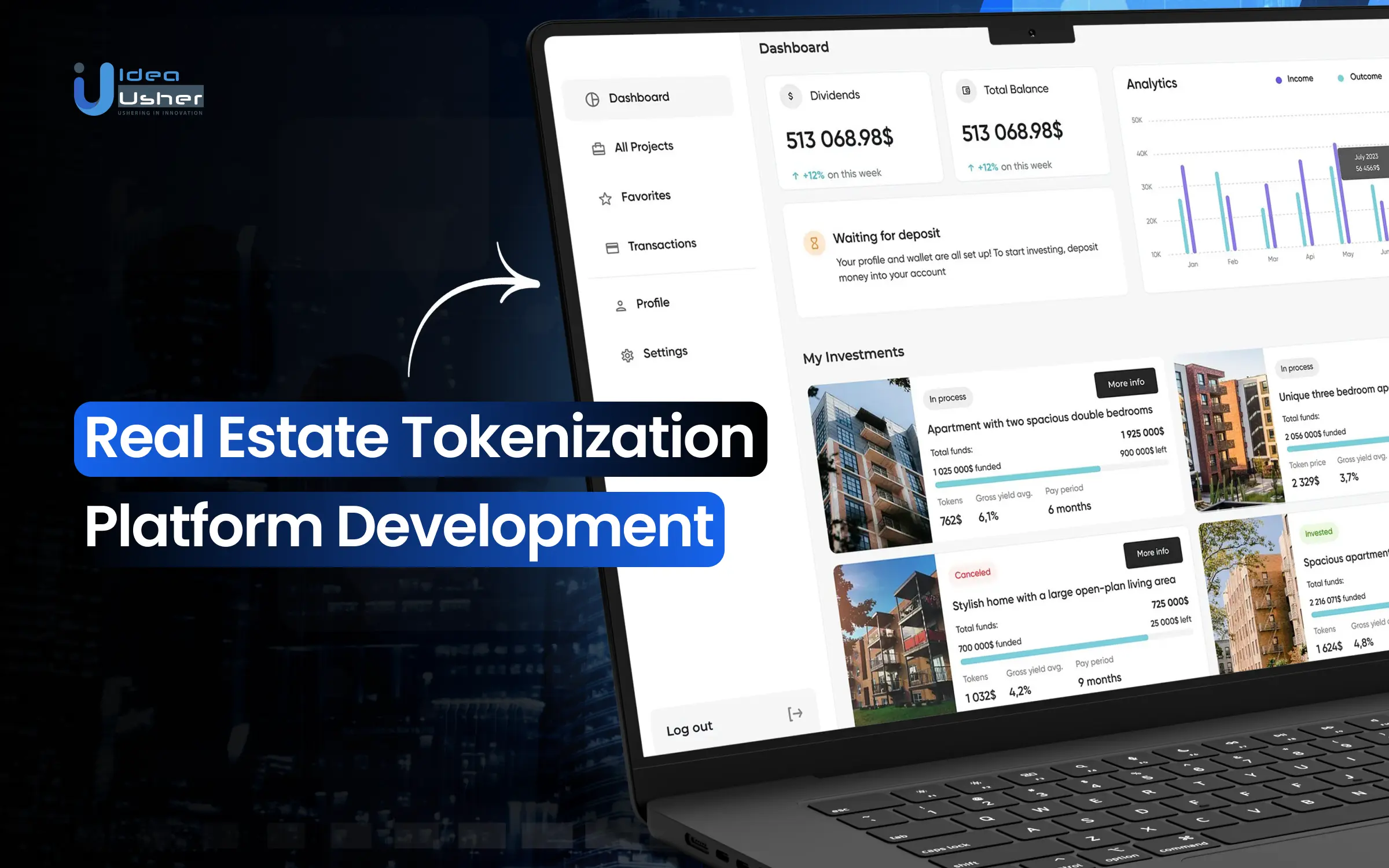

In recent years, fractional property ownership powered by blockchain tokens has emerged as a transformative force in real estate investing. By leveraging blockchain technology, investors can now purchase digital shares, known as property tokens: that represent partial ownership of tangible assets. This innovation not only democratizes access to high-value properties but also introduces unprecedented liquidity and transparency to a traditionally illiquid market.

How Blockchain Tokenization Splits Property Ownership

The core mechanism behind fractional property ownership is the process of tokenization. Here’s how it works: a real estate asset, such as an apartment building or commercial space, is divided into hundreds or thousands of digital tokens on the blockchain. Each token signifies a specific fraction of ownership in the underlying property. Investors can buy as many tokens as they wish, tailoring their exposure to suit their investment goals and risk appetite.

This model is gaining traction among both retail and institutional investors seeking more flexible entry points into real estate markets. Platforms like PropBlock and Ekta are already enabling users to participate in fractional ownership structures, offering global access to properties that were once reserved for high-net-worth individuals or large funds.

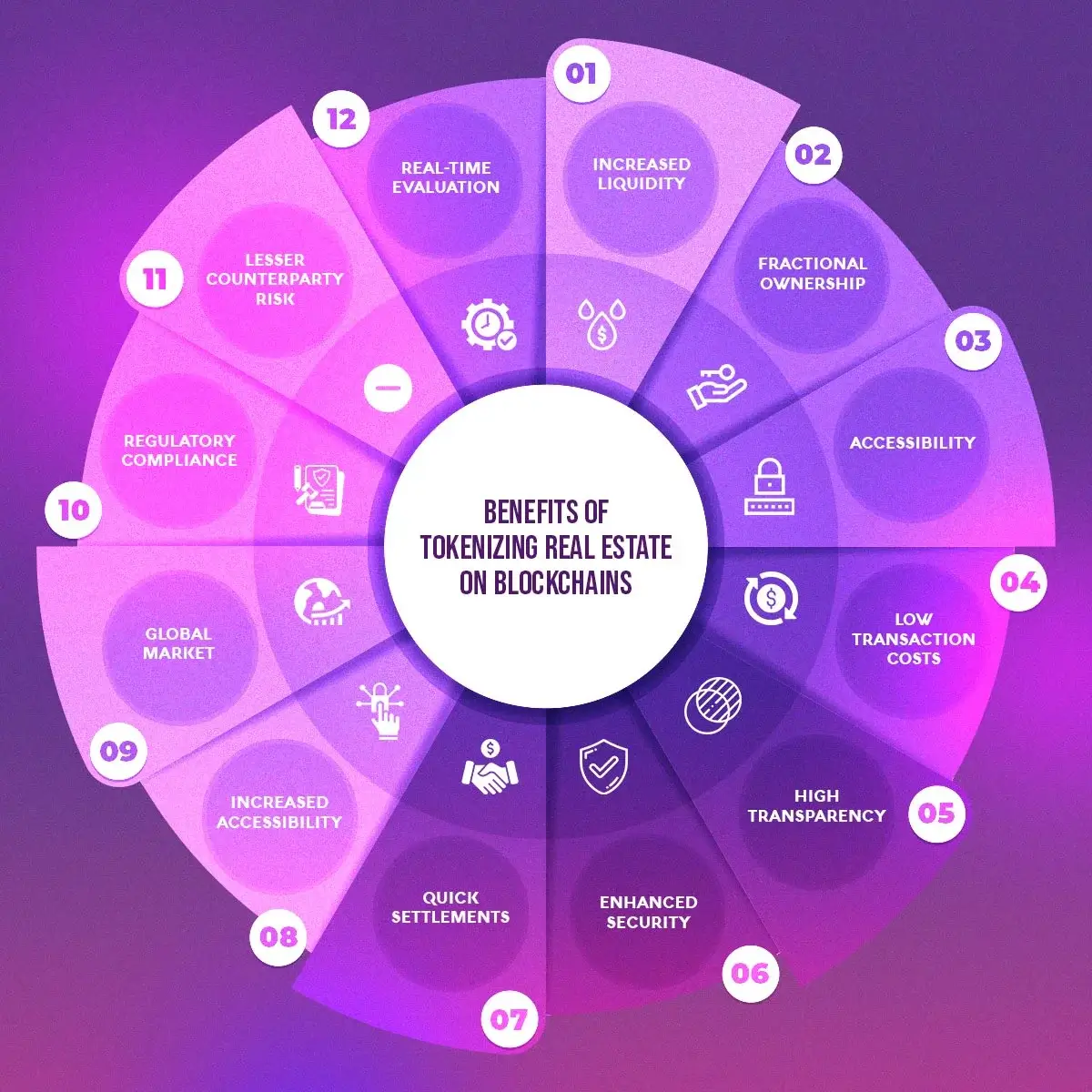

Key Benefits of Fractional Property Ownership with Blockchain Tokens

-

Increased Accessibility: Fractional ownership via blockchain tokens lowers the financial barrier, enabling more investors to participate in real estate markets that were once limited to high-net-worth individuals. (Source: Oases Global)

-

Improved Liquidity: Tokenized real estate assets can be bought and sold on secondary markets, allowing investors to easily trade their shares—unlike traditional property investments, which are typically illiquid. (Source: Wikipedia)

-

Efficient Income Distribution: Smart contracts automate the distribution of rental income to token holders based on their ownership percentage, ensuring timely and transparent payouts. (Source: Homecubes)

-

Enhanced Transparency and Security: Blockchain’s decentralized ledger provides an immutable and transparent record of ownership and transactions, reducing the risk of fraud and building investor trust. (Source: Homecubes)

-

Global Investment Opportunities: Platforms like PropBlock allow investors worldwide to access and invest in tokenized real estate, broadening the range of available properties and diversifying portfolios. (Source: PropBlock)

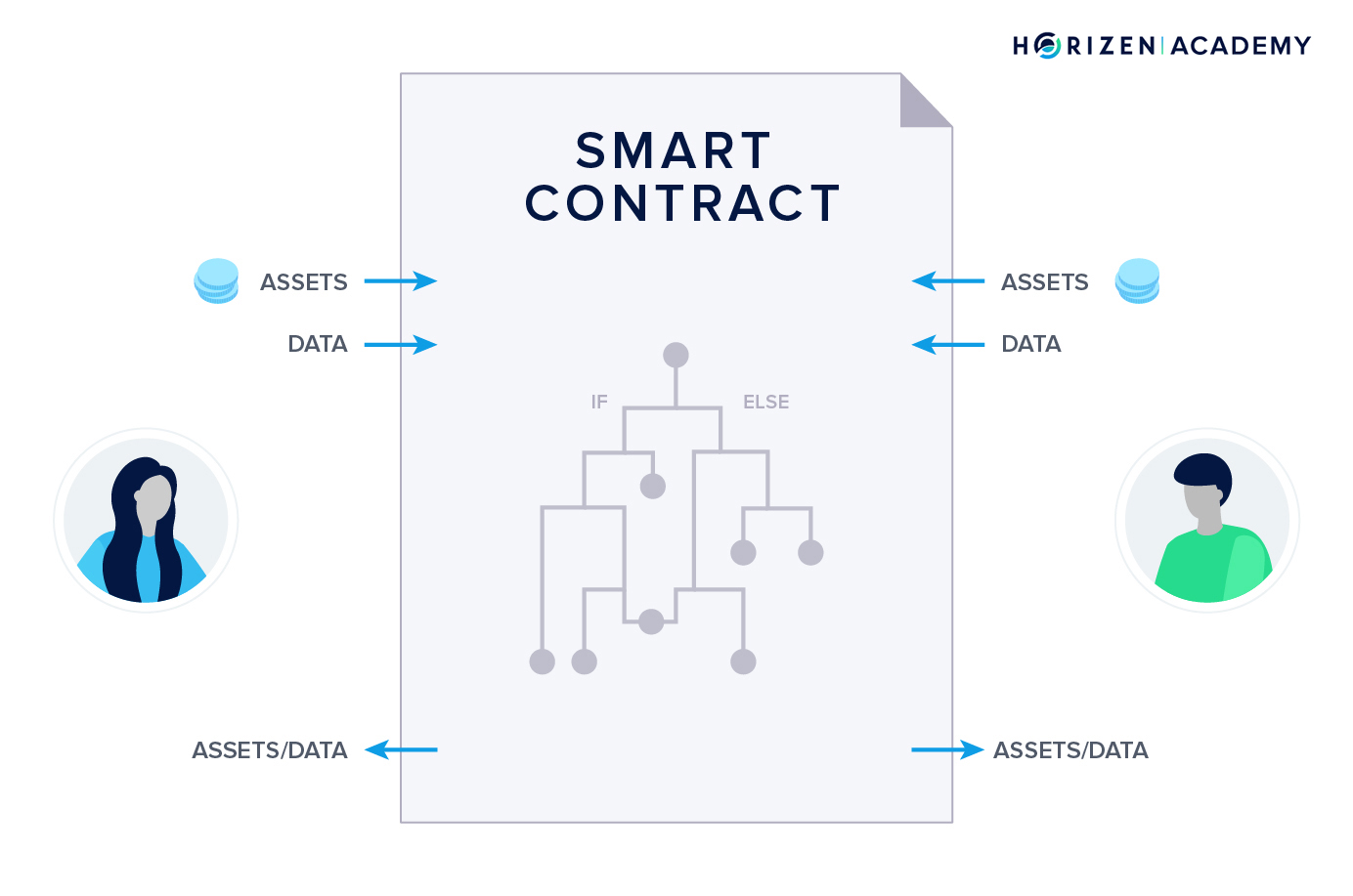

The Role of Smart Contracts in Income Distribution

Blockchain’s programmable layer brings another critical advantage: income distribution smart contracts. These self-executing agreements automate complex processes such as rental income payouts, profit-sharing, and even governance decisions among token holders. For example, when a tenant pays rent, smart contracts can instantly allocate each investor’s share based on the number of tokens they hold, eliminating manual calculations and reducing administrative costs.

This automation also extends to other vital functions like voting on property management issues or approving maintenance expenses. The result is a more efficient, transparent system where every transaction is recorded immutably on the blockchain ledger. For a deeper dive into how these mechanisms work in practice, see this overview from Homecubes.io.

Transparency and Security for Investors

One of the most compelling features of blockchain-based fractional ownership is its emphasis on transparency and security. Every transaction, from token issuance to secondary market trades, is permanently recorded on a decentralized ledger accessible to all participants. This transparency not only builds trust but also reduces fraud risk by providing an auditable trail of all financial activities related to the property.

Furthermore, because these systems operate without centralized intermediaries, investors benefit from lower fees and faster settlement times compared to traditional real estate transactions. Blockchain’s inherent security protocols protect against unauthorized alterations or data breaches, making it an attractive solution for safeguarding both capital and sensitive information.

As blockchain real estate platforms mature, the advantages of fractional property ownership are becoming increasingly tangible. Not only do token holders gain exposure to rental income and long-term appreciation, but they also enjoy the flexibility to liquidate positions on secondary markets. This marks a significant shift from conventional real estate, where investors are often locked into multi-year commitments or face steep transaction costs when exiting their positions.

The secondary trading of property tokens is rapidly evolving. Marketplaces are emerging that allow investors to buy and sell their fractional shares with greater ease and speed than traditional property transactions. This improved liquidity is particularly attractive during periods of market volatility or when investors need to rebalance portfolios quickly.

Emerging Platforms and Global Adoption

Several pioneering platforms are setting the pace for industry adoption. PropBlock has created an ecosystem where institutions can launch tokenized offerings, manage compliance, and provide seamless access for both local and international investors. Meanwhile, companies like Ekta have introduced NFT-based fractional ownership models, lowering entry barriers even further by allowing fractions of properties to be owned and traded as digital collectibles. These innovations highlight a broader trend: blockchain-powered real estate is not just a theoretical concept but an operational reality attracting diverse investor profiles worldwide.

Leading Platforms for Fractional Property Ownership

-

PropBlock: This platform enables institutions to launch and manage tokenized real estate investment offerings, allowing investors to acquire fractional ownership in global properties. PropBlock leverages blockchain for enhanced liquidity, automated income distribution, and transparent record-keeping.

-

Ekta: Ekta is a blockchain network that facilitates fractional real estate ownership through NFTs. Investors can purchase and exchange digital fractions of real-world properties, making property investment more accessible and tradable.

-

RealT: RealT is a US-based platform that tokenizes residential properties, primarily in the United States. Investors can buy blockchain-based tokens representing shares in rental properties, receiving proportional rental income distributed via smart contracts.

-

Lofty AI: Lofty AI offers fractional ownership of US rental properties through blockchain tokens. Investors can buy and sell property shares easily, with automated daily rental income payouts managed by smart contracts.

-

Oasis Pro Markets: Oasis Pro Markets operates a regulated digital asset exchange, supporting the trading of tokenized real estate and other alternative assets. The platform enables fractional ownership and secondary market liquidity for property-backed tokens.

The global appetite for these solutions is evident in recent moves by major developers such as Seazen Group in China, who are now exploring tokenization strategies to address liquidity challenges in their domestic market (Reuters). As more established players join the space, regulatory frameworks continue to evolve to support investor protection while fostering innovation.

What Investors Should Know Before Participating

While the benefits are compelling, prospective investors should approach tokenized real estate with a critical eye. Due diligence remains essential: understanding the legal structure behind each token offering, verifying platform credibility, and assessing property fundamentals are all crucial steps. Regulatory environments can vary significantly across jurisdictions; some tokens represent direct equity in properties while others may confer rights through special-purpose vehicles or trusts.

Additionally, liquidity, while improved, may still depend on platform adoption and market depth. As with any investment, risk assessment should include consideration of market volatility, counterparty reliability, and potential changes in local real estate laws.

Looking Ahead: The Future of Blockchain Real Estate

The trajectory for tokenized rental income, automated income distribution smart contracts, and global access points toward a more inclusive investment landscape. As technology continues to lower barriers and increase transparency, it’s likely that both retail and institutional investors will increasingly turn to blockchain real estate as a core component of diversified portfolios.

This evolution is not without its challenges, but for those willing to embrace innovation while maintaining prudent risk management strategies, fractional property ownership via blockchain tokens offers an unprecedented blend of accessibility, efficiency, and security in real estate investing.