What if you could invest in a Manhattan apartment building, a Dubai villa, or a Miami office tower with just $100? As of mid-2025, this is no longer a hypothetical. Thanks to blockchain-powered fractional real estate ownership, property investing has become radically more accessible, borderless, and dynamic than ever before. Over $7 billion worth of property has already been tokenized globally, with more than 1.2 million investors participating through platforms that let anyone buy digital fractions of real-world assets.

Breaking Down the Barriers: How Blockchain Democratizes Property Investment

Traditional real estate investing has always favored the well-capitalized and well-connected. Minimum investments in commercial properties typically run into six figures or more. Geographic restrictions and complex legal frameworks further limit access for smaller investors and those outside major financial hubs.

Blockchain technology flips this script by tokenizing property ownership. In simple terms, real estate assets are split into hundreds or thousands of digital tokens on public blockchains like Ethereum. Each token represents a fractional share in the underlying property, entitling holders to rental income and appreciation. Platforms such as RealT and Homebase now enable investors from over 125 countries to participate – often with entry points as low as $100 per token.

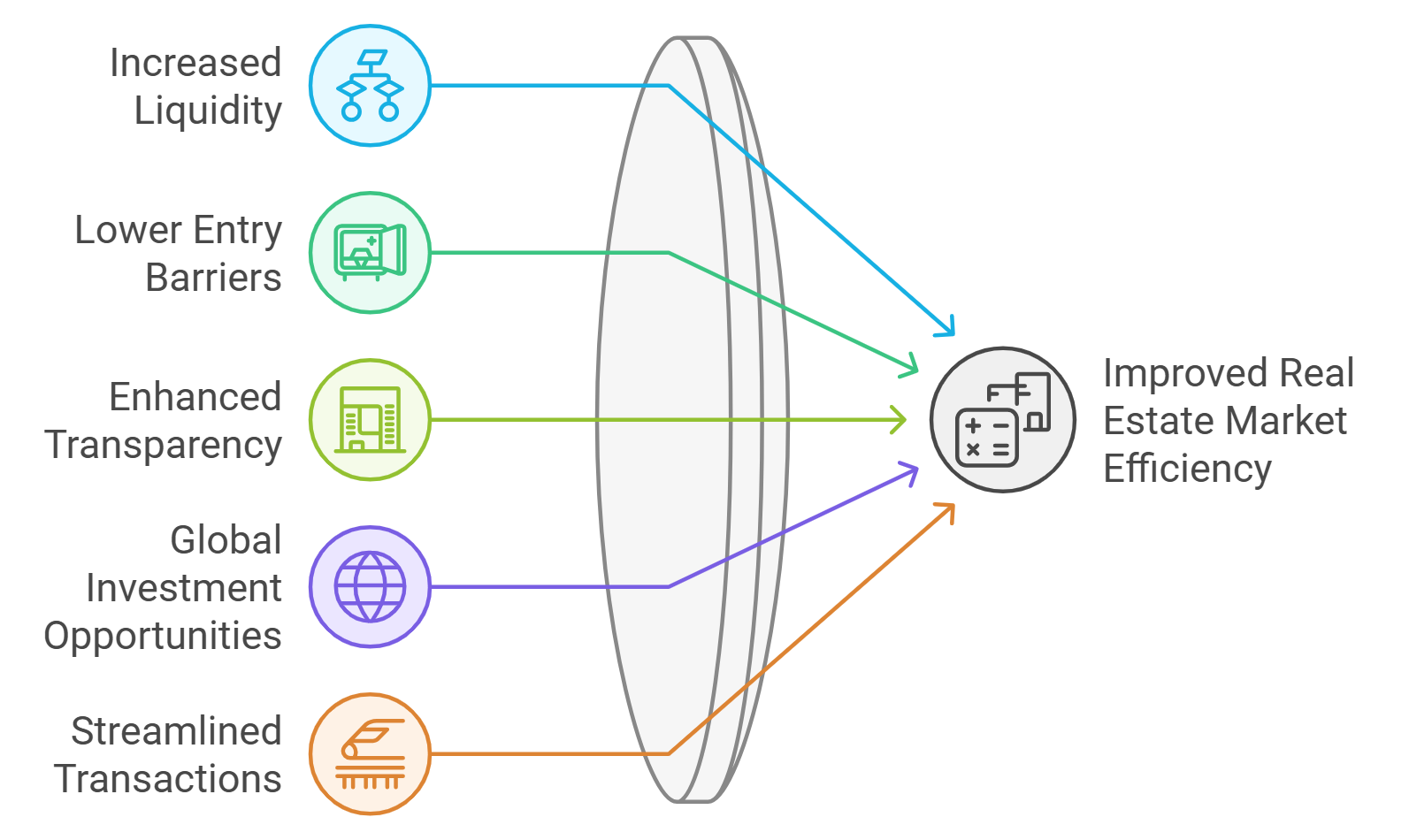

Top 5 Benefits of Fractional Real Estate Ownership via Blockchain

-

Global Accessibility: Platforms like RealT and Homebase enable investors from over 125 countries to buy fractional property shares, breaking down traditional geographical barriers.

-

Low Minimum Investment: Blockchain-based solutions such as Homebase allow participation for as little as $100, making property investment possible for a broader range of people.

-

Enhanced Transparency and Security: Transactions are recorded on public blockchains like Ethereum, providing immutable records and reducing fraud risk for investors.

-

Improved Liquidity: Tokenized real estate can be traded on secondary markets, offering investors the chance to buy or sell property shares more easily compared to traditional real estate.

-

Direct and Efficient Ownership: Smart contracts automate processes such as dividend distribution and voting, reducing administrative overhead and increasing efficiency for investors.

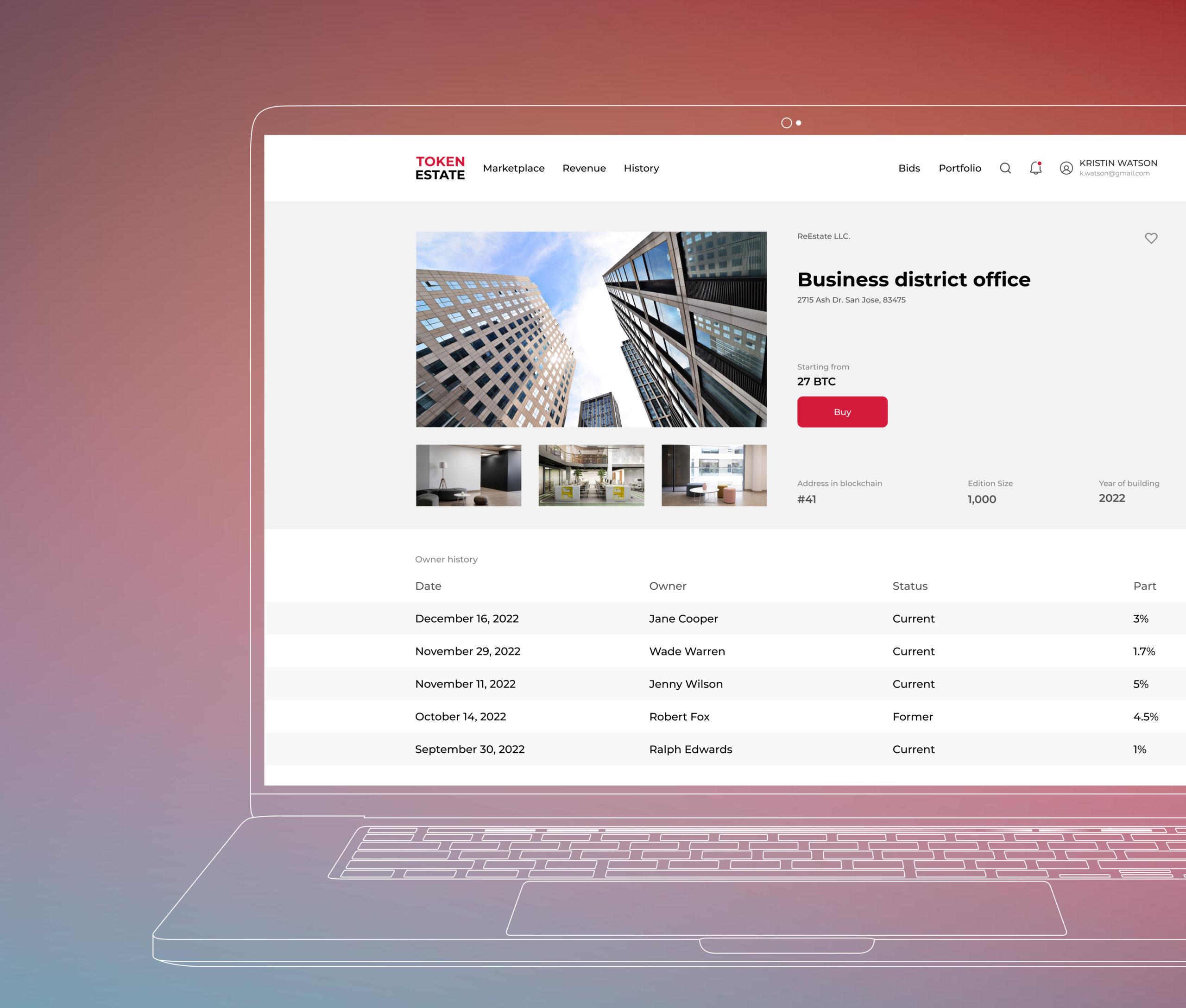

This shift is not just about accessibility; it’s about transparency. Every transaction is recorded on-chain for full auditability. Smart contracts automate rent distributions and governance votes, reducing manual errors and administrative overhead.

The Global Expansion: From Local Deals to Worldwide Participation

The numbers tell a compelling story: over 1.2 million global investors have joined the movement toward global real estate tokenization. Platforms are partnering with US-based operators as well as leveraging government-backed frameworks in forward-thinking jurisdictions like Dubai, where clear guidelines support compliant fractional sales.

This new model erases borders for both capital and opportunity. An investor in Singapore can co-own a Texas multifamily complex alongside partners from Berlin and Buenos Aires – all managed seamlessly via blockchain protocols. The result? A new era where prime real estate is no longer reserved for institutional giants but open to individuals worldwide.

Key Platforms Leading the Charge in 2025

The ecosystem supporting blockchain property investment has matured rapidly since its early experiments. Today’s leading tokenized real estate platforms combine robust compliance frameworks with user-friendly interfaces:

- RealT: Known for single-family rentals across US cities, RealT allows global investors to earn yield from day one.

- Homebase: Offers fractional shares starting at $100, making it possible for retail participants to access high-quality properties previously out of reach.

- Securitize: Facilitates regulated tokenized REITs that can be traded peer-to-peer or on secondary markets (though liquidity remains an evolving challenge).

- Dubai Government-backed Platforms: Set the standard for regulatory clarity in tokenized asset sales within the Middle East.

This proliferation of options means that regardless of your location or capital base, there’s likely a compliant platform ready to onboard you into global real estate investing.

Yet, as with any emerging asset class, investors must look beyond the glossy marketing. While fractional real estate ownership has removed many traditional barriers, it hasn’t made risk obsolete. Liquidity remains a persistent challenge; despite $7 billion in tokenized property and over 1.2 million participants as of mid-2025, secondary trading volumes for property tokens are still modest. Many investors find themselves holding tokens for months or years, waiting for either buybacks or rare peer-to-peer trades.

Regulatory clarity is improving but far from universal. Dubai’s government-backed platforms are a model of compliance and transparency, but other regions lag behind. US-based platforms must navigate a patchwork of securities laws, while cross-border tax treatment for rental income and capital gains can be confusing for global participants. The maturation of property tokens compliance will be a key theme to watch over the next cycle.

“Tokenization lets me diversify into properties I never dreamed I’d own, but I always check the platform’s legal structure and exit options. “

What Fractional Ownership Means for Investment Strategy

The strategic implications are profound. Investors can now construct globally diversified portfolios by allocating small amounts across multiple markets, property types, and risk profiles, all without intermediaries or legacy paperwork. This granular allocation was previously only possible for institutions with deep pockets and legal teams.

With minimum investments as low as $100 per token, retail investors can access property-backed yields that were once locked behind private equity gates. Rental income is distributed automatically via smart contracts, creating a new paradigm of passive income that is both programmable and transparent.

3 Ways Tokenized Real Estate Transforms Portfolios

-

Global Diversification Made Simple: Platforms like RealT enable investors from over 125 countries to purchase fractional shares of properties worldwide, breaking down geographical barriers and allowing for truly global portfolio diversification.

-

Lower Capital Requirements: Thanks to tokenization on platforms such as Homebase, investors can gain exposure to real estate markets for as little as $100, making property investing accessible to a much broader range of participants.

-

Enhanced Liquidity and Flexibility: Blockchain-powered marketplaces, including RedSwan, facilitate secondary trading of real estate tokens, offering investors the potential for increased liquidity and the ability to rebalance portfolios more dynamically—though liquidity remains a developing aspect of the market.

However, due diligence remains critical: platform solvency, asset quality, governance rights embedded in smart contracts, and local regulatory status should be at the top of every checklist. Not all tokens are created equal, some offer direct claims on cashflow while others mimic more traditional REIT structures.

The Road Ahead: Opportunities and Open Questions

The momentum behind fractional blockchain property investment is undeniable, but so are its growing pains. As more jurisdictions clarify their stances and secondary markets mature, expect improved liquidity and broader acceptance among both retail and institutional players.

If you’re considering your first step into this space or looking to deepen your exposure, focus on platforms with proven track records and transparent operations. Stay informed about evolving regulations in your jurisdiction, especially if you plan to invest across borders.

The future of real estate investing is being built right now by those willing to embrace change, not just in technology but in mindset. For the first time ever, owning a piece of global prime property is just a few clicks (and $100) away.