Real estate development has long been constrained by the slow, opaque, and regionally siloed nature of traditional financing. Today, on-chain real estate loans are redefining the landscape, empowering developers to unlock global liquidity through blockchain-based solutions. By leveraging tokenization and decentralized finance (DeFi) protocols, property developers can now access capital faster, more efficiently, and with far fewer barriers than ever before.

Tokenizing Real Estate: Turning Land into Digital Collateral

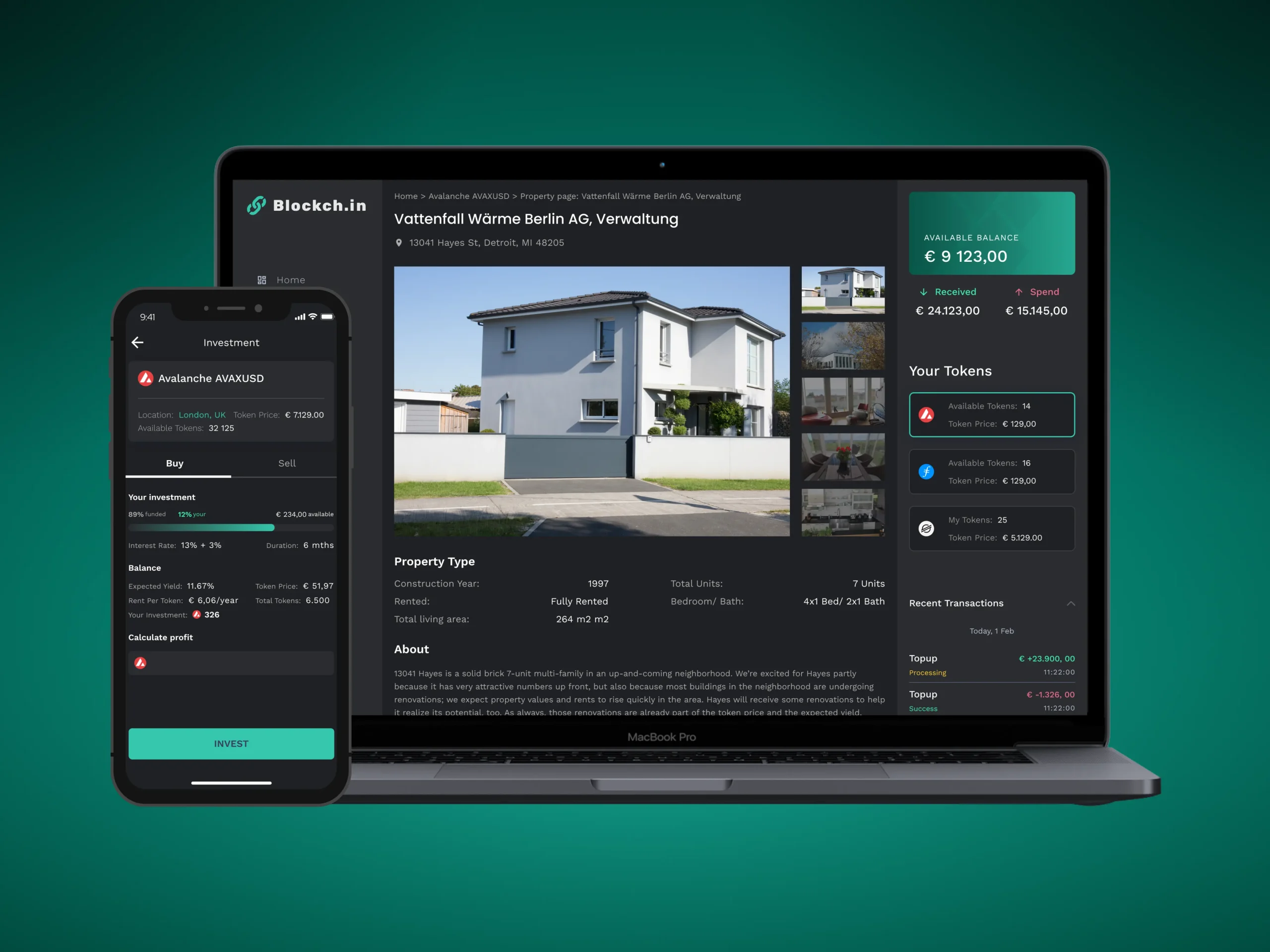

The core innovation behind this shift is real estate tokenization. By converting property rights into digital tokens on a blockchain, developers can fractionalize ownership and make previously illiquid assets tradeable on a global scale. As highlighted by platforms such as Robinland, projects can issue debt assets as crypto tokens that represent claims against real-world properties. These tokens can then be used as collateral to obtain funding from DeFi lenders, sidestepping much of the friction found in legacy banking systems. For an in-depth look at how this process works in practice, see Robinland’s platform.

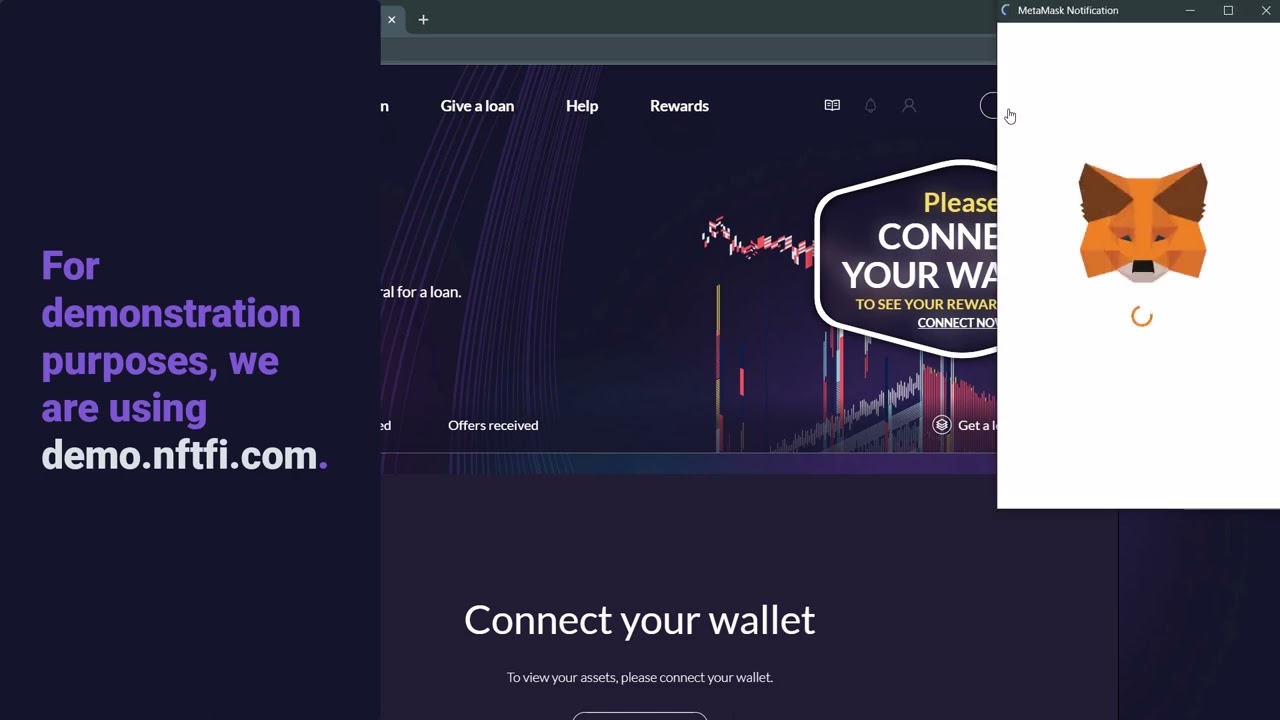

This model is not limited to fungible asset tokens; it also extends to NFTs (non-fungible tokens) that represent unique property interests or loan agreements. NFT-backed property loans enable developers to lock up their asset-backed NFTs in lending protocols and borrow stablecoins or other cryptocurrencies against them. Once the loan is repaid, the NFT, and thus control over the underlying asset, is returned to the developer.

“Converting high-value physical assets into NFT format enables these assets to be used as collateral on digital platforms. ”

DeFi Lending Protocols: Bridging Traditional Assets and Blockchain Capital

The integration of real-world assets (RWAs) with DeFi lending protocols marks a pivotal evolution for global real estate liquidity. A landmark example is the January 2025 partnership between Clearpool and PropChain. Here, PropChain launched a Credit Vault on Clearpool’s protocol using tokenized real estate as collateral, enabling borrowers to secure loans directly against property-backed tokens in a transparent, decentralized environment. This approach not only reduces reliance on banks but also democratizes access to capital for developers worldwide.

Such collaborations are rapidly expanding market options for both borrowers and lenders:

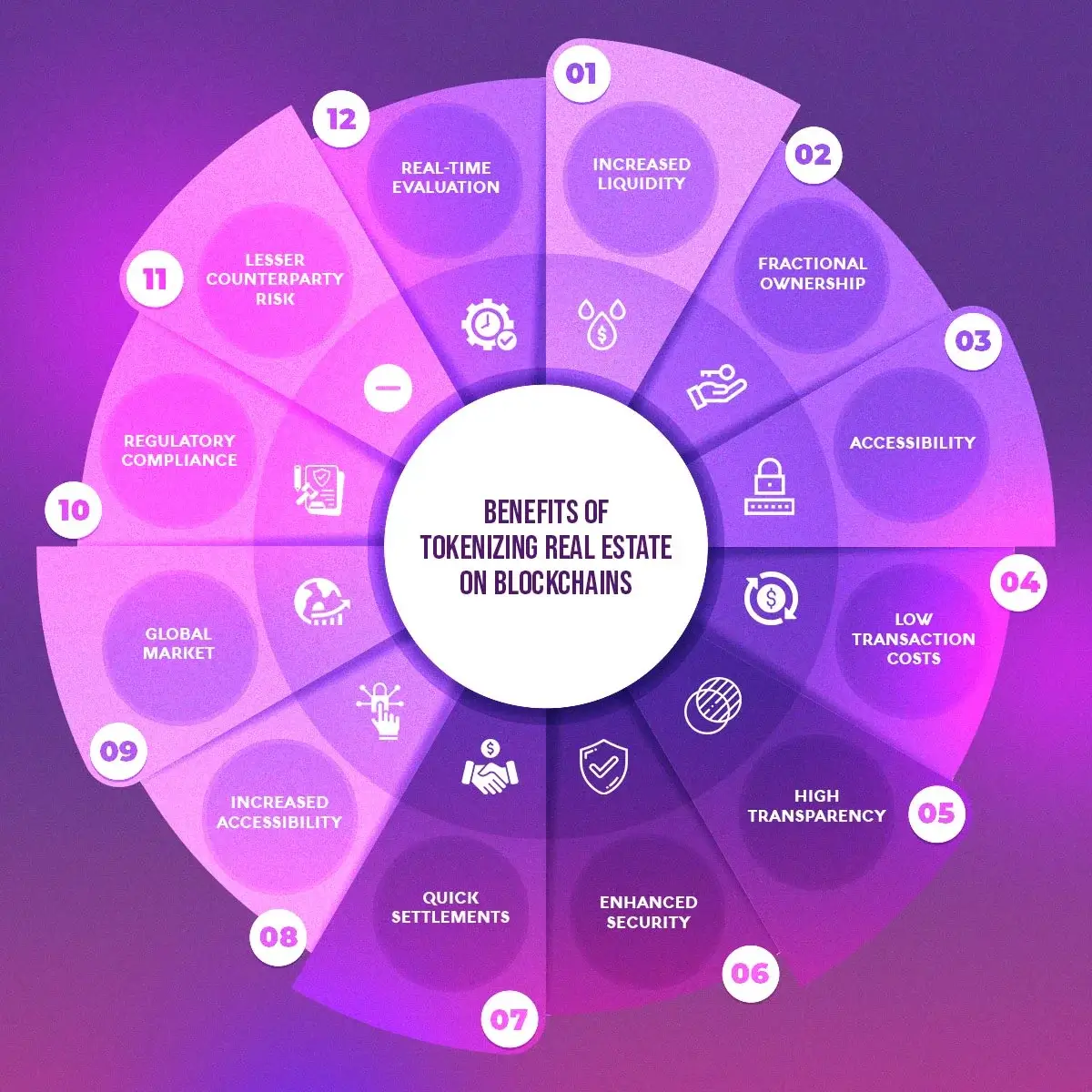

Key Benefits of DeFi-Powered Real Estate Lending

-

Enhanced Liquidity Through Tokenization: Developers can tokenize real estate assets as NFTs or digital tokens, enabling fractional ownership and easier trading on secondary markets. This increases access to global capital and unlocks liquidity that was previously difficult to access. Example: Robinland’s platform transforms real estate-backed debt into on-chain tokens.

-

Faster and More Efficient Funding: Blockchain-based lending protocols streamline the loan approval and disbursement process, allowing developers to access capital much more quickly than with traditional banks. Example: NFTfi enables instant NFT-backed loans for real estate assets.

-

Lower Financing Costs: DeFi lenders often offer more competitive interest rates and reduced fees compared to conventional financial institutions, lowering the overall cost of capital for developers. Example: Clearpool’s partnership with PropChain offers property-backed lending at competitive rates.

-

Global Investor Access and Democratization: Tokenized real estate projects can attract a broader pool of investors worldwide, breaking down geographical barriers and enabling participation from both retail and institutional investors. Example: Platforms like PropChain facilitate global investment in tokenized property assets.

-

Improved Transparency and Security: On-chain transactions are recorded on public blockchains, providing transparent, tamper-proof records of ownership and loan terms. This enhances trust and reduces the risk of fraud for developers and investors alike. Example: Blockchain App Factory’s tokenization solutions emphasize transparent property transactions.

By removing geographical barriers and automating much of the due diligence through smart contracts, these protocols accelerate time-to-capital while offering competitive rates compared to traditional institutions.

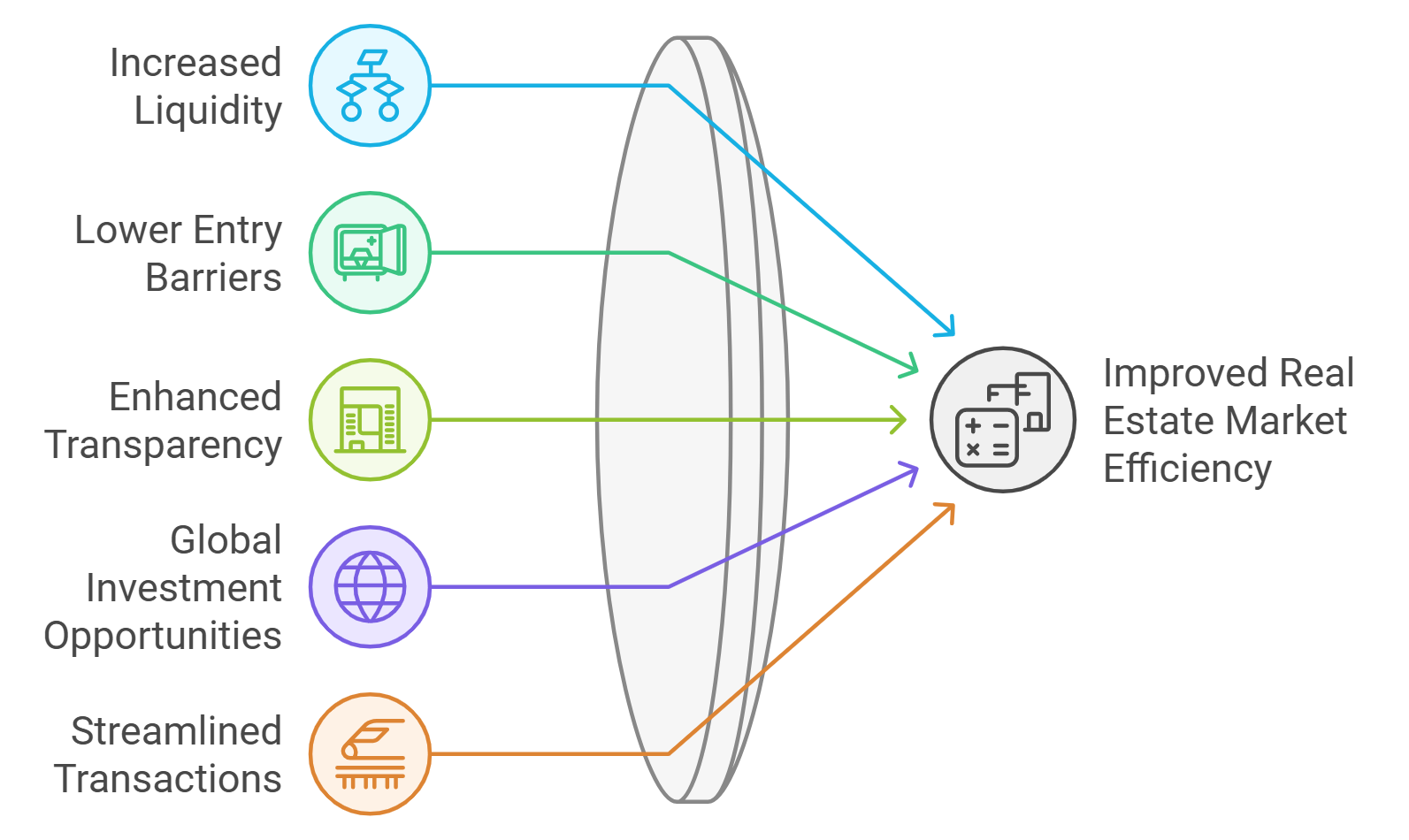

The Liquidity Advantage: Global Markets Meet Local Projects

Liquidity has historically been one of real estate’s greatest challenges. Tokenized assets change this paradigm by enabling secondary market trading, developers can sell portions of their holdings or refinance projects without lengthy negotiations or regulatory bottlenecks typical of cross-border transactions. As noted by Clearpool’s collaboration with PropChain, this model provides unprecedented flexibility for project financing at every stage of development.

The result? Developers gain access to a diverse pool of investors, from family offices in Zurich to crypto funds in Singapore, all within a single digital marketplace.

While the promise of global liquidity for real estate developers is compelling, it is important to recognize the nuanced challenges that still shape this emerging market. Regulatory clarity remains a critical variable. Jurisdictions differ in their approach to digital asset-backed lending, and compliance is non-negotiable for institutional-grade projects. Developers must actively monitor evolving frameworks and ensure that tokenized offerings align with securities laws and real estate statutes in each operational region. For a deeper dive into legal considerations, see the research from Legal Nodes and related academic analysis here.

Market depth is another consideration. While secondary trading of property tokens has increased, overall liquidity can still be thin compared to equities or major cryptocurrencies. Early adopters should be prepared for periods where selling or refinancing tokenized assets may require more time or price flexibility than traditional investors might expect.

“Real-world assets (RWAs) are powering the future of NFT lending by bringing stability, trust, and tangible value to an industry long dominated by volatility. ”

Future Outlook: Institutional Adoption and Market Maturity

The next phase of tokenized real estate financing will likely be driven by greater institutional participation and standardized protocols for asset evaluation, custody, and settlement. As blockchain infrastructure matures, we can expect more robust credit scoring models for on-chain loans, interoperability between platforms, and insurance products tailored to digital collateral.

Developers who invest early in understanding these systems will have a competitive edge as adoption accelerates. The ability to tap into global capital pools 24/7 – without intermediaries – could redefine project timelines and returns across every property sector.

Key Risks & Due Diligence for On-Chain Real Estate Loans

-

Regulatory Compliance Uncertainty: Developers must ensure that tokenized real estate offerings adhere to local and international laws, including securities regulations and anti-money laundering (AML) requirements. Non-compliance can result in legal penalties or project shutdowns.

-

Market Liquidity & Exit Strategies: While tokenization aims to enhance liquidity, secondary markets for real estate tokens are still nascent. Developers should evaluate trading volumes and the ability to resell or exit positions before committing assets.

-

Asset Valuation & Transparency: Verify the accuracy and transparency of property valuations used for NFT or token collateralization. Inaccurate or opaque valuations can expose developers to over-leverage or under-collateralization risks.

-

Technological Integration & Custody: Assess the infrastructure for managing, storing, and transferring digital tokens. Secure custody solutions and robust wallet management are essential to protect against loss or unauthorized access.

-

Counterparty & Smart Contract Risk: Evaluate the reliability of counterparties and the robustness of smart contracts governing the loan. Bugs or vulnerabilities in smart contracts can lead to loss of assets or unintended liquidations.

Transparency is another major advantage: Every transaction involving tokenized property or NFT-backed loans is recorded on-chain, providing a tamper-proof audit trail that increases trust among lenders, borrowers, and regulators alike. This transparency not only deters fraud but also simplifies reporting requirements for compliance-minded institutions.

Practical Steps: How Developers Can Get Started

For those considering their first move into blockchain property development finance:

- Assess your portfolio: Identify properties or projects suitable for tokenization based on value, location, and legal status.

- Select reputable platforms: Work with established providers like Robinland or PropChain to structure compliant offerings.

- Pilot with a single asset: Test the process end-to-end before scaling up exposure.

- Create an investor relations strategy: Communicate clearly with both crypto-native investors and traditional stakeholders about rights, risks, and returns.

The convergence of blockchain technology with real estate finance is not just theoretical – it’s already reshaping how capital flows into development projects worldwide. For those willing to navigate early complexities in exchange for speed, flexibility, and global reach, on-chain real estate loans represent one of the most exciting frontiers in modern property markets.