Imagine owning a slice of a five-star resort in Aspen, a luxury villa in Bali, or a high-rise penthouse in Dubai, all without the multi-million-dollar price tag or the headaches of international property law. Thanks to fractional tokenization of luxury real estate, this vision is rapidly becoming a reality for global investors. By leveraging blockchain property investment, the world’s most coveted assets are being divided into digital tokens, allowing anyone to buy and trade fractional shares of prime real estate with unprecedented ease.

Breaking Down Barriers: How Fractional Tokenization Works

Traditional luxury real estate has long been the playground of the ultra-wealthy, with sky-high entry points and complex cross-border regulations. Fractional tokenization is flipping the script. Here’s how it works: each property is represented by a set of digital tokens on a blockchain. Investors purchase these tokens, each signifying a specific share of the property’s value and income streams.

This innovation is empowering a new wave of global investors. No longer do you need $10 million to get into the game, now, you can start with just a few hundred or thousand dollars, depending on the platform and property. The process is streamlined, secure, and transparent, thanks to blockchain’s immutable ledger and automated smart contracts.

Real-World Examples: Tokenizing Trophy Assets for Global Access

The past year has seen explosive growth in tokenized luxury property platforms:

Major Examples of Fractional Tokenization in Luxury Real Estate

-

DarGlobal’s Tokenization Initiative: DarGlobal is pioneering the conversion of luxury real estate assets into digital tokens, enabling global investors to buy fractional shares in premium properties with enhanced liquidity and transparent transactions. Learn more.

-

Binaryx’s Global Luxury Properties: Binaryx specializes in tokenizing luxury vacation homes in locations like Bali, Turkey, and Montenegro, offering fractional ownership and real-time rental income to investors worldwide. Explore Binaryx properties.

-

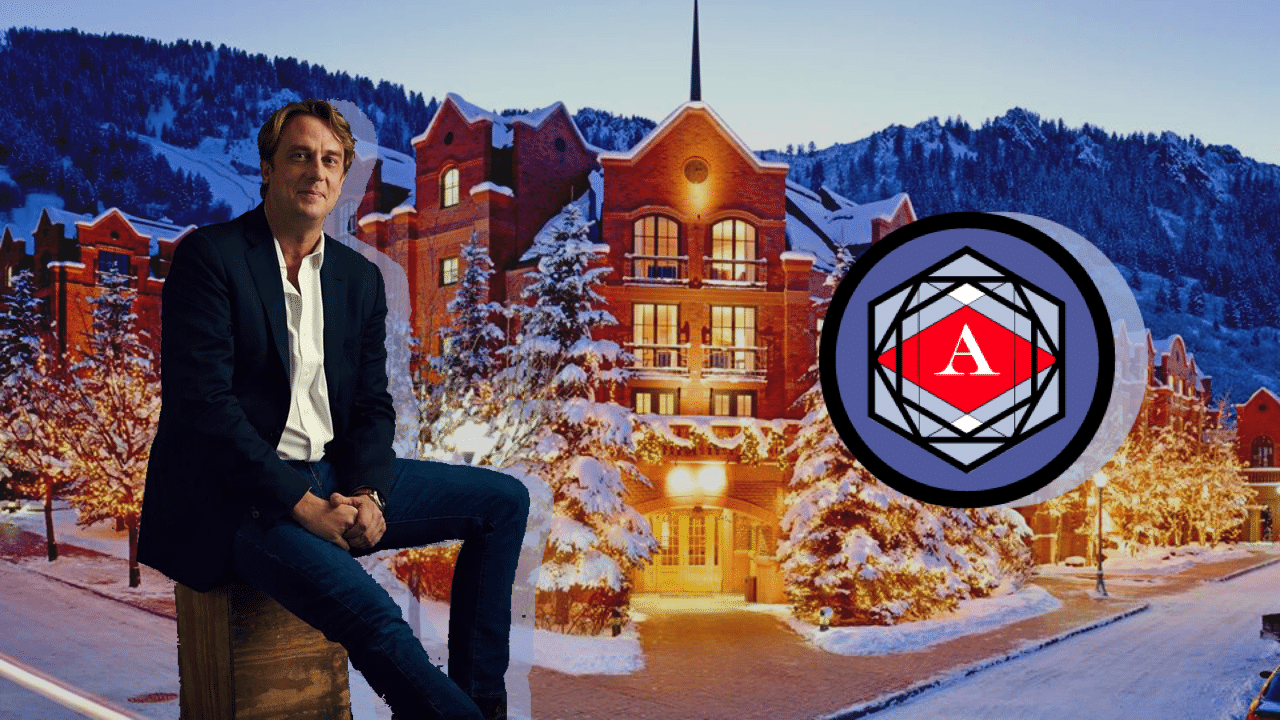

St. Regis Aspen Resort Tokenization: The St. Regis Aspen Resort made headlines by issuing 18 million “Aspen Coins” on Ethereum, allowing accredited investors to own and trade nearly 19% of the luxury resort as digital tokens. Read about Aspen Coin.

-

Dubai’s Regulatory Leadership: Dubai has become a global hub for real estate tokenization, with government-backed platforms facilitating the fractional sale of luxury properties to investors from over 35 countries, all under robust regulatory guidelines. Discover Dubai’s tokenized real estate.

– DarGlobal’s Tokenization Initiative: By converting physical assets into digital tokens, DarGlobal offers worldwide access to shares in premium properties, with simplified transactions and enhanced liquidity. – Binaryx’s Global Luxury Properties: Investors can buy fractional ownership in vacation homes across Bali, Turkey, and Montenegro, enjoying real-time rental income distributions. – St. Regis Aspen Resort: In a landmark move, 18 million “Aspen Coins” were issued on Ethereum, representing nearly 19% ownership in the iconic resort, all tradable by accredited investors. – Dubai’s Regulatory Leadership: With government-backed platforms and clear guidelines, Dubai recently saw two luxury properties sold via blockchain tokens to buyers from over 35 countries.

These examples showcase the democratization of high-end real estate, opening doors for a diverse global investor base and injecting fresh liquidity into traditionally illiquid markets.

Why Global Investors Are Flocking to Digital Assets in Real Estate

The appeal of digital assets in real estate goes far beyond novelty. Investors are drawn by three core benefits:

- Accessibility: Fractional ownership slashes capital requirements, letting more people participate in once-exclusive markets.

- Liquidity: Unlike conventional real estate deals, tokens can be traded on regulated exchanges, providing flexibility and faster exit options.

- Transparency and Security: Blockchain records every transaction, reducing fraud and boosting investor confidence.

This paradigm shift isn’t just theoretical, it’s already reshaping how and where capital flows into luxury properties worldwide. For more on how these new structures lower investment barriers, check out this guide on fractional tokenization for global investors.

As tokenized luxury property platforms mature, investors are discovering that they can diversify across continents and asset classes without the headaches of traditional real estate investing. Platforms like RealT and Fraxtor, for example, have made it possible to seamlessly buy, hold, and trade fractional interests in high-value properties, all with a few clicks. This is a far cry from the paperwork, legal fees, and lengthy settlement periods that once defined the luxury property market.

Navigating Risks and Regulatory Frontiers

Of course, this new frontier isn’t without challenges. Regulatory frameworks for fractional tokenization luxury real estate are still evolving. While Dubai has set a global standard with clear government-backed guidelines, other regions lag behind or offer only patchwork rules. Investors need to be mindful of local laws, platform credibility, and the underlying asset’s due diligence. Transparency is improving, though, with many platforms now providing real-time access to tenant data, inspection reports, and risk disclosures.

Another key factor is liquidity. While tokenized assets are far more liquid than traditional real estate, secondary markets are still developing. Not every tokenized property will have instant buyers, so investors should weigh their time horizons and the platform’s trading volume.

What’s Next? The Future of Global Luxury Property Investment

The momentum shows no signs of slowing. As more trophy assets are fractionalized and listed on blockchain property investment platforms, expect to see:

Top Trends in Tokenized Luxury Real Estate

-

Regulatory Innovation in Leading Markets: Dubai has positioned itself as a regulatory pioneer, with government-backed initiatives and clear guidelines that have facilitated the sale of luxury properties via blockchain tokens to international buyers.

-

Real-Time Income Distribution: Platforms like Binaryx are offering investors not just ownership, but also real-time rental income from tokenized luxury vacation properties, making high-end real estate more attractive and practical for global participants.

-

Institutional-Grade Tokenization Projects: Landmark cases such as the St. Regis Aspen Resort tokenization—where 18 million Aspen Coins were issued on Ethereum—showcase how luxury assets are being fractionalized for accredited investors.

-

Enhanced Transparency and Security: Blockchain-based tokenization ensures every transaction is securely recorded and easily auditable, increasing investor confidence and reducing fraud in the luxury real estate sector.

– Increased cross-border investment flows as regulatory clarity spreads and platforms interoperate – More innovative token structures, including revenue-sharing and utility tokens for property perks – Enhanced investor protections and insurance products tailored to digital real estate assets – Broader adoption by institutional investors seeking exposure to global real estate without the usual barriers

For investors who crave diversification and flexibility, digital assets in real estate are opening doors that were previously bolted shut. Whether you’re looking to earn rental income from a Balinese villa or speculate on appreciation in a Dubai penthouse, tokenization is making it possible – and practical.

Ready to Start Your Journey?

The democratization of luxury real estate is no longer a distant dream. Thanks to blockchain innovation, global investors now have direct access to some of the world’s most exclusive properties. If you’re ready to explore how fractional tokenization can reshape your portfolio, dive deeper with this comprehensive guide on fractional ownership and global markets.