Imagine owning a slice of a Miami rental property or a Dubai penthouse for just $100. Thanks to blockchain-powered platforms, this is no longer a fantasy reserved for the ultra-wealthy. Tokenized real estate has shattered traditional barriers, letting everyday investors tap into global property markets with the same ease as buying a stock or cryptocurrency. If you’re curious about how to invest in tokenized real estate with $100, you’re in the right place.

Why Tokenized Real Estate Is Changing the Game

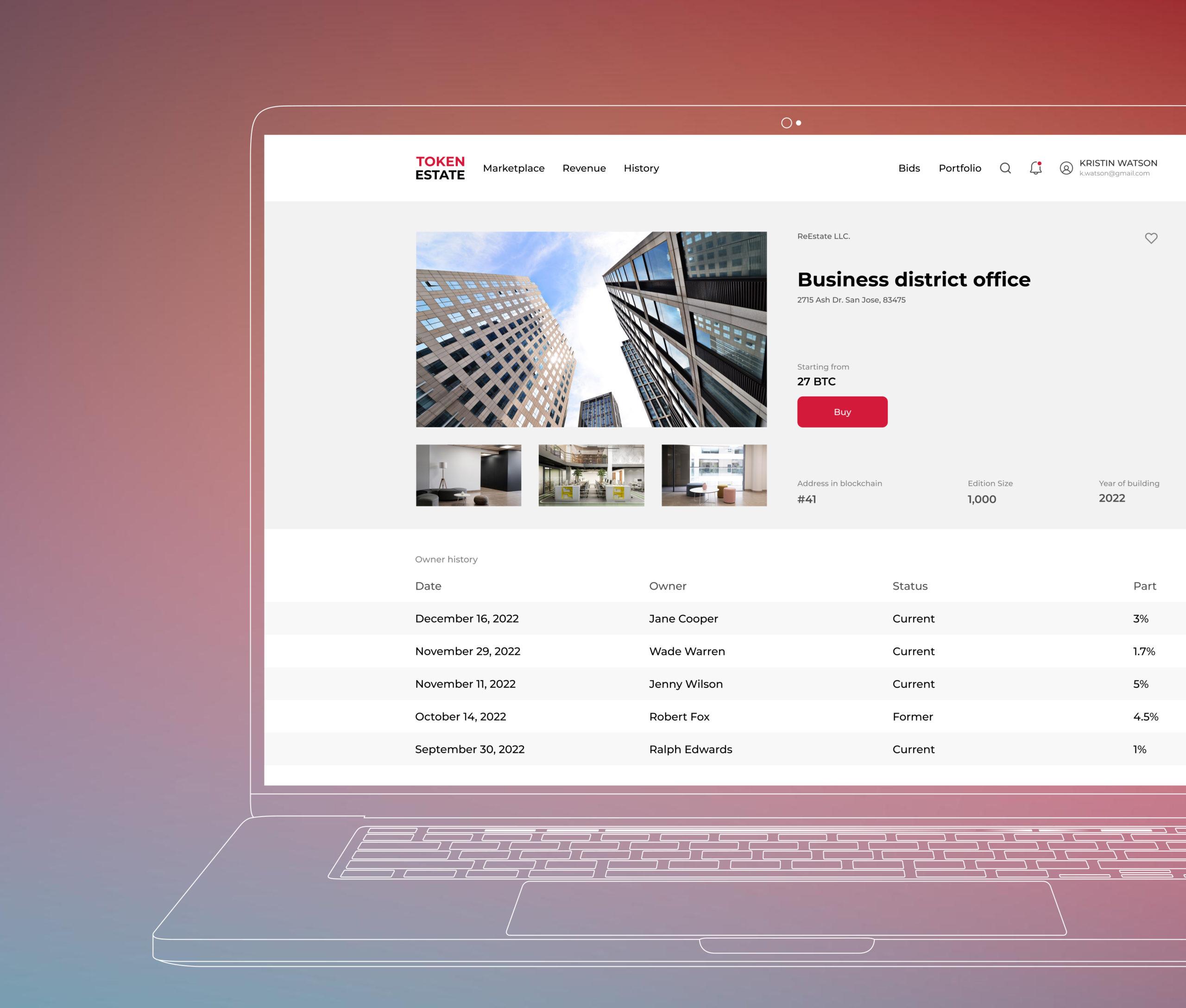

At its core, fractional property ownership blockchain technology divides real estate into digital tokens. Each token represents a share in a property, tracked and traded on the blockchain. The result? You can own a fraction of a high-value asset, receive rental income, and benefit from property appreciation – all with an entry point as low as $100.

The numbers speak for themselves: platforms like RealT and Lofty offer U. S. rental property tokens starting at $50, while Libertum opens up Dubai’s real estate market from $100. This innovation is fueling a projected $16.1 trillion tokenized asset market by 2030, with real estate expected to account for nearly 30% of that total.

How Does $100 Tokenized Investment Actually Work?

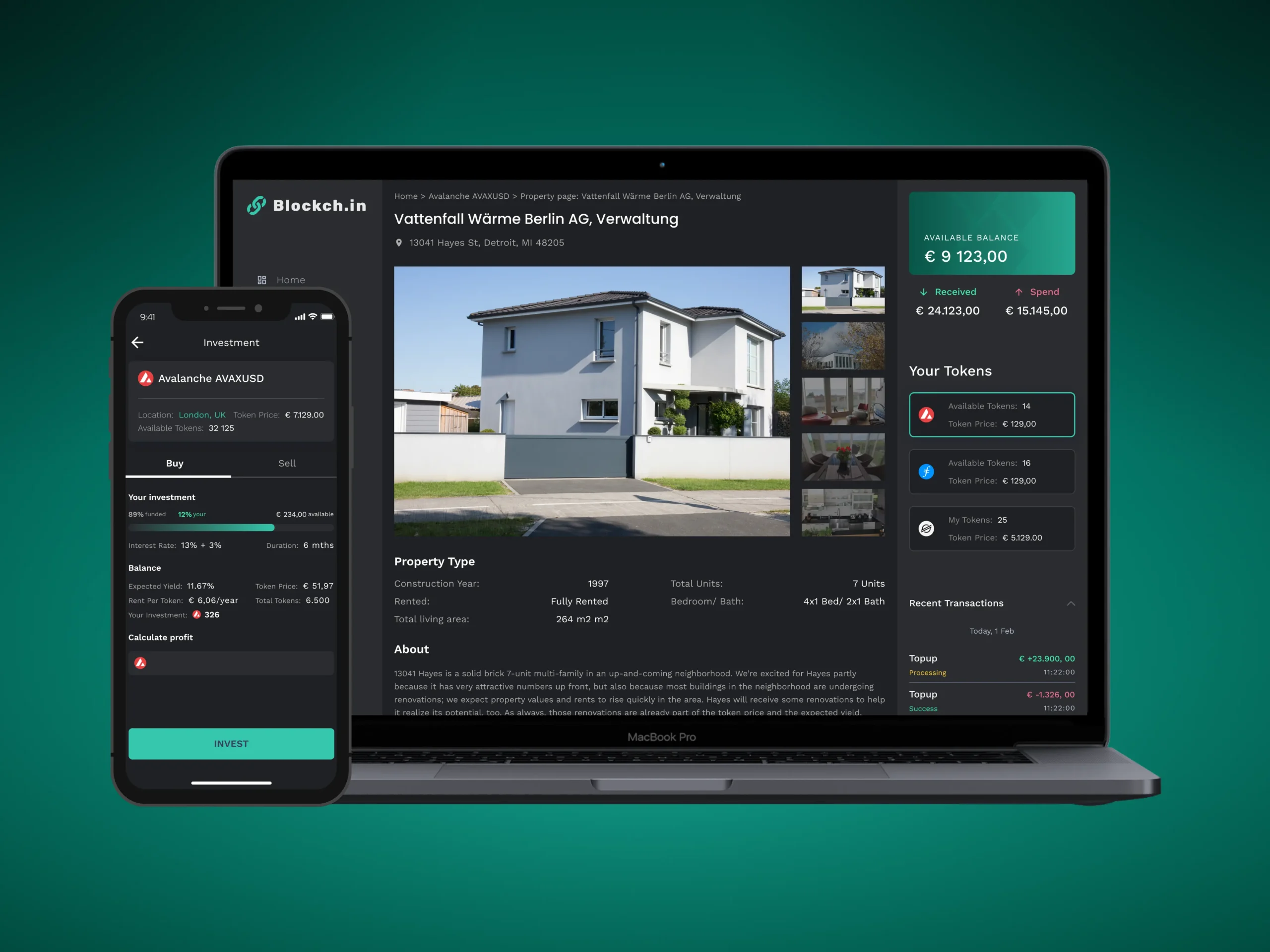

Let’s break it down: when you invest your $100, you’re buying digital tokens that represent ownership in a real property. These tokens are stored in your digital wallet and entitle you to a share of rental income and any appreciation in property value. Some platforms even allow you to trade your tokens with other users, adding liquidity that’s rare in traditional real estate investing.

The process is straightforward, but the key is choosing the right platform and understanding the basics. Here’s what you need to know about getting started:

Top 5 Platforms for $100 Tokenized Real Estate

-

Lofty lets you invest in U.S. rental properties for as little as $50. Earn daily rental income and trade property tokens easily on their marketplace.

-

RealT offers fractional ownership of U.S. real estate starting at $50 per token. Investors receive regular rental income payouts in cryptocurrency.

-

Homebase enables you to buy fractional shares in real estate with a minimum investment of $100. Their platform is user-friendly and focuses on transparency and compliance.

-

Libertum provides access to Dubai’s premium real estate market with investments starting at $100. Enjoy potential tax-free returns and exposure to international properties.

-

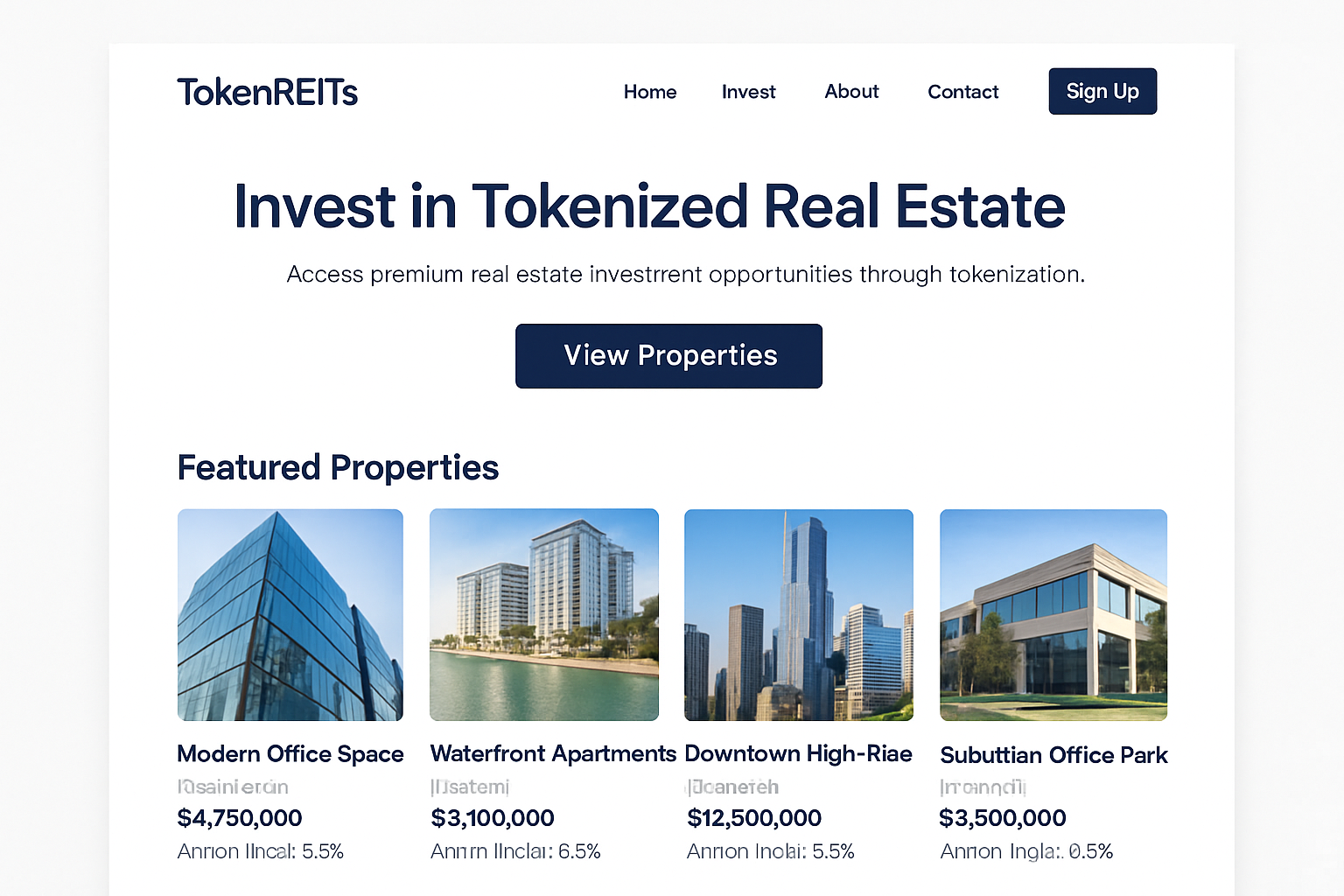

TokenREITs aggregates various tokenized real estate offerings, allowing you to start investing with just $100. The platform features curated property tokens and educational resources for beginners.

Getting Started: Step-by-Step Tokenized Property Investment

Ready to take the plunge? Here’s a high-level overview of the process:

Platforms like Lofty and Homebase make it easy to browse available properties, review rental yields, and complete your investment in just a few clicks. For more detail on how to buy property tokens online, check out our comprehensive step-by-step guide for beginners.

What Makes Tokenized Real Estate Different from Crowdfunding?

While both models open access to real estate with low minimums, tokenized real estate offers unique advantages. With blockchain-backed tokens, ownership is transparent and easily transferable. You’re not just a passive backer – you’re a verified fractional owner, with direct exposure to rental income and price appreciation. Plus, thanks to secondary markets, you can often sell your tokens quickly if you need liquidity.

Of course, not all tokenized real estate platforms are created equal. It’s crucial to compare fees, payout structures, property types, and jurisdictional regulations. Some platforms focus on U. S. single-family rentals, while others open the door to international commercial assets or luxury apartments in global hotspots like Dubai. Always review the platform’s due diligence process and transparency around property management before committing your $100.

Managing Risk and Maximizing Returns

Every investment comes with risk, and tokenized real estate is no exception. While blockchain adds a layer of security and transparency, you should still consider factors like property location, tenant stability, platform reputation, and regulatory compliance. Diversifying your $100 investment across multiple properties or even across different cities can help spread risk and smooth out returns over time.

One unique benefit of tokenized real estate is the potential for arbitrage. For example, if a property token trades at $100 on Platform A but fetches $110 on Platform B, savvy investors can buy low and sell high, just like in crypto or stock markets. However, always account for transaction fees and withdrawal limits before attempting this strategy.

Another key consideration is liquidity. Unlike traditional real estate, where selling your stake can take months, many tokenized platforms offer secondary markets where you can sell your tokens quickly, sometimes instantly, at prevailing market prices. This flexibility makes it easier to adjust your portfolio as your goals or market conditions change.

Common Questions About $100 Tokenized Real Estate Investing

It’s natural to have questions before diving in, especially when it comes to taxes, regulatory oversight, or how rental income is distributed. Most platforms pay out rental income monthly or quarterly, typically in stablecoins or fiat currency. Be sure to check whether your chosen platform handles tax reporting or if you’ll need to track income and capital gains yourself.

The Future Is Fractional: Why Now Is the Time to Start

The landscape for digital property ownership is evolving fast. As tokenized real estate moves further into the mainstream, early adopters who start with even a modest $100 can build a diversified portfolio that was once unthinkable for non-institutional investors. The combination of blockchain transparency, fractional ownership, and low entry costs is democratizing access to one of the world’s oldest wealth-building vehicles.

If you’re ready to explore further or want a more detailed roadmap tailored to your goals, check out our in-depth resource on how to buy your first property token online. The future of property investing is here, and it starts with your first $100.