Fractional real estate ownership powered by blockchain property tokens is rapidly reshaping how investors access, trade, and profit from real estate in 2025. No longer limited to institutional players or high-net-worth individuals, the market now welcomes anyone with as little as $50 to participate in global property portfolios. The convergence of tokenization technology and regulatory clarity has set the stage for what many call a new era of democratized, on-chain property investing.

Tokenization: Breaking Down Barriers in Real Estate

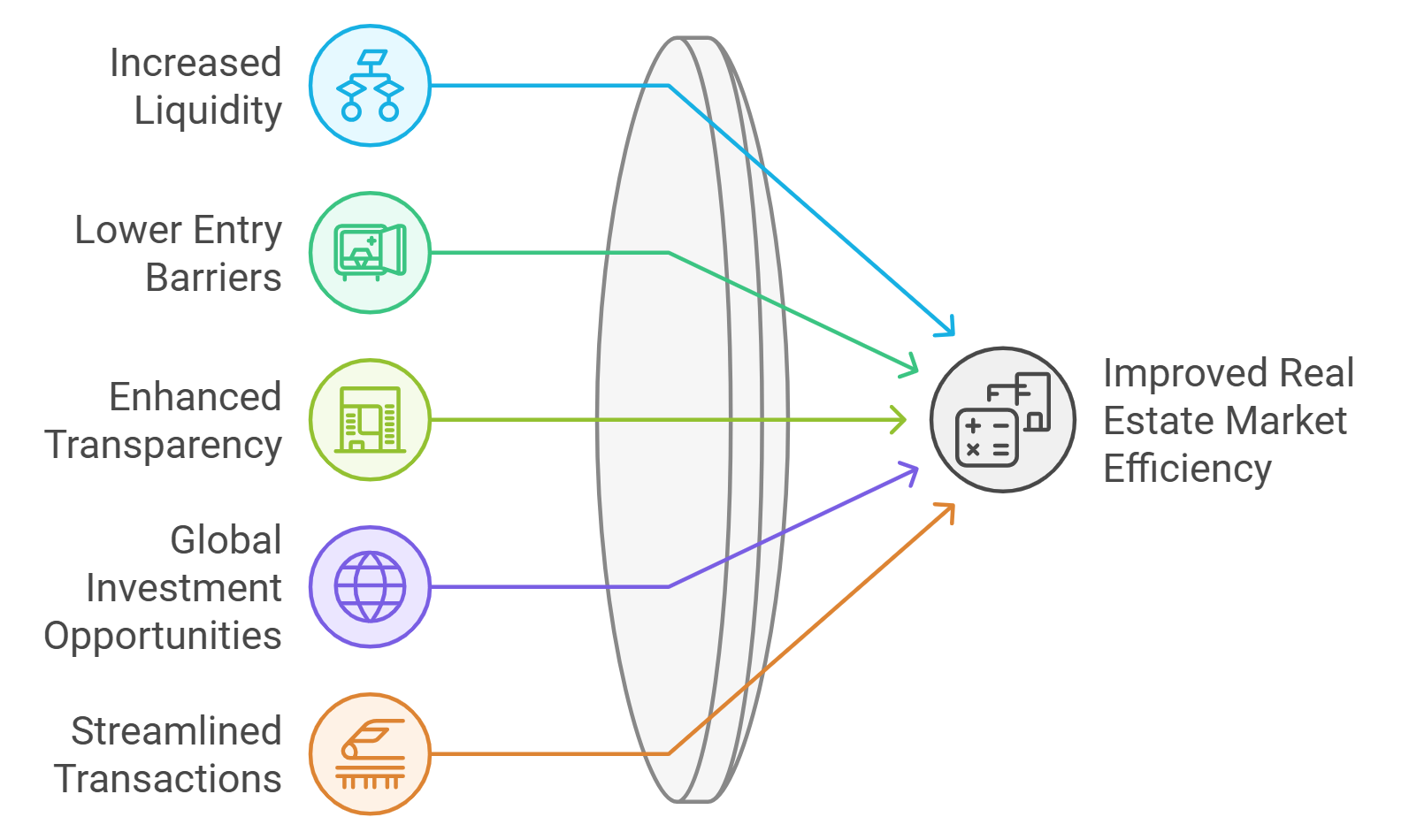

Tokenization is the process of converting real-world assets like properties into digital tokens on a blockchain. Each token represents a fractional share of ownership or economic rights in the underlying asset. In 2025, this approach has unlocked unprecedented liquidity and accessibility for both seasoned investors and newcomers looking for passive income through tokenized property.

Here’s how it works: A property is legally structured (often via an LLC or trust), then its ownership or revenue stream is divided into thousands of tokens. These tokens are issued on a secure digital ledger, making them easily transferable between parties worldwide. Smart contracts automate rental income distribution, voting rights, and compliance checks – reducing administrative overhead and ensuring transparency.

The 2025 Marketplace: Key Platforms and Real-World Examples

The adoption curve for fractional real estate ownership has steepened dramatically this year. As of September 2025, over $7 billion worth of property has been tokenized globally, with more than 1.2 million investors actively participating (source: Blockchain App Factory). The market’s trajectory points toward a projected $4 trillion by 2035 according to Deloitte’s latest insights.

Top Tokenized Real Estate Platforms in 2025

-

RealT: A pioneer in U.S. property tokenization, RealT has enabled fractional ownership of over 700 properties valued at more than $130 million. Investors receive daily rental income in stablecoins and can trade tokens on secondary markets, making real estate investment accessible and liquid.

-

Propy: Propy bridges traditional real estate with blockchain by offering global tokenization of residential and commercial assets. Its platform integrates KYC, legal compliance, and smart contract-powered title transfers, streamlining the entire property transaction process for both buyers and sellers.

-

Lofty AI: Built on Algorand, Lofty AI allows investors to purchase fractional shares of income-generating properties starting at $50. The platform stands out for its AI-powered analytics, which help users make informed investment decisions and automate income distribution via smart contracts.

-

MANTRA: In 2025, MANTRA partnered with Dubai’s DAMAC Group in a $1 billion initiative to tokenize Middle Eastern real estate assets. This move positions Dubai as a leading global hub for digital and crypto asset-backed property investment.

-

Seazen Digital Assets Institute: Launched by China’s Seazen Group in Hong Kong, this initiative explores tokenizing real-world assets, including property income streams and intellectual property. It marks a significant step for Asian real estate tokenization efforts in 2025.

Let’s spotlight three influential platforms:

- RealT: With over 700 U. S. -based properties valued at $130 million tokenized, RealT lets users buy fractions of rental homes and receive daily stablecoin dividends.

- Propy: Bridging traditional title systems with smart contracts, Propy simplifies KYC and legal compliance while supporting both residential and commercial asset tokenization worldwide.

- Lofty AI: Built on Algorand, Lofty AI offers fractional ownership starting at just $50 per share and leverages AI analytics to help users make data-driven investment choices.

This proliferation of platforms is fueling competition – driving down fees and expanding the diversity of available properties across continents. For more detail on how these mechanisms work at the technical level, visit our deep-dive guide here.

The Mechanics Behind Blockchain Property Tokens

The core innovation lies in representing ownership as programmable digital assets. Each blockchain property token can be bought, sold, or traded instantly on secondary markets – sidestepping much of the friction found in traditional real estate transactions. This fluidity appeals to younger investors seeking shorter holding periods or tactical portfolio adjustments.

Smart contracts, self-executing code stored on blockchains like Ethereum or Algorand, handle everything from dividend payouts to transfer restrictions based on regulatory requirements. For example:

- If you own tokens representing a share in a Miami rental apartment via RealT, your cut of daily rent arrives automatically as USDC stablecoin – no landlord needed.

- If you choose to sell your stake tomorrow because you spot a better opportunity elsewhere, you can do so instantly via integrated marketplaces without waiting weeks for escrow closure.

Regulatory Frameworks Catch Up With Innovation

The U. S. Securities and Exchange Commission (SEC) now classifies most tokenized real estate offerings as securities. This means issuers must comply with existing securities laws – including registration or qualifying for an exemption – which brings greater investor protection but also raises the bar for platform operators. Non-compliance has resulted in enforcement actions that underscore the importance of robust legal frameworks underpinning every offering.

Globally, regions like Dubai are emerging as leaders; DAMAC Group’s recent $1 billion partnership with MANTRA aims to tokenize Middle Eastern assets at scale. Meanwhile China’s Seazen Group is exploring asset-backed tokens out of Hong Kong to tap into cross-border capital flows.

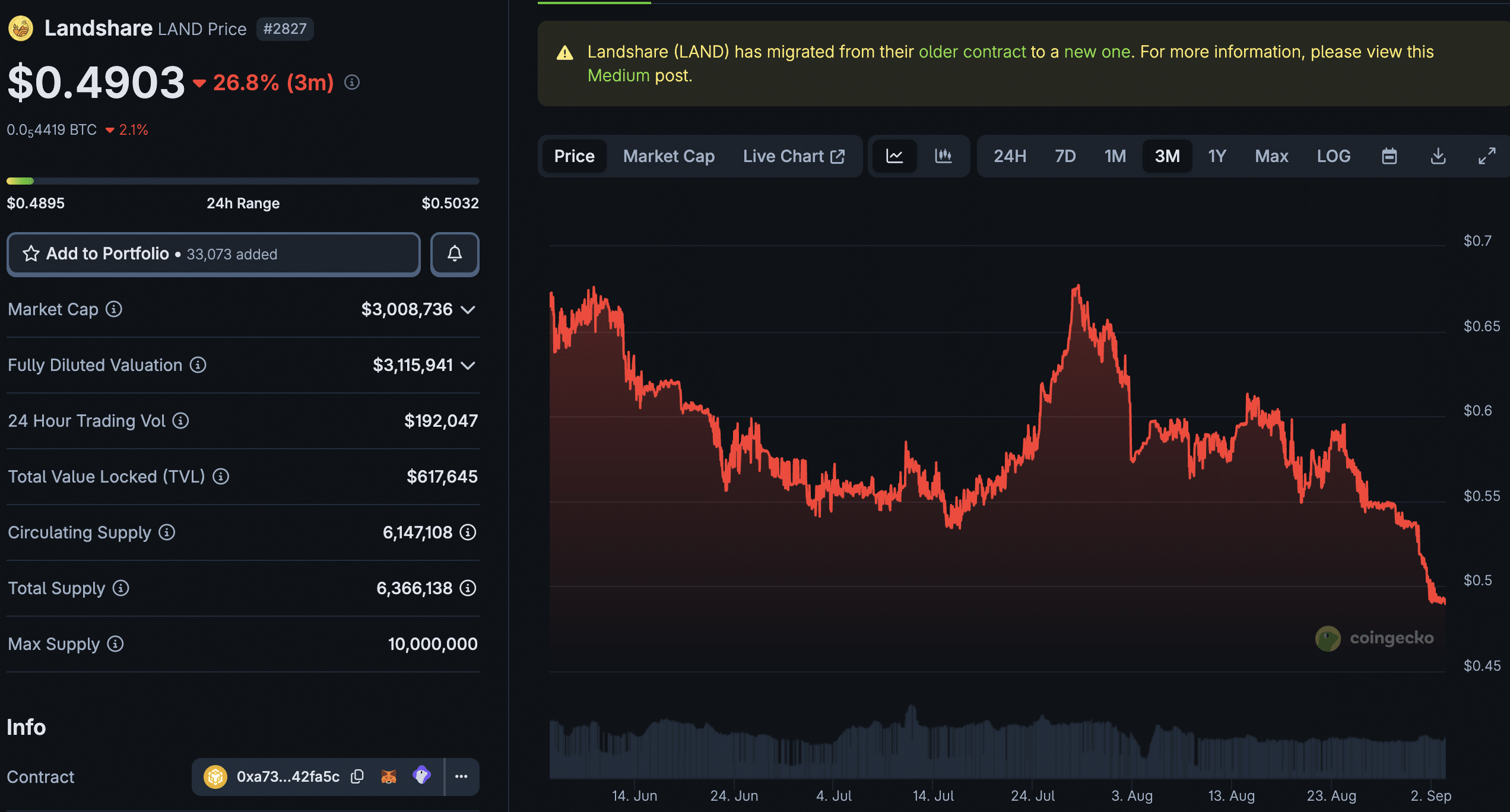

As tokenized real estate platforms mature, investor expectations are shifting from hype to performance. Liquidity, the ability to buy or sell tokens efficiently, remains a central concern. While secondary markets for blockchain property tokens are expanding, recent research shows that trading volumes for many real-world asset (RWA) tokens still lag behind traditional equities. This is partly due to fragmented regulatory regimes and the nascency of on-chain marketplaces, but also relates to the need for broader institutional adoption.

Despite these hurdles, the advantages of fractional real estate ownership are clear. Investors can now diversify across geographies and property types with unprecedented ease, allocate capital in smaller increments, and receive passive income from tokenized property without the headaches of direct management. Platforms like Lofty AI even automate reinvestment strategies and provide analytics-driven insights, enabling smarter portfolio construction for both retail and professional investors.

Opportunities and Risks: What Investors Should Know

Fractional ownership via blockchain tokens unlocks new pathways for global participation in real estate markets. However, it’s essential to recognize the risks alongside the rewards:

Pros and Cons of Tokenized Real Estate in 2025

-

Lower Entry Barriers: Tokenization allows investors to purchase fractional ownership in real estate with minimal capital—platforms like Lofty AI offer entry points as low as $50, making property investment accessible to a broader audience.

-

Enhanced Liquidity: Digital tokens representing property fractions can be traded on blockchain platforms such as RealT, enabling quicker entry and exit compared to traditional real estate, though actual trading volumes remain modest in many cases.

-

Automated Income Distribution: Smart contracts automate rental income distribution—investors on platforms like RealT receive daily rental payouts in stablecoins, ensuring transparency and efficiency.

-

Global Accessibility: Platforms like Propy and RealT allow investors worldwide to participate in diverse property markets, overcoming traditional geographic and regulatory boundaries.

-

Regulatory Complexity: The SEC classifies most tokenized real estate offerings as securities, requiring strict compliance with securities regulations. Non-compliance can lead to enforcement actions, increasing legal and operational risks for both platforms and investors.

-

Liquidity Challenges: Despite theoretical liquidity, many tokenized real estate assets still experience low trading volumes and limited investor participation, as highlighted by recent studies. This can hinder the ability to quickly sell tokens at fair market value.

-

Market Maturity and Security Risks: As the sector grows—projected to reach $4 trillion by 2035 (Deloitte)—the market remains relatively young, with evolving standards and occasional security vulnerabilities in smart contracts and platforms.

-

Global Expansion and Innovation: Major developments in regions like Dubai (DAMAC Group’s $1 billion deal with MANTRA) and China (Seazen Group’s tokenization initiative) signal rising adoption and innovation, but also introduce new regulatory and operational complexities.

Opportunities include lower entry barriers, near-instant liquidity (on active platforms), transparent transaction records, and automated income distribution. These features make real estate investing with crypto more accessible than ever before.

Risks span regulatory uncertainty in some jurisdictions, platform solvency concerns, smart contract vulnerabilities, and potential illiquidity if secondary marketplaces do not develop as expected. Due diligence on both the underlying property asset and the issuing platform remains crucial.

The Globalization of Tokenized Property Markets

The international scope of blockchain property tokens is rapidly expanding. In 2025 alone:

- Dubai: DAMAC Group’s $1 billion collaboration with MANTRA signals major institutional confidence in RWA tokenization across the Middle East.

- China: Seazen Group’s Hong Kong digital assets initiative highlights growing interest among Asian developers to leverage blockchain for cross-border investment flows.

- Europe and U. S. : Regulatory sandboxes and pilot programs have proliferated as governments seek to balance innovation with investor protection.

This globalization brings both opportunity, via diversified deal flow, and complexity as investors must navigate varied legal frameworks when acquiring fractional stakes abroad. For a comprehensive breakdown on how these cross-border investments work in practice, see this detailed resource.

Would you invest $1,000 in a tokenized rental property this year?

With over $7 billion in real estate already tokenized and platforms like RealT and Lofty AI making fractional ownership more accessible, blockchain-based property investment is gaining momentum in 2025. Would you take the leap into tokenized real estate this year?

What Comes Next?

The next phase for tokenized real estate will hinge on three factors: mainstream adoption by institutional investors; harmonization of global securities regulation; and technical advances that unlock true liquidity at scale. As these trends accelerate into late 2025 and beyond, expect to see more innovative offerings, such as dynamic pricing models or hybrid DeFi integrations, that further blur the line between traditional finance and digital asset markets.

The bottom line? Fractional real estate ownership through blockchain tokens is no longer a fringe concept, it’s fast becoming a core pillar of modern portfolio strategy. For investors seeking exposure to real assets while retaining flexibility and transparency, this model offers an increasingly compelling proposition.