Imagine owning a slice of a Miami rental, a piece of a Dubai high-rise, or a share in a Chicago apartment building, all for just $100. Thanks to tokenized real estate, this is now a reality for everyday investors. With blockchain technology, you can buy digital tokens representing fractional property ownership, unlocking passive income and global diversification without the need for hefty down payments or landlord headaches. If you’ve ever wondered how to invest in tokenized real estate, you’re in the right place.

Step 1: Choose a Reputable Tokenized Real Estate Platform

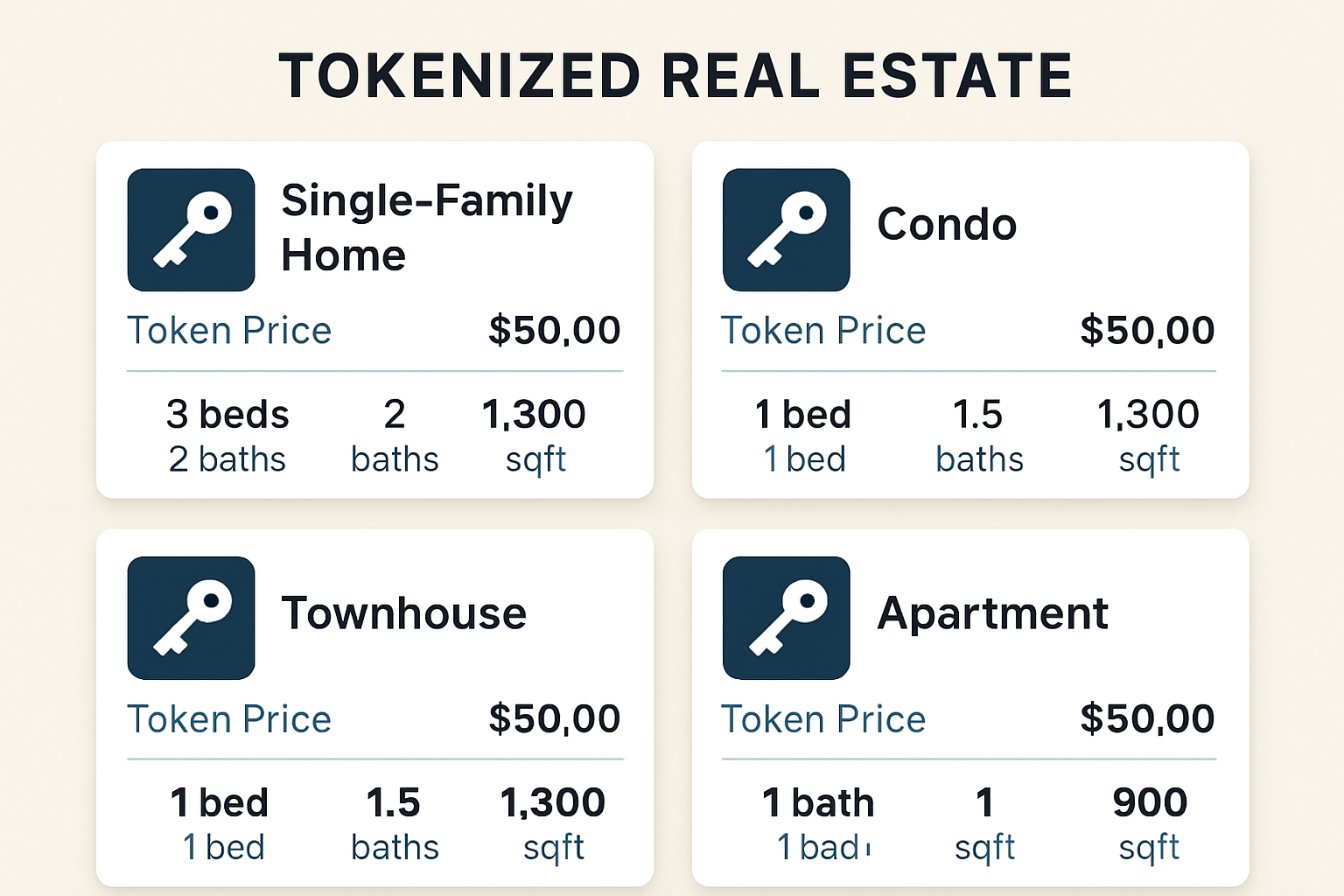

First things first: pick a trustworthy platform that specializes in fractional property ownership via blockchain. The top names right now include RealT, Lofty, and HoneyBricks. Each offers access to vetted properties, transparent reporting, and investment minimums as low as $50 to $100. For example, RealT lets you own part of U. S. rental homes, while Lofty focuses on single-family rentals with daily rental income payouts. HoneyBricks is known for its curated portfolio of institutional-grade real estate.

Best Tokenized Real Estate Platforms for Beginners

-

Choose a Reputable Tokenized Real Estate Platform (e.g., RealT, Lofty, or HoneyBricks)Start by selecting a trusted platform that offers fractional ownership in real estate. RealT and Lofty allow you to invest in U.S. rental properties from just $50, while HoneyBricks specializes in tokenized commercial real estate. Each platform provides an intuitive interface and transparent property details.

-

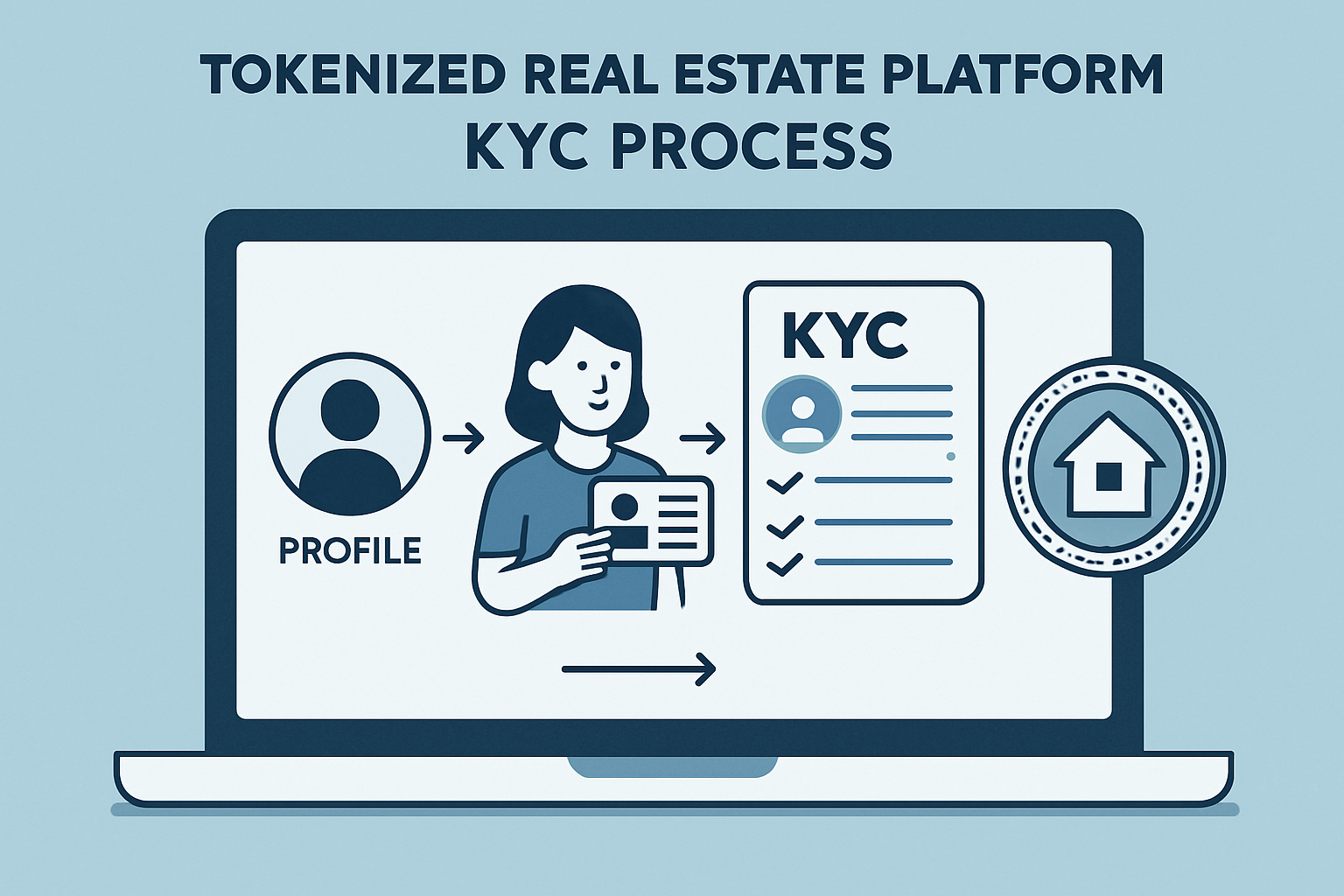

Complete KYC/AML Verification and Fund Your Account with at Least $100Sign up and complete the Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to ensure compliance and security. Then, deposit at least $100 using supported payment methods such as bank transfer, credit card, or cryptocurrency.

-

Browse Available Tokenized Properties and Analyze Key Metrics (location, yield, token price)Explore the platform’s marketplace to review properties. Analyze important metrics like location, expected rental yield, minimum token price, and legal documentation to make informed decisions.

-

Purchase Property Tokens Fractionally Using Fiat or CryptoDecide how much you want to invest (minimum $50–$100) and purchase property tokens using fiat currency or supported cryptocurrencies. This gives you fractional ownership and potential for passive income.

-

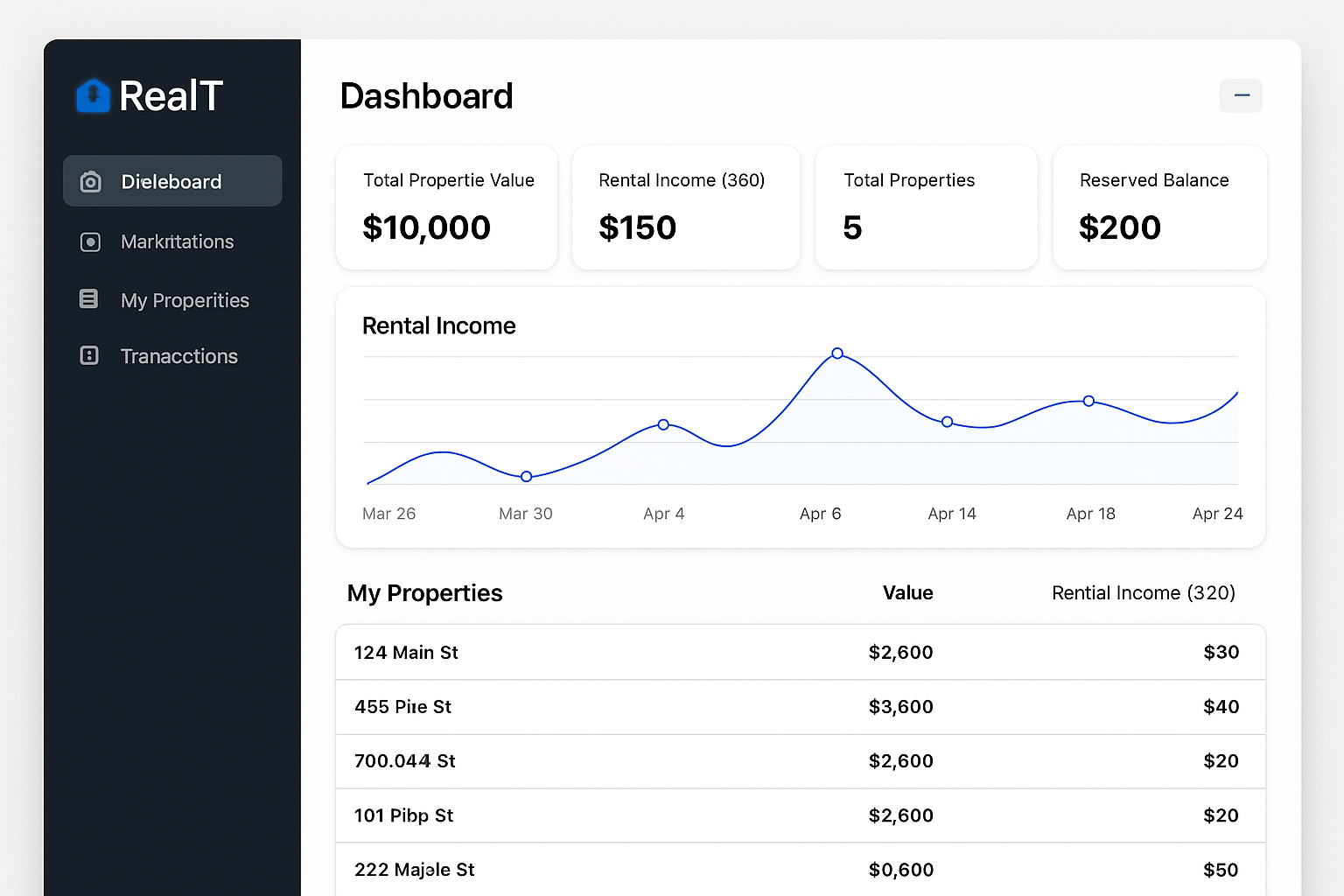

Track Your Investment and Collect Passive Rental Income DistributionsMonitor your portfolio through the platform’s dashboard. Most platforms distribute rental income regularly—sometimes daily or weekly—directly to your account, allowing you to see your returns grow in real time.

When choosing your platform, check for user-friendly dashboards, clear fee structures, and robust security measures. Look for platforms that are transparent about their asset selection process and provide detailed property reports. Want to explore how fractional ownership is making property investment accessible? Check out this guide on fractional ownership with tokenized real estate.

Step 2: Complete KYC/AML Verification and Fund Your Account with at Least $100

Once you’ve picked your platform, it’s time to get verified. Every reputable platform will require you to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This protects both you and the broader ecosystem from fraud and ensures regulatory compliance.

The process usually involves uploading a government-issued ID and a selfie for identity verification. Once approved, you can fund your account using bank transfer, credit card, or even cryptocurrency, just make sure you deposit at least $100 to meet the minimum investment requirement.

Step 3: Browse Available Tokenized Properties and Analyze Key Metrics

With funds in your account, the fun really begins! Platforms like RealT, Lofty, and HoneyBricks offer intuitive dashboards where you can browse a variety of tokenized properties. Pay attention to critical metrics such as:

- Location: Is the property in a high-demand city or growth market?

- Yield: What is the projected rental income or annualized return?

- Token Price: How many tokens can you buy with your $100?

- Legal Documentation: Are contracts and ownership structures clearly outlined?

Diversification is key, consider spreading your investment across several properties or markets. For more insights on how tokenization lowers entry barriers for global investors, read this deep dive into real estate tokenization.

The Power of Fractional Property Ownership

This approach lets you invest alongside others, sharing both the rewards and risks. You don’t need to save up for years or take out a massive mortgage, just start with $100 and watch your property tokens generate passive income over time.

Step 4: Purchase Property Tokens Fractionally Using Fiat or Crypto

Ready to become a fractional property owner? Once you’ve analyzed your options, it’s time to buy your first property tokens. Most platforms let you purchase tokens using traditional fiat currencies (like USD, EUR) or popular cryptocurrencies. Simply select the property you want, enter the amount you’d like to invest (starting at $100), and complete the transaction. The platform will handle the technical side – you’ll receive digital tokens in your account, each representing a slice of the underlying property.

Keep an eye on transaction fees and minimum purchase requirements. Some platforms even allow you to split your $100 across multiple properties, supercharging your diversification from day one. If you want a more detailed walkthrough of the buying process, check out this beginner’s step-by-step guide.

Step 5: Track Your Investment and Collect Passive Rental Income Distributions

Once you own property tokens, you’re officially in the game! Your investment dashboard will update in real time, showing your fractional ownership stake, accrued rental income, and property appreciation. Most platforms distribute rental income (minus property management fees) directly to your account, either daily, weekly, or monthly. This is where tokenized real estate shines: you start earning passive income with zero landlord headaches.

Want to cash out or adjust your portfolio? Many tokenized real estate platforms feature secondary markets, letting you buy or sell tokens with other investors. This added liquidity is a huge advantage over traditional real estate, where selling can take months. For more on how fractional ownership opens global investment opportunities, see this guide on global property tokenization.

5 Simple Steps to Invest $100 in Tokenized Real Estate

-

Choose a Reputable Tokenized Real Estate Platform (e.g., RealT, Lofty, or HoneyBricks). These platforms let you start with as little as $50–$100 and offer fractional ownership of real properties.

-

Complete KYC/AML Verification and Fund Your Account with at Least $100. Register, verify your identity for compliance, and deposit funds via bank transfer, credit card, or crypto. This unlocks access to property investments.

-

Browse Available Tokenized Properties and Analyze Key Metrics (location, yield, token price). Review property details, expected rental returns, and legal documents to make informed decisions.

-

Purchase Property Tokens Fractionally Using Fiat or Crypto. Select your preferred property and buy tokens representing your share, starting from $100. Most platforms accept both traditional and digital payments.

-

Track Your Investment and Collect Passive Rental Income Distributions. Use the platform dashboard to monitor performance, receive rental payouts, and access secondary markets for liquidity if available.

What to Watch Out For

While the barriers to entry are lower than ever, smart investors know to stay vigilant. Always:

- Double-check platform compliance and security measures

- Read all legal documentation before investing

- Be aware of local tax implications on rental income and capital gains

- Remember that property values and yields can fluctuate with the market

Tokenized real estate is still a new frontier. Regulations are evolving, and not all platforms are equal. Do your due diligence and never invest more than you’re willing to lose. For a deeper dive into how fractional tokenization is transforming property investment for as little as $100, visit this comprehensive resource.

Start Small, Think Big: The Future of Passive Income

The beauty of tokenized real estate is its accessibility. With just $100, you can start building a truly global portfolio and unlock passive income streams that were once reserved for the wealthy elite. Whether you’re stacking tokens in Miami or Dubai, or diversifying across multiple cities, you’re planting seeds for long-term wealth – all with a few clicks.

So if you’re ready to take action, follow these five steps: choose a reputable platform (like RealT, Lofty, or HoneyBricks), complete KYC/AML verification and fund your account with at least $100, analyze available properties, purchase property tokens fractionally using fiat or crypto, and track your investment as you collect passive income distributions. The future of real estate investing is here – and it’s open to everyone.