Smart contracts are rapidly redefining how rental income is distributed in the tokenized real estate market. By embedding rules directly into self-executing code on the blockchain, smart contracts enable automated, transparent, and efficient rental payouts to property token holders. This shift eliminates the need for manual processing or trusted intermediaries, creating a streamlined experience for both investors and property managers.

How Smart Contracts Power Automated Rental Income

The core innovation lies in programmable agreements that execute predefined actions once specific conditions are met. For tokenized properties, this means rental income can be distributed automatically and proportionally to each investor’s wallet based on their ownership share. Platforms like Rentible. io have pioneered “Yield Distributor Smart Contracts, ” which accept deposited project tokens and autonomously calculate and send out yield payments with clockwork precision. This process not only guarantees timely payouts but also offers a fully auditable record on-chain.

Traditional real estate income distribution often involves layers of administration, delayed transfers, and potential disputes over calculations or timing. Smart contracts solve these pain points by:

- Eliminating human error from payment calculations

- Ensuring every transaction is transparent and traceable

- Reducing administrative overhead for property managers

- Providing investors with predictable, hassle-free returns

The Rise of Fractional Ownership Through Tokenization

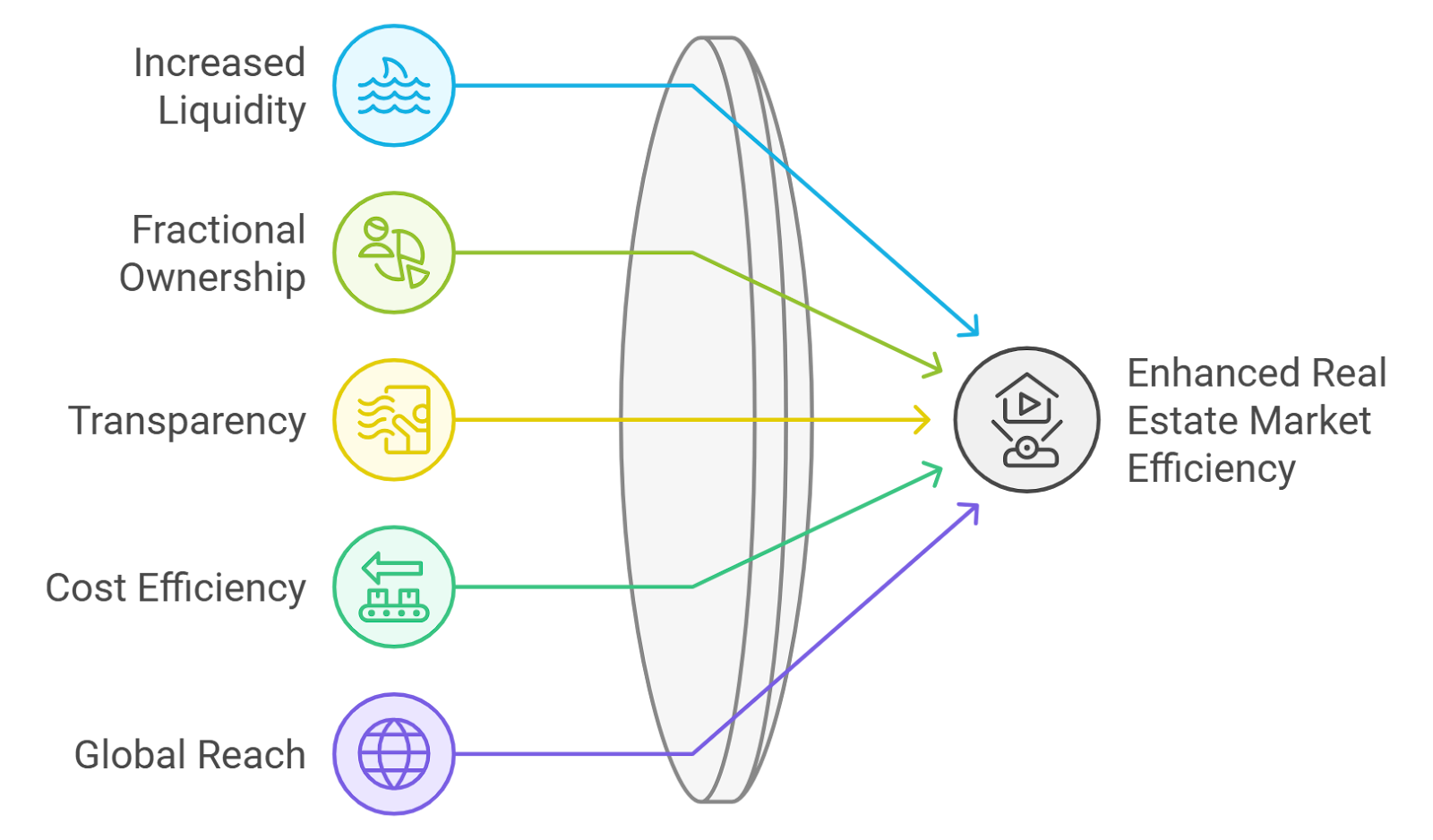

One of the most disruptive aspects of blockchain property management is its ability to fractionalize real estate assets. Through property tokenization technology, a single building or complex can be divided into hundreds or thousands of digital shares. Investors purchase these tokens to claim a slice of ownership – and with it, a proportional share of the rental income.

Smart contracts serve as impartial referees in this system. They track who owns which tokens at any given moment, automatically adjusting payout calculations if tokens are bought or sold. This makes secondary trading seamless while ensuring that all entitled parties receive their exact portion of rental yields.

Key Benefits of Automated Real Estate Payouts for Investors

-

Timely and Reliable Income Distribution: Platforms like Rentible.io use Yield Distributor Smart Contracts to ensure rental income is distributed automatically and on schedule, reducing delays and missed payments.

-

Fractional Ownership Accessibility: Smart contracts enable fractional ownership of tokenized real estate assets, allowing investors to own and receive income from a portion of a property, as seen with platforms like RealT.

-

Reduced Administrative Overhead: By automating rental payouts, smart contracts eliminate the need for manual processing and intermediaries, leading to lower operational costs and fewer administrative errors.

-

Enhanced Transparency and Auditability: All transactions are recorded on the blockchain’s immutable ledger, providing investors with clear, auditable records and increasing trust in the process.

-

Improved Security and Trust: The decentralized and self-executing nature of smart contracts—used by companies like LaProp—reduces the risk of fraud and unauthorized changes, safeguarding investor interests.

Integrating Decentralized Automation for Reliable Payouts

The evolution doesn’t stop at basic automation. Leading projects like LaProp have integrated decentralized automation services such as Chainlink Keepers to further optimize the reliability of rent distributions. These services monitor blockchain conditions and trigger smart contract functions exactly when scheduled – all without manual intervention or centralized control.

This approach delivers several strategic advantages:

- Enhanced trust-minimization: No single party controls payout execution; everything runs according to open-source code and decentralized triggers.

- No missed deadlines: Rental payments reach token holders on time, every time.

- Future-proof scalability: As portfolios grow from dozens to thousands of properties, automation ensures efficiency isn’t lost to complexity.