Imagine owning a piece of a luxury apartment building in Miami or a bustling commercial property in London – not as a millionaire, but as an everyday investor with just $50 in your digital wallet. That’s the new reality thanks to fractional ownership in tokenized real estate. Blockchain-powered platforms are rapidly dismantling the traditional barriers that kept small investors out of prime real estate, offering unprecedented access, liquidity, and transparency.

Tokenization: The Real Estate Game Changer

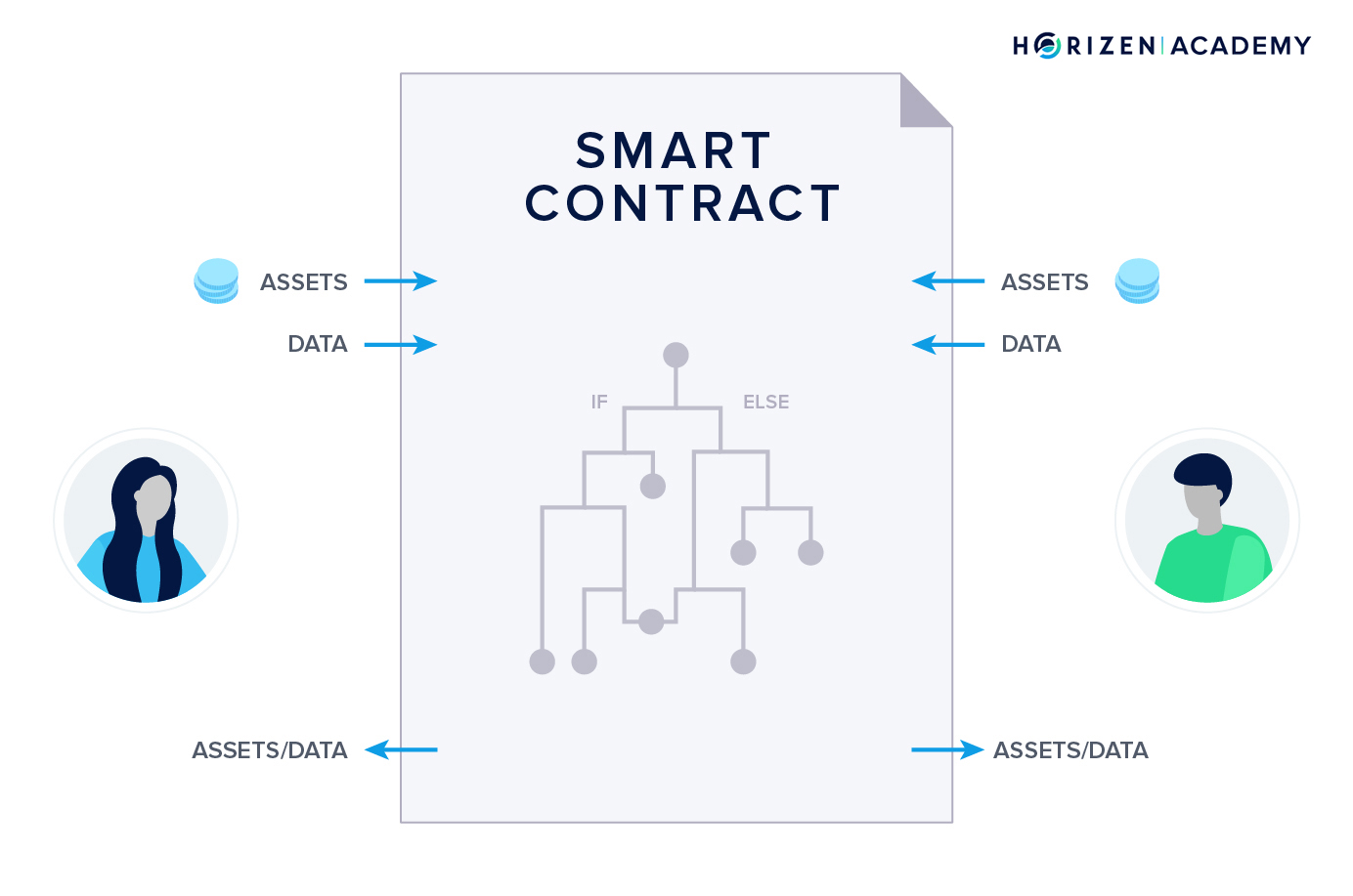

At its core, tokenization means creating digital tokens that represent fractional shares of physical properties. These tokens live on blockchains like Ethereum, making them secure, transparent, and easily tradable. Instead of needing hundreds of thousands for a down payment, investors can now buy into properties with as little as $50 – a seismic shift from the old world of real estate investing.

This isn’t just theoretical. Platforms like RealT and Lofty AI are already letting users buy property shares for under $100. Each token gives you rights to rental income, appreciation, and even voting on property management decisions – all recorded immutably on-chain. Read more about how these platforms lower investment barriers here.

Why Fractional Ownership Matters for Small Investors

Fractional ownership is more than just splitting up properties; it’s about democratizing wealth-building opportunities. Here’s why this matters:

- Diversification: Instead of putting all your savings into one asset, you can spread risk across multiple properties in different markets.

- Low Minimums: Platforms like Lofty AI allow entry points as low as $50 – opening doors for students, gig workers, and anyone sidelined by traditional finance.

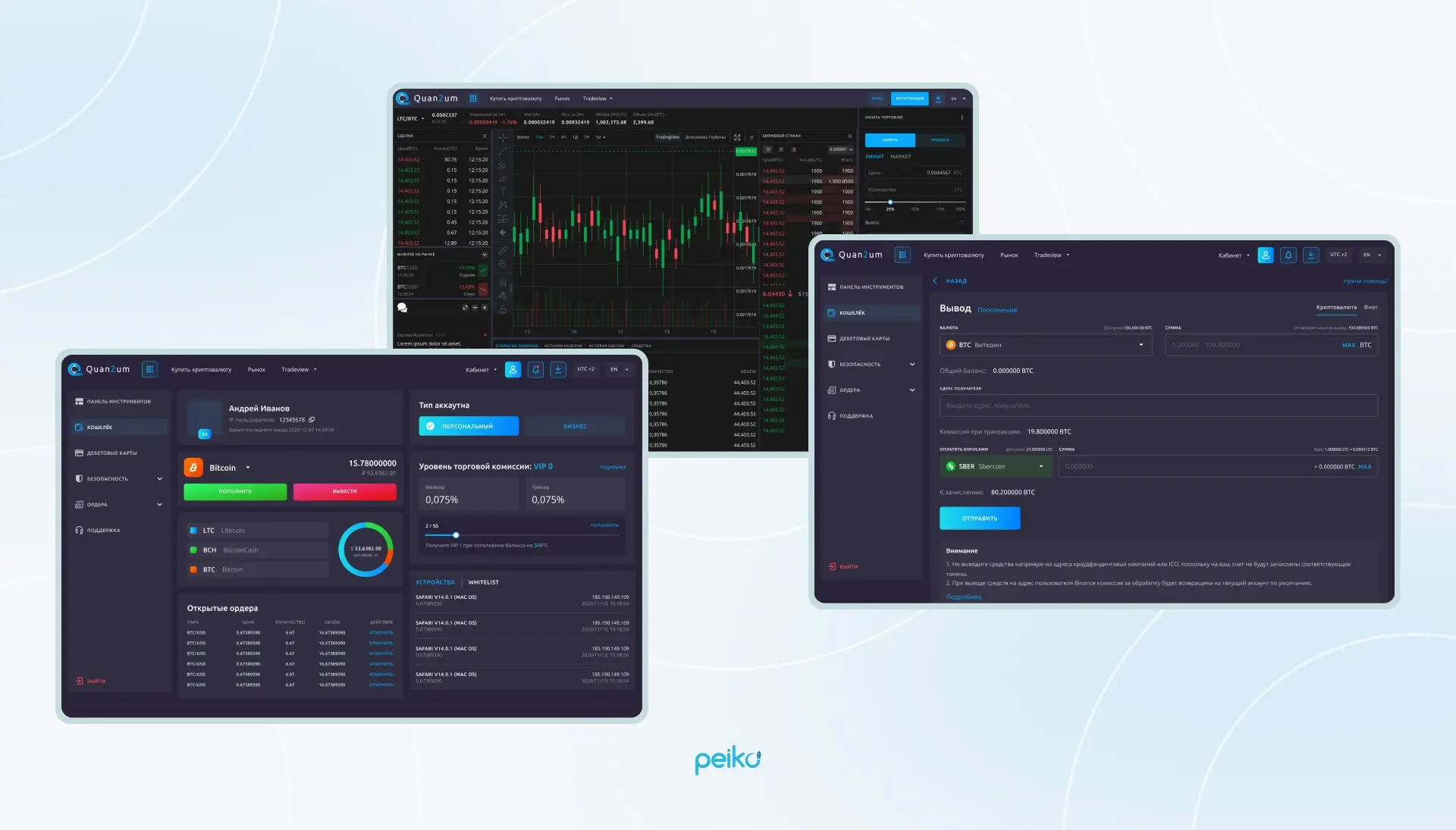

- Liquidity: Unlike conventional real estate (where sales take months), tokenized shares can be traded 24/7 on secondary markets.

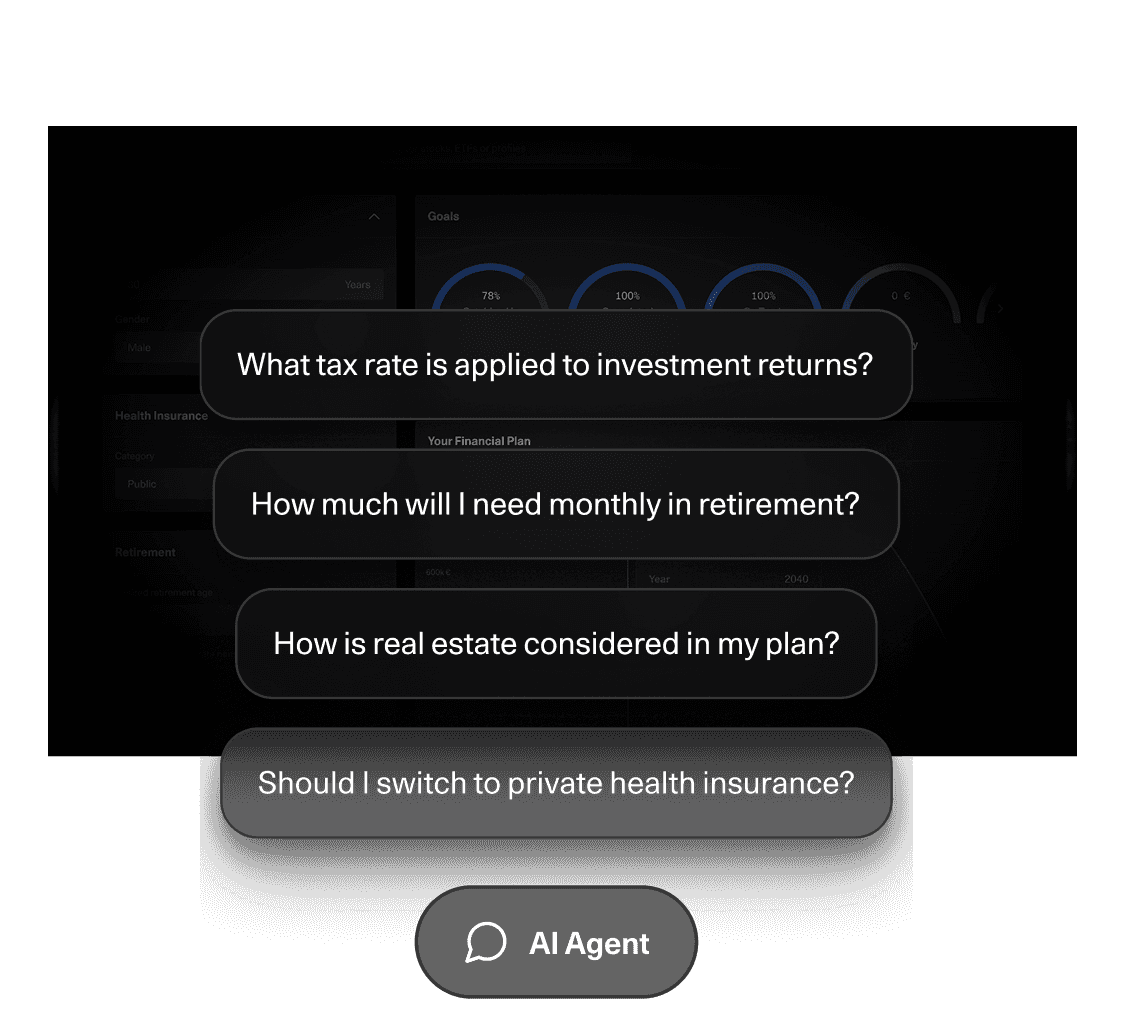

- Simplicity: Smart contracts automate rent collection and payouts, so investors receive passive income without landlord headaches.

This innovation is already attracting a new wave of digitally native investors who want exposure to global real estate without the legacy red tape or massive capital requirements. According to

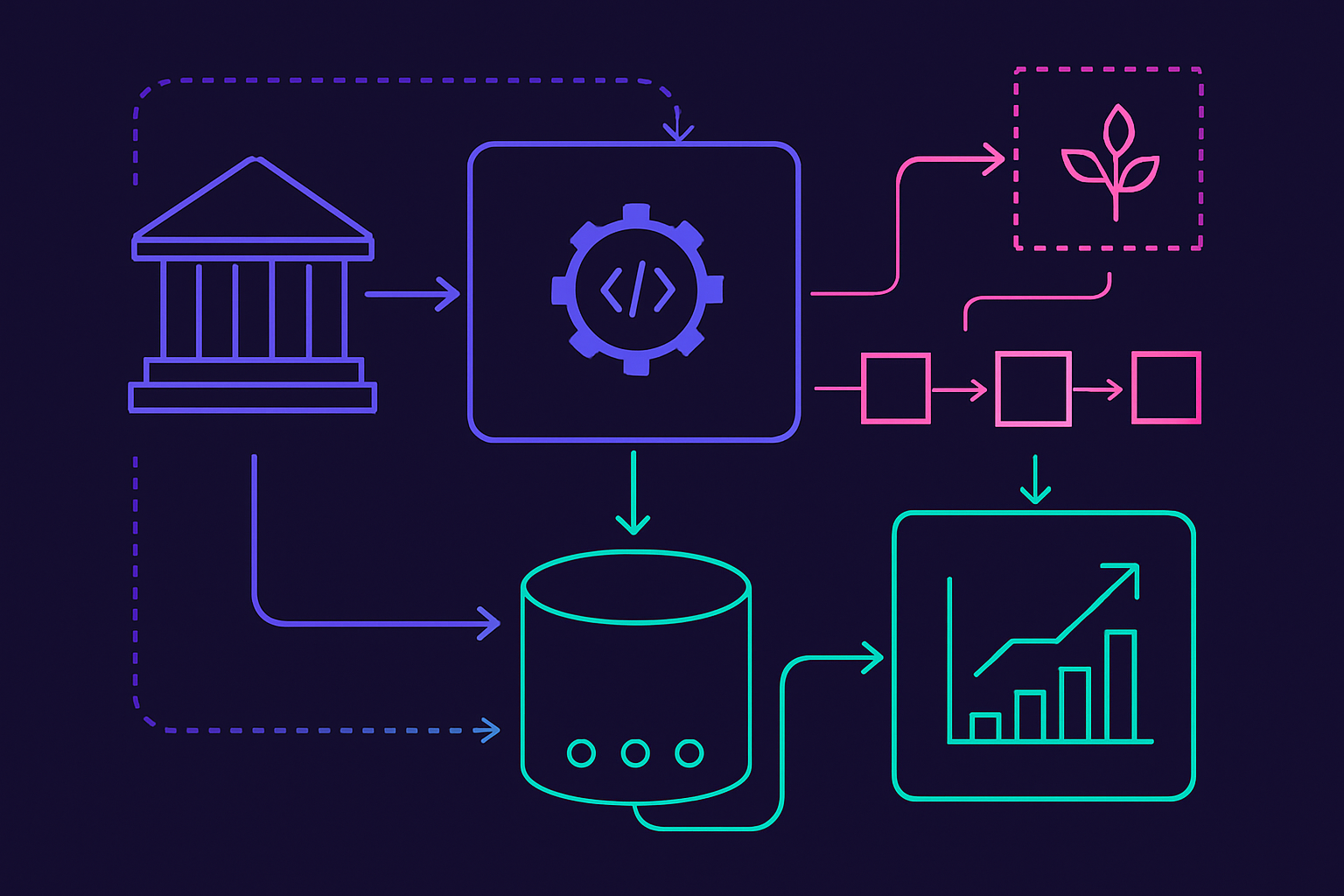

The Mechanics: How Does Tokenized Property Investment Work?

The process is refreshingly straightforward compared to old-school investing:

- A platform acquires or partners with a property owner to tokenize the asset.

- The property is divided into hundreds or thousands of digital tokens – each representing fractional ownership (e. g. , 0.01% per token).

- You sign up, complete KYC/AML checks, and purchase tokens through fiat or crypto payments.

- Your ownership stake entitles you to a proportional share of rental income and future appreciation – all tracked transparently on the blockchain.

This model removes geographic boundaries too. Want exposure to Japanese multifamily housing or US student rentals? Platforms like RealT make cross-border investing possible with just an internet connection and some spare change.

Explore how global markets are opening up here.

Security and transparency are at the core of this new paradigm. Every transaction is immutably recorded on the blockchain, making ownership records tamper-proof and accessible to all parties. Smart contracts automate rental distributions and transfers, minimizing human error and reducing administrative costs. For investors, this means less bureaucracy and more trust in the system.

Top Benefits of Fractional Real Estate Ownership

-

Low Minimum Investment: Platforms like RealT let investors start with as little as $50, making real estate accessible to almost anyone.

-

Diversification Made Easy: Fractional ownership allows investors to spread funds across multiple properties, reducing risk and increasing portfolio stability.

-

Automated Passive Income: Smart contracts on blockchain platforms automate rental income distribution, so investors receive earnings without manual intervention.

-

24/7 Liquidity: Tokenized real estate can be traded anytime on supported platforms, giving investors flexibility to buy or sell property shares when needed.

-

Global Access: Investors from around the world can participate in real estate markets previously limited by geography, thanks to blockchain-powered platforms.

-

Enhanced Transparency & Security: Blockchain records every transaction immutably, providing clear proof of ownership and reducing fraud risk.

But what truly sets tokenized real estate apart is accessibility. In 2025, leading platforms like RealT and Lofty AI have set minimum investments at just $50, enabling virtually anyone to get started. This is a game-changer for those who previously saw real estate as out of reach due to high upfront costs or lack of connections. Now, students, freelancers, or even retirees can diversify their holdings across properties in different cities or countries without breaking the bank.

Liquidity is another major leap forward. Unlike traditional real estate deals that can drag on for months, tokenized property shares can be traded 24/7 on secondary markets. This flexibility allows investors to respond quickly to market shifts or personal financial needs, without being locked into illiquid assets for years.

The impact isn’t just anecdotal, market data shows a surge in participation from small investors globally. Reports reveal that thousands are now earning daily rental income from properties they never physically visit, simply by holding digital tokens. The ability to start investing with as little as $50 has made headlines across fintech circles.

What’s Next? The Evolving Landscape of Tokenized Real Estate

The momentum behind fractional real estate ownership continues to build as regulatory clarity improves and new platforms enter the space. Many experts predict that tokenization will soon extend beyond residential and commercial properties into niche sectors like vacation rentals, farmland, or even infrastructure projects, all available in bite-sized digital shares.

If you’re considering your first step into tokenized property investment, it’s smart to research platform credibility, understand local regulations, and diversify across multiple assets. The tools are more robust than ever before, and resources like this guide explain how fractional ownership works for those ready to dive deeper.

The bottom line? Tokenization isn’t just lowering barriers, it’s blowing them wide open. With secure blockchain rails, automated smart contracts, and ultra-low minimums (as little as $50), the global real estate market is finally within reach for everyone willing to take the leap. Whether you’re building your first portfolio or adding digital assets to an established strategy, fractional ownership offers a practical path toward wealth creation in the new era of property investment.