Ready to turn just $100 into your first step toward real estate wealth? Thanks to the rise of tokenized real estate, you no longer need deep pockets or insider connections to invest in property. Blockchain technology now enables fractional ownership, letting everyday investors buy digital property tokens for as little as $50 to $100. Whether you’re a crypto enthusiast, a real estate rookie, or simply curious about diversifying your portfolio, this guide will walk you through exactly how to start investing in tokenized real estate with just $100.

Why Tokenized Real Estate is a Game Changer for Beginners

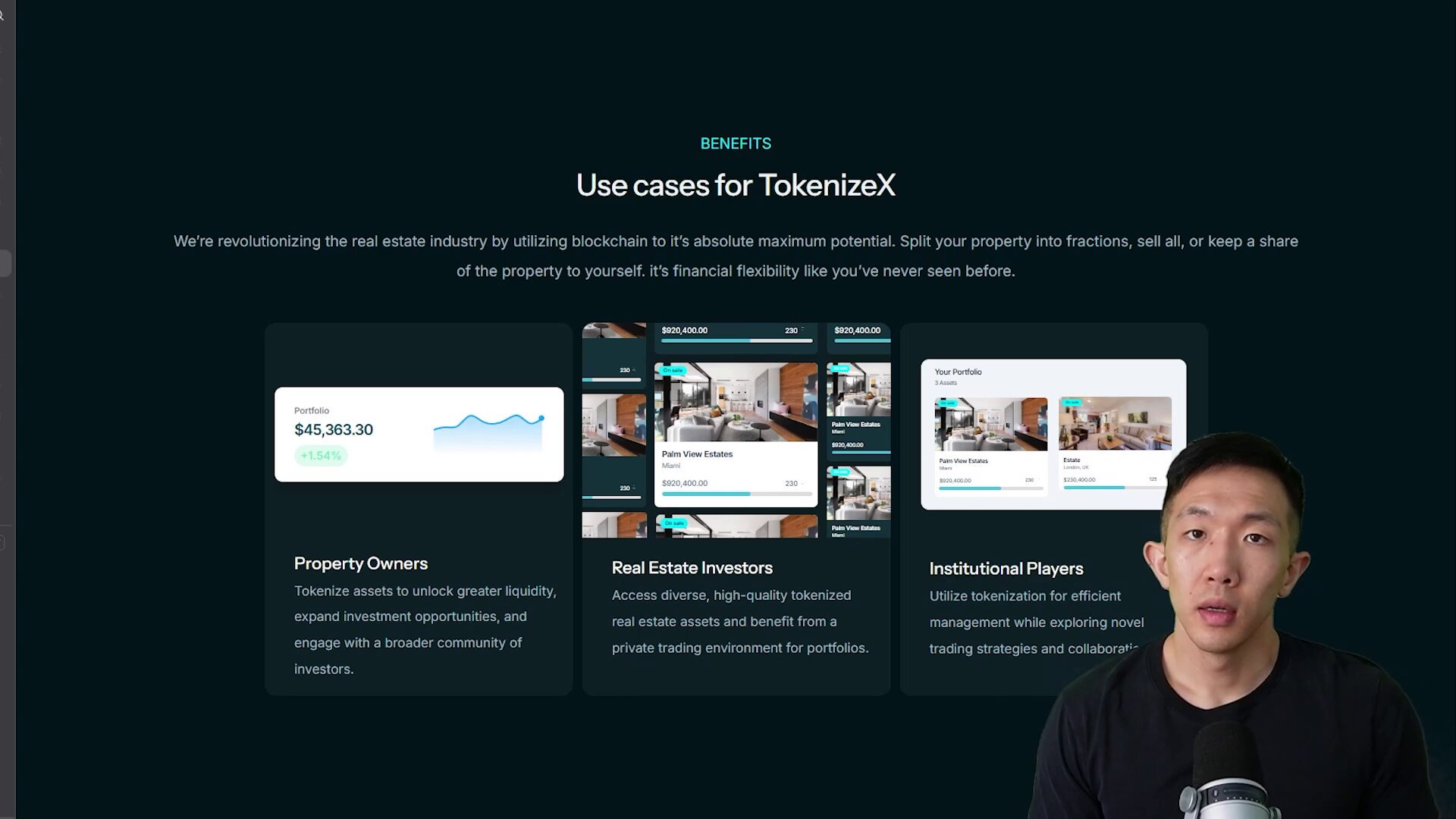

Tokenization is revolutionizing property investment by breaking down major assets into smaller, tradable digital tokens. Instead of saving for years to afford a down payment, you can now invest in high-value properties by purchasing fractional shares. This approach offers:

- Low entry costs: Start investing with as little as $50-$100.

- Diversification: Spread your investment across multiple properties or markets.

- Liquidity: Some platforms offer secondary markets so you can trade tokens anytime.

- Global access: Invest in U. S. , European, or even emerging market properties from anywhere.

If you’ve ever wished for a way to get into real estate without massive capital or paperwork headaches, tokenization is your answer.

Your Step-by-Step Guide: Invest in Tokenized Real Estate with $100

The process is refreshingly straightforward. Here’s what every beginner should know about getting started:

Select the Right Platform (and Why It Matters)

The platform you choose will shape your experience and returns. Today’s top global property token platforms include:

Top Tokenized Real Estate Platforms for $50-$100 Investments

-

RealT — Invest in U.S. rental properties with as little as $50. RealT offers fractional ownership, allowing you to earn rental income and trade tokens on secondary markets. Properties are fully vetted and managed, making it easy for beginners to start.

-

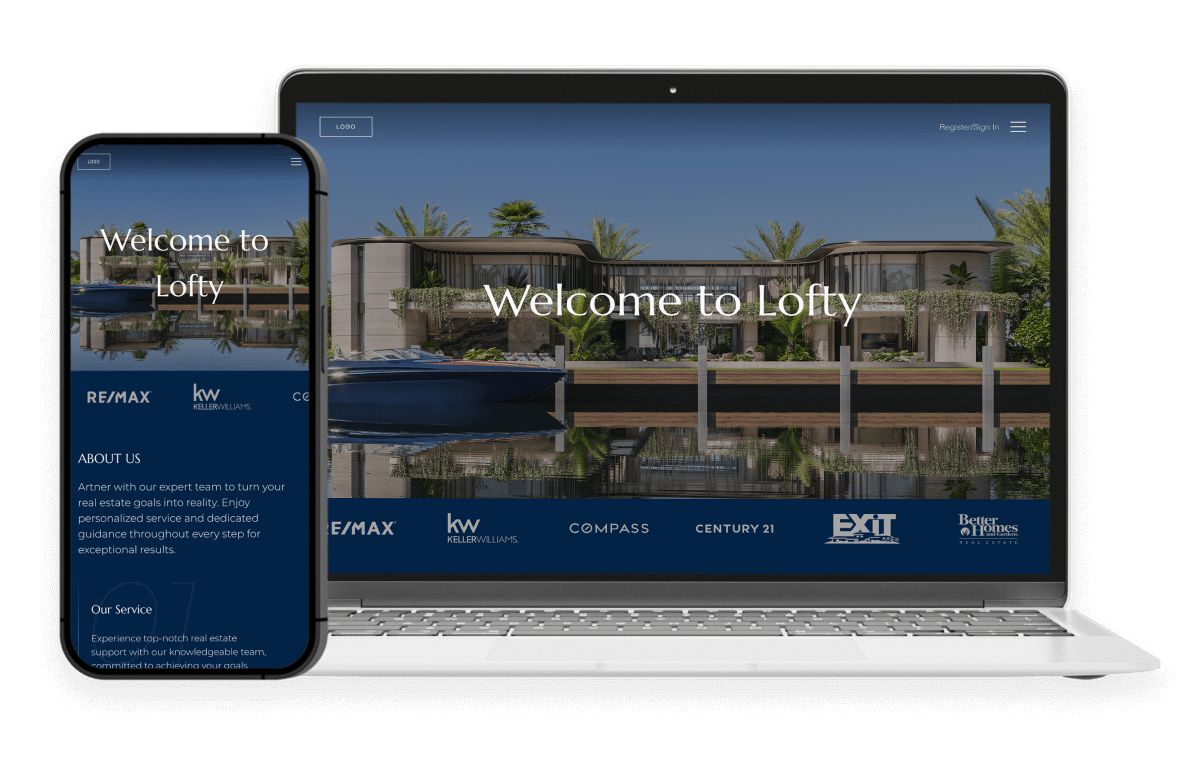

Lofty — Start investing in single-family rental properties for just $50. Lofty provides daily rental income payouts and instant liquidity through its in-platform marketplace. The platform is known for its user-friendly experience and transparent property data.

-

Propbase — Own fractions of global real estate assets starting at $100. Built on the Aptos blockchain, Propbase enables users to purchase tokens representing curated properties, with rental yield distributed to investors.

-

EstateX — Invest in fractional property shares with a minimum of $100. EstateX focuses on making real estate accessible, offering daily rental yield and a growing selection of tokenized properties across Europe and beyond.

RealT: Fractional U. S. rental properties with investments starting at just $50.

Lofty: Single-family rentals from $50 minimum.

EstateX and Propbase: Both offer curated international property deals, with minimums as low as $100.

Each platform has its own flavor, some focus on residential rentals with steady yields, others on commercial buildings or even global vacation homes.

KYC and Account Setup: Your Digital Key to Property Ownership

No skipping this step! After picking your platform, you’ll need to register and complete KYC (Know Your Customer) and AML (Anti-Money Laundering) verification. Expect to provide ID documents and basic personal info, this isn’t just bureaucracy; it’s what keeps the space secure and compliant with regulations worldwide (learn more here). Most platforms make onboarding fast and user-friendly so you can get started within minutes.

Add Funds and Explore Properties: Where the Magic Happens

You’re almost ready to become a digital landlord! Once verified, fund your account using bank transfer, credit card, or even crypto (depending on the platform). Double-check any deposit fees or minimums, most platforms let you start right at the crucial $50-$100 threshold. Then browse available properties by location, asset type (residential/commercial), expected yields, and legal docs before making your pick.

With your account funded, it’s time for the fun part: buying your first property tokens. Each token represents a slice of real estate ownership, think of it as holding digital keys to a portion of a physical property. Decide how much you want to invest (as little as $50 or $100 on platforms like RealT, Lofty, EstateX, or Propbase), then confirm your purchase. The process is transparent and typically takes just a few clicks. You’ll receive instant confirmation and can track your holdings in the platform dashboard.

Track Returns and Stay Engaged: Managing Your Digital Portfolio

After purchasing your tokens, you’ll unlock access to live dashboards showing property performance, rental income distributions, appreciation, and market updates. Many platforms pay out rental yields directly to your wallet, sometimes weekly or monthly, so you can literally watch your investment grow in real time.

Some marketplaces even feature secondary markets, letting you sell or trade tokens with other investors if you want to cash out early or rebalance your holdings. This liquidity is a massive advantage over traditional real estate, where selling often means months of paperwork.

Pro Tips for First-Time Token Investors

- Diversify: Don’t put all $100 into one property, spread across different assets or even multiple platforms for less risk.

- Research returns: Compare expected rental yields, occupancy rates, and local market trends before buying tokens.

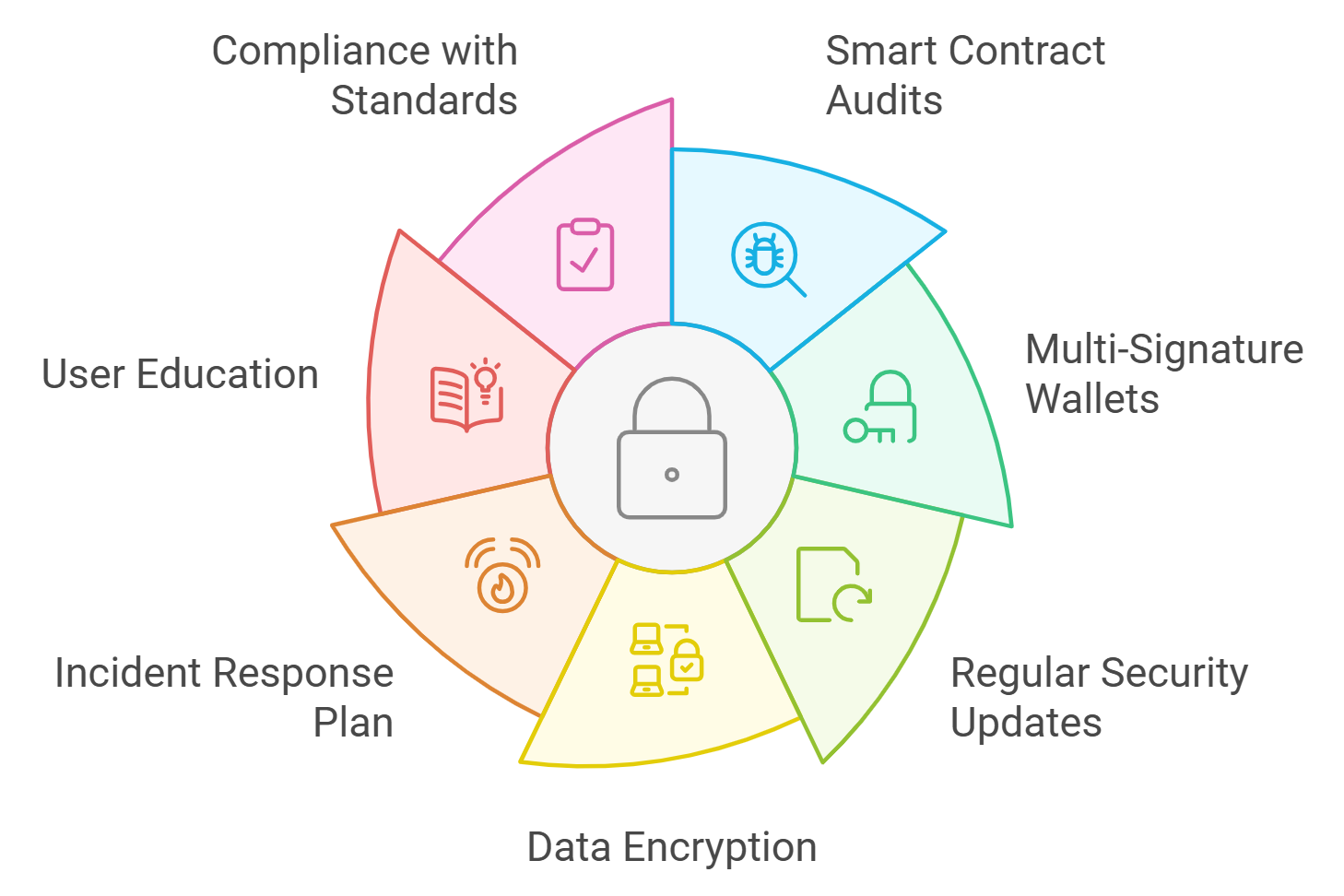

- Stay compliant: Only use regulated platforms that offer full transparency on legal docs and KYC/AML procedures.

- Understand tax implications: Rental income may be taxable in your country; consult with a tax professional for peace of mind.

From $100 to Global Property Owner: What’s Next?

The best part about starting with just $100 is the flexibility it gives you. You can reinvest your rental earnings into more tokens, diversify across continents (imagine holding shares in Miami condos and European villas), or experiment with different asset types like commercial spaces. As platforms mature and regulations evolve, expect even more features, think automated yield reinvestment or instant cross-border transfers.

If you’re ready to take action now, or just want to explore what’s possible, check out top guides from industry leaders like Polytrade, RealT, and Tokenizer Estate. The world of tokenized property is open, for anyone with ambition and $100 to spare.