Property NFTs are quietly rewriting the playbook for real estate investment and rental income, moving the industry from a world of slow paperwork and exclusive deals to one of digital transparency and global access. The buzz isn’t just hype – it’s a fundamental shift in how people can own, manage, and profit from real estate assets. By transforming physical properties into digital tokens, blockchain platforms are lowering barriers to entry, automating rent distribution, and making property portfolios as liquid as trading stocks.

Fractional Ownership: The End of Real Estate Gatekeeping

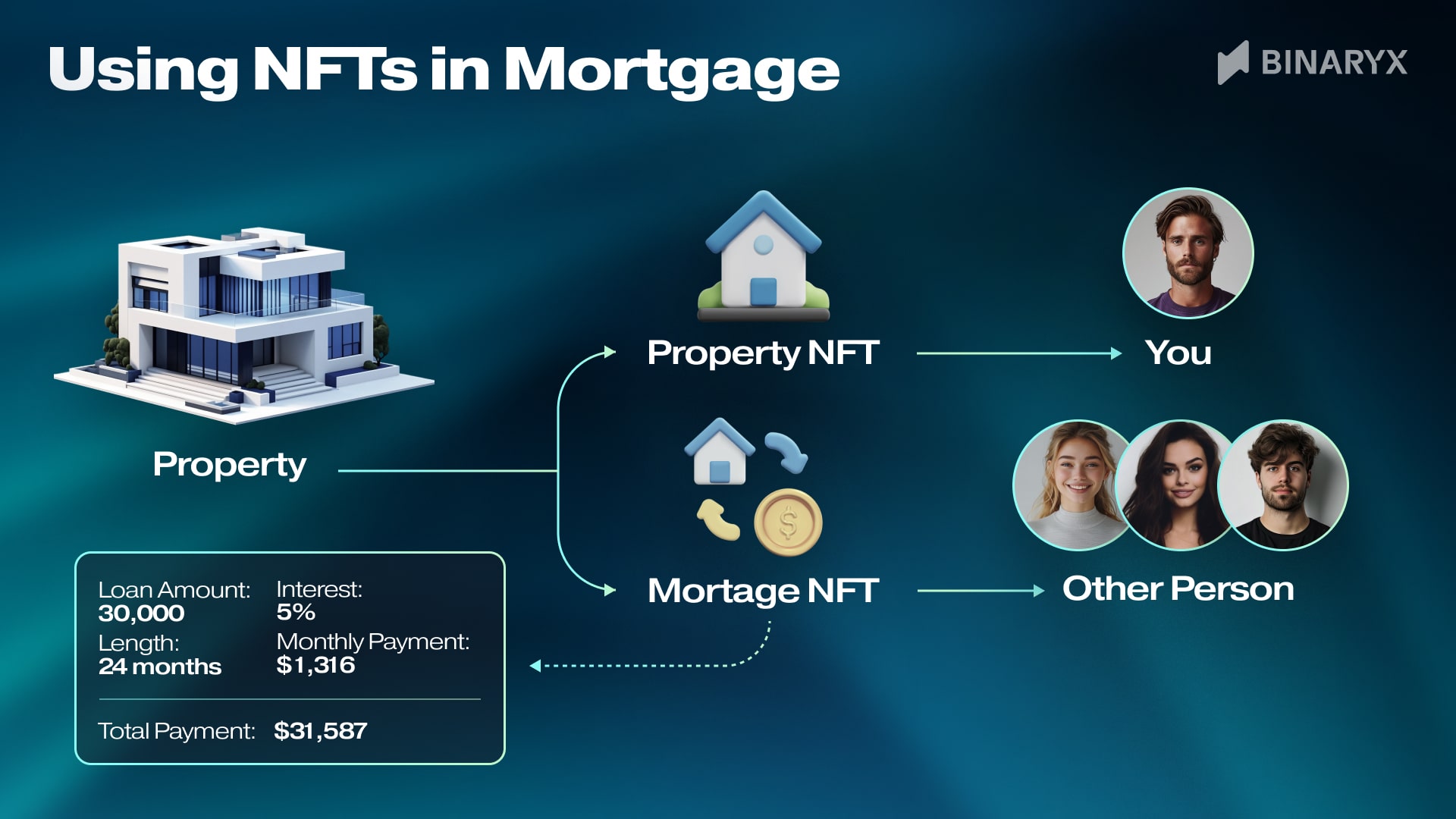

Traditionally, owning income-producing property required significant capital, legal wrangling, and local knowledge. With Property NFTs, the script flips: a single building can be divided into hundreds or thousands of unique tokens. Each NFT represents a direct claim on a fraction of the asset’s value and its rental proceeds. Instead of buying an entire apartment or commercial unit, investors can now purchase just 0.1% – or even less – of a property.

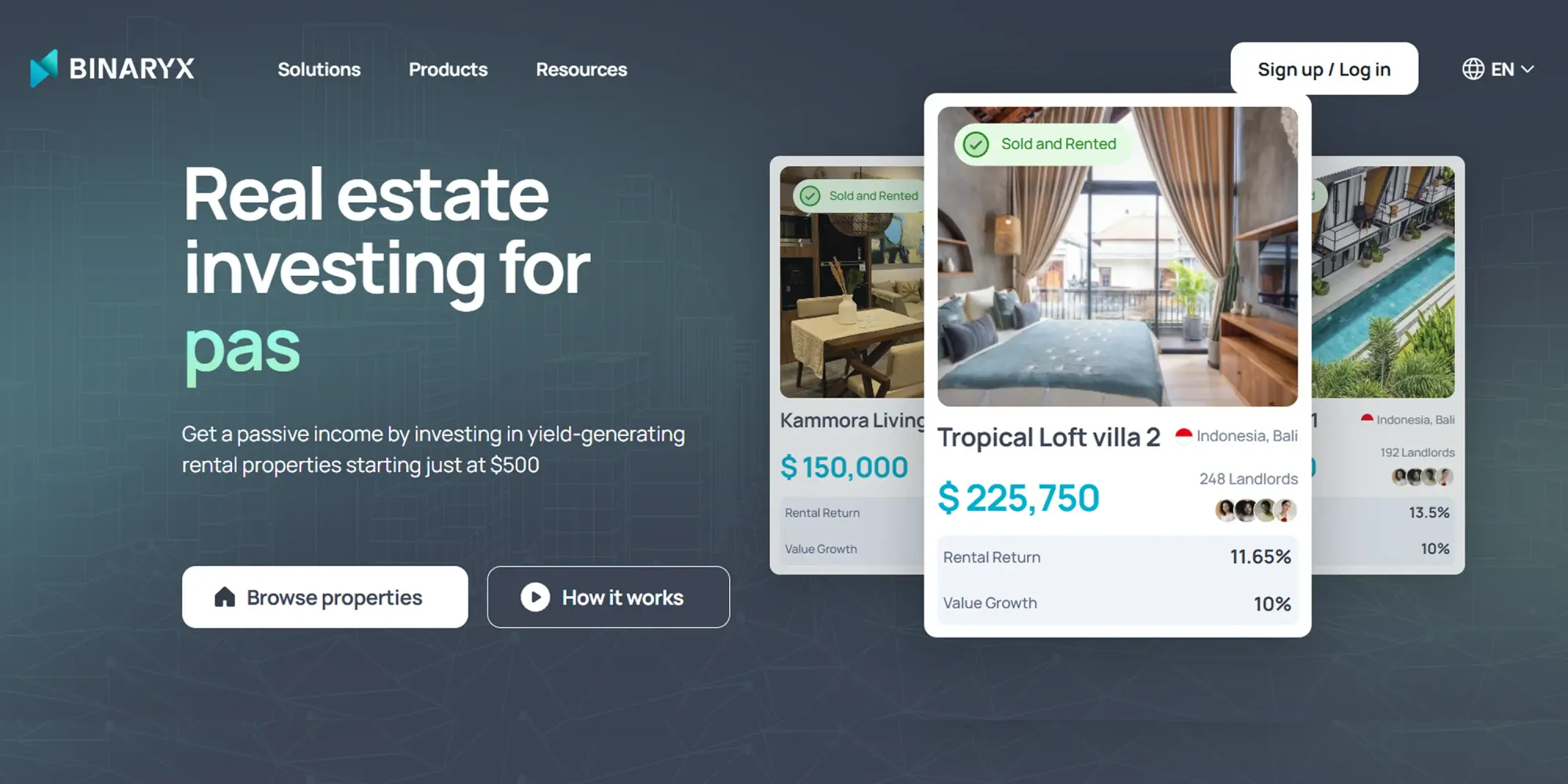

This model isn’t theoretical. Platforms like Property Holders have already enabled users worldwide to buy fractions in real-world properties. Investors receive passive income proportional to their holdings without ever having to vet tenants or fix leaky faucets. Rental yields are distributed automatically in stablecoins such as USDC, sidestepping fiat banking delays and currency risk.

Automated Rental Income: Turning Properties Into On-Chain Yield Machines

The magic happens under the hood with smart contracts. These self-executing programs run on blockchain networks and enforce terms transparently: when rent is paid by tenants (often through traditional means), smart contracts instantly calculate each NFT holder’s share and distribute funds accordingly. No middlemen, no delays – just seamless passive income that appears in your wallet every month.

This automation boosts efficiency while slashing costs. Investors no longer need to rely on legacy property managers or opaque accounting; everything is auditable on-chain in real time. And because rental payments are typically made in stablecoins like USDC, there’s no waiting for wire transfers or worrying about cross-border fees.

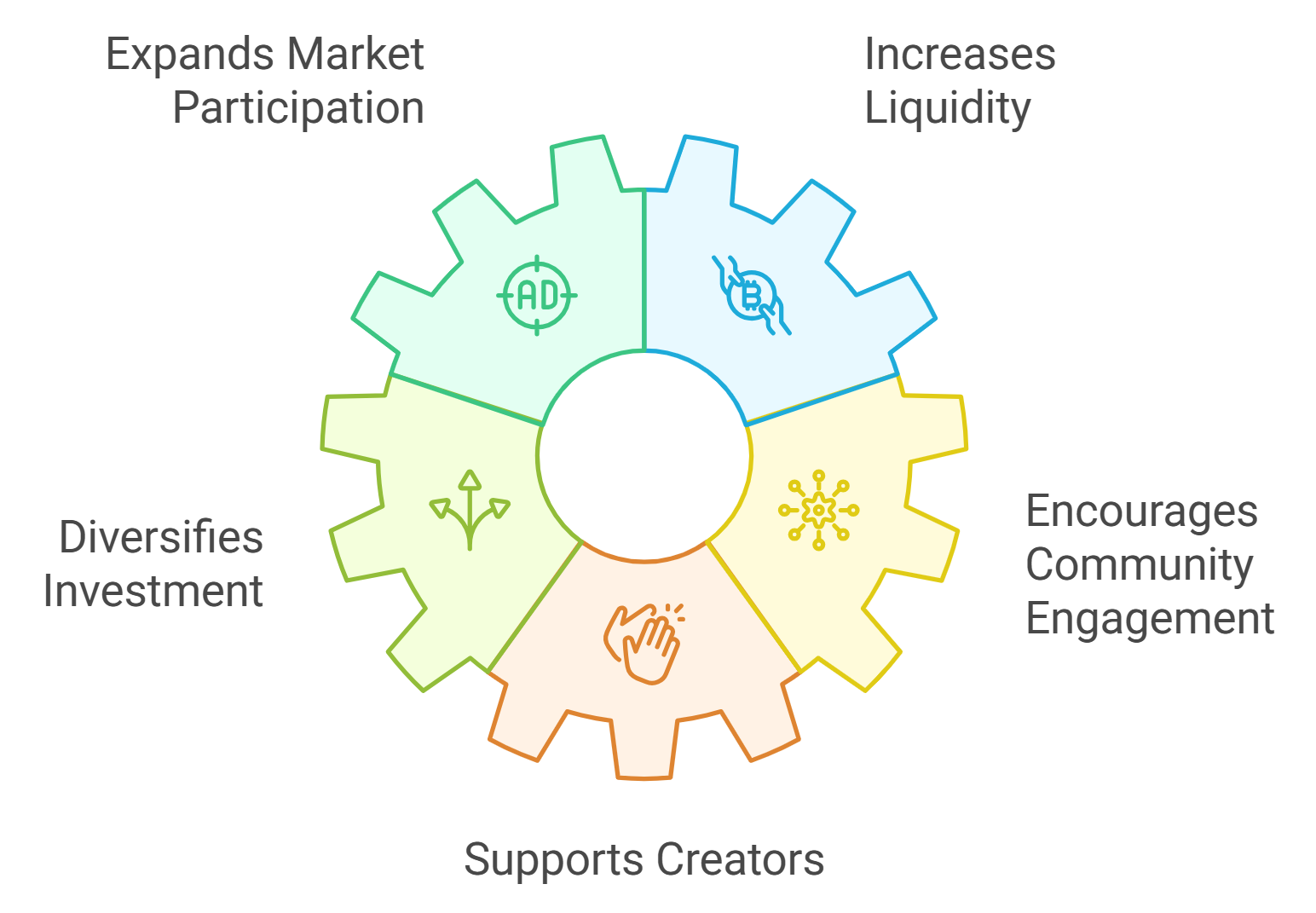

Democratizing Real Estate Investment Worldwide

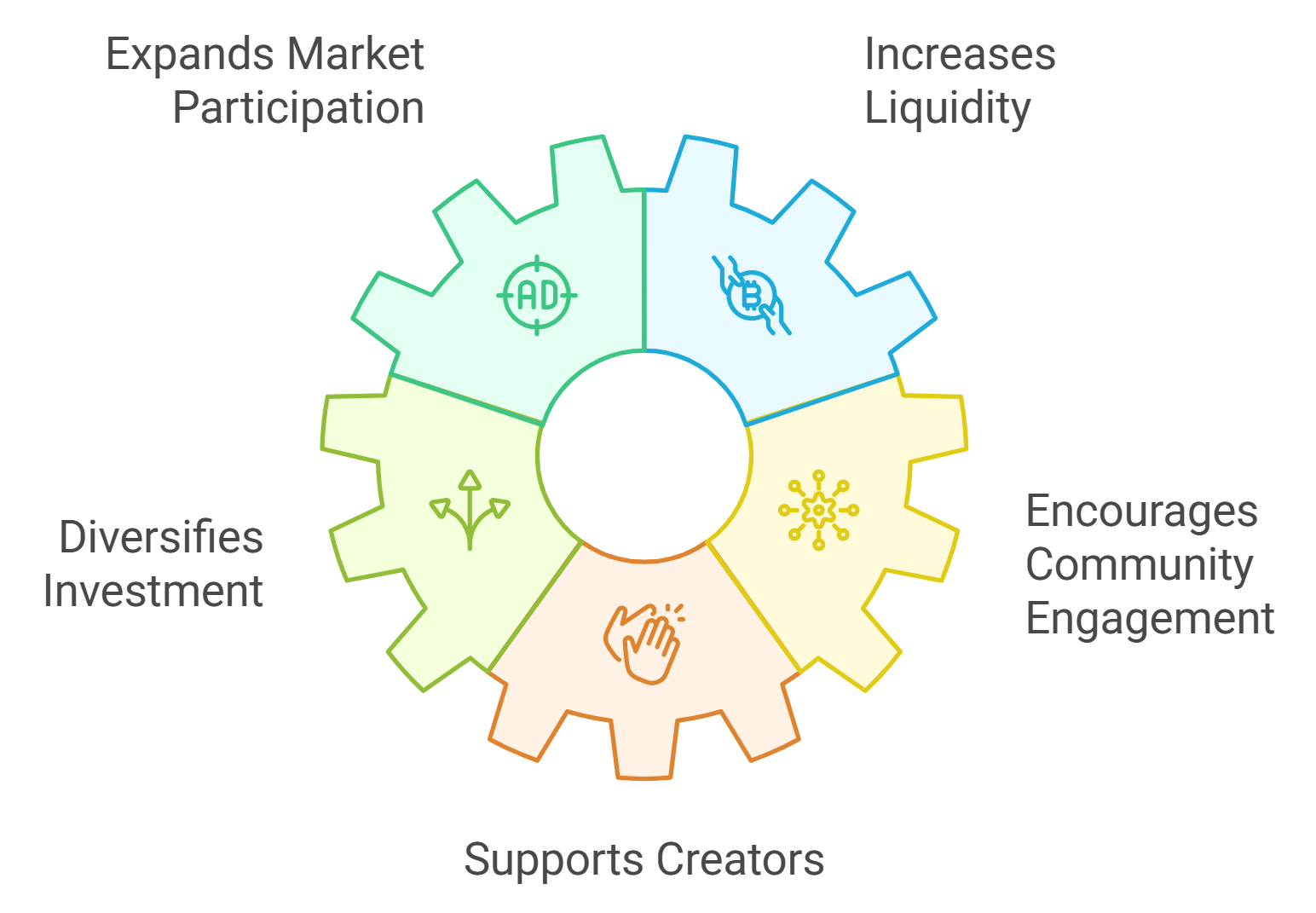

The implications go far beyond easier rent collection. Fractional ownership via NFTs democratizes access, allowing individuals who could never afford a whole property to build diversified portfolios across cities and countries. This opens up new opportunities for retail investors to participate in markets previously reserved for large funds or wealthy insiders.

Platforms like RealT and Zone 9 are putting this vision into practice by tokenizing rental apartments and distributing income directly to NFT holders around the globe. Some projects even allow secondary trading of these tokens on open marketplaces, letting investors exit positions quickly if market conditions change or liquidity is needed.

If you want an in-depth look at how these mechanisms work across various platforms (and see real-world case studies), check out our detailed guide at this link.

Yet, as with any seismic innovation, the rise of digital property assets introduces new strategic considerations. Liquidity, while improved, is still evolving; secondary markets for property NFTs are nascent and may not always offer instant exits at fair value. Regulatory clarity is another moving target. Jurisdictions differ on how tokenized real estate is classified, taxed, and governed. As adoption grows, expect a patchwork of legal frameworks before global standards emerge.

Still, the ability to trade fractional property ownership in near real time is a leap forward from traditional syndications or REITs. Investors can rebalance portfolios on the fly, respond to changing macro trends, or capitalize on local property booms from anywhere in the world. For landlords and developers, tokenization unlocks new capital sources by appealing to a broader base of micro-investors.

The Future: Programmable Ownership and On-Chain Governance

The next evolution will likely see blockchain property management go beyond rent distribution. Smart contracts can embed voting rights for major decisions (like renovations or sales), giving NFT holders an active voice in asset management. This paves the way for decentralized autonomous organizations (DAOs) overseeing entire portfolios, where community members collectively govern properties and share profits.

Tokenized real estate platforms are already experimenting with features such as automated compliance checks, transparent expense reporting, and dynamic rental pricing, all enforced by code rather than human discretion. As these systems mature, expect costs to fall further and transparency to increase across the industry.

If you’re curious about how specific platforms like Renta Network are pioneering these models in live rental markets, or want to dive deeper into case studies, explore our related analysis at this page.

Risks and Rewards: What Investors Should Watch

No innovation is without risk. While on-chain rental income provides transparency and automation, investors must scrutinize platform security, underlying property quality, and jurisdictional risks. Smart contract bugs or governance attacks could disrupt income flows or compromise asset control. Due diligence remains essential, just as it does with any high-potential but emerging asset class.

The rewards? Lower entry barriers, global diversification, 24/7 liquidity potential, and a chance to participate in real estate’s digital transformation from the ground floor up. As more assets move on-chain and regulatory certainty grows, expect both institutional capital and mainstream investors to follow.

The bottom line: Property NFTs are not just a technical gimmick, they’re a new operating system for real estate investment. For those ready to embrace this shift strategically (and with eyes wide open), the future of income-generating property looks borderless and programmable.

Key Benefits of Property NFTs vs. Traditional Rentals

-

Fractional Ownership & Accessibility: Platforms like Property Holders enable investors to buy fractional shares of real estate via NFTs, lowering entry barriers and democratizing access to global property markets.

-

Automated & Transparent Rental Income: Smart contracts on blockchain platforms automate rent collection and distribution, ensuring timely, transparent, and tamper-proof payments to NFT holders.

-

Instant Liquidity & Easy Trading: NFT-backed property shares can be easily bought, sold, or traded on secondary marketplaces, offering far greater liquidity than traditional real estate investments.

-

Stable, Borderless Payments: Rental income is often distributed in stablecoins like USDC, providing stability and enabling seamless, cross-border transactions without traditional banking delays.

-

No Landlord Hassles: Investors earn passive income proportional to their NFT ownership without dealing with tenant management, repairs, or legal complexities typical of traditional rentals.

-

Portfolio Diversification: Property NFTs allow individuals to diversify their investments across multiple properties and locations, reducing risk compared to owning a single rental property.