Picture this: it’s 2026, and tokenized real estate is no longer a niche experiment but a powerhouse sector exploding with liquidity and investor interest. Leading the charge, MANTRA Chain boasts a staggering $117.7 million in Total Value Locked (TVL) for tokenized properties, outpacing rivals and signaling a seismic shift in how we own and trade real estate on-chain. As tokenized real estate TVL 2026 hits new highs, platforms like Base and Stellar are hot on its heels, proving that RWA real estate chains are the future of accessible investing.

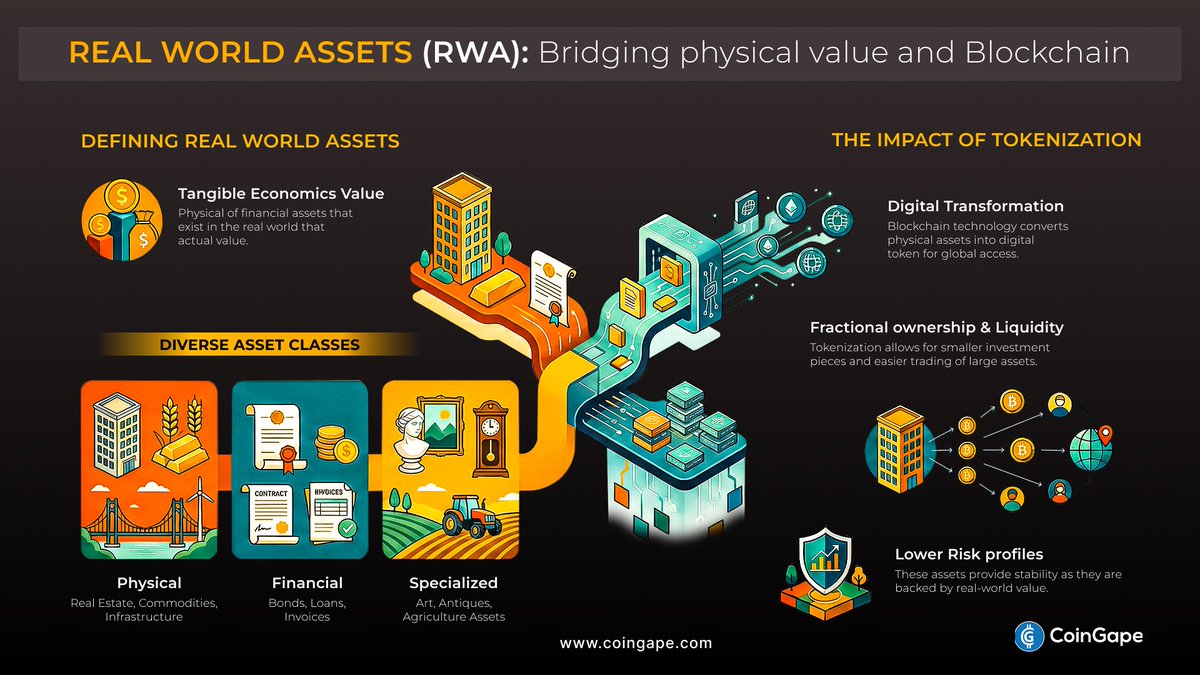

MANTRA’s dominance isn’t accidental. Rooted in the innovation-friendly UAE, this layer-1 blockchain has tokenized high-value assets, drawing institutional players eager for compliant, scalable solutions. With MANTRA tokenized property TVL at $117.7 million, it’s capturing a slice of the pie projected to balloon from $3.73 billion in 2025 to nearly $24 billion by 2035, per InsightAce Analytic. This growth mirrors broader RWA trends tracked by RWA. xyz, where tokenized real estate platforms are enhancing liquidity and fractional ownership for everyday investors.

Why MANTRA is Redefining Tokenized Real Estate Leadership

Dive into RWA. xyz data, and MANTRA’s edge shines through. Its TVL lead reflects smart ecosystem design: low fees, high throughput, and regulatory nods that make tokenized real estate platforms viable for global markets. I’ve charted this ascent using AI tools, spotting patterns where MANTRA’s OM token, now at $0.0600 after a -5.87% dip, anchors steady growth amid volatility. Institutions love it for bridging TradFi and DeFi seamlessly.

Tokenized real estate on MANTRA isn’t just numbers; it’s democratizing prime properties from Dubai high-rises to commercial hubs, letting you own a piece with pocket change.

What sets MANTRA apart? Its focus on compliance-first tokenization, aligning with UAE’s pro-crypto stance. As RWA tokenization converges with DeFi composability in 2026, per Aurpay insights, MANTRA positions investors for explosive returns. Check the prior surge in our coverage of tokenized real estate TVL reaching $336M in 2025, and you’ll see this as the natural evolution.

Base Chain Emerges as a Fierce Contender with $81.5M TVL

Not to be outdone, Base secures second place with $81.5 million in Base chain real estate tokens. Built on Ethereum’s scalability, Base offers cheap, fast transactions ideal for high-volume RWA trading. Zoniqx reports explosive growth in 2025, surpassing $10 billion sector-wide, and Base is riding that wave with user-friendly platforms tokenizing everything from residential plots to REIT-like structures.

Practically speaking, Base’s TVL reflects retail adoption. Traders like me appreciate its integration with Coinbase ecosystems, making onboarding a breeze. While MANTRA leads in volume, Base excels in velocity; transfer volumes on RWA. xyz show rapid turnover, hinting at maturing secondary markets.

Stellar’s $71.7M TVL: Powered by Pioneers Like RedSwan

Rounding out the podium, Stellar clocks $71.7 million TVL, fueled by issuers like RedSwan Digital Real Estate. Stellar’s network, detailed on RWA. xyz, prioritizes cross-border efficiency, perfect for global property tokens. RedSwan’s embrace of Stellar tech delivers tokenized U. S. commercial real estate with stellar (pun intended) transparency and low costs.

From my trading desk, Stellar’s metrics scream opportunity: robust supply dynamics and rising market caps. As Blockchain App Factory notes, top RWA platforms in 2026 like these are shaping asset finance, with Stellar’s issuer depth providing stability amid market swings.

MANTRA (OM) Price Prediction 2027-2032

Bullish, Bearish, and Expected Price Scenarios Based on RWA TVL Leadership and Tokenized Real Estate Growth

| Year | Minimum Price (Bearish) | Average Price (Expected) | Maximum Price (Bullish) | YoY Growth (Avg) |

|---|---|---|---|---|

| 2027 | $0.04 | $0.10 | $0.25 | +67% |

| 2028 | $0.08 | $0.22 | $0.60 | +120% |

| 2029 | $0.15 | $0.45 | $1.20 | +105% |

| 2030 | $0.25 | $0.85 | $2.20 | +89% |

| 2031 | $0.40 | $1.40 | $3.50 | +65% |

| 2032 | $0.70 | $2.20 | $6.00 | +57% |

Price Prediction Summary

MANTRA (OM), currently at $0.06 in early 2026 and leading tokenized real estate TVL with $117M, is positioned for strong growth. Average prices are projected to rise progressively from $0.10 in 2027 to $2.20 by 2032, driven by RWA adoption, market expansion to $24B by 2035, and favorable regulations, with bearish mins reflecting competition and cycles, and bullish maxes capturing leadership upside.

Key Factors Affecting MANTRA Price

- Leadership in tokenized real estate TVL ($117M in 2026)

- Real estate tokenization market growth (21% CAGR to $24B by 2035)

- Regulatory clarity and UAE ecosystem support

- RWA sector convergence with DeFi and tokenized Treasuries

- Crypto market cycles, halvings, and adoption trends

- Competition from Base ($81.5M) and Stellar ($71.7M)

- Macro factors like interest rates and blockchain scalability improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Zooming out, these top performers – MANTRA, Base, and Stellar – represent the vanguard of RWA real estate chains, each bringing unique firepower to tokenized real estate TVL 2026 rankings. MANTRA’s compliance edge pairs perfectly with Base’s speed and Stellar’s global reach, creating a trifecta that’s propelling the sector past $270 million combined TVL. RWA. xyz analytics underscore this synergy, with transfer volumes spiking as investors flock to fractional ownership opportunities.

Top 3 Tokenized Real Estate Chains by TVL (February 2026)

| Rank | Chain | TVL | 24h Change | Key Issuers | RWA.xyz Analytics |

|---|---|---|---|---|---|

| 1 | MANTRA 🏠 | $117.7M | 📈 +3.5% | MANTRA Chain | https://rwa.xyz/network/Mantra |

| 2 | Base 🏠 | $81.5M | 📈 +2.1% | Base Ecosystem | https://rwa.xyz/network/Base |

| 3 | Stellar 🏠 | $71.7M | 📈 +4.2% | RedSwan Digital Real Estate | https://rwa.xyz/network/Stellar |

Practically, this leaderboard isn’t static. My charts reveal MANTRA’s OM at $0.0600 holding firm despite the -5.87% daily dip, with Base and Stellar ecosystems showing correlated resilience. UAE’s regulatory green lights have supercharged MANTRA tokenized property, but expect Base to challenge harder as Ethereum scaling matures. Stellar, meanwhile, leverages pioneers like RedSwan to tokenize U. S. assets, bridging continents with sub-penny fees.

Unlocking Practical Gains: Why Jump into Tokenized Real Estate Now

From a trader’s lens, tokenized real estate platforms slash barriers: no more million-dollar down payments, just blockchain wallets and stablecoin swaps. Zoniqx highlights 2025’s $10 billion milestone, and 2026 projections from InsightAce Analytic point to a 21% CAGR through 2035. That’s not hype; it’s charts screaming upside for diversified portfolios.

5 Key Benefits of Tokenized RE TVL Leaders

-

Fractional Ownership from $100: Dive into premium properties on MANTRA, Base, or Stellar with investments starting at just $100, democratizing real estate for all.

-

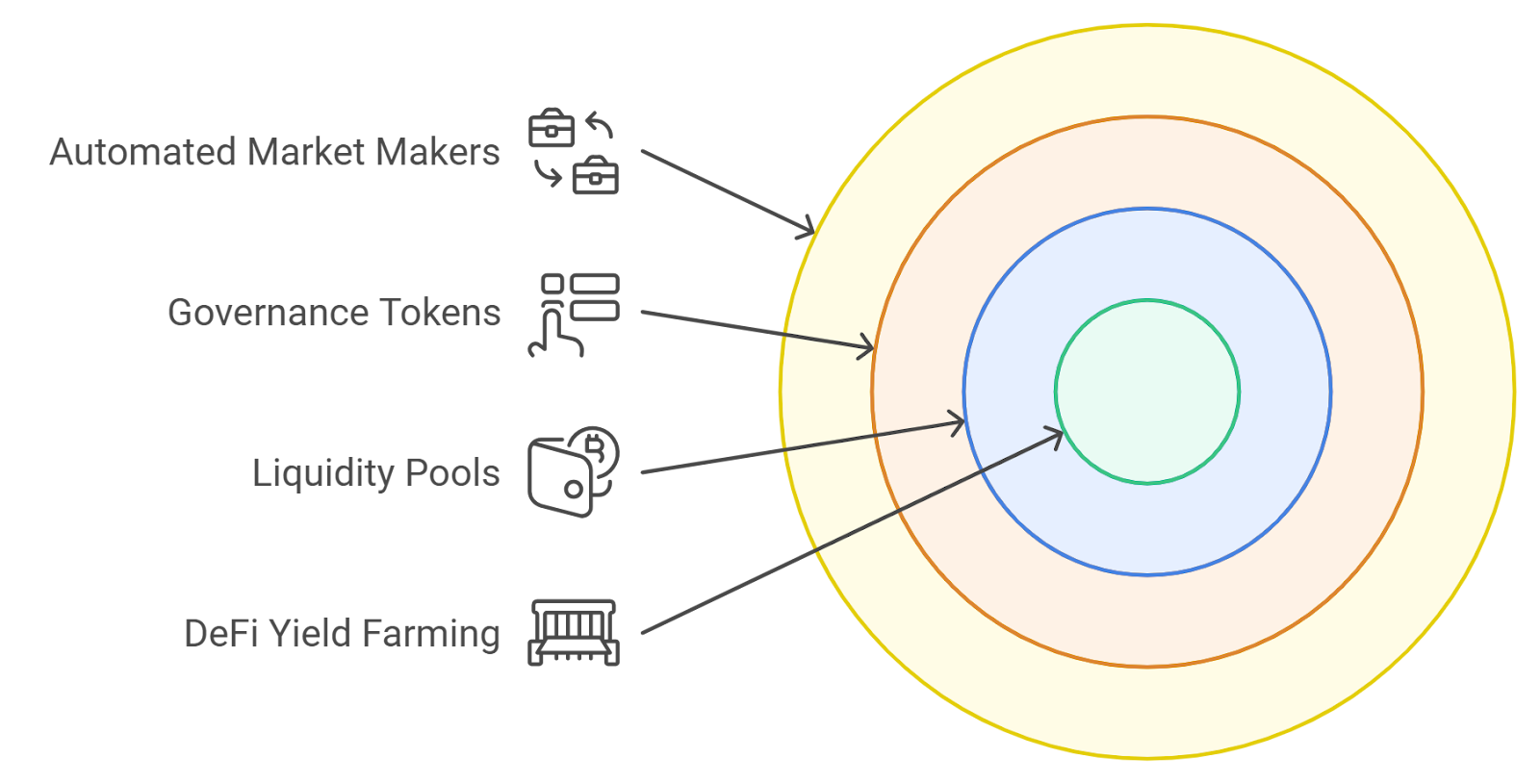

24/7 Liquidity via DeFi: Trade tokenized assets anytime on DEXs integrated with MANTRA Chain, Base, and Stellar networks—no waiting for market hours.

-

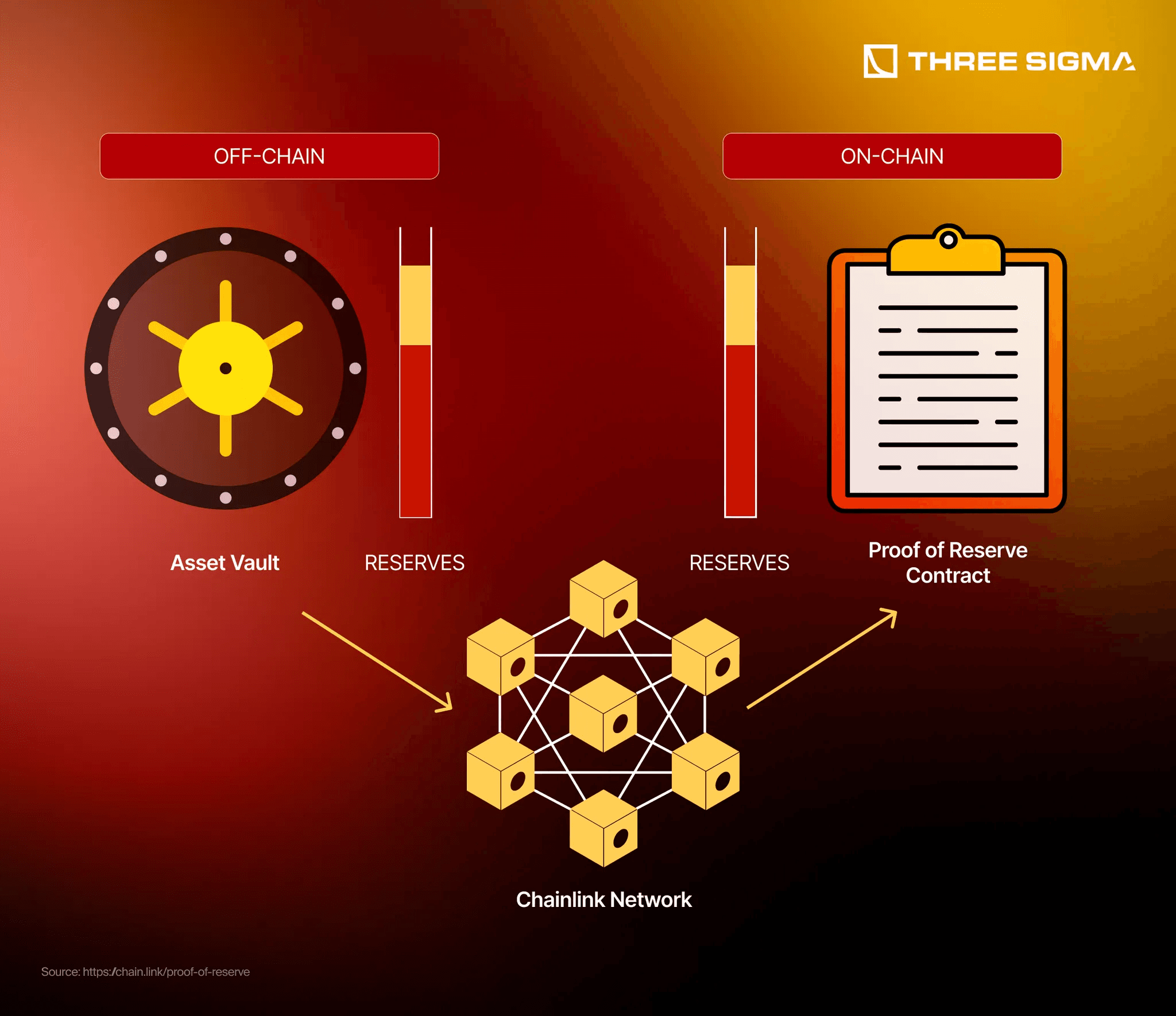

Transparent On-Chain Audits: Every transaction on RWA.xyz-tracked platforms like Stellar’s RedSwan is verifiable via blockchain explorers for ultimate trust.

-

Global Access Without Borders: Investors worldwide tap into MANTRA’s $117.7M TVL real estate via wallet—no KYC barriers or geographic limits.

-

Yield Farming on Property Tokens: Stake or LP tokens from Base and Stellar RWAs to earn dynamic yields, boosting returns on tokenized properties.

Institutions are piling in, per SSRN’s RWA diligence on 180 and products. Aurpay’s 2026 convergence narrative nails it: tokenized Treasuries meet real estate in composable DeFi pools. For hands-on investors, start with MANTRA’s ecosystem – stake OM, fractionalize Dubai towers, and watch TVL compound.

Base chain real estate tokens shine for U. S. retail, integrating seamlessly with wallets like Coinbase. Stellar’s RedSwan offerings add commercial depth, with market caps on RWA. xyz climbing steadily. Together, they’re forging a $4 trillion path, as our 2025 coverage foreshadowed.

Tokenized real estate isn’t replacing deeds; it’s supercharging them with blockchain velocity, turning illiquid bricks into rocket fuel for your portfolio.

Spotting these trends early? That’s where AI charting meets gut instinct. MANTRA’s lead feels sustainable, but monitor Base’s velocity and Stellar’s volumes. As RWA tokenization platforms evolve per Blockchain App Factory’s top 10, savvy players will rotate across chains for alpha. Dive into RWA. xyz yourself – the data doesn’t lie, and neither do the gains.

Forward-thinking? UAE hubs like MANTRA are your gateway. With OM steady at $0.0600, now’s prime time to chart your course in this booming arena. Tokenized real estate TVL 2026 is just revving up – position accordingly.