Transferring property ownership has long been a process fraught with friction, high costs, and the ever-present risk of fraud. The rise of tokenized title deeds and blockchain-based land registries is reshaping this landscape, offering a more secure, transparent, and efficient way to manage property rights. By moving title deeds onto a decentralized ledger, blockchain enables real estate assets to be represented as unique digital tokens. This innovation not only streamlines property transfers but also addresses systemic weaknesses in traditional systems.

Why Traditional Land Registries Struggle

In conventional land registries, records are often stored on paper or centralized databases that are vulnerable to tampering, loss, or unauthorized edits. This creates opportunities for fraudulent sales, unclear titles, and bureaucratic delays that can stall transactions for weeks or even months. According to research from Blockchain App Factory and RWaltz, these legacy systems are expensive to maintain and lack real-time transparency for stakeholders.

Fraud remains a persistent threat: forged documents and illegal transfers cost individuals and governments billions globally each year. Administrative bottlenecks further complicate due diligence processes for buyers and lenders. For investors seeking certainty and speed in property transactions, the current paradigm is increasingly unsatisfactory.

The Blockchain Advantage: Security, Transparency and Efficiency

Blockchain introduces three core improvements to land registry management:

Key Benefits of Blockchain Land Registries

-

Enhanced Security & Fraud Prevention: Blockchain’s immutable ledger prevents unauthorized changes and reduces risks of fraud, such as illegal land sales or document forgery. Once a property record is added, it cannot be altered or deleted.

-

Increased Transparency & Trust: All property transactions are transparently recorded and time-stamped on the blockchain, providing a clear audit trail accessible to buyers, sellers, and regulators.

-

Efficiency & Cost Reduction: Automated processes and smart contracts eliminate many intermediaries, speeding up property transfers and reducing administrative costs, as demonstrated by Sweden’s Lantmäteriet project.

-

Global Real-World Implementation: Countries like Zambia (Medici Land Governance), India, and California, USA (DMV blockchain title project) are already deploying blockchain-based land registries to improve security and streamline ownership transfers.

-

Improved Accessibility & Data Integrity: Decentralized records allow authorized parties to access up-to-date property data anytime, reducing errors and ensuring data consistency across jurisdictions.

Enhanced Security: Once title data is recorded on a blockchain ledger, it becomes immutable, no single party can alter or delete the record without consensus. This dramatically reduces fraud risk by making document forgery nearly impossible.

Transparency and Trust: Every transaction involving a property token is time-stamped and publicly verifiable on-chain. Buyers, sellers, regulators, all can audit the transaction history at any time without relying on opaque intermediaries. As noted by DLA Piper’s analysis (source), this level of transparency builds trust throughout the ecosystem.

Efficiency and Cost Savings: Smart contracts automate key steps in the transfer process, from verifying ownership to releasing funds upon completion of legal requirements. Sweden’s Lantmäteriet project has shown that such automation can cut transaction times from weeks to just hours while reducing administrative costs substantially (source).

Pioneering Real-World Implementations

The global movement toward property transfer blockchain solutions is gaining momentum:

- Zambia: Medici Land Governance is deploying blockchain-based systematic land titling to secure rights for underserved populations (source). This initiative aims to unlock economic development by giving citizens verifiable proof of ownership.

- India: Several state governments are piloting digital land registries using blockchain to combat unclear titles and fraudulent claims (source). Early results suggest improved efficiency and greater public trust in recordkeeping.

- California DMV: While focused on vehicle titles rather than real estate, California’s Department of Motor Vehicles digitized over 42 million car titles using blockchain technology in 2024, demonstrating scalability for other asset classes (source).

The Mechanics: How Tokenized Title Deeds Work

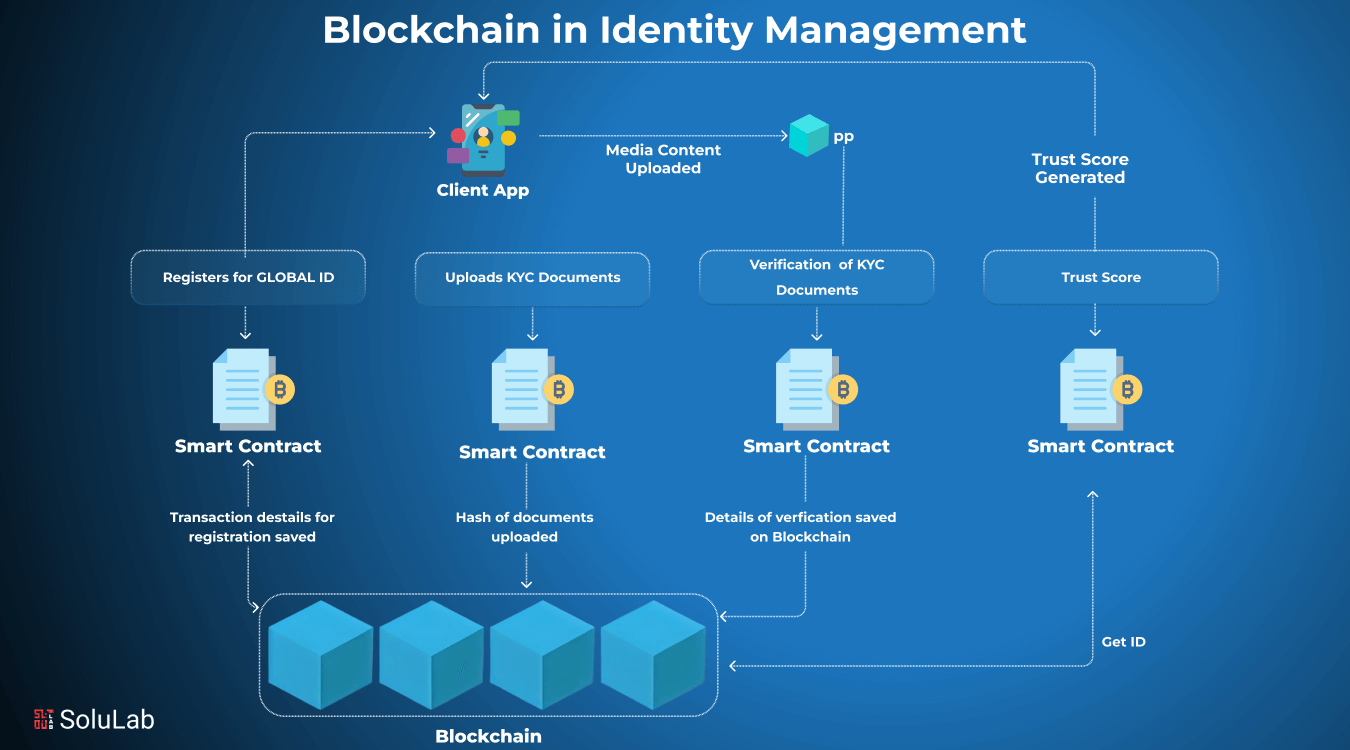

A tokenized title deed represents legal ownership of a specific parcel of real estate as a unique digital asset (often an NFT) on a blockchain network. When a property changes hands, this token is transferred between wallets via smart contract, instantly updating the public ledger with an auditable record of the new owner.

This approach eliminates duplicate records across agencies and provides an end-to-end audit trail accessible by all authorized parties. As explored in technical blueprints from Primior and SSRN eLibrary publications, platform selection (public vs private chains), security protocols, and regulatory compliance are critical considerations for successful deployment.

Legal enforceability remains central to the adoption of tokenized title deeds. For blockchain land registry systems to fully replace or augment traditional registries, governments must recognize digital tokens as legally binding proof of ownership. This is not merely a technical challenge but also a legislative and policy hurdle. Jurisdictions like Sweden and select Indian states are actively working to bridge these gaps, but widespread legal harmonization is still a work in progress.

Another key factor is interoperability. Property transfer blockchain solutions must integrate with existing cadastral systems, financial institutions, and regulatory bodies. Open standards for data formats and APIs are essential to ensure seamless data exchange between legacy databases and decentralized ledgers. Without such interoperability, the risk of creating parallel, siloed systems increases, undermining the universal transparency that blockchain promises.

Addressing Practical Challenges

While the technology is robust, several practical challenges can slow adoption:

Major Hurdles to Blockchain Land Registry Adoption

-

Legal and Regulatory Uncertainty: Many jurisdictions lack clear legal frameworks recognizing blockchain-based property records as legally binding, creating uncertainty for buyers, sellers, and government agencies.

-

Integration with Existing Systems: Legacy land registry databases are often fragmented and paper-based, making seamless integration with blockchain platforms complex and resource-intensive.

-

Technological Infrastructure Gaps: Reliable internet connectivity, secure digital identity systems, and technical expertise are prerequisites for blockchain adoption, which are lacking in many regions, especially in developing countries.

-

Data Privacy and Security Concerns: While blockchain is secure, sensitive personal and property data must be carefully managed to comply with privacy regulations and prevent unauthorized access.

-

Stakeholder Resistance and Lack of Awareness: Real estate professionals, government officials, and the public may resist change due to unfamiliarity with blockchain technology and concerns about job displacement or loss of control.

Digital Literacy: Many property owners, especially in emerging markets, lack familiarity with digital wallets or smart contract platforms. Education campaigns and user-friendly interfaces will be vital for broad participation.

Infrastructure: Reliable internet access and secure device management are preconditions for effective on-chain property management. Governments and service providers must invest in closing these digital divides.

Regulatory Uncertainty: As noted in the HK Law analysis, regulators are still adapting frameworks to accommodate digitally native property rights, a process that may take years in some jurisdictions.

The Road Ahead: Opportunities for Investors and Policymakers

The evolution toward tokenized title deeds represents more than just an upgrade to recordkeeping; it opens new avenues for fractional ownership, liquidity, and global investment in real estate markets previously constrained by local bureaucracy or opaque processes. For investors, this means access to a broader range of assets with lower entry barriers and improved due diligence tools.

For policymakers, blockchain land registry initiatives present an opportunity to enhance public trust while reducing administrative costs. The case studies from Zambia’s Medici Land Governance project and Sweden’s Lantmäteriet pilot highlight tangible benefits, from economic empowerment through secure land rights to millions saved annually on transaction processing (source). As these pilots scale up, expect further innovation in how governments issue, monitor, and enforce property rights on-chain.

“Research is the ultimate edge. ” Rigorous market analysis will remain crucial as legal standards evolve and new technical solutions emerge in this rapidly shifting space.

The transition from paper deeds to tokenized digital assets will not happen overnight, but its momentum is undeniable. Stakeholders who invest early in understanding both the technical mechanics and regulatory context stand to benefit most as this paradigm shift unfolds across global real estate markets.