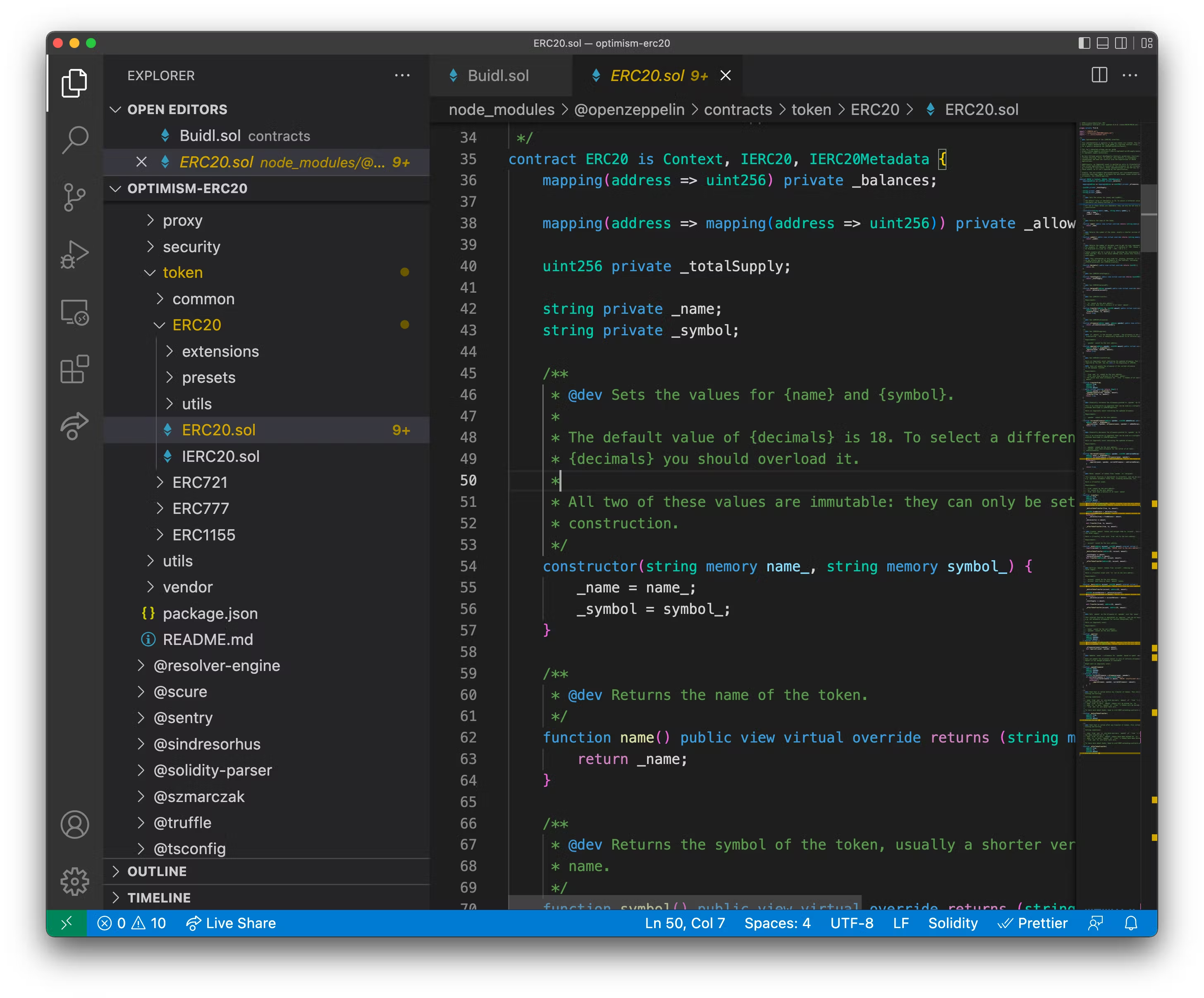

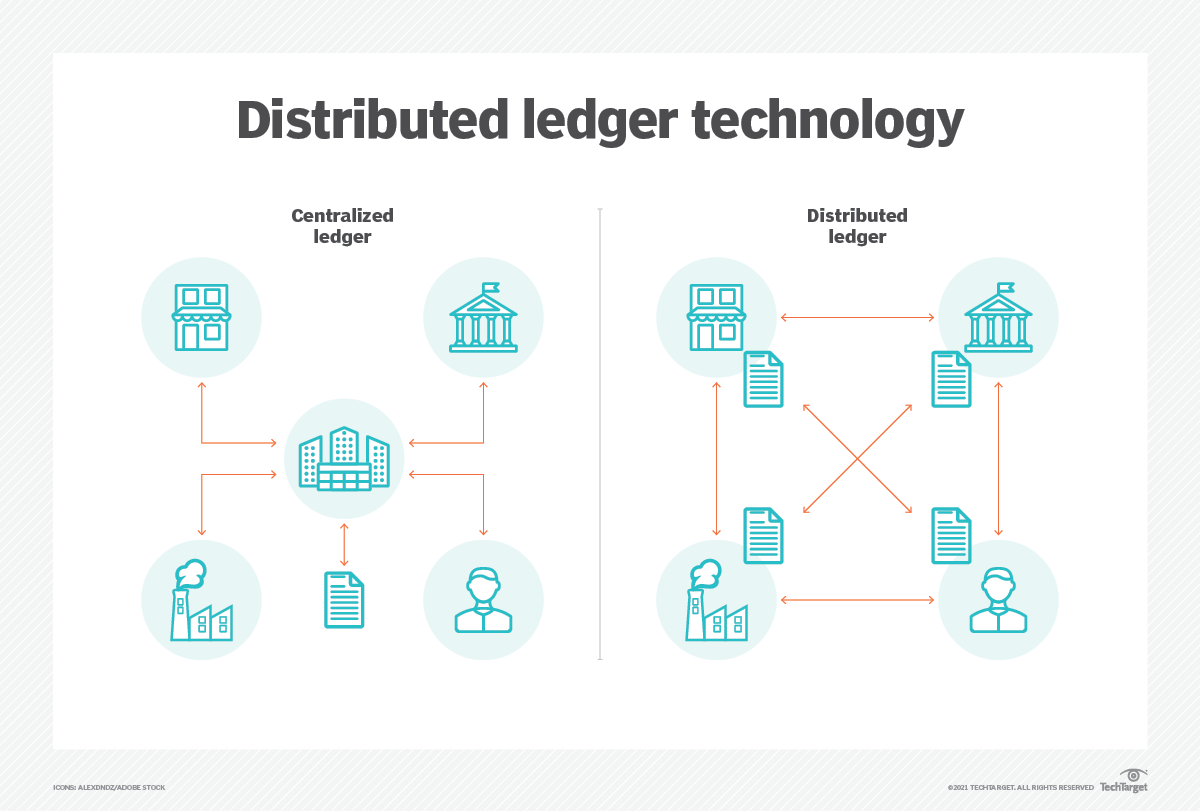

The convergence of blockchain technology and real estate investment is rapidly reshaping how investors access and benefit from property assets. At the heart of this transformation are smart contracts, which are enabling a new era of automated yield distribution in tokenized real estate. By leveraging programmable agreements on the blockchain, these systems streamline everything from rental income payments to ownership transfers, fundamentally changing the investor experience.

How Smart Contracts Transform Rental Income Distribution

Traditionally, distributing rental income from real estate investments has involved layers of intermediaries, manual calculations, and administrative delays. With tokenized real estate, each property is divided into digital tokens, representing fractional ownership. Investors who hold these tokens are entitled to a proportional share of income generated by the property, such as rent or dividends.

Smart contracts automate this process by executing programmed rules on-chain. When rental income is received, the smart contract instantly calculates the precise share owed to each token holder and distributes funds directly to their digital wallets. This eliminates delays, reduces costs, and minimizes human error.

“In tokenized ecosystems, this income is automatically distributed among token holders through smart contracts, ensuring transparency and efficiency. ” – Kenson Investments

Key Benefits: Transparency, Efficiency, Security

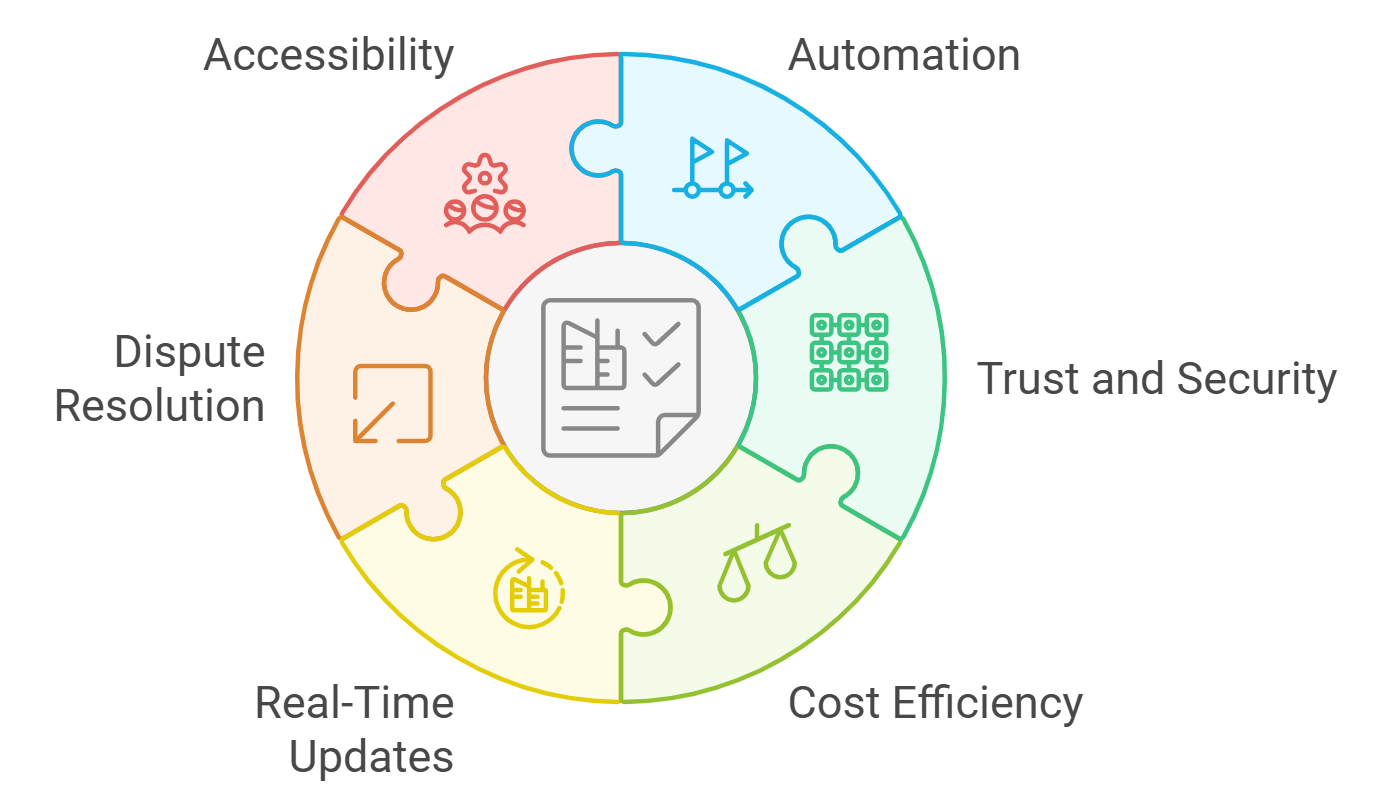

Top 5 Benefits of Smart Contracts in Property Token Yield Distribution

-

1. Enhanced Transparency: All yield distributions are recorded immutably on the blockchain, allowing investors to independently verify every transaction and ensuring a transparent audit trail.

-

2. Automated and Timely Payouts: Smart contracts, such as those used by Rentible.io, automatically calculate and distribute rental income to token holders, eliminating manual delays and ensuring investors receive payments on schedule.

-

3. Reduced Administrative Costs: By automating processes that traditionally required intermediaries, smart contracts can cut transaction and administrative costs by up to 30%, as highlighted in industry reports from platforms like Lofty.

-

4. Improved Security and Fraud Prevention: The decentralized, self-executing nature of smart contracts minimizes human error and reduces the risk of fraud, providing a more secure environment for yield distribution.

-

5. Seamless Compliance and Auditability: Platforms such as Elysia Real Estate and LaProp utilize smart contracts to automate compliance checks and provide a clear, auditable record of all distributions, simplifying regulatory oversight.

The advantages of blockchain rental income automation extend far beyond speed. Here are some critical benefits:

- Transparency: Every transaction is recorded on an immutable blockchain ledger. Investors can independently verify distributions at any time.

- Efficiency: Automation slashes administrative costs – platforms like Lofty report up to 30% reduction in transaction expenses compared to legacy systems.

- Security: Funds are handled by decentralized protocols rather than centralized administrators, minimizing risks of fraud or mismanagement.

- No Intermediaries: Investors receive their share directly without relying on third-party fund managers or transfer agents.

- Programmable Compliance: Smart contracts can enforce rules for eligibility, KYC/AML checks, and even tax withholding automatically.

Real-World Examples: Platforms Leading the Way

The practical impact of fractional real estate smart contracts is already visible across several pioneering platforms. For instance, Rentible. io‘s Yield Distributor Smart Contract allows investors to deposit their tokens and receive automated payouts based on their exact ownership percentage. Similarly, Elysia Real Estate’s system ensures monthly rental distributions flow directly to token holders’ wallets via its YieldDistributor contract. Meanwhile, LaProp utilizes decentralized automation services to monitor blockchain conditions and trigger scheduled payouts with precision (details here).

This new model not only increases confidence for investors but also sets a higher standard for operational integrity in property investing. As more platforms embrace these innovations, we’re seeing a shift toward a more open and accessible real estate market powered by blockchain technology.

Beyond rental income, the automation capabilities of smart contracts extend to other critical functions within tokenized property ecosystems. For example, smart contracts can manage capital calls, dividend payments, and even enforce compliance checks in real time. This level of automation is particularly valuable for global investors, who benefit from seamless, cross-border transactions without the friction of traditional banking or legal systems.

One of the most significant shifts is the reduction of counterparty risk. Since smart contracts operate autonomously based on transparent code, the possibility of delayed or withheld payments due to human error or bad actors is drastically reduced. Investors are empowered with real-time visibility into the performance and cash flows of their assets, which is a marked improvement over opaque, quarterly reporting cycles typical of legacy real estate funds.

Investor Experience: Simplicity and Control

For everyday investors, the process of receiving yield from tokenized real estate is now as simple as holding tokens in a compatible wallet. There is no need to chase down property managers, interpret complex statements, or wait for checks in the mail. Instead, distributions land automatically in digital wallets, often in stablecoins like USDC or ETH, providing instant liquidity and flexibility. This streamlined approach is attracting a new demographic of tech-savvy investors who value transparency and control.

Top Tokenized Real Estate Platforms with Automated Yield Distribution

-

Rentible.io leverages Yield Distributor Smart Contracts to automatically distribute rental income among fractional property owners. Investors deposit their tokens, and the contract ensures proportional, transparent, and timely payments based on each holder’s stake.

-

Elysia Real Estate features a sophisticated YieldDistributor contract that handles monthly rental income payments directly to token holders. The platform automates the calculation and distribution of yields, enhancing efficiency and transparency for investors.

-

LaProp integrates decentralized automation services to optimize rent distributions via smart contracts. Their system monitors blockchain conditions and triggers payouts precisely as scheduled, ensuring reliability and timeliness for all investors.

It’s also worth noting that programmable compliance within smart contracts ensures regulatory requirements are met without slowing down transactions. KYC/AML checks, investor eligibility, and even tax withholding can all be embedded into the contract logic, reducing legal risks and operational headaches for both issuers and investors.

What’s Next for Blockchain Rental Income Automation?

Looking ahead, we can expect continued evolution in how automated yield distribution is implemented. As tokenized real estate matures, more sophisticated smart contracts will enable features like dynamic fee structures, automated reinvestment options, and customizable payout schedules. Platforms are likely to integrate with decentralized finance (DeFi) tools, allowing property tokens to be used as collateral or staked for additional yield streams.

Market data shows that transaction costs can be reduced by up to 30% through smart contract automation, as reported by Lofty. As adoption grows, these savings could be passed on to investors in the form of higher net yields or lower entry barriers. The result is a more inclusive property investment landscape, one where fractional ownership, instant liquidity, and transparent cash flows become the norm rather than the exception.

“Smart contracts can handle periodic rental income payouts directly to token holders’ wallets, minimizing delays and administrative costs. ” – Blockchain App Factory

For those considering their first steps into tokenized property income distribution, now is an opportune time to explore platforms that leverage smart contracts for automated yield. As always, due diligence remains crucial, investors should assess platform security, contract audit status, and regulatory compliance before allocating significant capital.

The future of real estate investing is programmable, transparent, and automated. With smart contracts at the core of blockchain rental income automation, investors gain access to a new generation of income-generating assets, efficiently managed and distributed at the speed of code.