asset classes, and even risk profiles through blockchain-based vehicles.

The next evolution could see everything from commercial towers to vacation rentals available as fractional digital assets, each governed by transparent code rather than opaque paperwork. For forward-thinking investors seeking exposure to hard assets with liquidity potential, fractional real estate tokenization stands out as a powerful tool for portfolio construction in 2025 and beyond.