Imagine checking your portfolio and seeing not just the value of your real estate tokens, but live updates on occupancy rates, rental payments, and property expenses – all verified on-chain. This is no longer a futuristic fantasy. In 2025, real-time on-chain rental data is transforming tokenized real estate into a transparent, dynamic, and highly liquid asset class.

Transparent Rental Income: The New Standard for Tokenized Real Estate

One of the most powerful shifts in tokenized real estate 2025 is the ability to access live rental performance directly from blockchain records. Platforms like RealT have set the pace by delivering daily rental payments to investors’ wallets, with each transaction publicly verifiable and immutable. This level of transparency builds trust and eliminates the black box that once clouded traditional property investing.

No more waiting for quarterly reports or relying on opaque statements from intermediaries. Now, every stakeholder can see exactly how much rent was collected yesterday or whether a property is fully occupied – all in real time. For investors who crave data-driven confidence, this is a game changer. It’s not just about numbers; it’s about knowing your tokens are backed by actual cash flow you can track instantly.

From Illiquid to Instant: How On-Chain Data Supercharges Market Efficiency

The illiquidity of real estate has always been its Achilles’ heel. But with on-chain rental verification, things are different in 2025. When you can verify live property performance on the blockchain, buying or selling tokens becomes as seamless as trading stocks – or even faster. Investors are empowered to make decisions based on up-to-the-minute data rather than weeks-old projections.

This immediacy has fueled explosive growth in secondary markets for property tokens. According to Deloitte Insights, tokenized real estate is projected to reach $4 trillion by 2035 – up from less than $0.3 trillion just a decade ago. The catalyst? Reliable, real-time data streams that create true liquidity and confidence for both retail and institutional participants.

Automated Management: Smart Contracts Meet Live Rental Data

The marriage of smart contracts with on-chain rental data isn’t just making things faster; it’s making them smarter too. Smart contracts now automate everything from rent collection to maintenance triggers based on live inputs – slashing administrative overheads and reducing human error to near zero. For example, PropertyNFTs now come with built-in live update feeds that instantly reflect occupancy changes or late payments, triggering automated actions without manual intervention.

This automation doesn’t just benefit investors; property managers and tenants also enjoy smoother processes and fewer disputes thanks to transparent recordkeeping. Curious how these innovations work in practice? Explore our breakdown of PropertyNFTs live updates for a closer look at frictionless rentals.

Security and compliance are also getting a major upgrade thanks to real-time on-chain rental data. With every transaction logged immutably on the blockchain, audits become effortless and regulatory checks can be performed in seconds. Decentralized data platforms now offer zero-knowledge proofs, letting only authorized parties verify sensitive rental flows without exposing private information. This innovation is proving crucial as regulators worldwide ramp up scrutiny of digital property assets.

For investors, this means peace of mind: your income streams are not just visible but also secure and compliant by design. For property owners and managers, it’s a new era of operational efficiency, no more scrambling for receipts or reconciling spreadsheets at tax time.

Fractional Ownership Goes Global: Democratizing Real Estate with Live Data

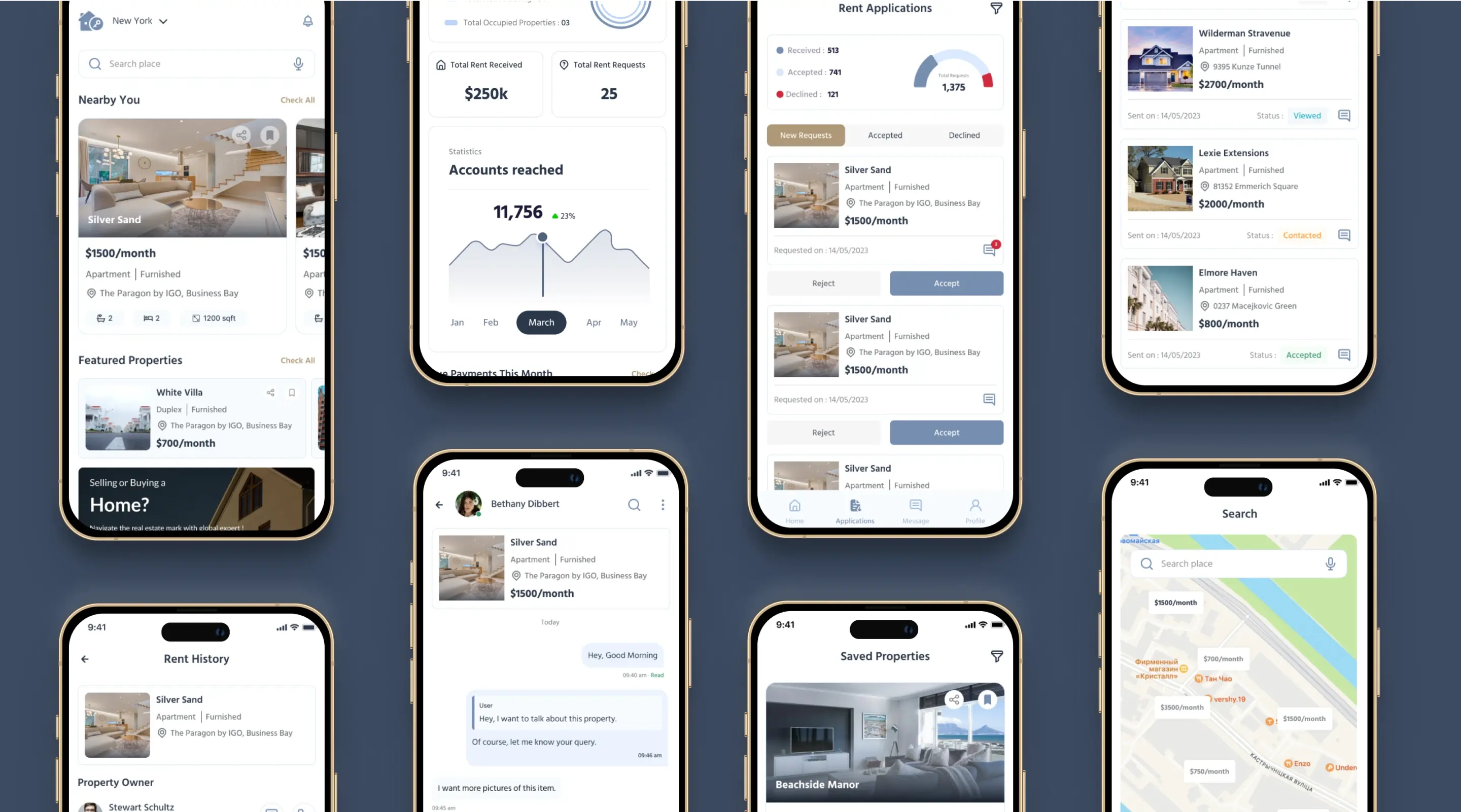

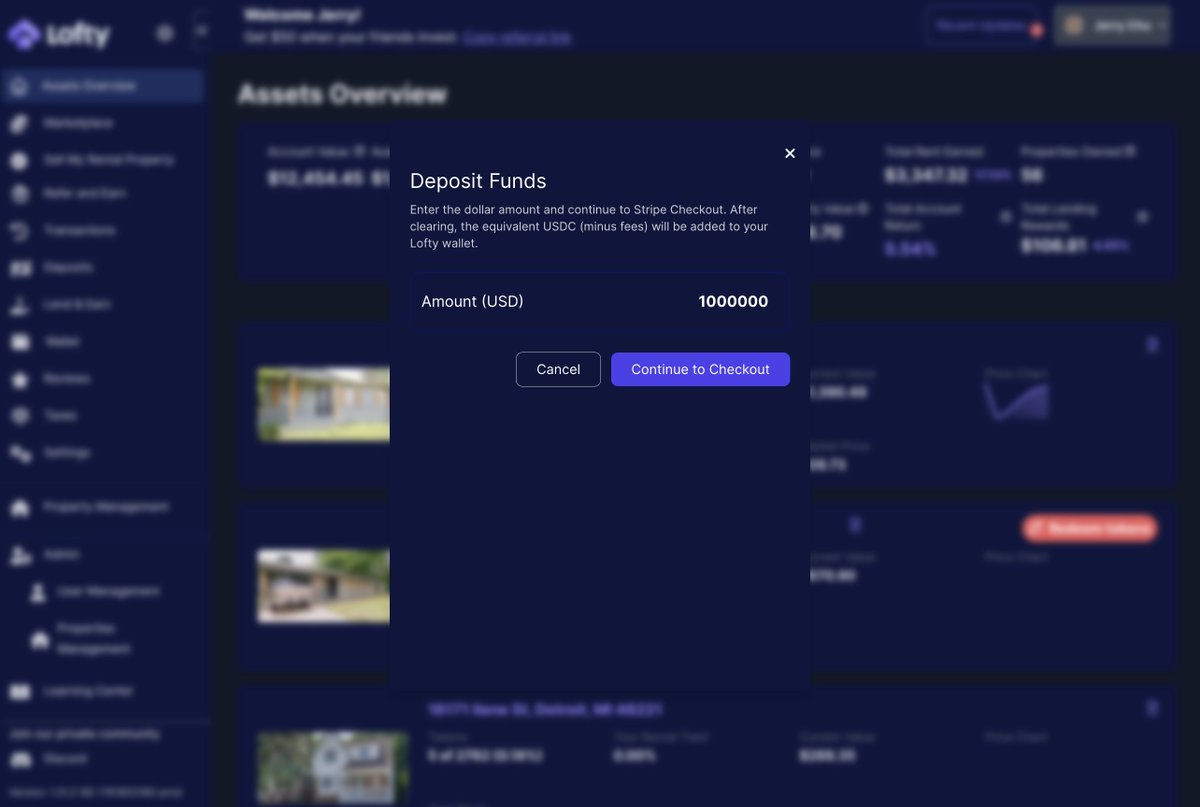

The magic of tokenization in 2025 isn’t just about tech, it’s about access. Fractional ownership powered by live on-chain data lets investors from around the globe own a share of prime properties for a fraction of the capital once required. Platforms like Lofty deliver daily rental yields and governance rights to token holders, all tracked transparently on-chain.

This democratization is driving fresh capital into markets that were previously out of reach for most individuals. Investors can now diversify across cities, property types, and even continents, all while monitoring live property performance blockchain-style from their phones. Curious how fractional ownership works under the hood? Check out our guide to fractional real estate ownership with blockchain tokens.

Key Benefits of Real-Time On-Chain Rental Data

-

Instant Payouts to Investors: Platforms like RealT deliver daily rental income directly to digital wallets, enabling investors to receive earnings in real time—no more waiting for monthly or quarterly distributions.

-

Automated Property Management: Smart contracts on blockchain platforms like PropertyNFTs automate rent collection, maintenance scheduling, and compliance checks, reducing manual admin and operational costs.

-

Global Accessibility & Fractional Ownership: Platforms such as Lofty allow investors worldwide to purchase fractional shares of tokenized properties, making real estate investment accessible with minimal capital and no geographic barriers.

-

Regulatory Peace-of-Mind: Decentralized data platforms like Space and Time provide secure, tamper-proof data and compliance tools, ensuring that rental data is verifiable and meets regulatory standards.

What’s Next? AI and Predictive Analytics Meet On-Chain Data

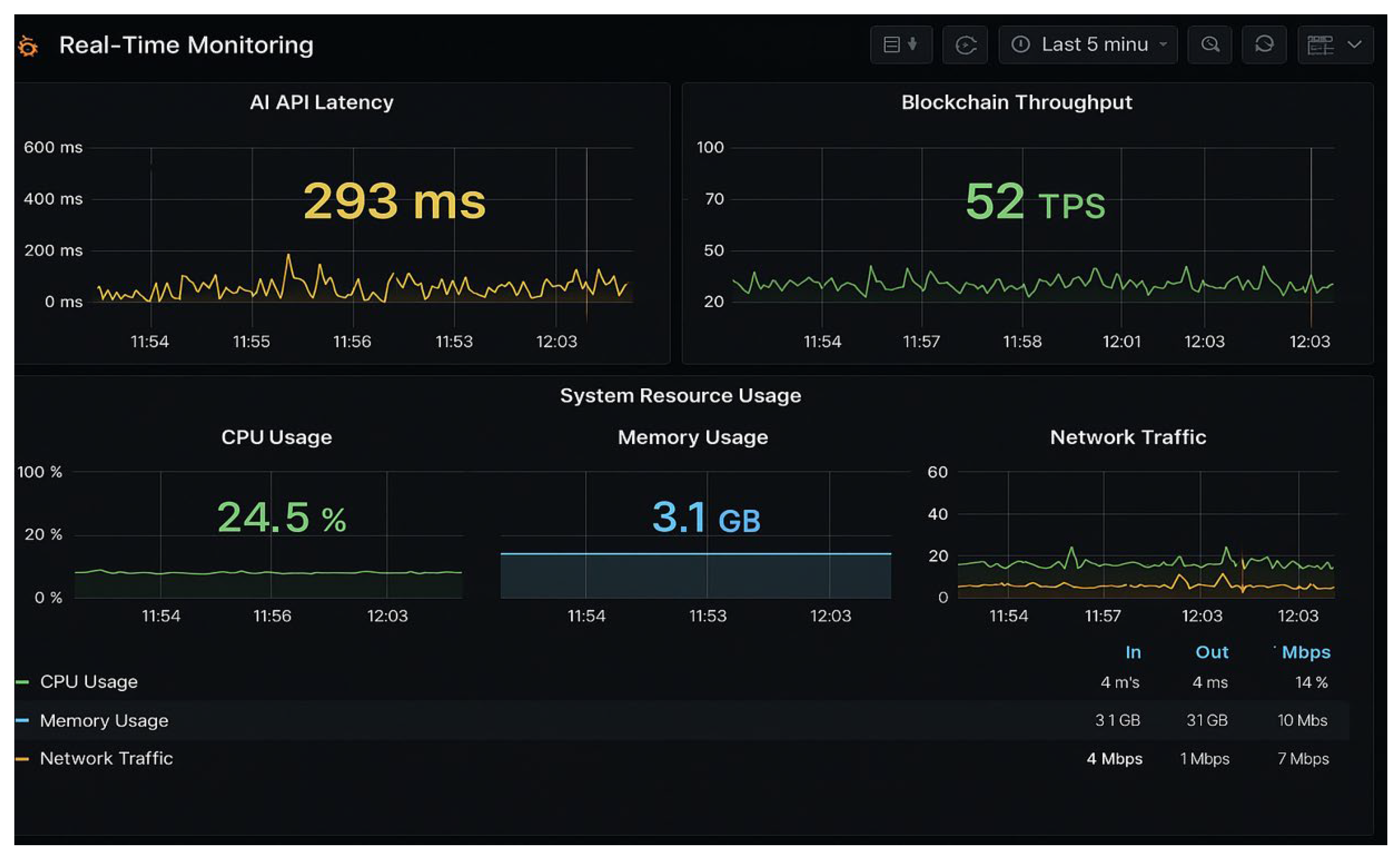

The integration doesn’t stop at transparency or efficiency. In 2025, leading platforms are layering AI-driven analytics atop real-time rental flows to forecast trends and spot emerging risks before they hit the headlines. Imagine your dashboard not only showing today’s occupancy rate but also predicting next month’s yield based on local economic signals and live tenant behavior, fully verified on-chain.

This combination is turning tokenized real estate into one of the most dynamic asset classes available. Institutional players are taking notice; retail investors are leveling up their strategies; and property managers are finally freed from paperwork purgatory.

As tokenization moves mainstream, expect the bar for tokenized property transparency to keep rising, and for those who embrace real-time on-chain rental data to lead the way in returns, resilience, and investor trust.