Blocksquare’s tokenized real estate network now spans 168 properties across 29 countries, representing over $204.9 million in on-chain assets. This milestone, achieved as of January 2026, positions the protocol as a frontrunner in bridging traditional property markets with blockchain liquidity. With its native token BST trading at $0.0245 amid a modest 24-hour gain of and 0.005680%, Blocksquare demonstrates resilient momentum in a maturing RWA sector.

From humble beginnings tokenizing $100 million across 118 properties in 21 countries, Blocksquare has scaled rapidly. Recent announcements highlight surpassing $200 million in July 2025, fueled by diverse assets like restaurants, hotels, healthcare facilities, apartments, and parking lots. This expansion, powered by 17 live marketplace operators, underscores a decentralized model where local partners drive global adoption.

Decentralized Infrastructure Empowering Global Operators

At its core, Blocksquare provides APIs and solutions that enable real estate operators to digitize properties, launch bespoke investment platforms, and connect investors to fractional ownership. Unlike centralized platforms, this protocol supports hundreds of portals worldwide, allowing entrepreneurs to tokenize assets without building from scratch. The result? A network effect where each new marketplace strengthens the ecosystem.

Consider the strategic edge: in a world where real estate liquidity remains hampered by high entry barriers and geographic limits, Blocksquare’s on-chain approach democratizes access. Investors from anywhere can buy into blocksquare tokenized real estate fractions, starting with minimal capital. This model has proven sticky, with properties now live in 29 countries, driven by partnerships that localize compliance and market expertise.

Asset Diversity Driving Broader Adoption

The portfolio’s variety sets Blocksquare apart. Beyond residential apartments, tokenized assets include commercial spaces like hotels and healthcare centers, even niche plays such as parking lots. This sectoral spread mitigates risk and appeals to varied investor appetites, from yield-seeking conservatives to growth-oriented speculators.

- Restaurants and hospitality: Capturing tourism rebound.

- Healthcare facilities: Tapping stable, recession-resistant demand.

- Parking infrastructure: Underrated urban essentials with steady cash flows.

By July 2025, the network hit 170 properties, a figure now refined to 168 with precise valuation at $204.9 million. Such granularity reflects ongoing audits and integrations, building trust in an nascent market.

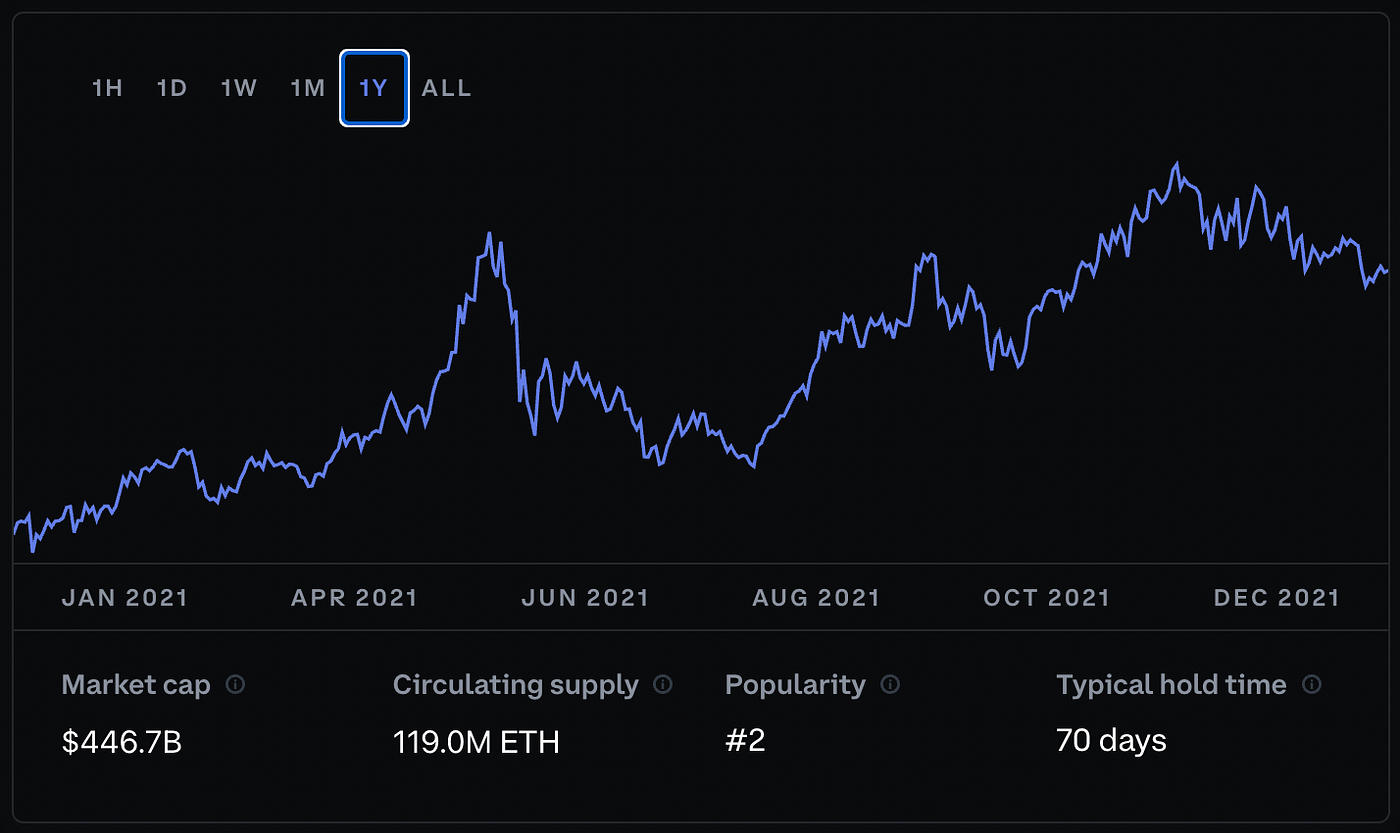

Blocksquare (BST) Price Prediction 2027-2032

Forecasts based on RWA tokenization growth, strategic partnerships, and global real estate adoption trends

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $0.0280 | $0.0720 | $0.2100 |

| 2028 | $0.0450 | $0.1400 | $0.4800 |

| 2029 | $0.0750 | $0.2800 | $1.1000 |

| 2030 | $0.1300 | $0.5500 | $2.2000 |

| 2031 | $0.2200 | $1.0500 | $4.5000 |

| 2032 | $0.3800 | $1.9000 | $9.0000 |

Price Prediction Summary

Blocksquare (BST) is positioned for substantial growth from its current $0.0245 price in 2026, driven by surpassing $200M in tokenized assets, partnerships like Vera Capital ($1B potential), and RWA market expansion. Minimum prices reflect bearish market cycles and regulatory hurdles; average assumes steady adoption; maximum envisions bull runs with mass tokenization.

Key Factors Affecting Blocksquare Price

- RWA sector boom with trillions in potential tokenized assets

- Strategic partnerships expanding to North America and beyond

- Increasing tokenized properties (170+ across 29 countries)

- Regulatory clarity for real estate tokenization

- Blockchain scalability and DeFi integrations

- Crypto market cycles and Bitcoin halving effects

- Competition from other RWA platforms

- Macro real estate market trends and liquidity improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Partnerships Accelerating North American and Beyond Push

Strategic alliances are turbocharging scale. The pact with Vera Capital targets up to $1 billion in U. S. real estate tokenization, unlocking America’s vast property wealth for global capital. Meanwhile, collaboration with Com2000. org advances modular housing RWAs in North America, aligning with sustainability trends.

These moves aren’t mere PR; they embed Blocksquare in high-value pipelines. As EU-backed initiatives from earlier phases evolve, the protocol eyes further regulatory green lights, potentially catalyzing exponential growth. For macro investors, this signals a pivot point: on-chain real estate in 29 countries isn’t hype, it’s infrastructure hardening against fiat uncertainties.

Blocksquare’s protocol empowers operators to run their own marketplaces, giving everyday people access to tokenized real estate worldwide.

Looking ahead in this first phase of expansion, the interplay of operator networks and tokenized diversity positions Blocksquare to capture more market share. With BST’s steady price action at $0.0245, early positioning could yield outsized returns as RWA TVL climbs.

Macro trends amplify this trajectory. As central banks navigate persistent inflation and geopolitical strains, tokenized real estate emerges as a hedge with yield baked in. Blocksquare’s network sidesteps traditional frictions like illiquid secondaries and paperwork marathons, channeling capital into productive assets across borders.

Investors eyeing fractional property tokens blocksquare should prioritize operator quality. Each of the 17 marketplace operators brings localized intel, from European regulatory savvy to North American scale. This federation model, rather than top-down control, fosters resilience; if one market softens, others buoy the protocol.

Benefits of Blocksquare Marketplaces

-

Global Access to 168 tokenized properties worth over $204.9M across 29 countries, unlocking diverse real estate investments.

-

Low Entry Barriers via fractional ownership, allowing investments starting from small amounts in high-value properties.

-

Operator-Driven Liquidity powered by 17 live marketplace operators building and expanding on-chain real estate markets.

-

Localized Compliance tailored per country, ensuring regulatory adherence for seamless global participation.

-

Steady Yields from tangible assets like hotels, apartments, and healthcare facilities, bridging real estate with DeFi.

Navigating Risks in a Scaling Network

No protocol scales without hurdles. Regulatory variance across 29 countries demands vigilant compliance, yet Blocksquare’s EU roots and partner ecosystems mitigate this. Smart contract audits and on-chain transparency further de-risk exposure, though oracle dependencies for off-chain rents warrant scrutiny.

Market volatility tags along with BST at $0.0245, up a hair in the last 24 hours. Yet, as RWA total value locked swells, protocol revenue from tokenization fees and marketplace cuts should accrue to holders. Opinion: this isn’t speculative froth; it’s foundational plumbing for a $300 trillion asset class finally unlocking liquidity.

For strategic allocation, blend BST holdings with direct property token exposure. Start small on high-conviction operators tokenizing cash-flow positive assets like healthcare or parking. As partnerships like Vera Capital’s $1 billion U. S. pipeline materialize, network effects compound: more properties draw more operators, spiraling liquidity.

This evolution mirrors early internet infrastructure plays. Just as protocols standardized web connectivity, Blocksquare standardizes real estate tokenization. Entrepreneurs worldwide now plug in, launching portals that pipe fractional ownership to retail and institutions alike. The proof? From 21 to 29 countries in under two years, with asset value doubling to $204.9 million.

Layer in sustainability angles from Com2000. org’s modular housing push. North America’s housing crunch meets blockchain efficiency, tokenizing prefab units for rapid deployment. Investors gain entry to resilient sectors, buffered against cycles.

Positioning for the RWA Inflection

At $0.0245, BST trades at a discount to its utility. With 17 operators live and counting, expect marketplace proliferation. Watch for integrations with major DeFi lenders, enabling collateralized loans against property tokens. This unlocks leverage without banks, a game-changer for yield optimization.

Fractional real estate ownership via Blocksquare isn’t theoretical; it’s operational across continents. For macro thinkers, pair this with broader RWA baskets. The forest view: tokenized assets rewrite wealth access, starting with property. Drill to the trees – select operators in growth corridors like U. S. suburbs or EU logistics hubs.

Blocksquare’s ascent from $100 million to over $204.9 million underscores execution amid hype. As on-chain real estate 29 countries becomes table stakes, the protocol’s operator-centric design positions it to lead. Stake early, diversify wisely, and watch liquidity transform silos into a global marketplace.