Fractional real estate investment is entering a new era in 2024, propelled by blockchain property tokens that are unlocking access to markets once reserved for institutional players. With over $7 billion in property already tokenized and more than 1.2 million investors participating globally as of September 2025, the landscape is changing rapidly. Blockchain platforms like RealT, Propy, and Lofty AI are leading this transformation, enabling anyone to own a share of prime real estate with just a few clicks. The result: greater liquidity, transparency, and accessibility for the average investor.

What Is Fractional Real Estate Investment via Blockchain?

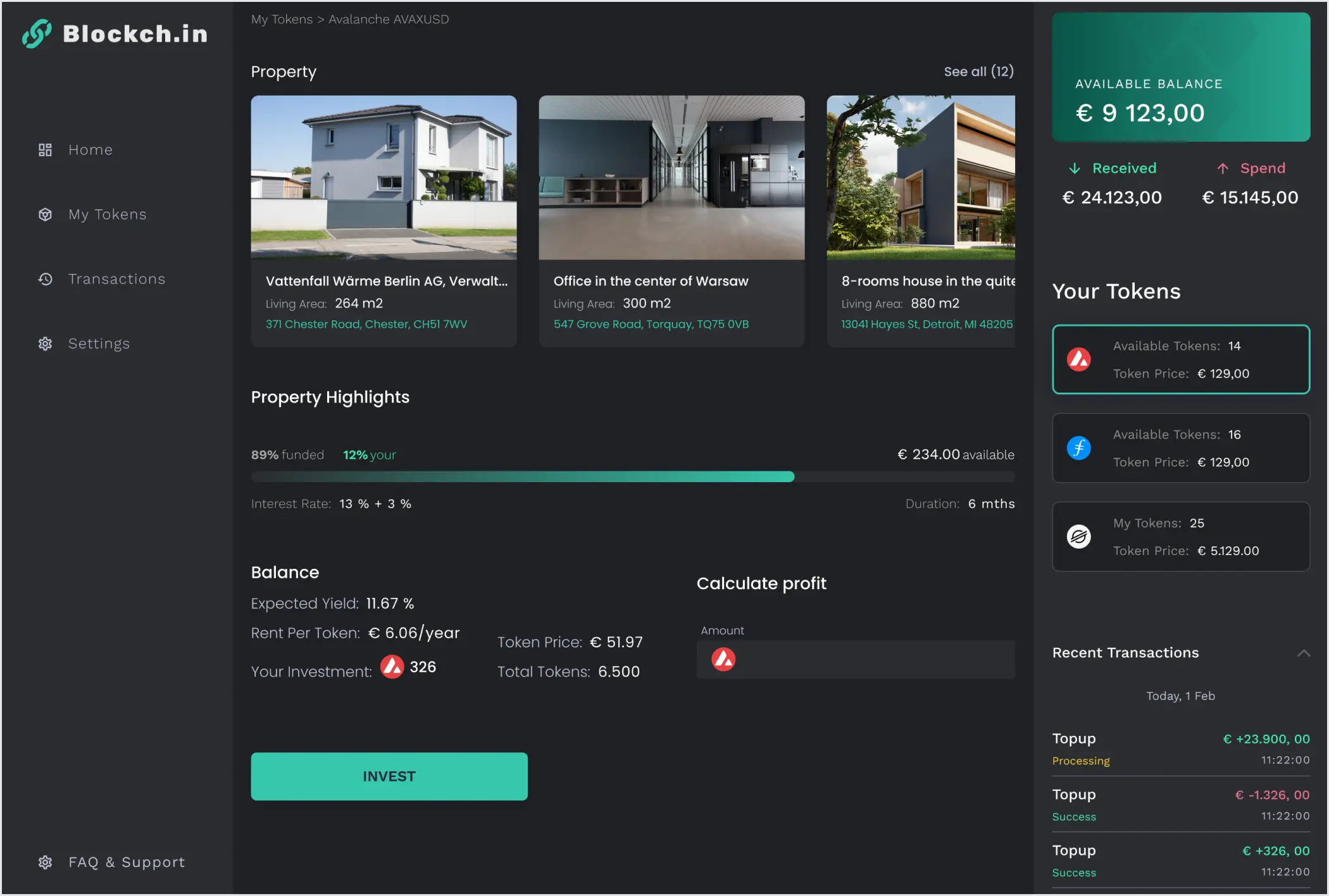

At its core, fractional real estate investment means you purchase a portion of a property rather than the entire asset. Traditionally, this was done through syndications or REITs. Today, blockchain technology has made it possible to split properties into thousands of digital tokens, each representing a direct stake in the asset itself. These blockchain property tokens can be bought or sold on specialized platforms, reducing entry barriers and increasing liquidity compared to legacy models.

Each token typically corresponds to an equity percentage in the underlying property, for example, 10,000 tokens might equal 100% ownership of a building. Investors can buy as many tokens as they wish based on their budget and risk appetite. This model not only democratizes access but also allows investors to diversify across multiple properties worldwide.

Why Are Investors Flocking to Tokenized Real Estate in 2024?

The momentum behind tokenized real estate in 2024 is driven by several factors:

Top Reasons Investors Are Choosing Blockchain-Based Fractional Real Estate in 2024

-

Increased Accessibility: Blockchain platforms like RealT, Propy, and Lofty AI allow investors to purchase fractional shares of global properties, lowering entry barriers and enabling participation with modest capital.

-

Enhanced Liquidity: Unlike traditional real estate, tokenized property shares can be bought and sold rapidly on secondary markets, providing investors with greater flexibility and faster access to funds.

-

Global Diversification: Investors can diversify portfolios across international markets, accessing properties in regions like the US, Europe, and the Middle East through platforms such as Lofty AI and Propy.

-

Transparency and Security: Blockchain technology records all transactions immutably, offering investors clear, tamper-proof ownership records and improved trust in property deals.

-

Lower Transaction Costs: Automation via smart contracts reduces reliance on intermediaries, cutting fees and streamlining the investment process for fractional property ownership.

-

Growing Market and Institutional Adoption: The tokenized real estate market surpassed $7 billion in 2025, with over 1.2 million active investors and major initiatives like the MANTRA and DAMAC Group $1 billion partnership accelerating mainstream adoption.

Liquidity: Unlike traditional deals that can take months or years to exit, blockchain-based platforms enable near-instant buying and selling of property tokens.

Transparency: All transactions are recorded on-chain for auditability.

Diversification: Investors can spread capital across residential and commercial assets globally.

Simplified Access: Platforms like Lofty AI and Propbase allow users to invest with minimal capital, sometimes under $100 per token.

This innovation is not just theoretical. Major projects such as MANTRA’s partnership with Dubai’s DAMAC Group (a $1 billion initiative) highlight how institutional players are embracing the space as well.

The Mechanics: How Do You Invest in Real Estate Tokens?

If you’re ready to invest in real estate tokens, here’s what the process typically looks like:

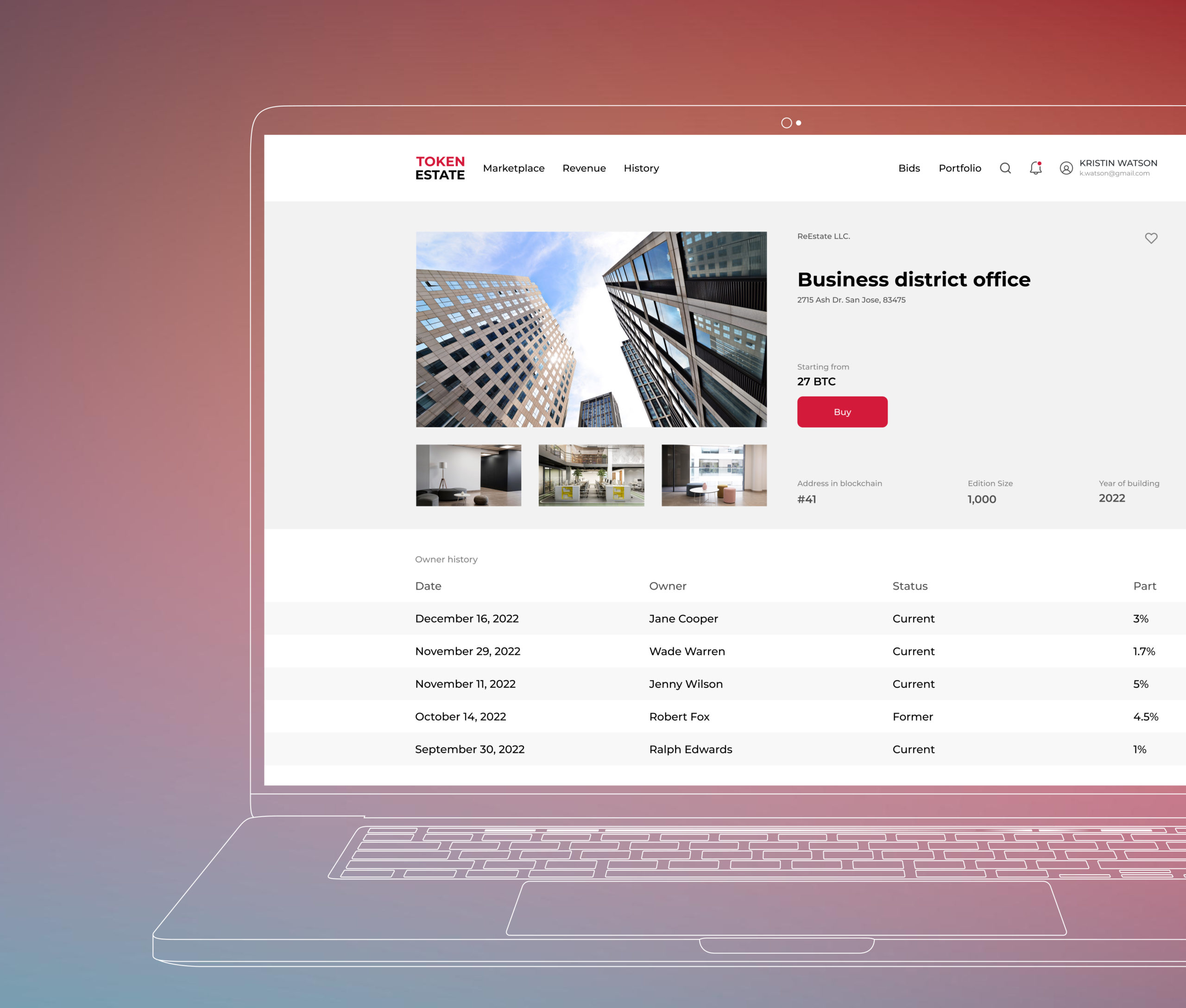

You start by registering with a compliant platform (such as RealT or Propy), completing KYC/AML checks, then browsing available properties. Each listing details key metrics like expected yield, location data, legal structure (often via SPVs), and total token supply. Once you select an asset, you purchase your desired number of tokens using fiat or crypto, instantly gaining exposure to rental income and potential appreciation.

This seamless process is making it easier than ever for both seasoned investors and first-timers to participate directly in global property markets without legacy friction points. For more technical details on how these mechanisms work, including legal structures, see our deep dive at How Fractional Real Estate Ownership Works with Blockchain Tokens in 2025.

Key Considerations Before You Buy Property Tokens

While the promise of blockchain property tokens is compelling, successful fractional real estate investment in 2024 requires thoughtful due diligence. Regulatory frameworks are evolving rapidly, and not all platforms are created equal. Pay close attention to:

- Jurisdiction and Compliance: Ensure the platform operates within clear legal guidelines and that property rights are enforceable in your country of residence.

- Asset Quality: Scrutinize underlying property fundamentals, location, tenant quality, historical returns, not just token mechanics.

- Liquidity and Exit Options: Some platforms offer secondary trading markets while others may require longer lock-up periods. Assess your need for flexibility.

- Fee Structures: Compare transaction fees, management costs, and potential hidden charges across platforms to protect your yield.

The best investors treat tokenized assets with the same rigor as traditional real estate, combining on-chain transparency with classic risk management discipline.

Top Platforms for Fractional Real Estate Investment in 2024

The competitive landscape is expanding quickly. Here are a few standout platforms at the forefront of tokenized real estate:

Top Platforms for Fractional Real Estate Tokens in 2024

-

RealT — A pioneer in U.S. property tokenization, RealT enables investors to purchase fractional ownership of real estate assets through blockchain-based tokens, offering automated rent distributions and a user-friendly marketplace.

-

Propy — Propy leverages blockchain to streamline property transactions and offers tokenized real estate opportunities, making global real estate investment more accessible and transparent for both retail and institutional investors.

-

Lofty AI — Lofty AI specializes in tokenizing income-producing properties, allowing investors to buy and sell fractional ownership instantly, with daily rental income payouts and a growing portfolio of U.S. properties.

-

Propbase (PROPS) — Propbase focuses on simplifying real estate investment by splitting properties into tokens, enabling users to invest in premium assets with low minimums and manage their holdings via a secure blockchain platform.

-

MANTRA x DAMAC — This partnership between MANTRA and Dubai’s DAMAC Group represents a $1 billion initiative to tokenize Middle Eastern real estate, opening up high-value regional assets to global investors via blockchain technology.

Learn more about how these structures work.

What Returns Can You Expect?

Returns on blockchain-based property tokens vary by asset type, location, and platform structure. Many residential properties offer annual yields between 5% and 10%, with additional upside from appreciation. Commercial assets can be higher but often carry more risk. The ability to trade tokens on secondary markets means investors can also realize liquidity premiums previously unavailable in private placements or syndications.

Property Token (PROP) Price Prediction 2026-2031

Forecasting the growth of the tokenized real estate market and PROP token value through 2031, based on current adoption, technological advancements, and market expansion.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Expected % Change (YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.25 | $1.75 | $2.50 | +35% | Early adoption accelerates; new platforms launch, but regulatory uncertainty tempers upside. |

| 2027 | $1.65 | $2.40 | $3.30 | +37% | Increased institutional interest; regulatory frameworks clearer; liquidity improves. |

| 2028 | $2.10 | $3.10 | $4.10 | +29% | Global expansion, more high-value properties tokenized; technology matures. |

| 2029 | $2.55 | $3.85 | $5.00 | +24% | Traditional real estate firms adopt tokenization; secondary markets thrive. |

| 2030 | $3.10 | $4.60 | $6.00 | +20% | Tokenization becomes mainstream; competition increases, but market grows. |

| 2031 | $3.55 | $5.40 | $7.20 | +17% | Widespread adoption; regulatory harmonization enables cross-border investments. |

Price Prediction Summary

The PROP token is projected to experience strong, sustained growth from 2026 through 2031, reflecting the rapid expansion of the tokenized real estate market. While prices may fluctuate due to broader crypto cycles and regulatory developments, the overall trend is upward, with increasing adoption, institutional involvement, and technological maturity driving value. Investors should consider both the potential for outsized gains and the risks posed by evolving regulation and competition.

Key Factors Affecting Property Token Price

- Global adoption of real estate tokenization platforms and services

- Regulatory clarity and harmonization across jurisdictions

- Technological advancements improving security, transparency, and liquidity

- Entry of institutional investors and large-scale property portfolios

- Market cycles in both crypto and traditional real estate sectors

- Competition from alternative tokenization projects and blockchains

- Macroeconomic conditions (interest rates, inflation, etc.) impacting real estate demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Risks and How to Manage Them

No innovation is without its challenges. Key risks include regulatory changes, technological vulnerabilities (such as smart contract bugs), illiquidity during market stress, or poor asset selection by issuers. Mitigating these risks involves diversifying across multiple properties and jurisdictions, using only reputable platforms with robust security protocols, and staying informed about evolving global regulations.

“Tokenization doesn’t remove risk, it redistributes it. Smart investors use new tools but never ignore old lessons. “

The Future of Fractional Real Estate Investment

The momentum behind tokenized real estate is unmistakable. With over $7 billion already tokenized globally as of September 2025, and projections pointing toward a $4 trillion market by 2035, fractional ownership via blockchain is set to become a mainstream portfolio allocation strategy for both individuals and institutions alike.

If you’re ready to explore further or want a technical breakdown of how digital property shares work at scale, check out our resource on how fractional real estate tokenization works, a $1 million property example.