The real estate world is buzzing, and it’s not just about rising property values or the latest skyscraper project. DAOs (Decentralized Autonomous Organizations) are rewriting the rulebook for property ownership, management, and investment. By leveraging blockchain technology, tokenized property DAOs are transforming how we govern assets, distribute profits, and make collective decisions. If you’re looking to understand why so many investors and developers are excited about decentralized asset management, you’re in the right place!

What Makes Real Estate DAO Governance Revolutionary?

Traditional real estate investment has always come with its fair share of headaches: paperwork mountains, opaque decision-making, slow transactions, and limited access for smaller investors. Enter real estate DAO governance. With a DAO structure, smart contracts automate key processes while voting rights are distributed among token holders. This means:

Key Advantages of DAO-Powered Real Estate Governance

-

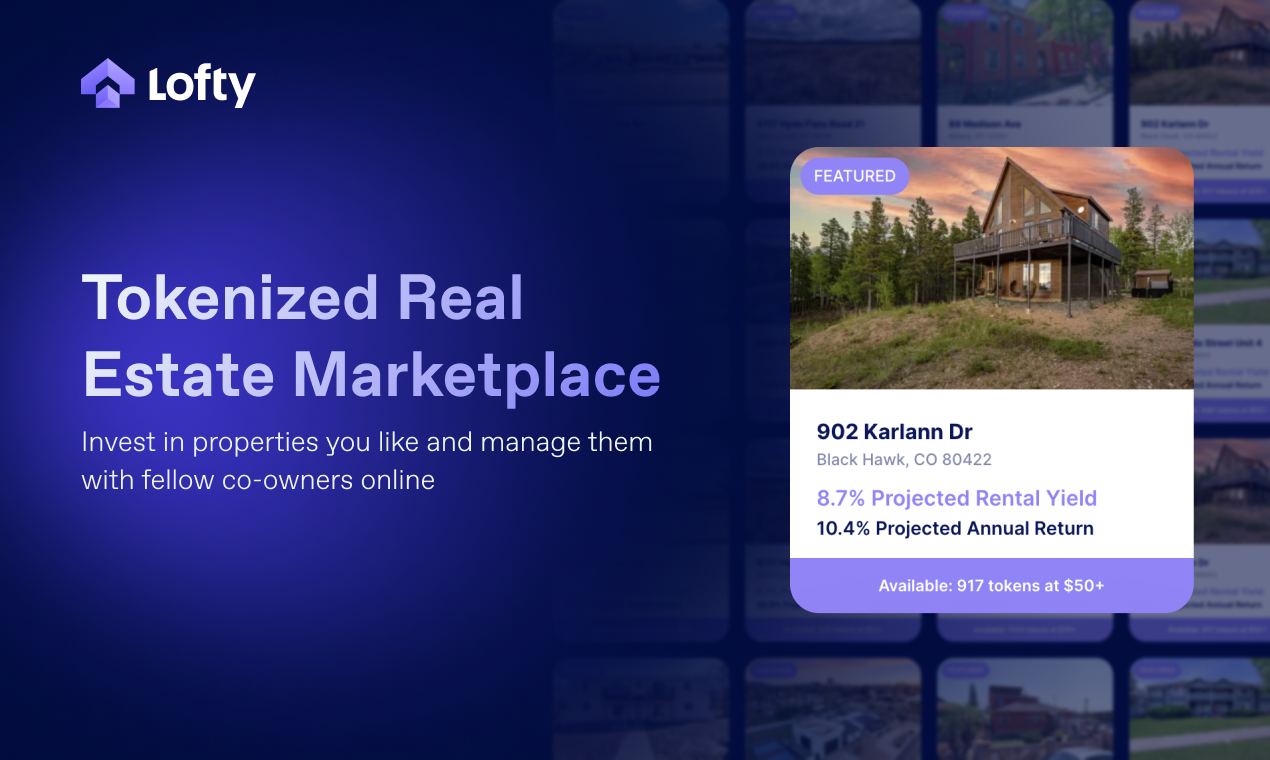

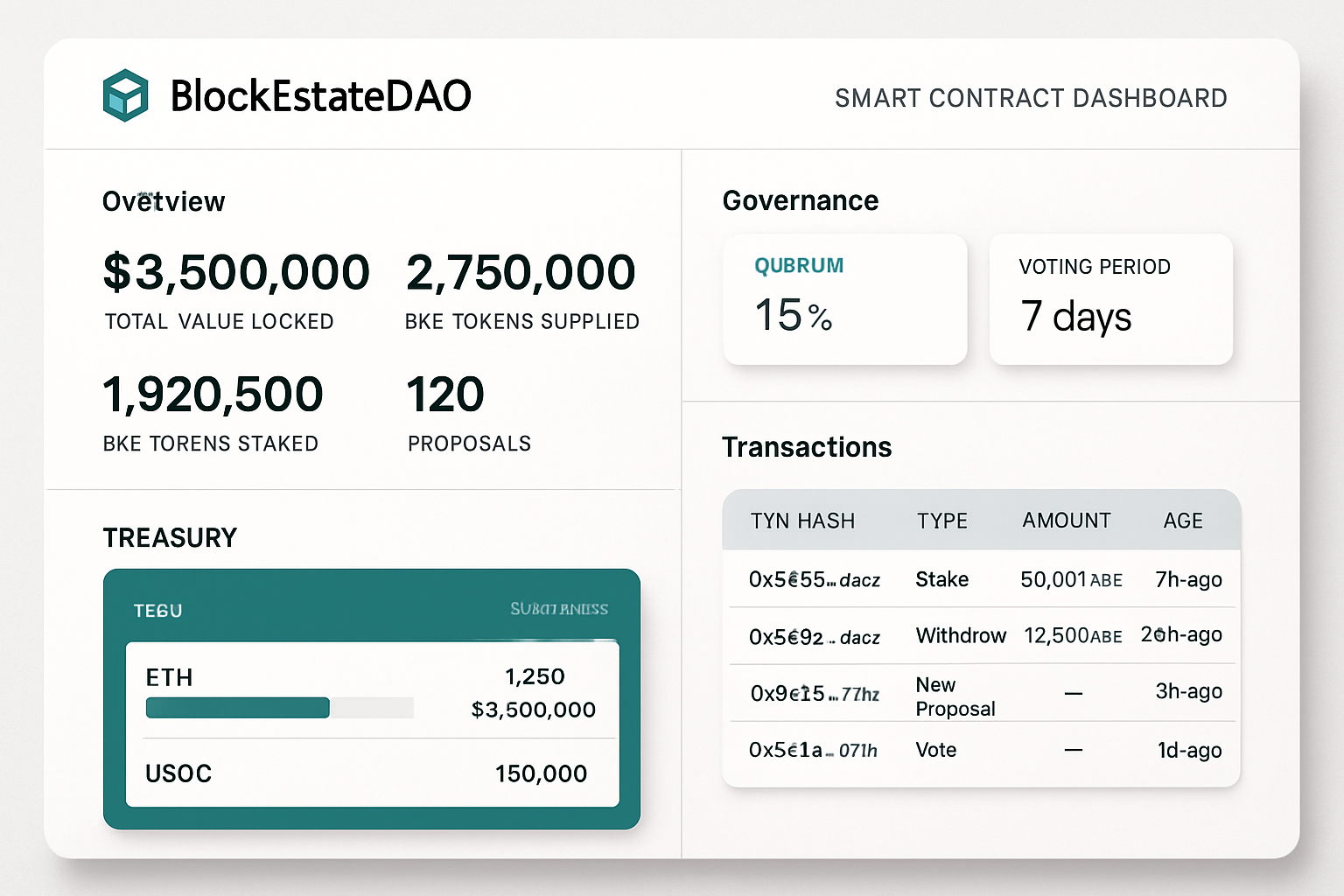

Collective Ownership & Decision-Making: DAOs like Lofty and BlockEstateDAO empower token holders to jointly own real estate assets and vote on key property decisions, fostering true democratic governance.

-

Enhanced Transparency: All transactions, votes, and financials are immutably recorded on the blockchain, ensuring full transparency for investors and regulators alike.

-

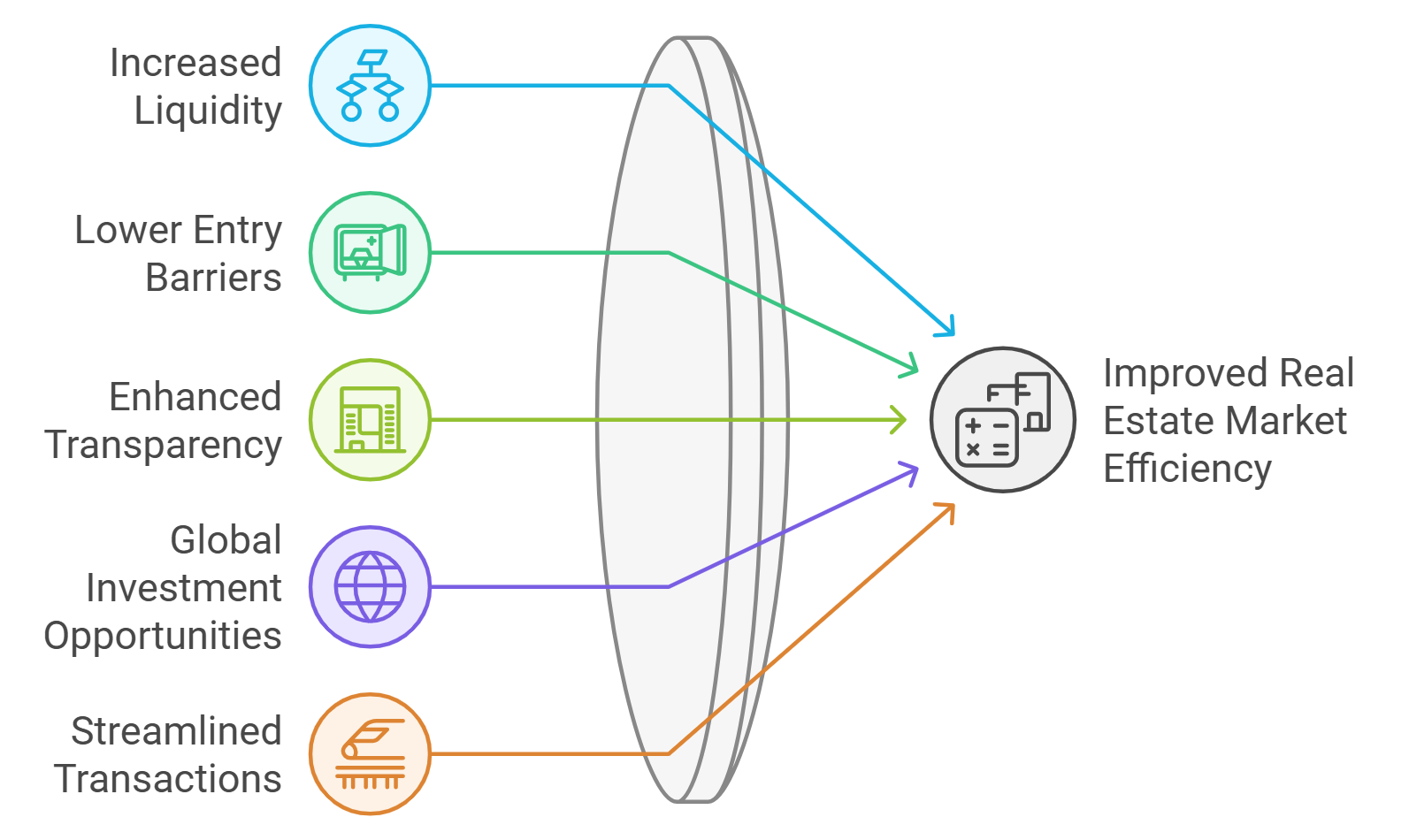

Increased Liquidity: Tokenization allows fractional ownership, enabling investors to buy and sell property shares with ease on platforms such as RealT, making real estate far more liquid than traditional models.

-

Automated Processes via Smart Contracts: DAOs leverage smart contracts to automate rent collection, distributions, and property management tasks, reducing administrative overhead and human error.

-

Global Accessibility: Anyone with internet access can participate in DAO-powered real estate investments, breaking down geographical and financial barriers for small investors worldwide.

On platforms like BlockEstateDAO and Lofty, each property is often held in a dedicated legal structure (like a “DAO LLC”) that owns the title outright. Token holders then become collective decision-makers on everything from approving repairs to distributing rental income. This isn’t just theory – it’s happening now.

How Tokenized Property DAOs Work in Practice

The nuts and bolts of a tokenized property DAO are elegant yet robust. Here’s how it typically works:

- Property Acquisition: A legal entity (often an LLC) acquires the property and is managed by a DAO.

- Tokenization: The property’s value is divided into digital tokens representing fractional ownership.

- Smart Contract Governance: All major decisions – from leasing terms to expense approvals – are voted on by token holders via blockchain-based smart contracts.

- Payouts and Reporting: Income streams (like rent) are distributed automatically based on token holdings; financials are visible in real-time.

This model isn’t just about efficiency – it’s about transparency and inclusion too. Even small investors can participate in high-value markets that were once out of reach.

The Power of Collective Decision-Making

One of the most exciting aspects of decentralized asset management is collective governance. Instead of relying on a single landlord or boardroom full of executives, every investor gets a seat at the table – literally! Decisions like renovations or refinancing are made through transparent voting mechanisms where every voice counts proportionally to their stake.

This isn’t just democratically satisfying; it also drives smarter outcomes as diverse perspectives shape each move.

Pushing Past Legal Hurdles

No revolution comes without obstacles. While DAOs can now be listed as legal owners in some jurisdictions (as seen with Hedera’s case studies), global regulatory clarity remains a work in progress. Each market may require unique structures or compliance steps to ensure DAOs have full legal standing as property owners.

If you’re considering stepping into this space, it pays to stay informed about your local rules and emerging best practices for smart contract governance in real estate.

On the upside, legal innovation is happening at a rapid pace. For example, platforms like Lofty have adopted the “DAO LLC” model, where each property sits inside its own limited liability company governed by token holders. This approach is gaining traction because it blends the best of both worlds: blockchain-powered transparency and traditional legal protection. As more jurisdictions recognize DAOs as legitimate property owners, expect to see this model become standard for tokenized real estate projects.

Unlocking Liquidity and Global Access

Perhaps the most game-changing aspect of tokenized property DAOs is liquidity. In the past, real estate was notorious for its illiquidity, you couldn’t just sell a fraction of your apartment overnight. Now, thanks to blockchain-based tokens, investors can buy or sell their shares on secondary markets in a few clicks. That means capital isn’t locked up for years; you can respond to market changes with agility.

How DAOs Boost Liquidity & Accessibility in Real Estate

-

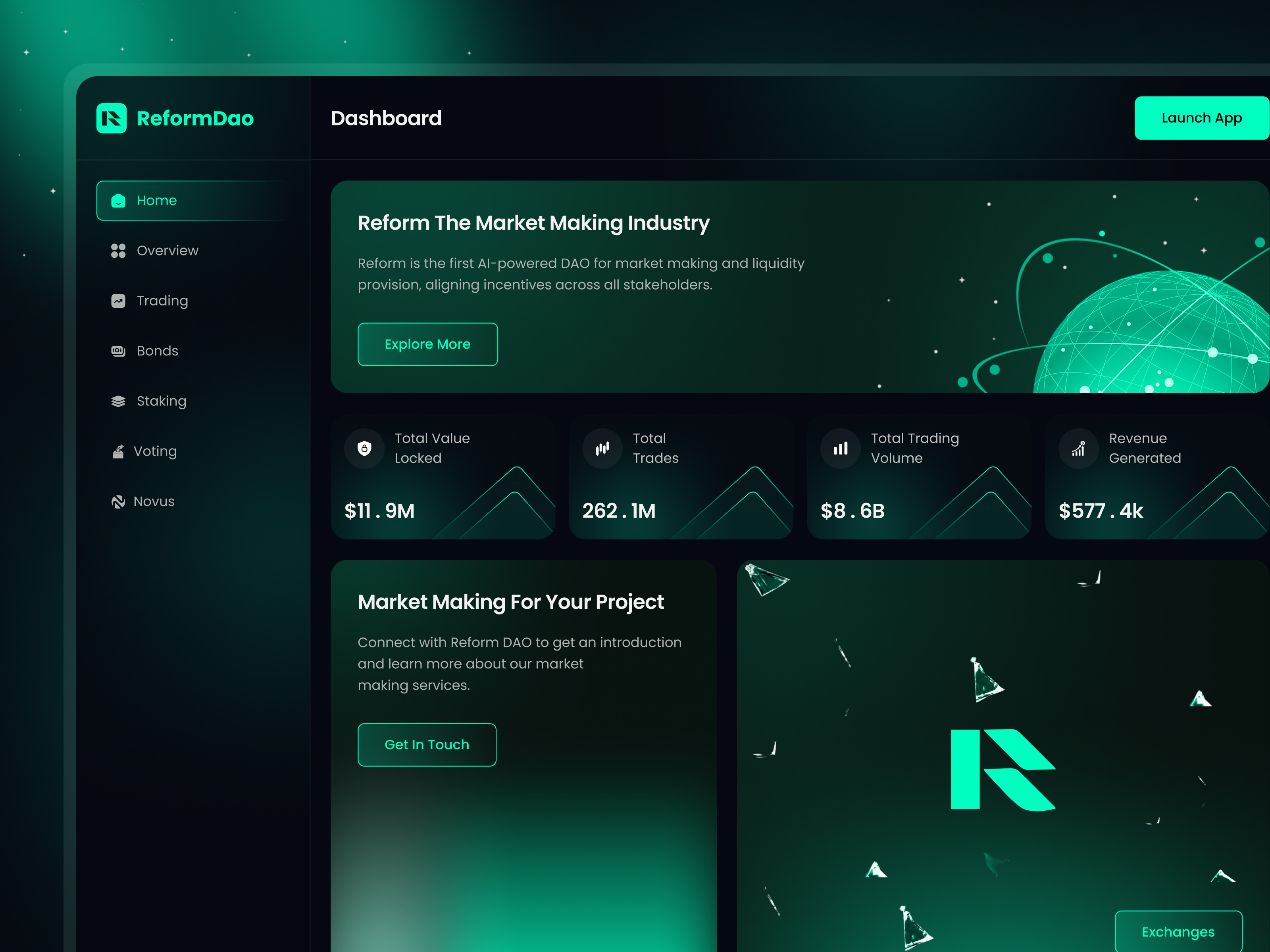

24/7 Global Trading on Secondary Markets: Platforms such as tZERO and OpenFinance allow tokenized real estate assets governed by DAOs to be traded peer-to-peer, increasing liquidity and enabling investors to enter or exit positions at any time.

-

Automated Income Distribution: DAOs utilize smart contracts to automatically distribute rental income and dividends to token holders, as seen on BlockEstateDAO. This streamlines payouts and enhances transparency for investors.

-

Lower Barriers to Entry for Small Investors: By leveraging DAOs, platforms like HomeCubes allow individuals to invest with minimal capital, democratizing access to real estate markets that were previously out of reach for many.

-

Transparent, Community-Driven Governance: DAO-powered real estate platforms such as Mintlayer and Blockchain App Factory empower token holders to vote on property management decisions, ensuring transparency and aligning incentives across the community.

This shift has opened doors for global participation. Someone in Singapore can invest in a Manhattan loft, while a retiree in Berlin can co-own Miami beachfront property, all without ever setting foot on-site. The barriers that kept everyday investors out of prime real estate are falling fast.

Challenges Ahead: Participation and Platform Maturity

Of course, no system is perfect yet. One ongoing challenge for decentralized asset management is ensuring active participation among token holders. While smart contracts automate much of the process, meaningful governance still requires engaged community members who vote on proposals and monitor operations.

Some platforms are experimenting with incentives like staking rewards or tiered voting rights to keep engagement high. Others are focusing on educational resources to help new investors understand their role in DAO governance.

The Road Ahead: Smarter, Fairer Real Estate Investment

The momentum behind tokenized property DAOs isn’t slowing down. As smart contract governance matures and legal clarity improves worldwide, expect even more innovative models to emerge, from sequential auction mechanisms that optimize decision-making (as seen in recent research) to cross-border DAOs pooling capital for mega-developments.

If you’re ready to explore this space as an investor or developer, start by joining DAO communities and learning how decentralized votes shape everything from maintenance budgets to profit distributions. The future of real estate is collaborative, transparent, and powered by blockchain-savvy participants who want more than just passive returns, they want a voice.

Trade smart, stay sharp! The era of decentralized asset management is here, don’t watch from the sidelines!