Tokenized real estate on Arbitrum is rapidly reshaping how investors around the globe access property markets. By leveraging blockchain technology, specifically Arbitrum’s scalable infrastructure, these platforms are lowering traditional barriers and democratizing exposure to high-value real estate assets. With Arbitrum (ARB) currently priced at $0.3203, the ecosystem is attracting attention from both crypto-native and institutional investors seeking more efficient, accessible, and transparent property investment solutions.

Fractional Ownership: Lowering the Barriers to Global Real Estate

Historically, direct real estate investment required substantial capital outlays and was limited by geographic and regulatory constraints. Tokenization solves these pain points by dividing property ownership into digital tokens, each representing a fractional share of a tangible asset. Platforms like Estate Protocol on Arbitrum now enable participation in premium properties for as little as $50 per investor. This model is not only making high-end assets accessible but also allowing for diversified exposure across geographies and asset types.

The implications for global investors are profound: no longer must one be a high-net-worth individual or navigate complex cross-border legal hurdles to own a slice of prime U. S. rental or hospitality properties. Instead, tokenized real estate platforms facilitate direct, borderless entry points using stablecoins like USDC, with rental income distributed automatically on-chain. For more details on how platforms like Estate Protocol structure these offerings, see their recent analysis.

Liquidity Unlocked: Trading Property Like Digital Assets

The illiquidity of traditional real estate has long deterred many investors, selling a physical property can take months or even years. On Arbitrum-powered platforms, however, tokenized real estate introduces secondary markets where tokens can be freely bought and sold in minutes rather than months. This newfound liquidity empowers investors to rebalance portfolios quickly in response to market events or personal needs.

Secondary trading also supports price discovery and transparency rarely seen in legacy property transactions. As noted in our recent analysis, this shift is enabling new strategies, such as short-term holding periods or tactical reallocations, that were previously out of reach for most market participants.

Operational Efficiency Through Smart Contracts

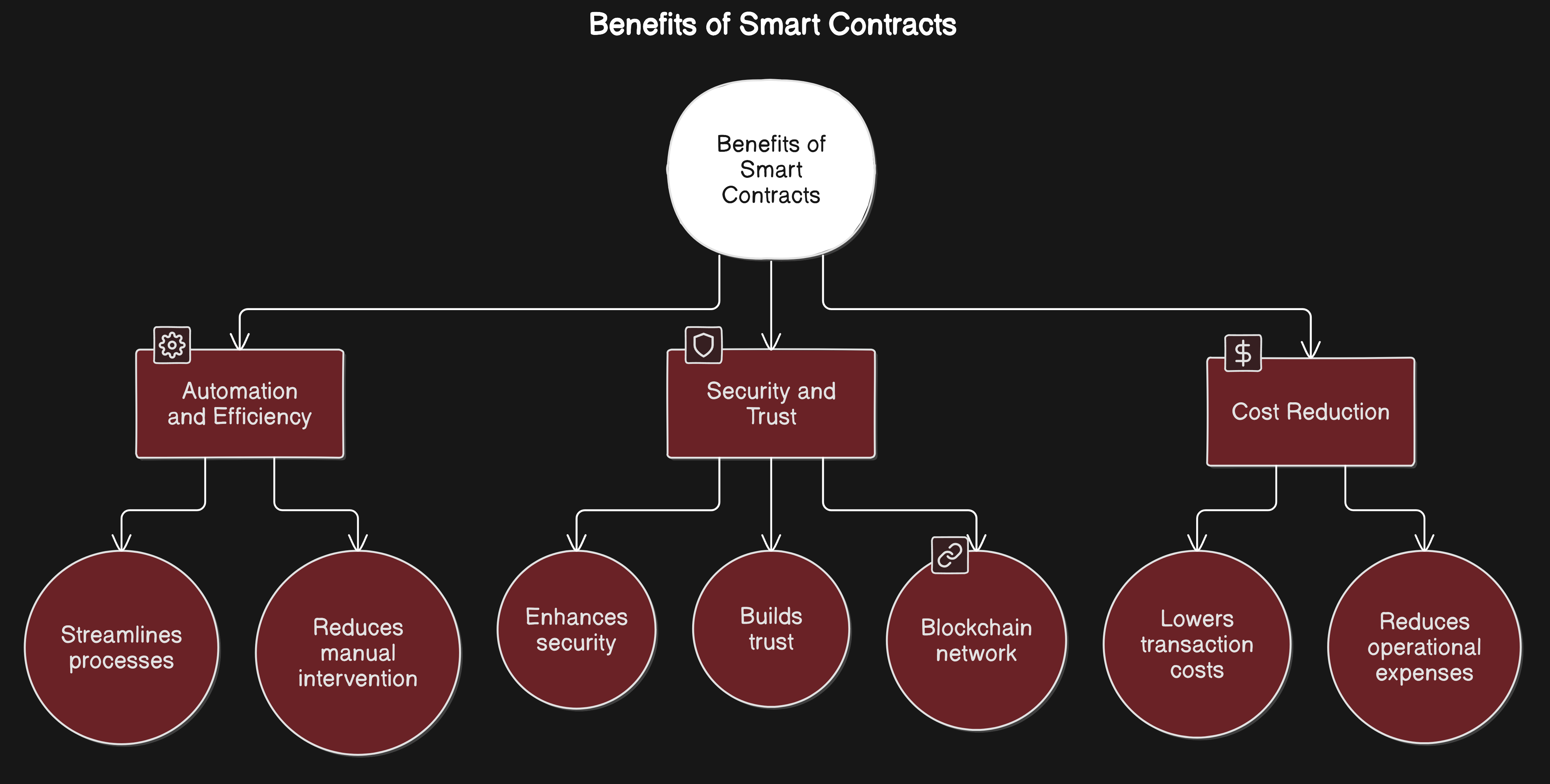

Beyond accessibility and liquidity, tokenized real estate on Arbitrum benefits from operational efficiencies made possible by smart contracts. These self-executing agreements automate everything from rental income distribution to compliance checks and voting rights among token holders. The result is lower administrative overhead and reduced risk of human error or fraud.

Every transaction, whether it’s a purchase, sale, or income payout, is immutably recorded on the blockchain for complete transparency and auditability. For example, platforms like Estate Protocol use smart contracts to distribute monthly Airbnb rental income directly to token holders’ wallets without intermediaries or manual processing delays (see their operational overview here).

For investors accustomed to the paperwork and delays of traditional real estate, this level of automation and speed is a paradigm shift. It not only reduces costs but also inspires greater trust among global participants, as all actions are verifiable on-chain. Importantly, Arbitrum’s low transaction fees and robust security make it an ideal foundation for scaling these operational benefits across diverse property types and jurisdictions.

Key Benefits of Tokenized Real Estate on Arbitrum

-

Fractional Ownership Lowers Entry Barriers: Platforms like Estate Protocol on Arbitrum enable investors to purchase fractional shares of high-value properties for as little as $50, democratizing access to premium real estate markets worldwide.

-

Enhanced Liquidity Through Secondary Markets: Real estate tokens on Arbitrum can be traded on secondary marketplaces, offering investors the ability to buy and sell property shares quickly—addressing the traditional illiquidity of real estate assets.

-

Operational Efficiency and Transparency: Leveraging Arbitrum’s scalable blockchain, smart contracts automate rental income distribution and property management, while all transactions are immutably recorded, reducing administrative costs and enhancing investor trust.

-

Global Market Access with Stablecoin Integration: Tokenized real estate platforms on Arbitrum, such as Estate Protocol, allow investors worldwide to access properties in markets like the U.S. and receive rental income in stablecoins like USDC, streamlining cross-border investment.

-

Emerging Regulatory Frameworks Support Innovation: Jurisdictions like Dubai are establishing clear guidelines for asset tokenization, enabling compliant, government-backed platforms that facilitate secure and legal fractional real estate sales.

Global Reach: Accessing International Markets Seamlessly

Tokenized real estate protocols on Arbitrum are removing the last barriers to cross-border property investment. By using blockchain-based tokens, investors from Europe, Asia, Africa, or the Americas can gain access to properties in markets like the U. S. or Dubai without the traditional headaches of local intermediaries, currency conversions, or opaque legal processes. The ability to transact in stablecoins such as USDC further simplifies global participation and ensures predictable, near-instant settlement of both purchases and rental income.

Consider the case of high-end Airbnb properties in the U. S. listed by Estate Protocol. Investors worldwide can purchase fractional shares and receive onchain rental income, all managed transparently and efficiently. This model is not only opening up lucrative markets to a broader investor base but also encouraging more property owners to list assets for tokenization, knowing they can tap into a global pool of capital.

Navigating Compliance: The Regulatory Landscape in 2025

Despite the obvious advantages, tokenized real estate on Arbitrum must operate within a shifting regulatory environment. Each jurisdiction sets its own standards for digital asset classification, investor protection, and property rights. While this can pose challenges, it is also driving innovation, with some regions embracing regulatory clarity to attract investment. Dubai, for example, has established government-backed frameworks for fractional property sales that provide clear guidelines and consumer protections (see more on regulatory progress here).

For investors, due diligence is vital. Understanding both the technical and legal frameworks underpinning each platform is non-negotiable. Leading protocols are responding with built-in compliance features, such as automated KYC/AML checks and jurisdictional restrictions coded into their smart contracts. As the regulatory picture matures, expect to see even more robust tools for risk management and investor security.

The Road Ahead: Opportunities and Risks

Looking forward, the tokenized real estate sector on Arbitrum is poised for significant growth. As more property types, from commercial towers to vacation rentals, are brought on-chain, and as the ARB price holds steady at $0.3203, the opportunities for global diversification and yield generation will only expand. However, this innovation is not without risks. Market volatility, evolving regulations, smart contract vulnerabilities, and platform solvency are all factors that disciplined investors must monitor closely.

Ultimately, tokenized real estate on Arbitrum offers a compelling blend of accessibility, liquidity, and efficiency unmatched by legacy systems. For those willing to navigate its complexities with care and rigor, it represents a new frontier in global property investment, one where capital can flow freely across borders and asset classes with unprecedented transparency.