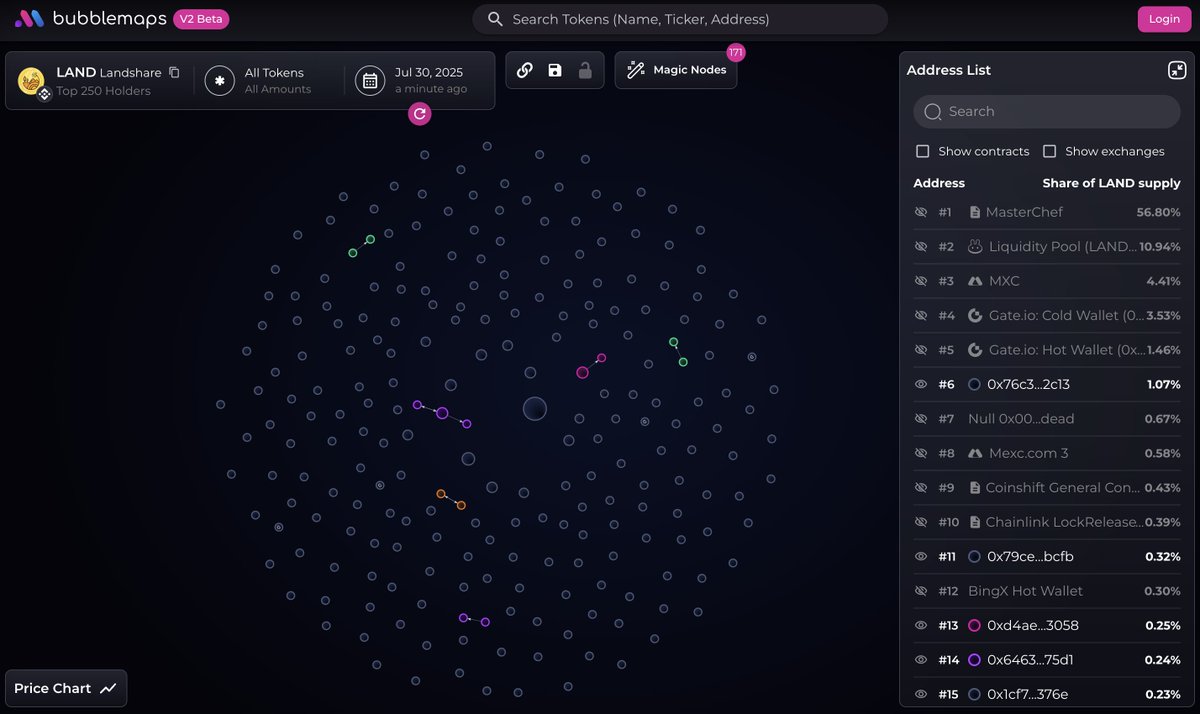

Tokenized real estate promised to shatter the illiquidity chains binding traditional property investments, enabling fractional ownership and instant trades on blockchain rails. Yet, as Landshare’s LAND token trades at $0.3200 with a modest 24-hour gain of and $0.001040 ( and 0.003250%), secondary markets for these assets remain stubbornly shallow. Thin order books breed volatility, and price dislocations scare off all but the boldest investors. This gap between vision and reality defines tokenized real estate secondary markets, where real estate token liquidity issues persist despite on-chain fanfare.

Landshare itself nails the crux: tokenizing a property is straightforward, but forging true liquidity demands more. Most projects halt at minting tokens, leaving holders with illiquid digital deeds. Q2 2025 research from Landshare underscores how blockchain accelerates deals via tokenization and smart contracts, yet secondary trading lags. Deloitte forecasts explosive growth by 2035, but today’s markets echo OneKey’s deep dive: shallow depth and low TVL fuel instability.

Regulatory Hurdles Stifling Fluid Trading

Inconsistent rules across borders form the first major roadblock. Tokenized assets straddle securities and commodities, inviting scrutiny that deters platforms from building robust exchanges. ScienceDirect highlights tokenization’s fit for high-cost, indivisible properties like land, but without regulatory clarity, secondary markets can’t standardize. Investors hesitate, volumes stay low, and bid-ask spreads gape wide. Landshare navigates this by focusing on compliant on-chain mechanisms, yet the sector-wide chill persists.

Adoption and Infrastructure Gaps Exposed

Limited uptake compounds the issue. Novelty means sparse participants; platforms lack the network effects of crypto natives like Bitcoin or Ethereum. Sharmo. org pinpoints this: low trading volumes widen spreads, while technical silos between tokenization protocols block seamless swaps. Investor education lags too, with many viewing blockchain as arcane rather than accessible. Zircon Tech flags liquidity as a core risk, where real estate’s inherent sluggishness meets immature DeFi plumbing. Result? Markets prone to dislocations, as seen in LAND’s tight 24-hour range from $0.3179 to $0.3246.

Landshare (LAND) Price Prediction 2026-2031

Forecast incorporating RWA liquidity improvements, DeFi utility expansions, and tokenized real estate market growth amid 2025 developments

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.28 | $0.55 | $1.05 |

| 2027 | $0.50 | $1.10 | $2.20 |

| 2028 | $0.90 | $1.90 | $3.80 |

| 2029 | $1.40 | $2.80 | $5.60 |

| 2030 | $2.00 | $4.00 | $8.00 |

| 2031 | $2.80 | $5.50 | $11.00 |

Price Prediction Summary

Landshare (LAND), currently at $0.32, is positioned for strong growth as it tackles tokenized real estate liquidity challenges through on-chain innovations like Real Asset Vault (RAV), DeFi suites, and partnerships. Projections reflect bullish RWA adoption, regulatory progress, and market cycles, with average prices potentially rising over 17x by 2031 in base scenarios, and up to 34x in maximum bullish cases, balanced by bearish risks from volatility and regulations.

Key Factors Affecting Landshare Price

- Enhanced liquidity via DS Swap DEX, LSRWA-USDT pools, and DeFi integrations reducing volatility in shallow RWA markets

- Explosive growth in tokenized real estate, projected to expand dramatically by 2035 per Deloitte

- Strategic partnerships (e.g., Defactor) enabling lending/borrowing against tokens without selling

- Improving regulatory clarity and standardization addressing current uncertainties

- Broader crypto bull cycles, RWA narrative strength, and rising investor education/adoption

- Technical advancements in interoperability and smart contracts accelerating secondary market maturity

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Medium analyses from Subunit capture the irony: tokenization targets illiquidity, high entry barriers, and transaction costs head-on, yet secondary venues underdeveloped. LinkedIn experts like Sainath Survase echo that while promises abound, execution falters on liquidity fronts.

Landshare’s Targeted On-Chain Remedies Emerge

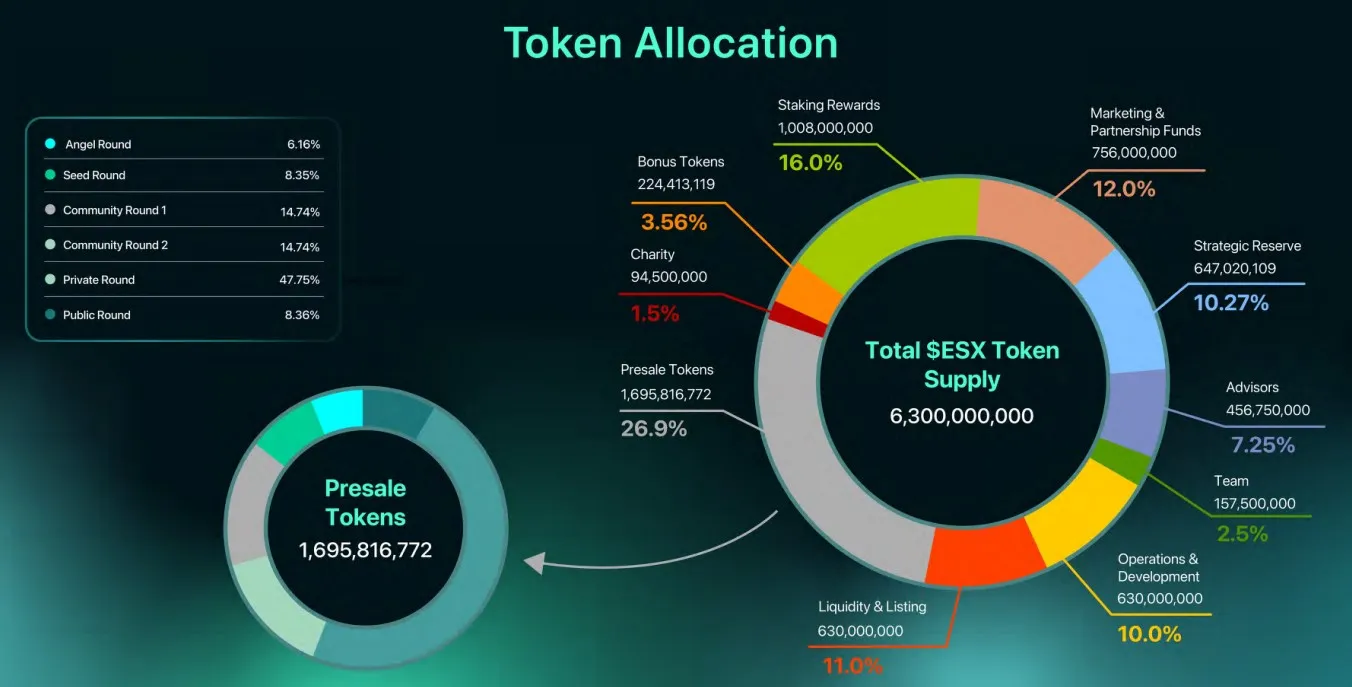

Enter Landshare’s Landshare RWA tokenization push, blending real-world assets with DeFi to inject life into stagnant pools. Their DS Swap Security Token DEX listing marks a leap, vowing fluid access amid lingering drags. Central to this is the Real Asset Vault (RAV), where users deposit USDC for stable yields backed by tokenized rentals. This lowers barriers, drawing retail into fractional property DeFi utility 2025.

The DeFi Suite amplifies: staking vaults, liquidity pools like LSRWA-USDT with extra rewards, and lending markets turn passive holdings active. No longer must owners sell to unlock value; borrow against tokens instead. Partnerships, such as with Defactor, enable USDC lending on LSRWA collateral, boosting flexibility. These moves address core pain points, fostering deeper markets and steadier on-chain real estate yields. As LAND holds at $0.3200, such innovations signal a pivot from stagnation to momentum.

Landshare’s playbook reveals how targeted fixes can thaw frozen secondary markets, setting the stage for broader transformation.

These on-chain fixes don’t just patch holes; they reengineer the liquidity engine for tokenized real estate secondary markets. Consider the Real Asset Vault’s yield mechanics: by anchoring USDC deposits to rental cash flows from tokenized properties, Landshare delivers predictable returns without the volatility spikes plaguing spot trades. This stability lures conservative capital, gradually thickening order books as more participants enter.

Landshare DeFi Liquidity Boosters

-

RAV Yields: Deposit USDC into Real Asset Vaults for stable returns backed by tokenized rental properties, attracting investors and enhancing asset utility.

-

LSRWA-USDT Pools: Liquidity pools pairing LSRWA tokens with USDT, enabling efficient trading and reducing slippage in secondary markets.

-

Staking Rewards: Stake assets in vaults for additional yields, incentivizing holders to lock tokens and deepen market liquidity.

-

Lending Markets: Borrow/lend USDC against LSRWA via partnerships like Defactor, offering flexibility without selling underlying real estate tokens.

DeFi integration takes it further. Liquidity pools pair LSRWA tokens with USDT, doling out rewards that compound holdings and discourage fire sales. Staking vaults lock in yields, while lending protocols let holders borrow against positions, preserving upside exposure. Defactor’s tie-up exemplifies this: investors collateralize LSRWA for USDC loans, sidestepping outright sales that fragment markets. Such composability turns static real estate tokens into dynamic DeFi primitives, echoing broader RWA maturation.

Quantifying the Liquidity Lift

To gauge progress, look beyond LAND’s steady $0.3200 perch. Its 24-hour band from $0.3179 to $0.3246 reflects nascent depth, but Landshare’s TVL growth hints at acceleration. Q2 2025 reports show tokenized deals closing faster via smart contracts, slashing settlement from weeks to minutes. Yet, as OneKey notes, thin books persist industry-wide, breeding dislocations. Landshare counters with DS Swap DEX listings, where security tokens trade permissionlessly, narrowing spreads through automated market making.

Liquidity Metrics Comparison: Traditional Real Estate vs. Landshare Tokenized

| Metric | Traditional Real Estate | Landshare Tokenized |

|---|---|---|

| Liquidity | Illiquid (months/years to sell) ⏳ | High (24/7 on-chain trading via DS Swap DEX) 💧 |

| Transaction Fees | High (5-10% commissions + intermediaries) 💸 | Low (minimal on-chain gas fees) 🤑 |

| Bid-Ask Spreads | Wide (low volume, fragmented markets) | Narrow (LAND 24h: $0.3179-$0.3246) |

| 24h Volume Proxy | N/A | Active (LAND $0.3200, +$0.001040 / +0.33%) 📈 |

| Yields | Rental income, infrequent payouts | On-chain (RAV vaults, DeFi staking pools) 🌟 |

| Market Depth | Shallow, high barriers | Enhanced (liquidity pools, lending partnerships) |

This table underscores the pivot. Traditional property flips demand 5-7% commissions and months-long closings; Landshare’s stack compresses that to instant swaps with yields often exceeding 8% APY from rentals. Bid-ask efficiency improves as pools deepen, volatility tames, and fractional shares democratize access. Still, scale matters: until TVL rivals DeFi blue chips, full maturity eludes.

Regulatory headwinds linger, but Landshare’s compliant design, KYC-gated vaults, audited contracts, builds trust. Investor education follows suit, with intuitive interfaces masking blockchain complexity. As adoption snowballs, network effects kick in: more liquidity begets more traders, spiraling toward self-sustaining markets. Deloitte’s 2035 boom projection feels prescient; early movers like Landshare prototype the path.

Challenges remain, from cross-chain silos to oracle risks in yield calcs, but Landshare’s fixes prioritize depth over hype. By wedding real estate’s yield moat to DeFi’s velocity, they forge on-chain real estate yields that rival TradFi bonds without the opacity. LAND’s micro-gain of and $0.001040 ( and 0.003250%) belies brewing momentum; watch as secondary volumes swell.

Forward thinkers see the blueprint: liquidity lags not from tech limits, but execution gaps. Landshare bridges them, proving Landshare RWA tokenization can deliver fractional property DeFi utility 2025. Investors eyeing resilient portfolios should track these rails closely, where property meets programmable capital, true transformation unfolds.