Real estate has long been the playground of the wealthy and well-connected. Traditionally, if you wanted a piece of a prime property in London, New York, or Singapore, you needed deep pockets and months to navigate legal and financial hurdles. But thanks to blockchain technology and the rise of tokenized real estate liquidity, this landscape is changing fast. Investors today can access global real estate markets with just a few clicks – and, crucially, they can buy and sell their holdings with unprecedented speed.

Tokenization: Turning Bricks Into Digital Assets

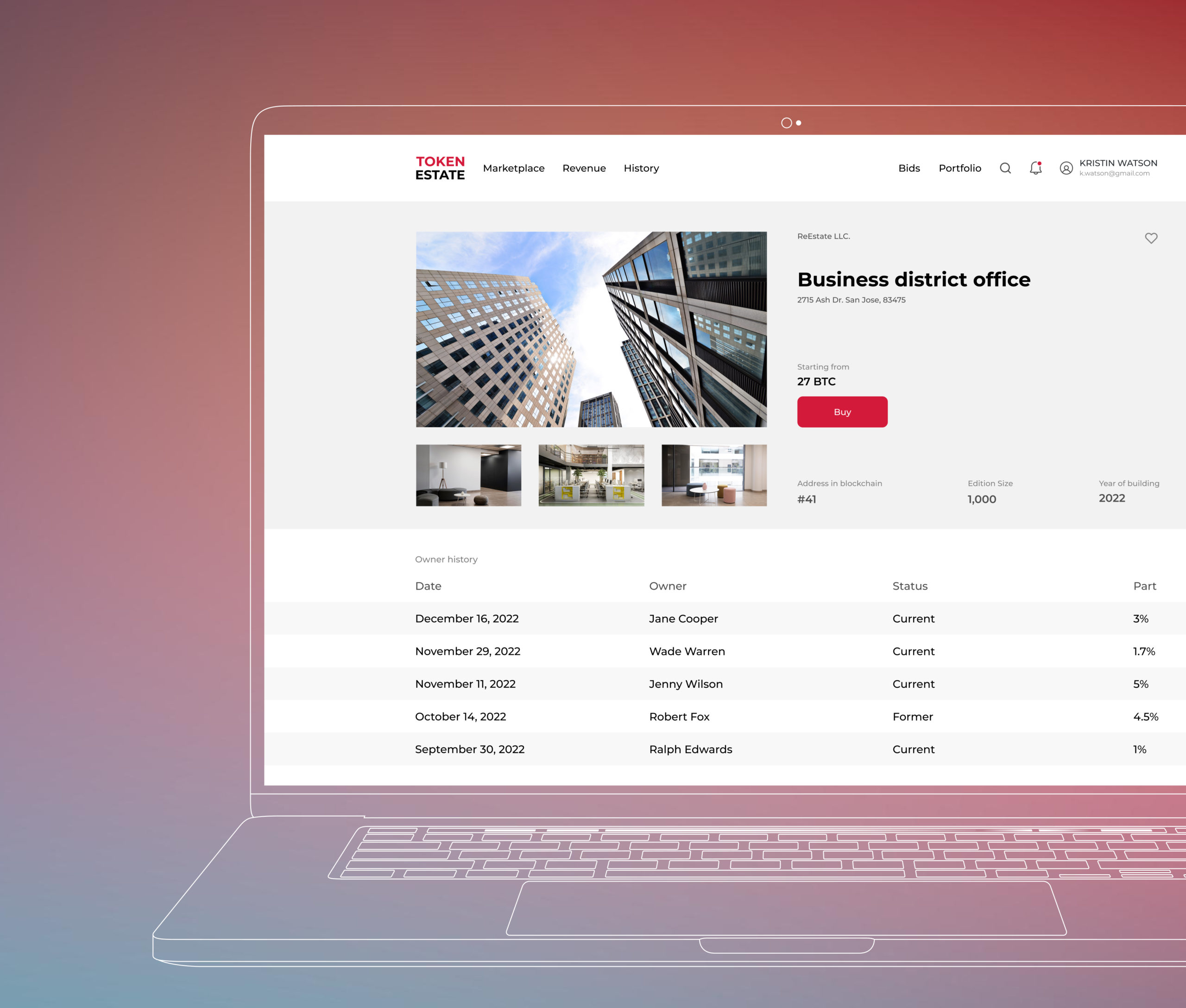

At its core, fractional property ownership blockchain solutions break up a property into digital tokens. Each token represents a fraction of ownership in the asset – think of it as owning one slice of a multi-million-dollar pie. These tokens are recorded on an immutable blockchain ledger, making transactions transparent and secure.

This process solves one of real estate’s biggest headaches: illiquidity. In the old world, selling your stake in a building could take months (or longer), often requiring you to offload your entire share at once. With tokenization, you can sell just a portion – or even a single token – on secondary markets that operate 24/7. No more waiting for buyers or dealing with paperwork mountains.

Unlocking Global Real Estate Token Investment

The magic doesn’t stop at liquidity. Tokenized real estate smashes through borders, giving anyone with an internet connection access to properties worldwide. Whether you’re in Berlin or Buenos Aires, you can invest in fractional shares of high-value assets across continents – all without jumping through regulatory hoops designed for billionaires.

This global reach drives up demand and competition for quality properties. As highlighted by Deloitte and Hedera’s recent reports, expanding the investor pool to a worldwide audience often leads to higher valuations for tokenized assets. It’s not just about making it easier to buy; it’s about unlocking new value for both investors and property owners.

Top Benefits of 24/7 Trading Property Tokens

-

Fractional Ownership: Investors can purchase small fractions of properties, making high-value real estate accessible with minimal capital. This is a key feature on platforms like RealT and Brickblock.

-

Lower Transaction Costs: Blockchain-based trading of property tokens reduces the need for intermediaries, cutting down on fees and administrative expenses. This efficiency is seen on platforms like tZERO and Brickblock.

Lowering Barriers: Real Estate Accessibility on Blockchain

Perhaps the most powerful impact is how real estate accessibility blockchain platforms democratize investment opportunities. No longer do you need $500,000 to get started; with tokenization, minimum investments can be as low as $100 (sometimes even less). This opens doors for everyday investors who want exposure to real assets but lack institutional-level capital.

The ability to buy or sell tokens at any time also gives investors more control over their portfolios. Need liquidity? Sell some tokens instantly rather than waiting months for a traditional sale process. Want to diversify? Spread your investment across multiple properties in different regions or sectors without breaking the bank.

If you want a deep dive into how these innovations are increasing liquidity for global investors, check out this resource: How Real Estate Tokenization Increases Liquidity For Global Investors.

Of course, with every disruptive innovation comes a new set of considerations. While tokenized real estate is shaking up the old guard, it’s not without challenges. Regulatory frameworks are still catching up, and the technological infrastructure behind these platforms must be robust enough to guarantee security and compliance for users across jurisdictions. Investors should always do their due diligence on the underlying asset, platform reputation, and local legal requirements before diving in.

That said, the momentum is undeniable. Secondary markets for global real estate token investment are growing rapidly, offering increased transparency and price discovery that was once unthinkable in traditional real estate. The ability to trade tokens around the clock means investors are no longer at the mercy of slow-moving intermediaries or outdated processes. This 24/7 environment is already attracting a new generation of digitally native investors who value speed, flexibility, and global reach.

What’s Next? The Road Ahead for Tokenized Real Estate

The future looks bright as institutional players dip their toes into tokenized assets. Major financial firms and real estate developers are exploring partnerships with blockchain platforms to unlock new funding sources and reach broader investor bases. As regulatory clarity improves and more high-quality properties come on-chain, expect both liquidity and accessibility to accelerate even further.

Ready to explore this space yourself? Here’s a quick list of what makes tokenized real estate such a game changer:

Top Reasons Tokenized Real Estate Is Revolutionizing Investing

-

Enhanced Liquidity: Tokenization converts real estate into digital tokens, making it easier and faster to buy, sell, or trade fractional ownership stakes. This eliminates the traditional delays and complexities of property transactions, allowing investors to access funds or exit positions with greater flexibility.

-

Greater Accessibility for All Investors: By dividing properties into affordable digital tokens, tokenized real estate lowers the investment threshold. Individuals can now participate in property markets with minimal capital, democratizing access to an asset class once reserved for the wealthy or institutional investors.

-

Global Market Reach: Tokenized real estate platforms enable cross-border investments, allowing investors worldwide to access properties in different countries without the usual regulatory or logistical barriers. This global accessibility increases diversification opportunities for investors and expands the pool of potential buyers for property owners.

-

Fractional Ownership and Portfolio Diversification: Investors can purchase small fractions of multiple properties, spreading risk across various markets and asset types. This flexibility was previously unattainable in traditional real estate investing, where large capital outlays were required for each property.

-

Transparent and Secure Transactions: Blockchain technology underpins tokenized real estate, providing a transparent, immutable record of ownership and transactions. This increases trust, reduces fraud, and streamlines the due diligence process for all parties involved.

For those looking to diversify beyond stocks or crypto with tangible assets that offer yield potential and inflation protection, property tokens represent an exciting frontier. You don’t have to be a mogul or tech wizard, just curious enough to seize the opportunities now available at your fingertips.

The bottom line: Tokenization is rewriting the rules of property investing. By breaking down barriers of entry, increasing liquidity through 24/7 trading, and connecting global capital with untapped markets, it’s giving power back to everyday investors everywhere. Stay sharp, this revolution is just getting started!