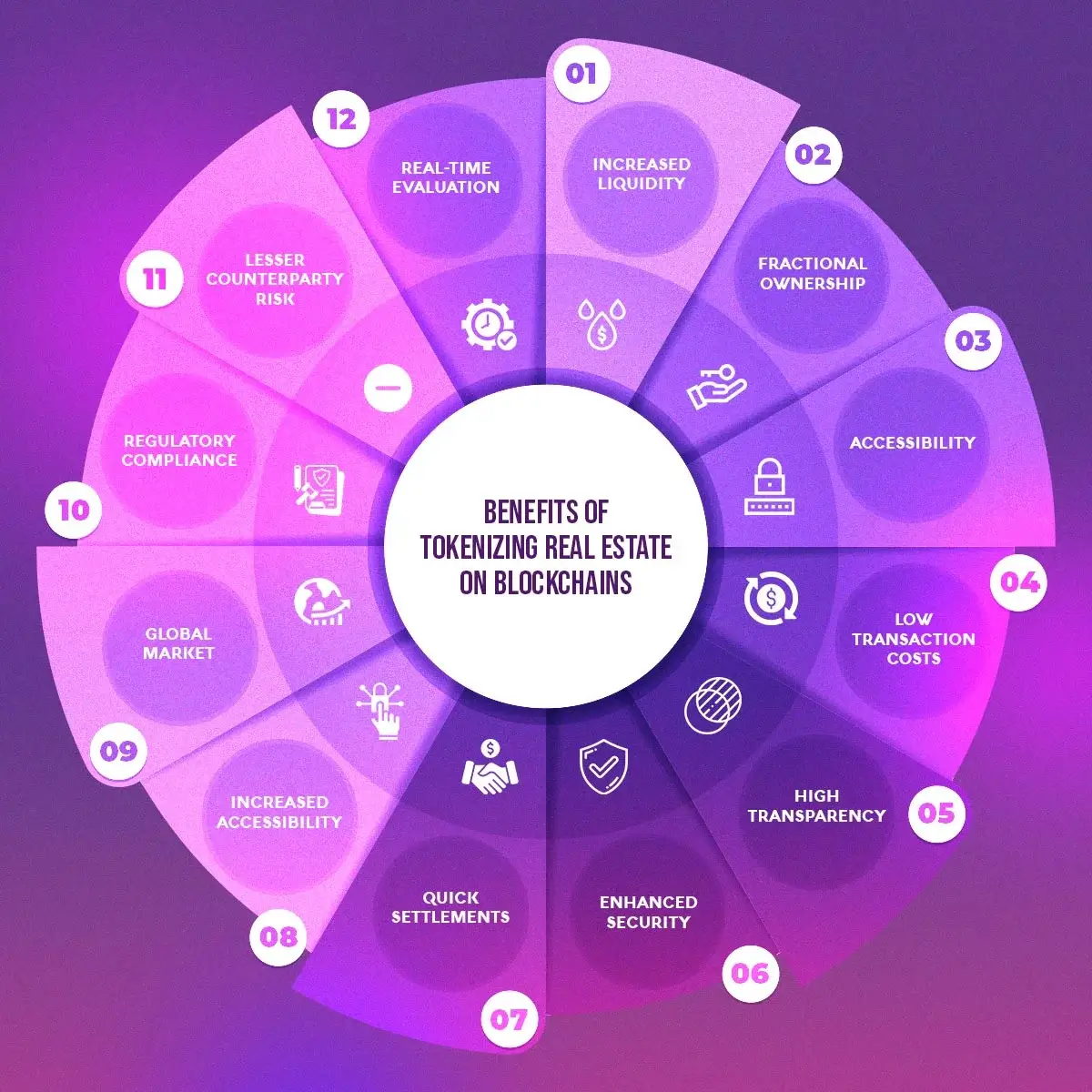

Fractional ownership in on-chain real estate is fundamentally changing how investors access property markets. By leveraging blockchain technology, this model allows individuals to purchase digital tokens that represent actual shares of a physical property. This not only lowers the traditional barriers to entry but also brings enhanced liquidity, transparency, and efficiency to real estate investing. In this article, we break down the precise step-by-step process that underpins fractional ownership in tokenized real estate, focusing on the legal, technical, and operational mechanisms that protect investors and streamline transactions.

Legal Structuring and Property Assessment

The journey begins with legal structuring and property assessment. The property owner works closely with legal advisors to evaluate the asset’s suitability for tokenization, ensuring all regulatory requirements are met. This often involves creating a Special Purpose Vehicle (SPV) or trust that holds the title to the property. The SPV acts as a bridge between the physical asset and its digital representation, providing a clear legal wrapper for fractional ownership. This step is critical for investor protection, as it establishes the legal rights attached to each token and ensures compliance with local and international securities laws.

“Tokenization is not just about technology; it’s about reimagining asset ownership within a robust legal framework. “

Tokenization and Smart Contract Deployment

Once the legal structure is in place, the next phase is tokenization and smart contract deployment. Here, the SPV’s ownership rights are digitally represented as blockchain tokens. A smart contract is created to govern these tokens, defining not just how many tokens are issued, but also the rules for ownership transfer, voting rights, and income distribution. This contract is self-executing, ensuring that all transactions and distributions occur according to predefined rules without manual intervention. Platforms such as RealT or Lofty AI use audited smart contracts to minimize risk and provide full transparency to investors.

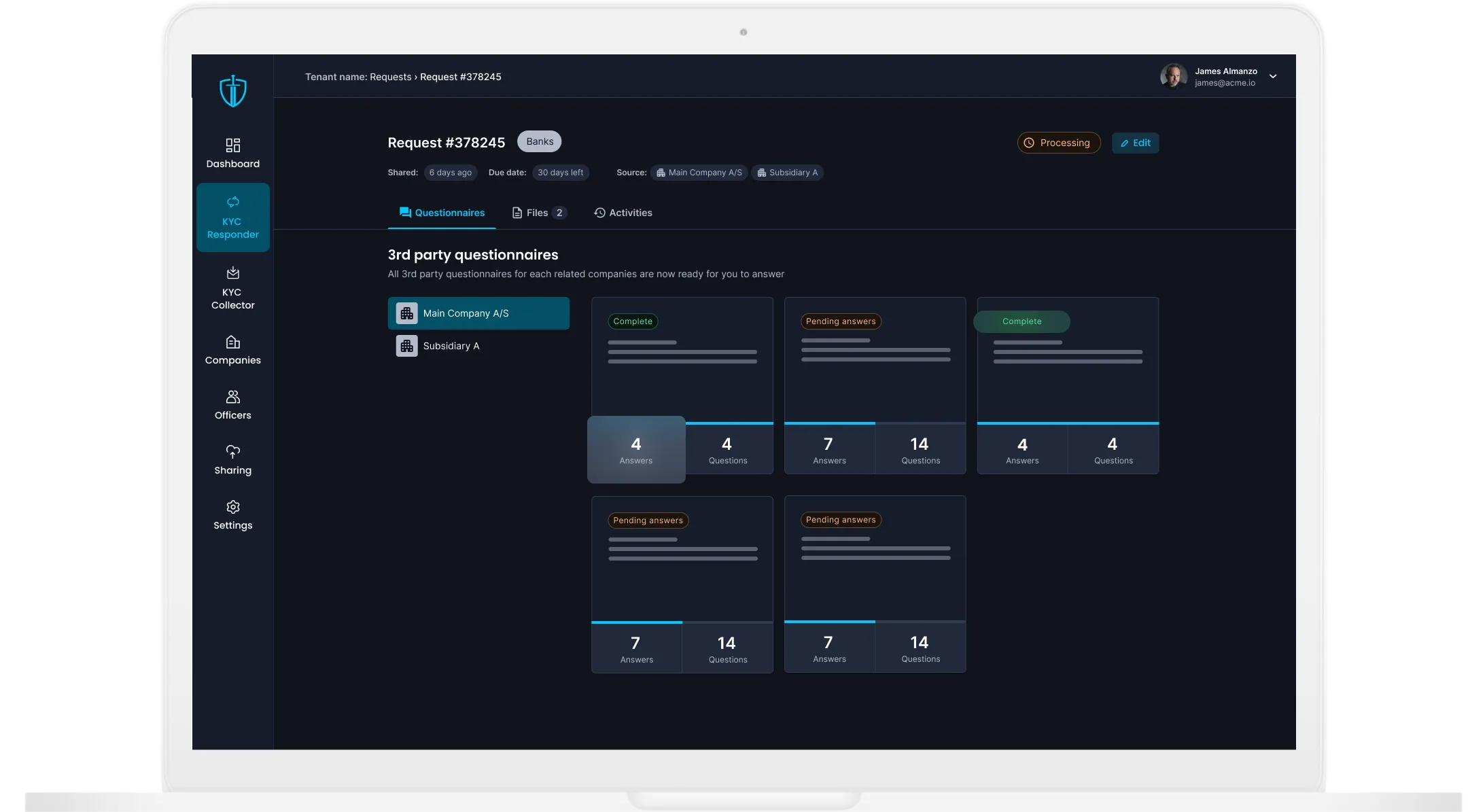

Investor Onboarding and KYC/AML Verification

With the property tokenized, potential investors must go through a robust onboarding process. This includes registering on a compliant platform and completing Know Your Customer (KYC) and Anti-Money Laundering (AML) verification. These procedures are essential for regulatory compliance and help prevent illicit activity within the ecosystem. Once verified, investors can review available properties and select the number of tokens they wish to purchase, each token representing a proportional share in the underlying asset.

Step-by-Step Investor Onboarding for Fractional Real Estate Tokens

-

Legal Structuring and Property Assessment: The property owner collaborates with legal experts to assess the asset, ensure regulatory compliance, and establish a Special Purpose Vehicle (SPV) or trust. This legal entity holds the property and forms the foundation for compliant tokenization.

-

Tokenization and Smart Contract Deployment: The property is digitally represented as blockchain tokens. A smart contract is deployed to define ownership rights, governance mechanisms, and rules for income distribution, ensuring transparency and automation.

-

Token Purchase and Blockchain Settlement: Investors purchase property tokens using fiat or cryptocurrency. Transactions are recorded on-chain, instantly updating the blockchain-based ownership ledger for transparency and security.

-

Automated Rental Yield Distribution: The platform collects rental income and distributes it proportionally to token holders via smart contracts. Payments are sent directly to investors’ crypto wallets, ensuring efficiency and transparency.

This step-by-step approach ensures that both legal and technical safeguards are in place before any capital is committed, giving investors confidence in the integrity of their on-chain property investment.

Token Purchase and Blockchain Settlement

Following onboarding, investors proceed to token purchase and blockchain settlement. On the chosen platform, participants use fiat currency or cryptocurrencies to buy their selected number of property tokens. Each transaction is immediately recorded on-chain, updating the decentralized ledger with the new ownership details. This instant, tamper-proof settlement is a key advantage of the real estate tokenization process, eliminating the need for slow, paper-based transfers and reducing counterparty risk. The blockchain’s immutable record ensures that every investor’s stake is transparently documented and easily auditable, strengthening trust in the system.

Automated Rental Yield Distribution

One of the most compelling features of on-chain fractional ownership is automated rental yield distribution. Rental income generated by the property is collected by the platform and distributed directly to token holders via smart contracts. These smart contracts calculate each investor’s share based on the number of tokens held, then automatically transfer payments to their digital wallets. This process is not only efficient but also highly transparent, as every payment is logged on the blockchain. Investors benefit from near real-time income distribution, with no reliance on intermediaries or manual accounting.

“Smart contracts don’t just automate payments, they bring a new level of accountability to rental yield distribution, making every transaction visible and verifiable on-chain. “

Why These Steps Matter for Investors

Each stage, from legal structuring to automated income, serves to reduce friction, enhance security, and democratize access to high-quality real estate assets. The use of SPVs and legal wrappers ensures clear property rights and regulatory compliance, while blockchain technology guarantees transparency and efficient settlement. Platforms like RealT and Lofty AI are setting industry standards by integrating these steps into seamless investor experiences.

Key Benefits of On-Chain Fractional Real Estate

- Lower Entry Barriers: Investors can participate with smaller capital commitments, opening up premium property markets to a wider audience.

- Enhanced Liquidity: Property tokens are often tradable on secondary markets, allowing for flexible exits and portfolio rebalancing.

- Transparency and Security: Blockchain’s immutable ledger reduces fraud risk and provides an open, auditable record of all transactions.

- Automated Yield Distribution: Smart contracts ensure timely, accurate income payments to token holders, minimizing administrative overhead.

By following this structured approach, investors can confidently explore fractional ownership real estate opportunities and harness the full potential of on-chain property investment. The integration of legal rigor, advanced technology, and automated financial flows is setting a new benchmark for transparency and efficiency in real estate markets worldwide.