Tokenized real estate is rapidly transforming how investors access and own property in the United States. By leveraging blockchain technology, investors can now purchase fractional interests in high-quality properties with unprecedented ease and transparency. But before diving into this digital frontier, understanding the legal landscape is essential. The rules are evolving, the stakes are high, and compliance is non-negotiable.

Why Tokenized Real Estate Is Gaining Ground in the US

The numbers tell a compelling story: According to Deloitte, US$4 trillion in real estate could be tokenized by 2035, up from less than US$0.3 trillion today. This surge is fueled by growing investor demand for liquidity, transparency, and global access. Tokenized property investment regulations are shaping new opportunities for accredited and non-accredited investors alike.

But what makes tokenization so attractive? It’s all about breaking down barriers to entry and unlocking fractional ownership of assets that were once reserved for institutional players. Imagine owning a piece of a Manhattan skyscraper or a luxury resort, without ever stepping foot inside or dealing with traditional paperwork.

The Legal Bedrock: SEC Regulations and Compliance

Here’s where things get serious: In the United States, most real estate tokens are classified as securities by the Securities and Exchange Commission (SEC). This means every offering must comply with federal securities laws, no shortcuts allowed. Issuers typically rely on exemptions to streamline compliance:

- Regulation D (506(c)): Enables unlimited capital raises from accredited investors with strict verification requirements.

- Regulation A and: Opens doors to both accredited and non-accredited investors (up to $75 million per year), but demands full SEC qualification.

- Regulation S: Applies to offerings outside the US, targeting non-US persons while sidestepping certain SEC rules.

If you’re evaluating a property token deal, always check which exemption applies, and whether it fits your investor profile. For a deep dive into these structures, explore our guide on legal structures behind tokenized property.

KYC, AML and Ownership Structures: Protecting Investors and Platforms

No one wants their investment tainted by illicit activity or legal ambiguity. That’s why Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are now standard practice for blockchain real estate investing USA platforms. These protocols verify investor identities and monitor transactions, protecting both issuers and buyers from regulatory pitfalls.

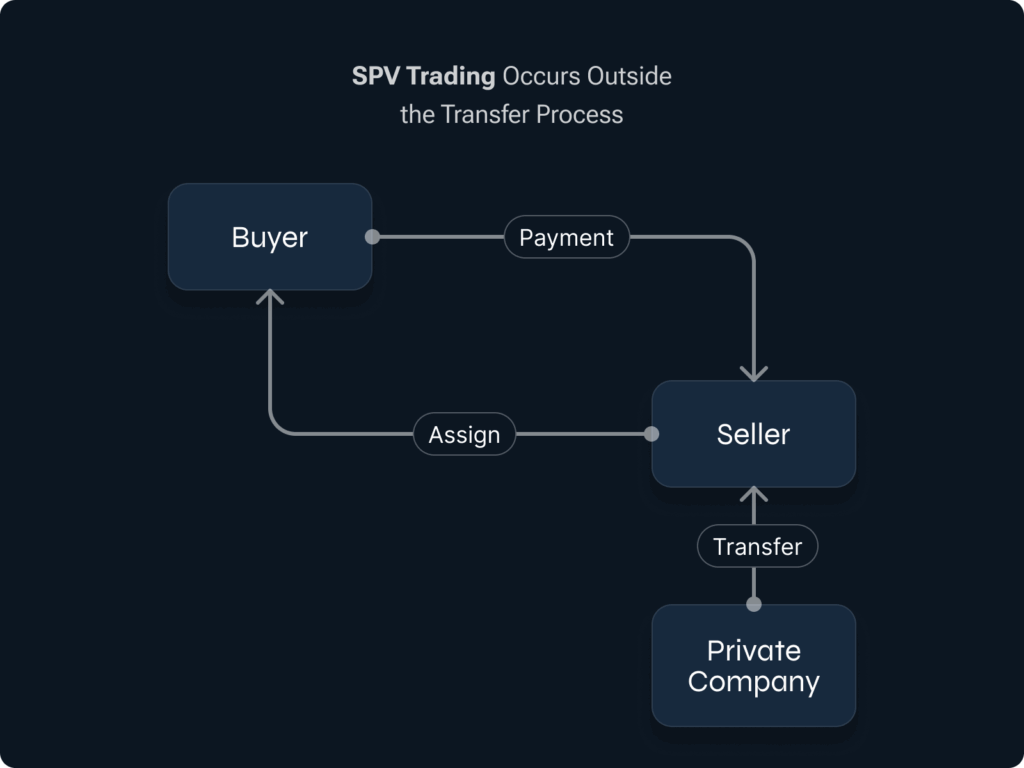

The next layer is clarifying ownership rights through robust legal structures like LLCs or Special Purpose Vehicles (SPVs). These entities hold title to the underlying property while issuing tokens that represent fractional interests, a critical step for ensuring your digital ownership translates into real-world rights.

Key Legal Considerations for US Tokenized Real Estate

-

SEC Securities Compliance: The U.S. Securities and Exchange Commission (SEC) typically classifies tokenized real estate as securities. Issuers must comply with federal securities laws, which may require registration or use of exemptions like Regulation D, Regulation A+, or Regulation S.

-

AML & KYC Requirements: Robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures are mandatory. Platforms must verify investor identities and monitor transactions to prevent illicit activities, following FinCEN guidelines.

-

Property Rights & Ownership Structures: Clearly defining how token ownership relates to the underlying real estate is essential. Common legal structures include Limited Liability Companies (LLCs) or Special Purpose Vehicles (SPVs) to ensure token holders have recognized ownership interests.

-

Taxation & Reporting Obligations: Tokenized real estate transactions can trigger capital gains, income taxes, and reporting duties. Consulting with tax professionals familiar with digital assets is crucial for compliance and accurate filings.

-

Evolving Regulatory Landscape: The legal environment for tokenized real estate is rapidly changing. Investors should stay updated on new SEC guidance, state laws, and IRS positions to ensure continued compliance.

The Tax Picture: Don’t Get Caught Off Guard

Tokenized real estate investments can trigger capital gains taxes on sales as well as income taxes on distributed profits. The IRS has yet to issue comprehensive guidance specific to property tokens, making it vital to consult tax professionals who understand both digital assets and traditional real estate rules. Stay proactive, tax surprises can erode returns faster than you think!

The bottom line? Investing in tokenized real estate offers immense possibilities, but only if you respect the legal framework that underpins this new asset class.

Best Practices for Navigating Tokenized Real Estate Investments

With the legal complexities mapped out, let’s focus on actionable steps. How do savvy investors actually approach tokenized property investment regulations and minimize risk in this fast-changing space?

1. Conduct Deep Due Diligence: Don’t just skim the offering documents. Scrutinize the issuer’s compliance track record, review their disclosures, and verify how they structure property rights for token holders. If you’re unsure about the underlying legal entity (LLC, SPV, trust), ask for clarity or walk away.

2. Engage Qualified Experts: The intersection of blockchain, securities law, and real estate is not a place to DIY your diligence. Retain legal counsel with experience in digital assets and real estate transactions. A seasoned tax advisor can also help you anticipate reporting requirements and optimize your tax position.

3. Stay Ahead of Regulatory Changes: The SEC regularly updates its stance on digital assets and tokenized securities. Subscribe to industry news sources or follow regulatory updates to ensure you’re never caught off guard by new compliance requirements.

Investor Protections and Platform Transparency

One of the biggest advantages of blockchain real estate investing USA style is transparency, every transaction is recorded on-chain, making it easier to audit ownership and cash flows. However, not all platforms are created equal. Look for those that provide clear reporting dashboards, regular audits, and robust investor communication channels.

Also evaluate whether the platform offers secondary market access, can you resell your tokens easily if needed? Liquidity is a major selling point but depends on both legal structuring and platform technology.

Frequently Asked Questions

Looking Forward: The Future of Property Tokens in America

The momentum behind property tokens is undeniable, Deloitte’s projection of $4 trillion in tokenized real estate by 2035 signals a generational shift in how Americans will invest. As regulatory frameworks mature and more high-quality properties come online as tokens, expect increased participation from both retail investors seeking diversification and institutions eyeing efficiency gains.

The next decade will see property ownership become as accessible as trading stocks online, but only for those who understand the rules of this new game.

If you’re ready to invest in tokenized real estate US markets or want to learn more about how LLCs and SPVs underpin secure ownership structures, keep exploring our resources at TokenREITs. com.