Fractional real estate tokenization is rapidly reshaping the global investment landscape, breaking down long-standing barriers to property ownership. By converting physical real estate assets into blockchain-based digital tokens, investors from around the world can now buy and trade fractions of properties for as little as $50. This democratization of access is not just a technological breakthrough, it’s a fundamental shift in how individuals participate in and benefit from the real estate market.

Why Fractional Real Estate Tokenization Matters in 2025

Traditionally, investing in real estate required significant upfront capital, complex paperwork, and local market knowledge. These barriers excluded millions of potential investors, especially those outside major financial centers or without access to institutional-grade opportunities. Tokenization changes this dynamic by splitting ownership into small, affordable shares called property tokens. Each token represents a legal claim on a portion of the underlying asset’s value and income streams.

The impact is profound: as of September 2025, more than $7 billion worth of property has been tokenized globally, with over 1.2 million active investors. The latest Deloitte projections anticipate this figure could reach $4 trillion by 2035. This explosive growth is fueled by both technological innovation and regulatory clarity in key markets such as Dubai and the United States.

Key Benefits: Accessibility, Liquidity and Global Reach

The appeal of fractional real estate tokenization lies in four core benefits:

- Increased Accessibility: Investors can participate with as little as $50-$100, opening doors to those previously priced out of traditional property markets.

- Enhanced Liquidity: Unlike direct property ownership, tokens can be traded on secondary markets, allowing investors to exit or rebalance positions quickly.

- Global Diversification: With platforms facilitating cross-border investment, individuals can diversify across geographies without navigating complex legal hurdles.

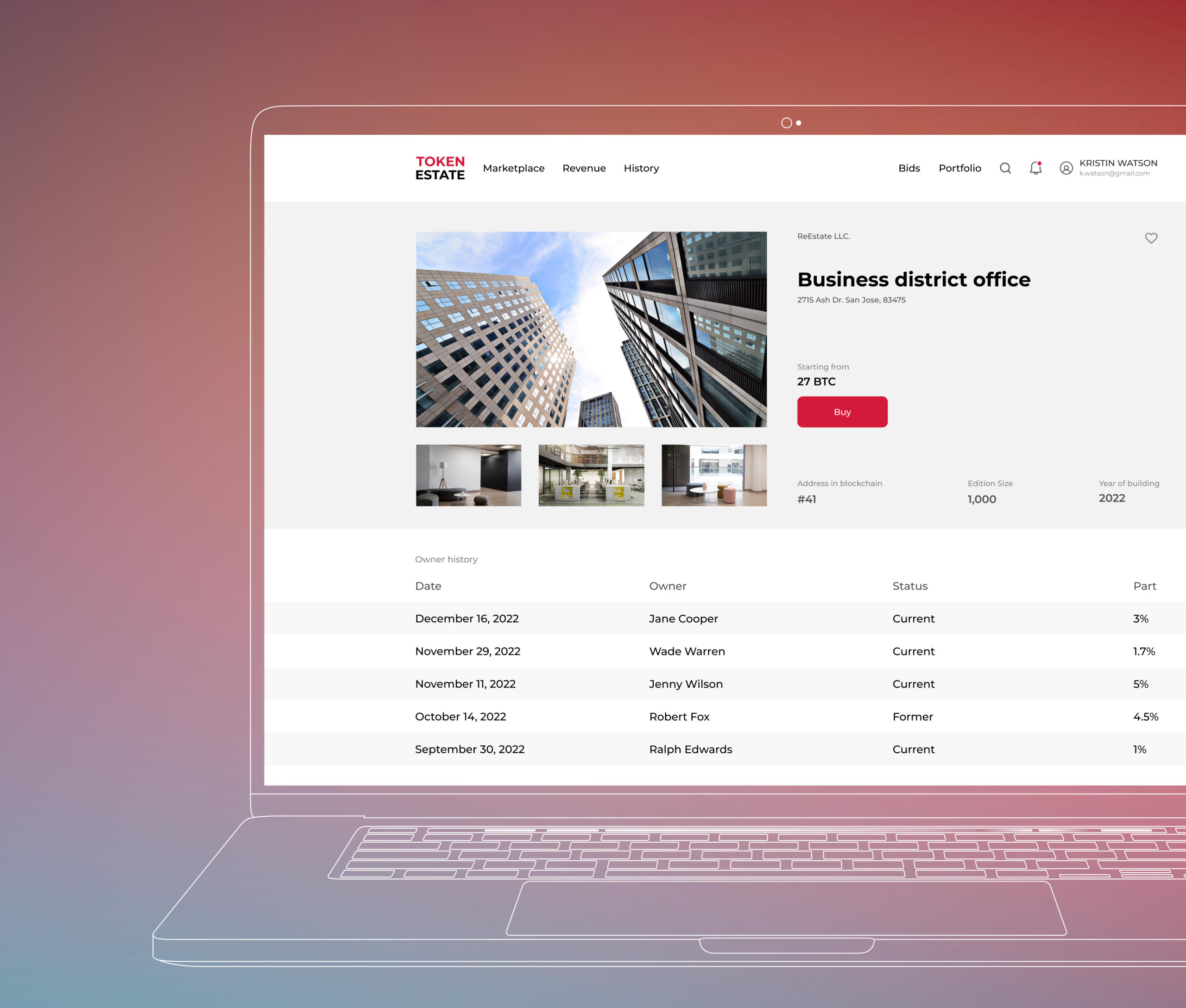

- Transparency and Security: Blockchain records all transactions immutably, reducing fraud risk and simplifying audits.

If you’re curious about how these mechanisms work in practice or want to see a step-by-step breakdown with numbers, see our illustrated guide: How Fractional Real Estate Tokenization Works: A $1 Million Property Example.

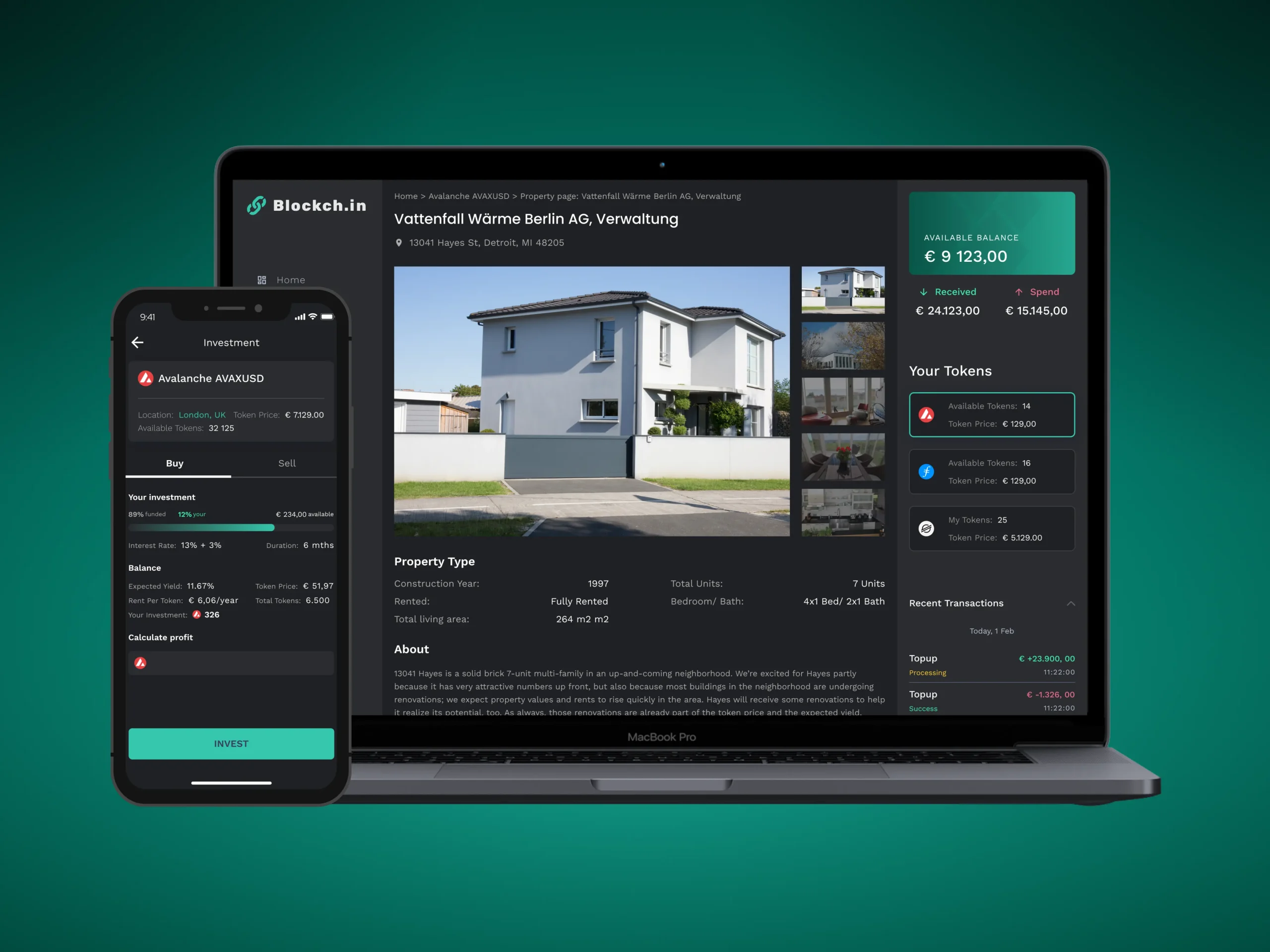

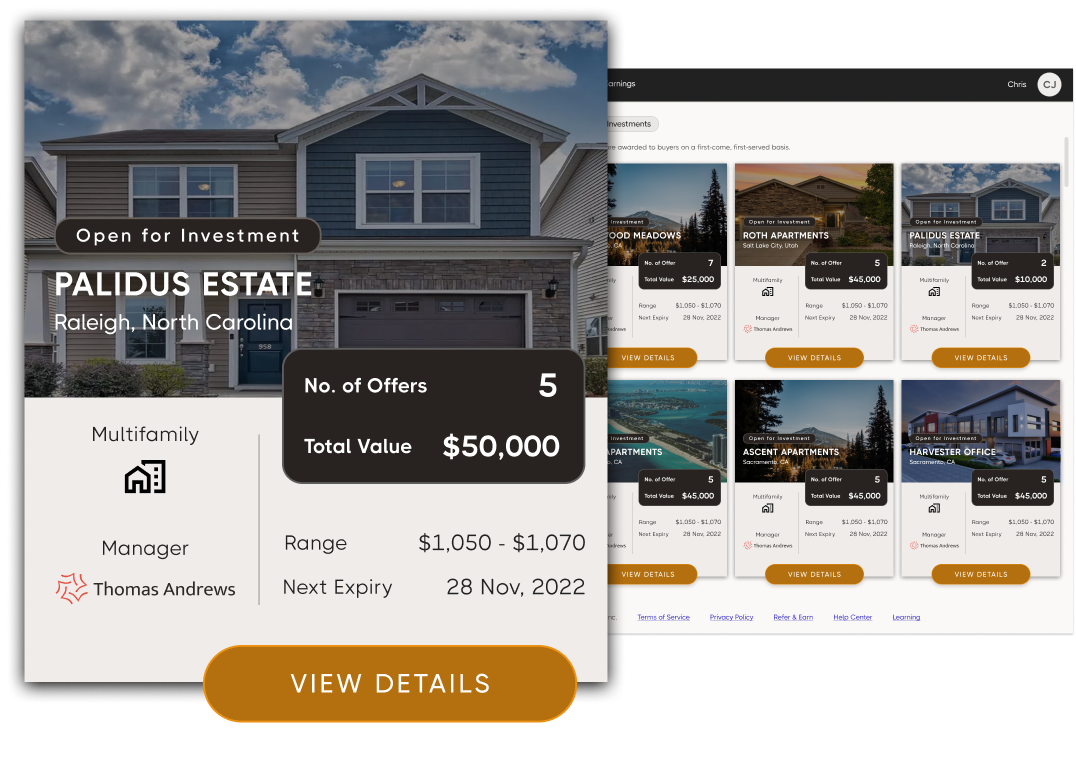

Top Platforms Driving Global Fractional Property Investment

Top 5 Platforms for Global Fractional Property Investment (2025-2026)

-

Lofty AI enables investors to buy fractional shares of income-generating properties starting at $50. Built on the Algorand blockchain, it offers AI-powered analytics for informed decision-making and provides daily rental income payouts to token holders.

-

RealT specializes in U.S. residential property tokenization, allowing global investors to purchase fractional shares and receive daily rental income. RealT is known for its strong compliance with U.S. regulations and a wide selection of Detroit and Midwest properties.

-

Binaryx focuses on luxury vacation and resort properties in international hotspots, such as Bali villas. Investors can access passive income opportunities through fractional ownership secured by U.S. law, with minimum investments starting at $500.

-

Propchain offers a blockchain-based marketplace for fractional property investment across Europe and the Middle East. The platform emphasizes transparency, regulatory compliance, and a diverse range of commercial and residential assets.

-

HoneyBricks makes institutional-grade real estate accessible to individual investors through tokenized shares. The platform focuses on U.S. multifamily and commercial properties, providing regular income and simplified global access.

The current leaders in this space are not only lowering entry thresholds but also innovating around compliance and investor experience. Let’s look at how each platform empowers users to invest globally with minimal capital:

- Lofty AI: Built on Algorand’s blockchain for speed and low fees, Lofty AI lets users buy fractional shares of vetted U. S. rental properties starting at just $50. Investors receive daily rental income distributions via stablecoins, making it attractive for both beginners and seasoned portfolio builders.

- RealT: Specializing in U. S. -based residential assets, RealT offers SEC-compliant tokenized shares that pay out rental income daily. The platform’s streamlined KYC process enables participation from dozens of countries while ensuring robust legal protection for investors.

- Binaryx: Unique for its focus on luxury vacation rentals (think Bali villas), Binaryx allows global users to own fractions starting at $500 per property share, secured under U. S. law for added investor confidence. Passive income from international resort properties is now within reach for everyday investors.

- Propchain: Propchain stands out by integrating advanced compliance tools and offering seamless cross-border transactions. Its marketplace lists both residential and commercial properties across Europe and Asia-Pacific regions, enabling true global diversification with minimal friction.

- HoneyBricks: HoneyBricks specializes in tokenizing institutional-grade commercial real estate across North America. With investments starting at just $100 per share, it appeals to those seeking exposure to trophy office buildings or multifamily assets without large minimums or lengthy lockups.

The Regulatory Landscape and Market Momentum

This surge would not be possible without evolving legal frameworks that legitimize tokenized offerings while protecting participants. Dubai has emerged as a regulatory leader, facilitating government-backed platforms that enable fractional sales under clear guidelines. In mid-2025 alone, two luxury Dubai properties were sold via blockchain tokens to buyers from over 35 countries, a milestone that signals growing trust among both issuers and investors worldwide.

The United States remains pivotal thanks to platforms like Lofty AI and RealT operating under SEC oversight; these firms have collectively brought hundreds of properties onto the blockchain while maintaining strict compliance standards, a key factor driving mainstream adoption among retail as well as accredited participants.

If you want deeper insight into how regulatory clarity is accelerating adoption, and what it means for your portfolio, explore our feature: How Fractional Real Estate Tokenization Lowers Investment Barriers for Global Investors.

As more investors and property owners recognize the benefits of fractional real estate tokenization, we are witnessing a shift in portfolio construction philosophies. The ability to allocate small amounts of capital across multiple properties, geographies, and asset types is transforming risk management and return expectations. For individual investors, this means the potential to build a globally diversified real estate portfolio for less than the traditional down payment on a single home.

Platforms like Lofty AI and RealT are leading by example in making U. S. properties accessible to international buyers with minimal friction. Meanwhile, Binaryx is carving out a niche by offering access to high-value vacation rentals in sought-after destinations, opportunities that were previously reserved for institutional or ultra-high-net-worth participants. Propchain‘s compliance-forward approach appeals to those seeking cross-border exposure without regulatory headaches, while HoneyBricks makes commercial real estate investment as simple as buying shares of a REIT but with the added transparency of blockchain.

How Tokenized Property Investment Is Shaping the Future

The momentum behind tokenized property investment is not purely speculative, it’s grounded in tangible improvements to efficiency, security, and access. By leveraging blockchain’s immutable ledger, platforms ensure transparent ownership records and rapid settlement times. This reduces costs for both issuers and buyers compared to legacy systems reliant on intermediaries.

The impact on liquidity cannot be overstated: Secondary markets for property tokens are now enabling near-instant trading of shares in assets that would otherwise take months or years to sell through conventional channels. This flexibility supports active portfolio management strategies previously unimaginable in direct real estate ownership.

Top 5 Real Estate Tokenization Platforms (2025–2026)

-

Lofty AI lets investors purchase fractional shares of income-generating properties starting at $50. Built on Algorand, Lofty AI offers global access, daily rental income payouts, and AI-powered analytics to help users diversify and manage their portfolios.

-

RealT specializes in U.S. residential properties, enabling fractional ownership and daily rental income distribution. Investors can buy, sell, and trade property tokens with ease, enjoying enhanced liquidity and transparent blockchain records.

-

Binaryx focuses on luxury vacation and resort real estate worldwide, including Bali villas and other international hotspots. Investors can start with as little as $500, earning passive income from global rental markets with legal compliance ensured by U.S. law.

-

Propchain provides a seamless platform for cross-border real estate investments, offering fractional shares in both residential and commercial properties. Propchain emphasizes regulatory compliance and instant liquidity through secondary market trading.

-

HoneyBricks enables investors to access institutional-grade real estate with fractional ownership starting at $100. The platform features blockchain-secured transactions, transparent reporting, and regular income distributions to token holders.

The bottom line? Fractional real estate tokenization has lowered barriers so dramatically that anyone with $50-$500 can participate in markets once reserved for large institutions or wealthy individuals. Whether you’re seeking stable rental yields from Midwest U. S. homes via Lofty AI or diversifying into international luxury resorts through Binaryx, there’s now an accessible pathway tailored to your investment goals.

If you want to see how these mechanisms play out step-by-step, from due diligence through token purchase and income distribution, visit our comprehensive explainer: How Fractional Property Ownership Works With Blockchain Tokens.

What’s Next? Growth Catalysts and Investor Considerations

The next decade will likely bring even greater innovation as smart contracts automate more aspects of asset management, think automated rent collection or instant compliance checks, and as regulators refine frameworks for cross-border participation. Expect greater integration between tokenized platforms and traditional finance infrastructure as well.

Caveats remain: Investors should still conduct due diligence regarding platform security, legal structure, and property fundamentals before committing capital. While liquidity is improving, it may not match that of public equities during periods of market stress. Regulatory regimes also vary by jurisdiction, always confirm whether your chosen platform meets local requirements.

This new era is ultimately about choice: empowering people everywhere to invest in high-quality assets regardless of geography or net worth. With compliance-focused leaders like Lofty AI, RealT, Binaryx, Propchain, and HoneyBricks at the helm, and billions already invested, the trajectory points toward an increasingly open global real estate market where opportunity is measured not by borders or balance sheets but by vision and access.