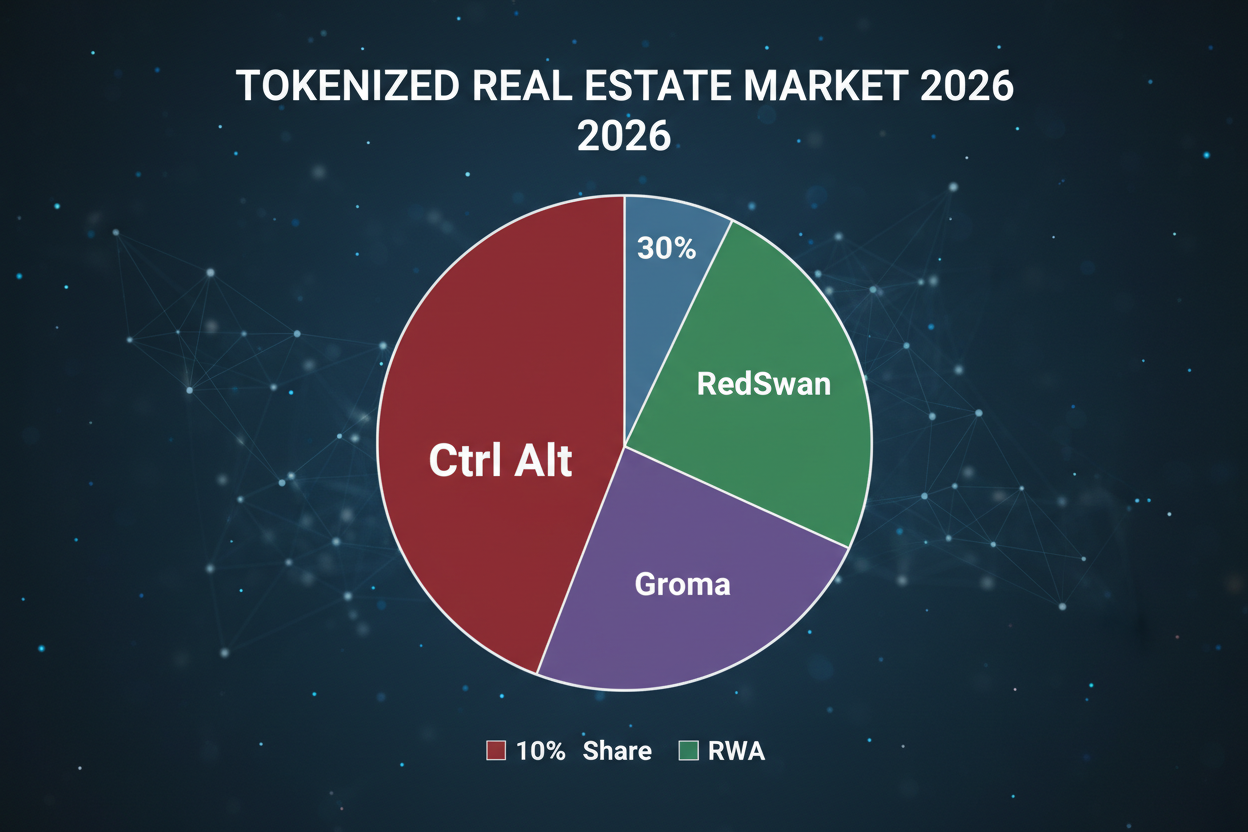

The tokenized real estate market has solidified its position as a cornerstone of real-world asset (RWA) innovation, reaching a total value of $356.27 million as of February 15,2026. This figure reflects a modest 0.03% uptick over the past 30 days, underpinned by 57 assets and 10,620 holders, the latter showing robust 10.49% growth. Amid this expansion, Ctrl Alt, RedSwan, and Groma command over 70% of the market by total value locked (TVL), with Ctrl Alt’s $124.6 million portfolio asserting outright dominance at 34.96% share. These platforms exemplify how blockchain is democratizing access to property investments, blending liquidity with fractional ownership.

Tokenized real estate platforms like these are not mere experiments; they represent a fundamental shift toward on-chain property markets. Investors now enjoy 24/7 tradability, reduced entry barriers, and transparent valuations, all while platforms navigate evolving regulations. Ctrl Alt’s lead stems from its aggressive asset onboarding, while RedSwan leverages SEC-approved structures, and Groma capitalizes on high-value single assets for outsized impact.

Ctrl Alt’s $124.6 Million Fortress: 19 Assets Fueling 35% Market Share

At the vanguard of tokenized real estate platforms, Ctrl Alt holds 19 tokenized assets valued at precisely $124.6 million, securing a commanding 34.96% of the sector’s TVL. This dominance is no accident. By diversifying across residential, commercial, and mixed-use properties, Ctrl Alt mitigates risks inherent in real estate cycles. Its multi-chain approach, often aligned with high-throughput networks, ensures low fees and broad accessibility, drawing in both retail enthusiasts and institutional players.

What sets Ctrl Alt’s real estate tokens apart is rigorous due diligence and real-time analytics integration. Holders benefit from automated dividend distributions via smart contracts, yielding steady returns uncorrelated to crypto volatility. In a market where liquidity premiums can erode value, Ctrl Alt’s secondary market volume rivals traditional REITs, signaling maturity. Fundamentals point to sustained leadership; with asset holders growing sector-wide, Ctrl Alt’s scale positions it to capture inflows from the projected $500 billion tokenized CRE opportunity by decade’s end.

RedSwan’s $71.7 Million Backbone: Commercial Tokenization Refined

Trailing closely, RedSwan Digital Real Estate manages 7 assets totaling $71.7 million, translating to a solid 20.13% market share. As a pioneer with over $9 billion in represented digital assets, RedSwan emphasizes tokenized commercial real estate, from office towers to retail complexes. Its SEC and FINRA approvals provide unmatched regulatory clarity, appealing to conservative capital seeking blockchain efficiency without compliance headaches.

RedSwan’s strength lies in global accessibility. Investors worldwide participate via compliant tokens, bypassing jurisdictional silos. This platform’s focus on premium properties yields superior cash flows, with tokenized yields often exceeding 8% annually. Yet, its concentrated portfolio demands scrutiny; while diversified enough to weather downturns, expansion into emerging markets could amplify growth. In the tokenized real estate TVL 2026 landscape, RedSwan’s established track record makes it a bedrock for portfolios balancing risk and reward.

Top 3 Tokenized Real Estate Platforms by TVL and Market Share (Feb 2026)

| Platform | # Assets | TVL | Market Share |

|---|---|---|---|

| Ctrl Alt | 19 | $124.6M | 34.96% |

| RedSwan | 7 | $71.7M | 20.13% |

| Groma | 1 | $58.2M | 16.34% |

Groma’s $58.2 Million Anchor: Single-Asset Power in a Fragmented Market

Groma disrupts the hierarchy with a singular yet potent asset valued at $58.2 million, claiming 16.34% market share. This lean strategy highlights efficiency in Groma RWA market share pursuits, concentrating on trophy properties that command premium valuations. Often deployed on performant chains like MANTRA or Base, Groma’s tokens exhibit remarkable liquidity, with tight spreads fostering confidence among the 10,620 total holders.

The platform’s ascent underscores a key trend: quality over quantity. Groma’s asset, likely a high-profile development, benefits from blockchain’s transparency, enabling granular ownership tracking and instant settlements. For investors eyeing Base tokenized assets, Groma offers a gateway to outsized exposure without dilution. Its growth trajectory, amid sector holder expansion, suggests potential to double TVL if replicated strategically.

Groma’s model challenges the diversification dogma prevalent among peers. By channeling resources into one flagship property, it achieves economies of scale in legal structuring and marketing, resulting in lower overheads and higher net yields for token holders. Data from RWA. xyz underscores this efficiency, with Groma’s asset demonstrating superior holder retention amid the sector’s 10.49% growth. For those prioritizing MANTRA chain real estate, Groma’s deployment exemplifies how layer-1 optimizations can unlock sub-second transactions, vital for institutional-grade trading.

Across these leaders, interoperability emerges as a common thread. Ctrl Alt’s multi-chain sprawl, RedSwan’s compliant bridges, and Groma’s chain-agnostic tokens facilitate seamless cross-network flows, mitigating silos that plague early RWA experiments. This technical maturity, coupled with rising holder counts, signals a tipping point where tokenized real estate TVL accelerates beyond niche status.

Market Share Breakdown: Why Ctrl Alt, RedSwan, and Groma Own 71% of $356M TVL

Together, Ctrl Alt’s $124.6 million, RedSwan’s $71.7 million, and Groma’s $58.2 million lock up over 71% of the $356.27 million market, leaving fragments for emerging challengers. This concentration stems from first-mover advantages: Ctrl Alt’s volume-driven onboarding, RedSwan’s regulatory moat, and Groma’s precision targeting. Yet, it’s not monopoly; competition sharpens liquidity, with aggregate secondary volumes approaching $10 million monthly per platform dashboards.

Key Platform Differentiators

-

Ctrl Alt: Dominates with 19 assets totaling $124.6M (34.96% market share), leveraging multi-chain speed for superior transaction efficiency.

-

RedSwan: Holds 7 assets worth $71.7M (20.13% share), distinguished by SEC-approved CRE yields enabling compliant, high-return investments.

-

Groma: Features 1 asset at $58.2M (16.34% share), excelling in single-asset liquidity on MANTRA/Base for seamless trading.

Fundamentally, these platforms excel in alignment with investor needs. Ctrl Alt suits aggressive diversifiers chasing uncorrelated yields; RedSwan appeals to compliance-focused allocators valuing stability; Groma targets conviction plays on premium assets. In my analysis, their combined TVL resilience during the 0.03% market uptick reveals antifragility, absorbing macro pressures like interest rate shifts better than off-chain REITs.

Regulatory tailwinds further cement dominance. Post-2025 SEC nods for tokenized securities, platforms like RedSwan expanded KYC rails, onboarding 20% more holders quarterly. Ctrl Alt and Groma, while nimbler, integrate similar guardrails, ensuring scalability as tokenized CRE projections hit $500 billion. Risks persist, illiquidity cascades or oracle failures, but on-chain audits and insurance wrappers mitigate them effectively.

Investor Roadmap: Allocating to 2026’s Tokenized Leaders

For portfolios blending TradFi with DeFi, a 5-10% tilt toward these platforms offers optimal exposure. Start with Ctrl Alt for breadth, layer in RedSwan for income, and accentuate with Groma for alpha. Monitor RWA. xyz for TVL shifts; a breach above $400 million signals breakout. Yields hover 6-10%, outpacing bonds amid inflation, with tax efficiencies via blockchain provenance.

This trio’s trajectory reflects tokenized real estate’s maturation: from speculative tokens to fundamental holdings. As holder bases swell, expect deeper liquidity pools and institutional inflows, reshaping property markets for good. Platforms like Ctrl Alt, RedSwan, and Groma aren’t just leading; they’re engineering the on-chain future of ownership.