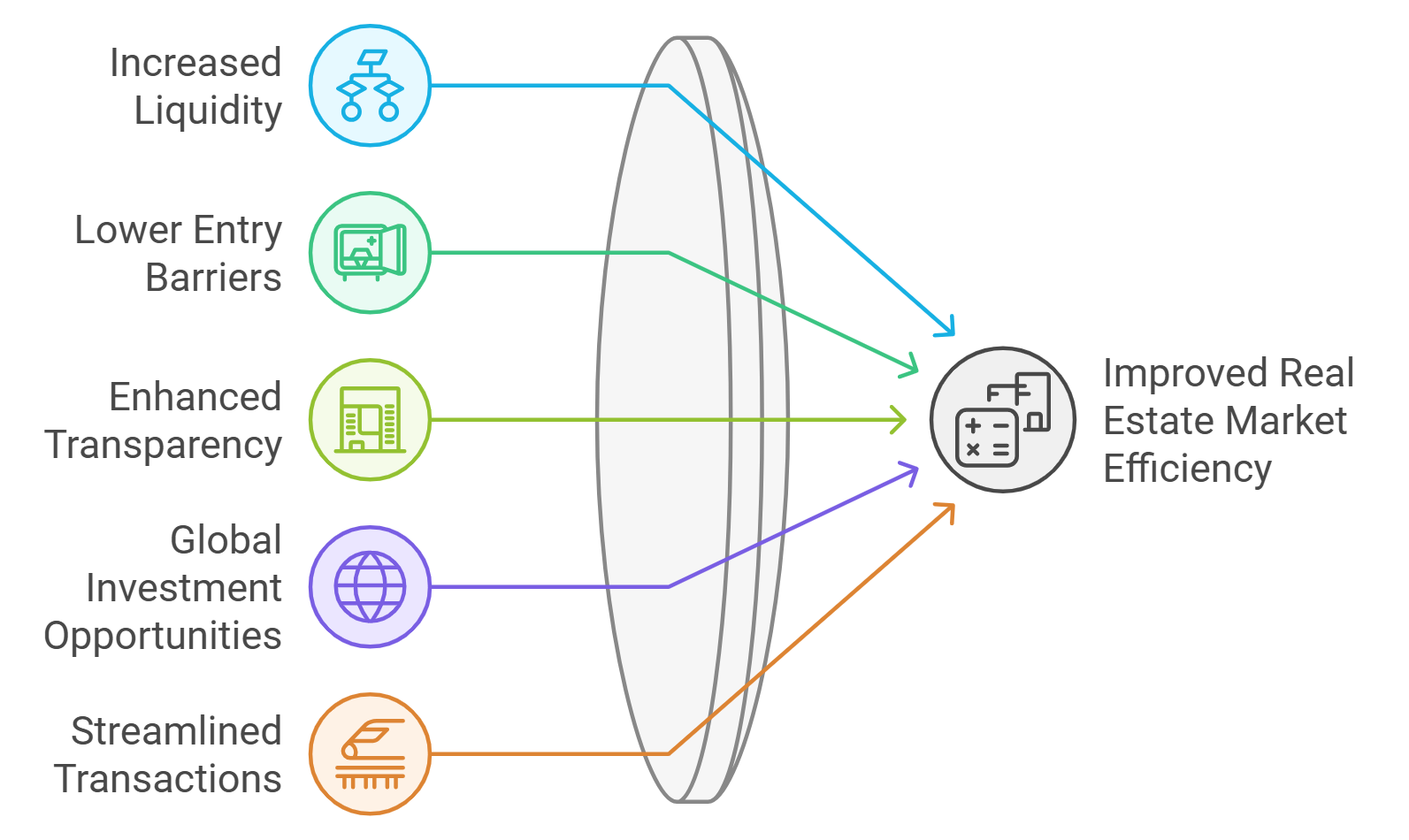

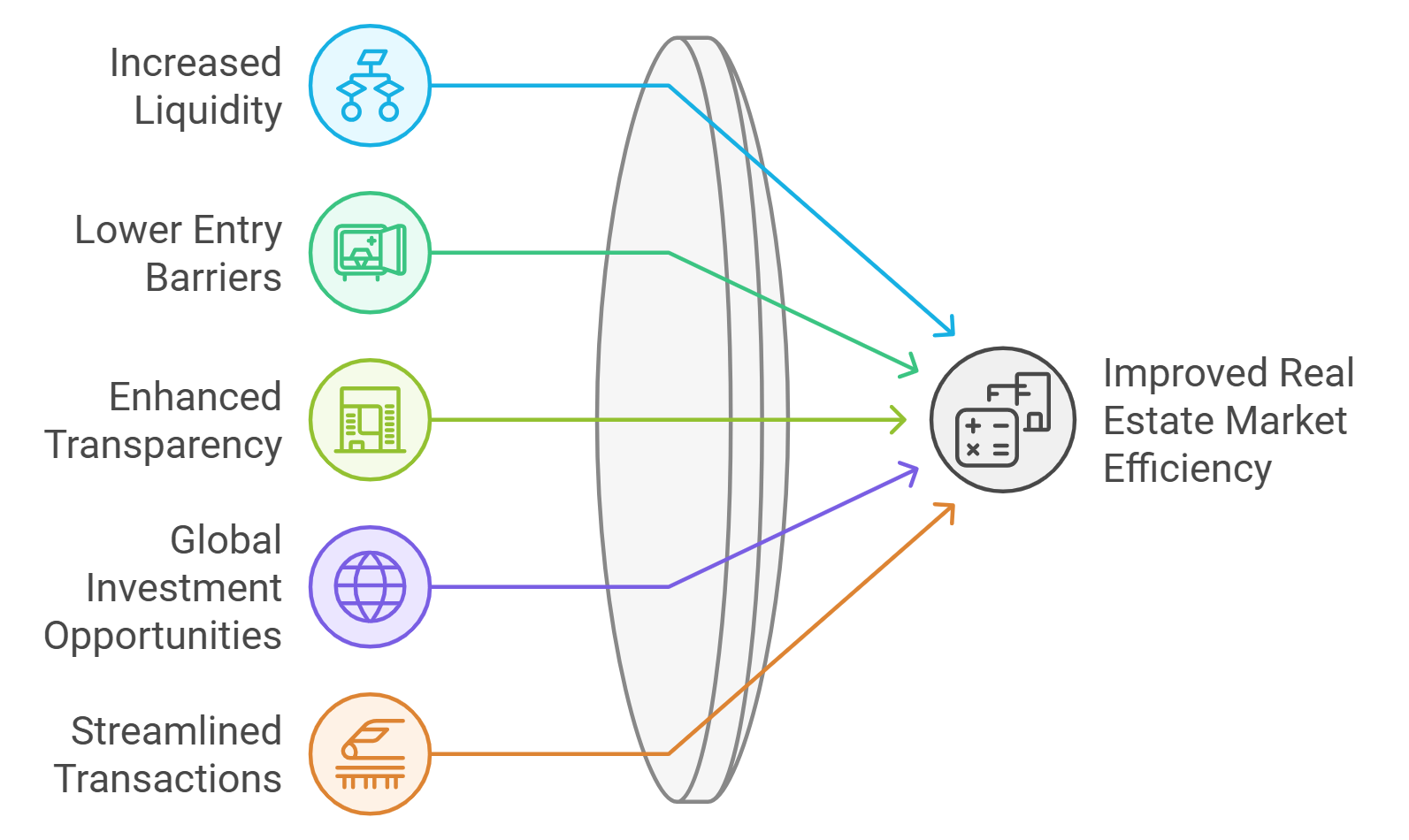

Tokenized real estate platforms are reshaping the property investment landscape, making global on-chain property ownership accessible, liquid, and transparent. In 2025, a curated group of eleven platforms stands out for their technology, investor experience, and innovative approaches to fractional ownership. Let’s explore how these leaders compare on features, fees, and user experience, so you can spot the best fit for your digital real estate portfolio.

Fractional Ownership: Lowering the Barriers

One of the most disruptive features across top tokenized real estate platforms is fractional ownership. By converting physical assets into digital tokens, investors can own a slice of high-value properties with minimal capital outlay. Here’s how leading platforms stack up:

- RealT: Known for its ultra-low entry point, starting at just $50, RealT lets investors buy fractional stakes in U. S. rental properties and receive weekly passive income. The platform’s liquidity is bolstered by regular additions of new tokenized assets.

- HoneyBricks: Specializes in commercial real estate in North America, offering curated deals with institutional-grade due diligence. Minimum investments start at $1,000, targeting accredited investors seeking stable yield.

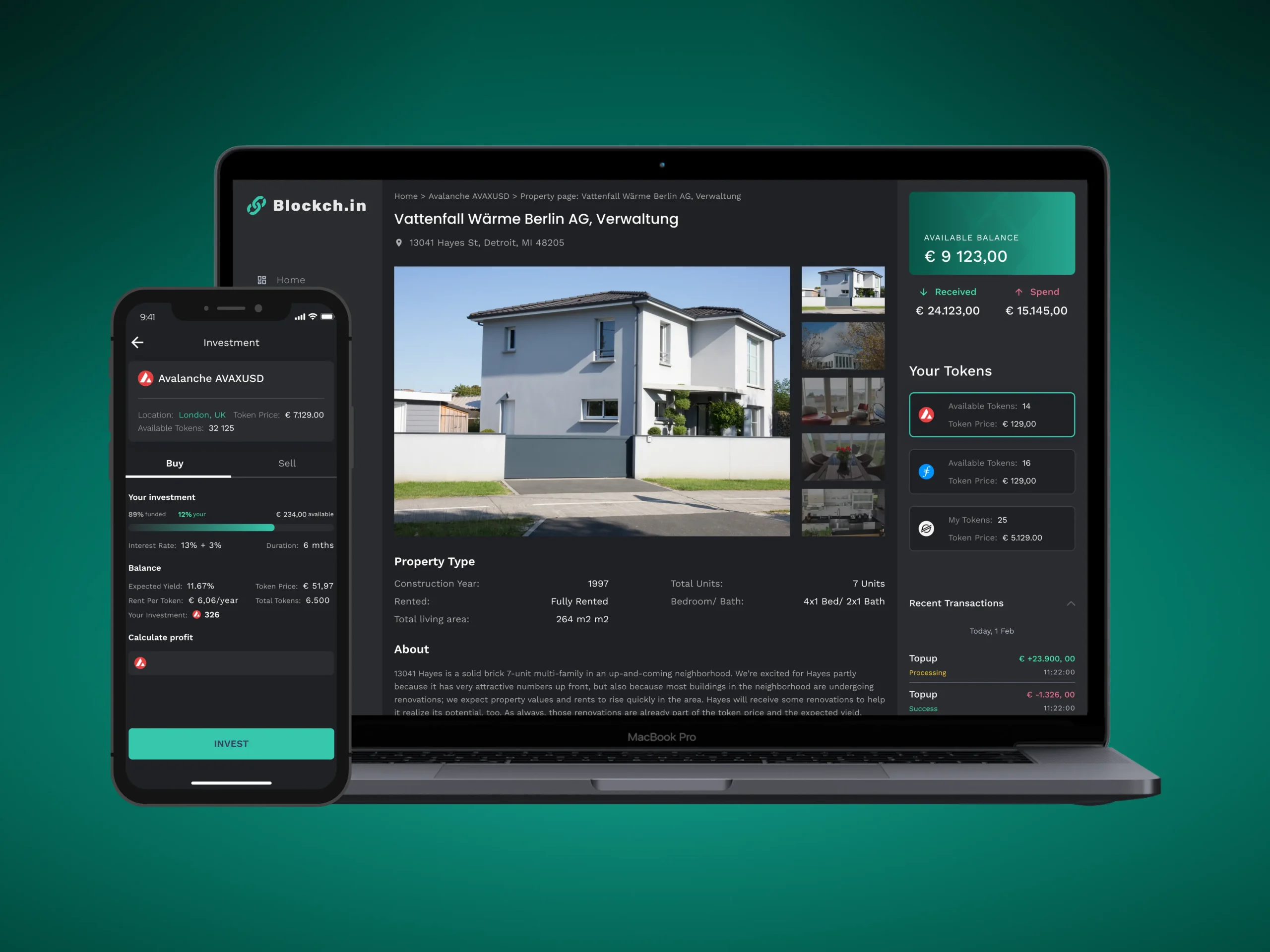

- SolidBlock: Focuses on both residential and commercial properties globally. Their platform supports flexible investment sizes and secondary trading for liquidity.

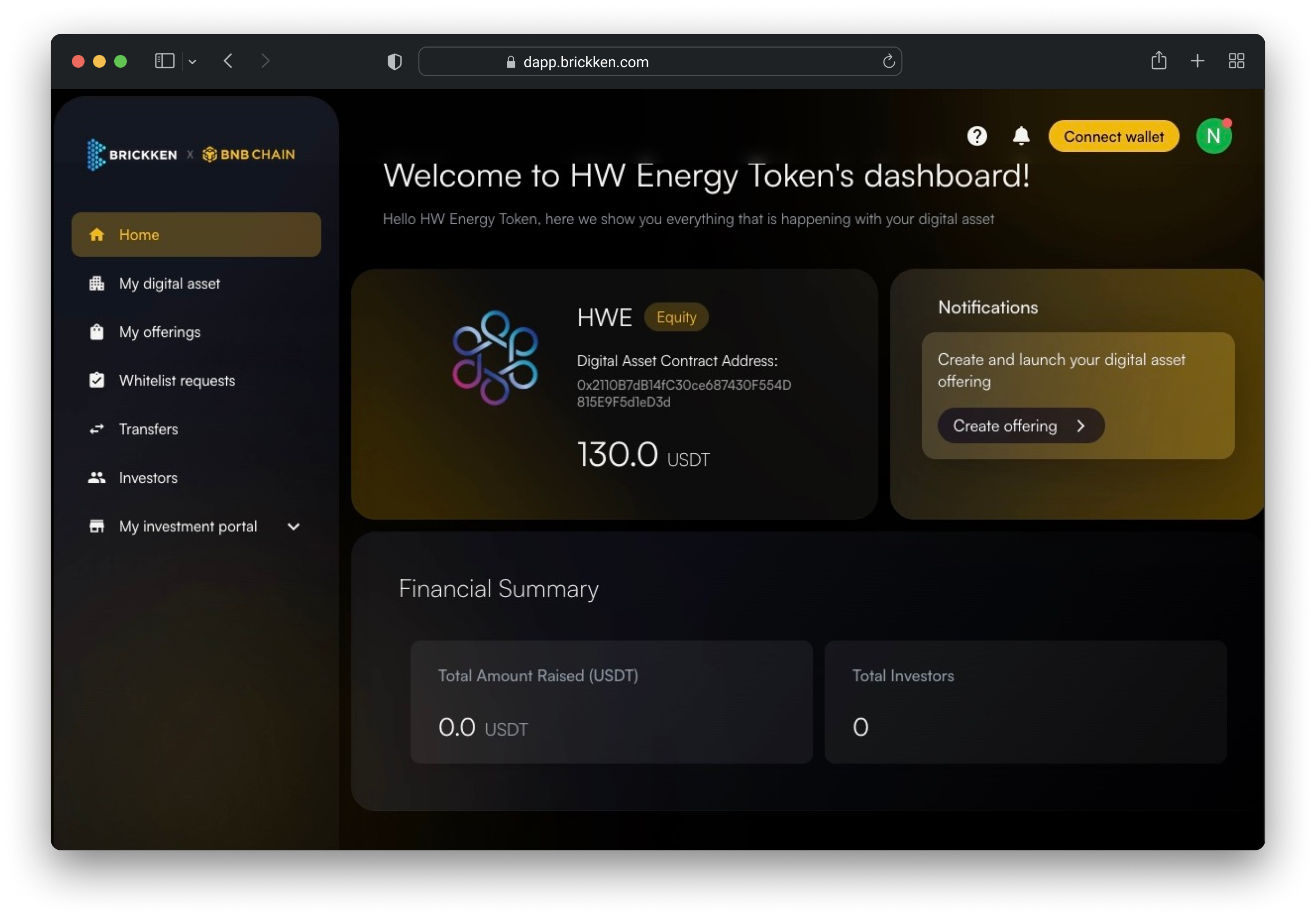

- Brickken: Empowers property owners to tokenize assets directly via an intuitive dashboard. Investors benefit from transparent fractionalization and easy onboarding.

Diving Into Fees: What Are You Really Paying?

Fees can make or break your returns, so it’s crucial to understand each platform’s model before investing. Here’s a snapshot of how costs compare among market leaders:

Comparison of Leading Tokenized Real Estate Platforms: Features, Fees, and User Experience (2025)

| Platform | Key Features | Fee Structure | User Experience Highlights |

|---|---|---|---|

| RealT | Fractional U.S. property ownership, weekly income, high liquidity | 2% transaction fee; 1-5% management; 1-3% secondary market fees | Mandatory KYC, U.S.-focused, low minimum ($50) |

| HoneyBricks | Commercial real estate focus, fractional investments | 1-3% transaction/management fees | Easy onboarding, global access, KYC required |

| SolidBlock | Customizable tokenization for sellers, B2B focus | Customized fees (case-by-case) | Tailored solutions, institutional-grade platform |

| Brickken | Tokenization for property owners, white-label options | Platform and management fees (varies) | User-friendly, supports both B2B and B2C |

| Propine | Institutional custody, compliance infrastructure | Institutional custody fees (not specified) | Designed for institutions, robust compliance |

| Blocksquare | B2B tokenization solutions, Ethereum/IPFS integration | B2B pricing (not disclosed) | Business-focused, not direct to retail investors |

| Tokeny Solutions | White-label tokenization, investor onboarding tools | White-label setup fees (not specified) | Streamlined onboarding, customizable platform |

| Smartlands | Regulated investment platform, security tokens | Success-based fees (not specified) | Regulated, European focus, investor dashboard |

| ReitBZ (BTG Pactual) | Brazilian real estate, performance-linked tokens | Performance-based fees (not specified) | Accessible via exchanges, focus on returns |

| Harbor (BitGo) | Custody, compliance, token issuance | Custody & compliance fees (not specified) | Institutional-grade security, U.S. compliance |

| Slice | Commercial real estate, cross-border investments | Success and management fees (not specified) | Global access, streamlined compliance, KYC required |

Note: Always review current fee schedules on each platform before committing capital, the above are indicative ranges based on latest disclosures.

User Experience: Compliance Meets Convenience

The best blockchain real estate marketplaces blend robust compliance with seamless UX. Let’s break down what sets each apart in terms of investor journey:

- Propine: Focused on institutional-grade custody for digital securities. Propine excels at regulatory compliance across multiple jurisdictions but may feel more technical to retail users.

- Blocksquare: Primarily B2B, empowering companies to tokenize their own portfolios using Ethereum or IPFS protocols. Individual investors typically access Blocksquare-powered deals via partner marketplaces.

- Tokeny Solutions: Streamlines onboarding with KYC/AML integrations and offers white-label solutions so partners can launch branded investment portals quickly.

- Smarlands and Slice: Both platforms emphasize cross-border accessibility and secondary trading options, with Smartlands focusing on agricultural/European assets and Slice targeting U. S. /international commercial deals.

The Global Angle: Multi-Jurisdictional Access

Diversity is key, not just in asset type but also geography. Platforms like ReitBZ (a BTG Pactual initiative targeting Latin America) open up exposure beyond traditional markets while maintaining regulatory rigor through security tokens. Meanwhile, Harbor (now part of BitGo) brings institutional trust to U. S. -based offerings by integrating advanced custody solutions with compliance-first architecture.

For investors who crave transparency and control, these platforms deliver a range of dashboards, real-time reporting, and performance analytics. Brickken and Tokeny Solutions are notable for their user-centric interfaces, making it easy for both new and seasoned investors to track holdings, distributions, and compliance status. Meanwhile, Propine stands out for institutional users needing full custody solutions that meet the highest regulatory standards.

Liquidity and Secondary Markets: Unlocking Flexibility

A key value proposition of tokenized real estate is secondary market liquidity. While traditional property investments can take months to exit, blockchain-powered platforms are working to shorten this window dramatically:

- SolidBlock: Enables peer-to-peer trading of property tokens with instant settlement on-chain. Their model supports both primary issuance and active secondary trading.

- Smartlands: Focuses on regulated secondary markets in Europe, allowing investors to trade agricultural and commercial property tokens after initial lock-up periods.

- Slice: Offers a global marketplace for U. S. and international properties with a strong emphasis on liquidity events through periodic auctions or direct peer trades.

- Harbor (BitGo): While now integrated into BitGo’s ecosystem, Harbor’s legacy includes pioneering compliant secondary transfers, critical for institutional adoption.

Security and Compliance: Staying Ahead of Regulation

The regulatory landscape for blockchain real estate is evolving fast. Platforms like ReitBZ (BTG Pactual) have set the bar high by working closely with regulators in Latin America to ensure investor protection while offering exposure to a diversified portfolio of commercial assets. Similarly, Propine, Tokeny Solutions, and Blocksquare prioritize compliance by integrating KYC/AML processes directly into their onboarding flows, making it easier for users to invest across borders without sacrificing security.

Top 11 Tokenized Real Estate Platforms Compared

-

RealT: Fractionalizes U.S. real estate with low entry points (from $50), weekly passive income, and high liquidity. Known for user-friendly onboarding and robust compliance.

-

Propine: Singapore-based, offers end-to-end digital asset custody and compliance for real estate tokenization, catering to institutional clients with a secure, regulated infrastructure.

-

Blocksquare: Provides white-label tokenization infrastructure for businesses, enabling property owners to issue real estate tokens on Ethereum and IPFS. Focused on B2B solutions.

-

Tokeny Solutions: Empowers property owners to digitize and fractionalize assets, with streamlined investor onboarding and compliance via their modular platform.

-

SolidBlock: Specializes in tokenizing high-value properties and commercial real estate, offering global investor access and customizable investment structures.

-

HoneyBricks: Focuses on U.S. commercial real estate, enabling investors to earn passive income through blockchain-based fractional ownership and automated compliance.

-

Brickken: Offers a decentralized platform for tokenizing real-world assets, including real estate, with a focus on transparency and investor governance.

-

Smartlands: UK-based, enables fractional ownership of real estate and other assets, with a focus on regulated, compliant investment opportunities for global investors.

-

ReitBZ (BTG Pactual): Latin America’s first tokenized real estate fund, launched by BTG Pactual, providing exposure to Brazilian real estate through blockchain-based REIT tokens.

-

Harbor (now part of BitGo): Pioneered compliance-driven tokenization for U.S. real estate and private securities; now integrated with BitGo for enhanced custody and security.

-

Slice: Enables international investors to access U.S. commercial real estate, offering fractional ownership, regulatory compliance, and a seamless digital onboarding process.

Choosing Your Platform: Key Takeaways for Investors

The right platform depends on your investment goals:

- If you want low entry barriers and fast income streams: RealT or HoneyBricks offer compelling options.

- If you’re an institution or developer seeking robust B2B tools: Blocksquare or Tokeny Solutions are industry leaders.

- If you need regulatory assurance across multiple regions: Propine or ReitBZ stand out for their compliance-first approach.

- If liquidity is your priority: SolidBlock and Slice provide active secondary markets.

The tokenized real estate space is dynamic, platforms are constantly evolving features in response to user demand and regulatory shifts. With the current price of RealLink (REAL) at $0.0634, the market signals ongoing interest in digital property assets as part of a diversified portfolio. Whether you’re seeking passive income from fractional ownership or looking to launch your own tokenized asset program, these eleven platforms represent the cutting edge of on-chain property investment in 2025.

Which feature matters most when choosing a tokenized real estate platform?

Tokenized real estate platforms offer a variety of features, from low minimum investments to seamless user experiences and robust security. As an investor, which feature is most important to you when selecting a platform?