As of February 2026, the tokenized real estate sector has reached a pivotal moment: platforms are aggressively dropping minimum investments to $100 or less, transforming a historically exclusive asset class into a viable option for everyday investors. This shift, driven by blockchain’s efficiency, allows global participation in U. S. rental properties and luxury assets with unprecedented accessibility. No longer confined to million-dollar deals, fractional tokenized real estate $100 entry points are reshaping portfolios worldwide.

RealT and Lofty Set the New Standard at $50 Minimums

RealT, a pioneer on Ethereum, has long championed fractional ownership of U. S. rental properties, but 2026 marks a bold evolution with investments starting at just $50. Investors earn daily rental income in stablecoins, secured by blockchain transparency. Lofty mirrors this model, tokenizing single-family homes and distributing yields promptly. These platforms exemplify how tokenized property low minimums 2026 eliminate geographic and capital barriers, enabling retail investors to diversify into real assets without intermediaries.

This isn’t mere marketing; it’s rooted in smart contract automation. Property tokens represent precise fractional shares, tradable on secondary markets. For instance, a $50 stake in a Detroit rental might yield 8-12% annualized returns, paid out daily, far outpacing traditional savings. Yet, risks like market volatility and regulatory flux demand due diligence.

Top 5 Platforms in 2026

-

RealT ($50 min): Pioneers fractional ownership of U.S. rental properties on Ethereum, with daily stablecoin yields.

-

Lofty ($50 min): Offers daily rental yields from U.S. properties via tokenized shares.

-

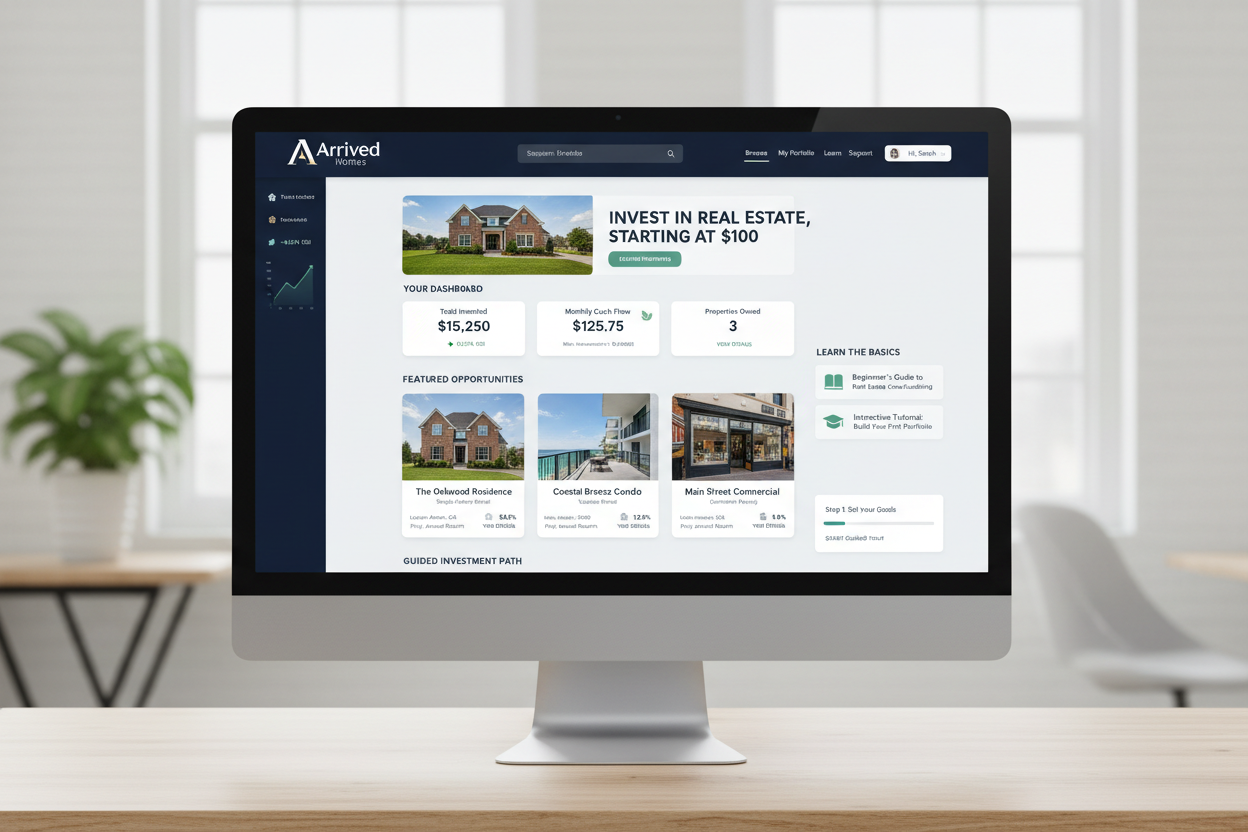

Arrived Homes ($100 min): Focuses on single-family rentals with quarterly dividends.

-

Binaryx ($50 min): Provides access to luxury international properties.

-

EstateX ($100 min): Enables Web3 fractional ownership with low entry barriers and daily rent claims in ESX tokens.

Arrived Homes and Binaryx Expand Horizons to $100 and Below

Arrived Homes targets single-family rentals with a $100 threshold, appealing to those seeking quarterly dividends from vetted U. S. properties. Binaryx pushes boundaries further, offering luxury international assets from $50, blending high-end appeal with blockchain liquidity. These developments underscore a broader trend: real estate tokenization platforms $100 entry are no longer aspirational but operational reality.

EstateX (ESX) emerges as a standout, tokenizing the $300 trillion market with daily rent claims in native tokens. Its platform removes illiquidity woes, letting users trade shares instantly. As per recent analyses, such innovations could unlock $4 trillion in tokenized real estate by year-end, fueled by fractional models.

Tokenization’s Core Mechanics Driving Accessibility

At its heart, on-chain fractional property investment leverages ERC-20 or ERC-721 standards to divide properties into tradable tokens. Smart contracts handle rent collection, distribution, and governance, slashing administrative costs by 70-80% compared to REITs. This automation is game-changing: investors claim yields daily, not quarterly, and exit positions via DEXs without broker fees.

Regulatory tailwinds bolster this. U. S. SEC approvals for tokenized securities have proliferated, while Europe’s MiCA framework eases cross-border flows. Platforms now integrate KYC seamlessly, mitigating compliance hurdles. Still, I caution that while yields entice, underlying property fundamentals – vacancy rates, cap rates – remain paramount. Blindly chasing low minimums risks overexposure to unproven assets.

Early adopters report portfolio boosts: a $500 allocation across three platforms might generate $50 monthly passive income. Compare 50 and options via specialized hubs to match risk appetites. This era demands analytical rigor; tokenization amplifies returns but doesn’t erase real estate’s cyclical nature.

Balancing opportunity with prudence requires scrutinizing platform fundamentals. RealT’s track record, with thousands of tokenized properties since 2019, offers reassurance, whereas newer entrants like EstateX must prove sustained yields. EstateX real estate tokens promise daily claims in ESX, but token volatility adds a layer of uncertainty absent in stablecoin payouts from Lofty or RealT.

Yield Comparison: Tokenized Platforms vs. Traditional Alternatives

To quantify the appeal, consider annualized returns. Tokenized platforms consistently deliver 8-12% yields from rental income, surpassing many public REITs at 5-7%. This edge stems from direct ownership fractions, bypassing management fees that erode traditional fund performance. Yet, total returns hinge on property appreciation, which blockchain tokens now capture more fluidly through secondary markets.

EstateX (ESX) vs. Major Cryptocurrencies: 6-Month Price Performance

Comparison amid fractional tokenized real estate platforms dropping minimums to $100 in 2026 (RealT: 10% yield/$50 min, Lofty: 9-11%/$50, EstateX: 9%/$100 vs. REITs: 6%)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| EstateX | $0.002060 | $0.0462 | -95.5% |

| Bitcoin | $74,763.00 | $60,000.00 | +24.6% |

| Ethereum | $4,879.00 | $4,000.00 | +22.0% |

Analysis Summary

EstateX (ESX) has plummeted 95.5% over the past six months, starkly contrasting with gains of 24.6% for Bitcoin and 22.0% for Ethereum, highlighting volatility in niche real estate tokens versus established cryptocurrencies.

Key Insights

- EstateX token price declined sharply by 95.5% from $0.0462 to $0.002060.

- Bitcoin surged 24.6% from $60,000 to $74,763.

- Ethereum rose 22.0% from $4,000 to $4,879.

- Performance underscores risks in emerging real estate tokenization projects despite attractive platform yields and lowered minimums.

Real-time data as of 2026-02-04 from CoinMarketCap (EstateX) and Yahoo Finance (BTC, ETH). 6-month historicals from 2025-08-08 for EstateX; changes per provided market data.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/estatex/

- Bitcoin: https://finance.yahoo.com/quote/BTC-USD/history/

- Ethereum: https://finance.yahoo.com/quote/ETH-USD/history/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Global investors benefit immensely. A European or Asian buyer can now own U. S. assets without currency conversion hassles or local regulations, thanks to on-chain settlement. EstateX’s Web3 integration exemplifies this, enabling seamless ESX token swaps for broader DeFi exposure.

Practical Steps for Entering at $100 Thresholds

Getting started demands minimal friction. Connect a Web3 wallet like MetaMask, complete KYC on the platform, and purchase tokens via stablecoins or fiat ramps. RealT and Lofty streamline this to under five minutes. For deeper guidance, explore how to invest under $100. Diversify across 3-5 properties to mitigate vacancy risks; a $300 portfolio might yield $25-35 monthly.

Challenges persist. Secondary market liquidity varies – premium properties trade briskly, but niche assets lag. Regulatory scrutiny intensifies; while U. S. clarity aids, jurisdictions like China restrict access. Platforms counter with geofencing and compliant oracles for off-chain data like occupancy rates.

Looking forward, 2026 projections from 4IRE signal a $4 trillion tokenized market, propelled by institutional inflows and AI-driven property selection. Binaryx’s luxury focus hints at ultra-premium fractions under $100, blending trophy assets with retail scale. This evolution favors patient, fundamentals-driven investors who treat tokens as hybrid real-digital holdings.

Tokenized real estate’s low entry points herald a paradigm shift, empowering portfolios once deemed inadequate for property exposure. By prioritizing yield transparency and blockchain audits, everyday investors can harness these tools effectively, building wealth in an increasingly on-chain world.