For investors navigating the evolving world of tokenized real estate, the ability to track property tokens, manage diversified portfolios, and receive timely alerts is no longer a luxury, it’s a necessity. As blockchain adoption accelerates in the real estate sector, platforms have emerged with robust dashboards and analytic tools tailored specifically for property token investors. In 2025, these solutions offer more than basic tracking: they provide actionable insights, compliance management, and a seamless interface between traditional real estate metrics and on-chain data.

Why Tracking Property Tokens Matters in 2025

The tokenized real estate market has matured rapidly, with top platforms like RealT, Securitize Markets, and Redswan CRE transforming how investors interact with digital property assets. The value proposition of property tokenization, fractional ownership, global access, and secondary market liquidity, depends on an investor’s ability to monitor their holdings in real time. With increased regulatory oversight and more sophisticated investment strategies entering the space, portfolio management tools have become central to risk mitigation and performance optimization.

Below is a curated list of the top 5 tools for tracking and managing your favorite property tokens. Each solution brings unique features, from AI-powered analytics to customizable alerts, that enable both retail and institutional investors to stay ahead in this dynamic market.

Top 5 Tools for Tracking Property Tokens in 2025

-

RealT Portfolio Dashboard: The RealT Portfolio Dashboard offers investors a comprehensive view of their tokenized real estate holdings. It provides real-time analytics, rental income tracking, and portfolio performance metrics tailored specifically for RealT property tokens.

-

Securitize Markets Portfolio Tracker: The Securitize Markets Portfolio Tracker enables users to monitor their tokenized real estate assets, access transaction histories, and receive compliance notifications. Its regulated platform supports secondary market trading and investor onboarding.

-

Redswan CRE Marketplace Alerts: Redswan CRE Marketplace provides customizable alerts for new property token listings, price changes, and portfolio updates. The platform focuses on commercial real estate tokenization, offering detailed analytics and market insights for investors.

-

Tokeny Solutions Investor Portal: The Tokeny Solutions Investor Portal streamlines the management of tokenized real estate assets. Features include investor onboarding, compliance management, and real-time tracking of property token performance.

-

Dune Analytics Custom Property Token Trackers: Dune Analytics allows users to build and share custom dashboards for tracking property token transactions and portfolio metrics. Its powerful querying tools enable deep insights into tokenized real estate activity across multiple blockchains.

1. RealT Portfolio Dashboard: Unified Token Management

RealT‘s Portfolio Dashboard has set the benchmark for user-friendly interfaces in the tokenized property sector. Investors can view live balances across multiple properties, track rental income distributions in stablecoins or fiat-pegged tokens, and analyze historical performance, all within one consolidated dashboard. The platform also offers downloadable tax documents tailored for various jurisdictions, making compliance straightforward even as regulations evolve.

A standout feature is its integration with major DeFi protocols: users can see which tokens are staked or used as collateral elsewhere on-chain. This holistic overview empowers investors to make informed decisions about reallocating capital or rebalancing their portfolios as market conditions shift.

2. Securitize Markets Portfolio Tracker: Compliance Meets Analytics

Securitize Markets has established itself as a leader in compliant tokenized securities trading. Its Portfolio Tracker gives investors granular control over their holdings by providing detailed breakdowns of asset classes (commercial vs residential), transaction histories, and dividend payments. Importantly, Securitize’s regulated Alternative Trading System (ATS) enables direct access to secondary market liquidity, a crucial feature for those seeking timely exits or portfolio adjustments.

The tracker also integrates automated KYC/AML checks and provides alerts when new investment opportunities matching your risk profile become available on their marketplace. This blend of regulatory rigor with advanced analytics makes it particularly attractive to institutional players entering the space.

3. Redswan CRE Marketplace Alerts: Never Miss an Opportunity

The Redswan CRE Marketplace, known for its focus on high-value commercial real estate (CRE), offers an alert system tailored specifically for active traders and opportunistic investors. Through custom notifications based on asset type, location, or price movement thresholds, users can stay informed about new listings or significant changes within their watchlist assets.

This tool is especially valuable given the cyclical nature of commercial markets, timely entry or exit can significantly impact returns in sectors like office or multifamily properties. Redswan’s alert system ensures that you’re not just passively tracking your investments but actively managing them based on real-time data feeds from both blockchain records and traditional CRE sources.

4. Tokeny Solutions Investor Portal: Streamlined Lifecycle Management

Tokeny Solutions stands out for its comprehensive Investor Portal, which is designed to simplify the entire lifecycle of property token investments. The portal offers a centralized view of all tokenized asset holdings, real-time updates on distributions, and automated investor onboarding. What makes Tokeny particularly powerful is its ability to handle regulatory compliance in multiple jurisdictions, integrating KYC/AML processes seamlessly into the user experience.

Investors benefit from customizable dashboards that track performance metrics, ownership percentages, and historical cash flows across diverse property types. For those managing large or multi-asset portfolios, the portal’s workflow automation tools reduce administrative overhead and ensure that critical deadlines for reporting or corporate actions are never missed. This level of operational efficiency provides a distinct edge in a market where speed and accuracy are paramount.

5. Dune Analytics Custom Property Token Trackers: Transparency Through On-Chain Data

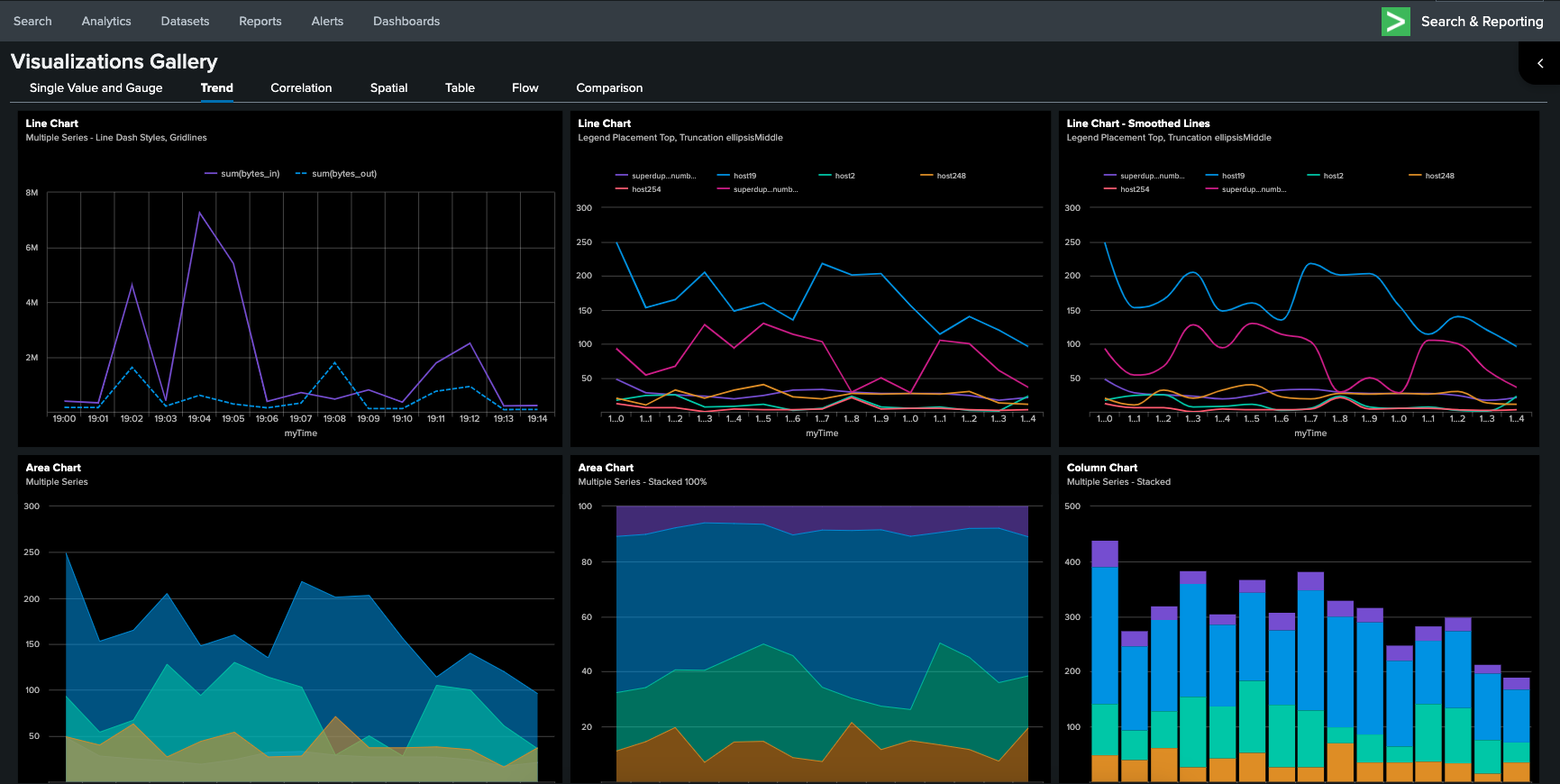

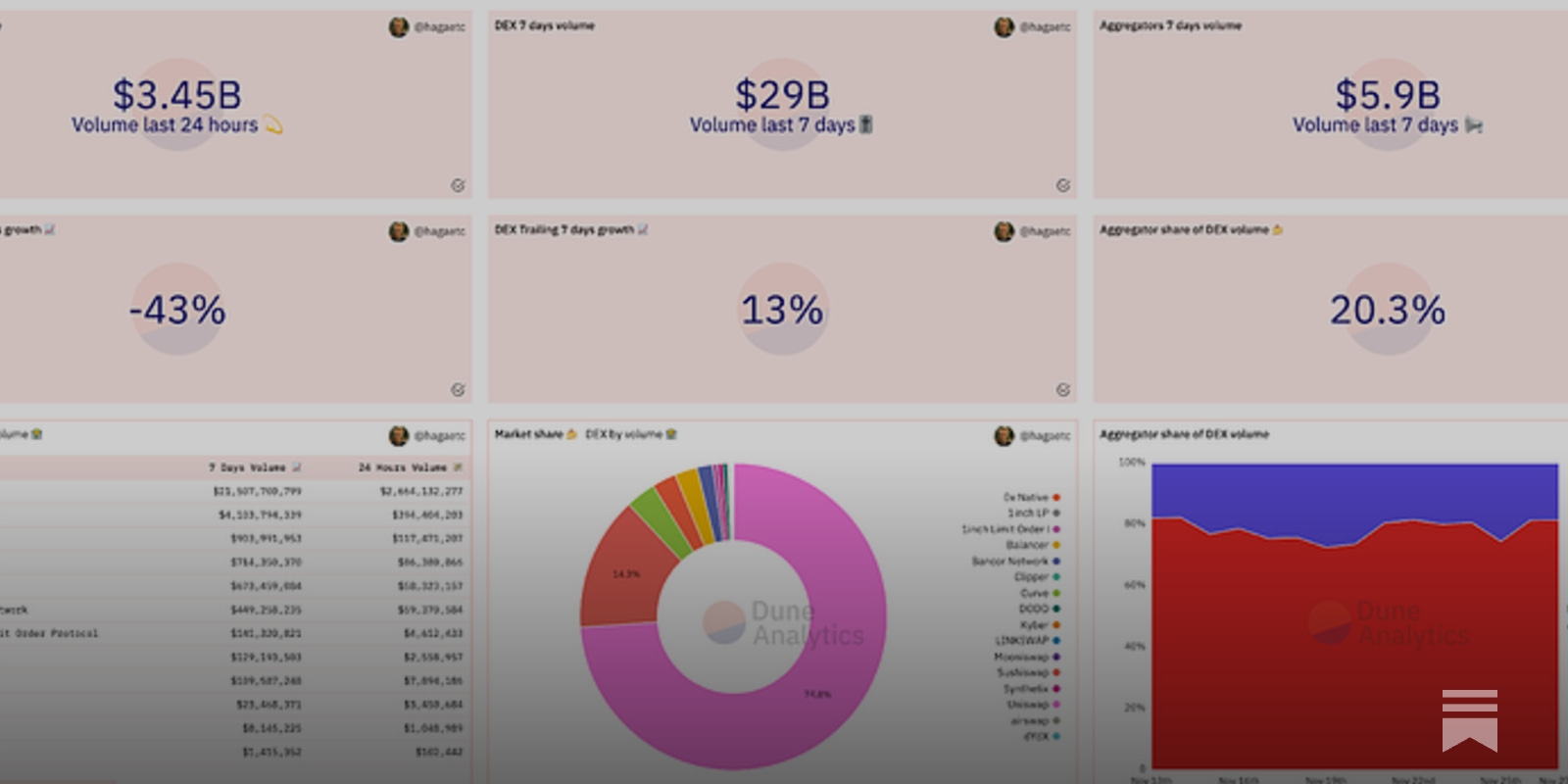

Dune Analytics brings a new dimension to property token tracking by leveraging the transparency of public blockchains. With Dune’s custom trackers, investors can create bespoke dashboards that visualize everything from price movements and trading volume to wallet distribution for specific tokens or platforms like RealT and Securitize Markets.

These trackers are highly customizable, allowing users to set up alerts for unusual on-chain activity, such as large transfers or sudden liquidity spikes, which can serve as early indicators of market shifts. For data-driven investors, Dune Analytics offers the ability to backtest strategies against historical blockchain data or monitor portfolio health in real time without relying solely on platform-provided interfaces.

Choosing the Right Tool for Your Strategy

No single platform will fit every investor’s needs. Retail participants may prioritize ease of use and integrated tax reporting as offered by RealT, while institutional players could value Securitize’s regulatory infrastructure or Tokeny’s workflow automation. For those who want granular control over data and analytics, Dune’s open-ended approach is invaluable.

It’s also important to consider how these tools complement broader investment goals such as diversification, liquidity management, or risk-adjusted returns. For more on how tokenized real estate enhances portfolio diversification and accessibility, see this research-driven analysis.

Pros & Cons of Top 5 Property Token Tracking Tools

-

RealT Portfolio DashboardPros: Purpose-built for RealT property tokens, offering real-time balance updates, rental income tracking, and detailed asset breakdowns. User-friendly interface tailored for fractional property investors.Cons: Limited to RealT tokenized properties; lacks cross-platform aggregation or analytics for tokens from other issuers.

-

Securitize Markets Portfolio TrackerPros: Supports a wide range of tokenized real estate assets, including those issued via Securitize. Features integrated compliance, investor onboarding, and access to a regulated secondary market.Cons: Platform navigation can be complex for new users; primarily focused on assets issued through Securitize, with limited third-party token support.

-

Redswan CRE Marketplace AlertsPros: Specializes in commercial real estate (CRE) token tracking, with customizable alerts for new listings, price changes, and trading activity. Offers detailed analytics for CRE assets.Cons: Focused on commercial rather than residential properties; some advanced analytics require a premium subscription.

-

Tokeny Solutions Investor PortalPros: Robust compliance and investor management tools, supporting multiple real estate token issuers. Streamlines onboarding, KYC/AML, and provides transparent transaction histories.Cons: Primarily designed for institutional investors; interface may feel technical for retail users.

-

Dune Analytics Custom Property Token TrackersPros: Highly customizable dashboards using on-chain data, enabling users to track any ERC-20 property token. Free access to community-built analytics and real-time visualizations.Cons: Requires some technical knowledge to set up custom queries; data accuracy depends on the quality of user-generated dashboards.

Best Practices for Effective Portfolio Management

- Set custom alerts: Use Redswan CRE Marketplace Alerts or Dune Analytics notifications to stay ahead of major market moves.

- Diversify across platforms: Leverage multiple dashboards (e. g. , RealT and Securitize) for redundancy and cross-validation of your holdings.

- Automate compliance: Take advantage of KYC/AML integrations in Tokeny Solutions and Securitize Markets to streamline regulatory tasks.

- Monitor on-chain activity: Use Dune Analytics to gain transparency into whale movements or liquidity changes that may impact pricing.

- Review performance regularly: Download reports from each tool monthly to analyze risk-adjusted returns versus benchmarks.

The convergence of blockchain technology with real estate investing has made sophisticated portfolio management accessible even to smaller investors. By selecting the right mix of tracking tools, whether it’s RealT for rental income monitoring, Securitize for compliant trading, Redswan for timely alerts, Tokeny for lifecycle automation, or Dune Analytics for deep data insights, you position yourself at the forefront of this rapidly evolving asset class.