Fractional commercial real estate investing has undergone a seismic shift in 2025. Thanks to blockchain-powered property tokens, it’s now possible to own a piece of an office tower, warehouse, or shopping center with as little as $50. The days of needing deep pockets or institutional connections to enter this market are fading away. Let’s dive into how you can start investing in fractional commercial real estate using property tokens, and what makes this approach so compelling for investors seeking both diversification and liquidity.

Why Property Tokens Are Changing Commercial Real Estate

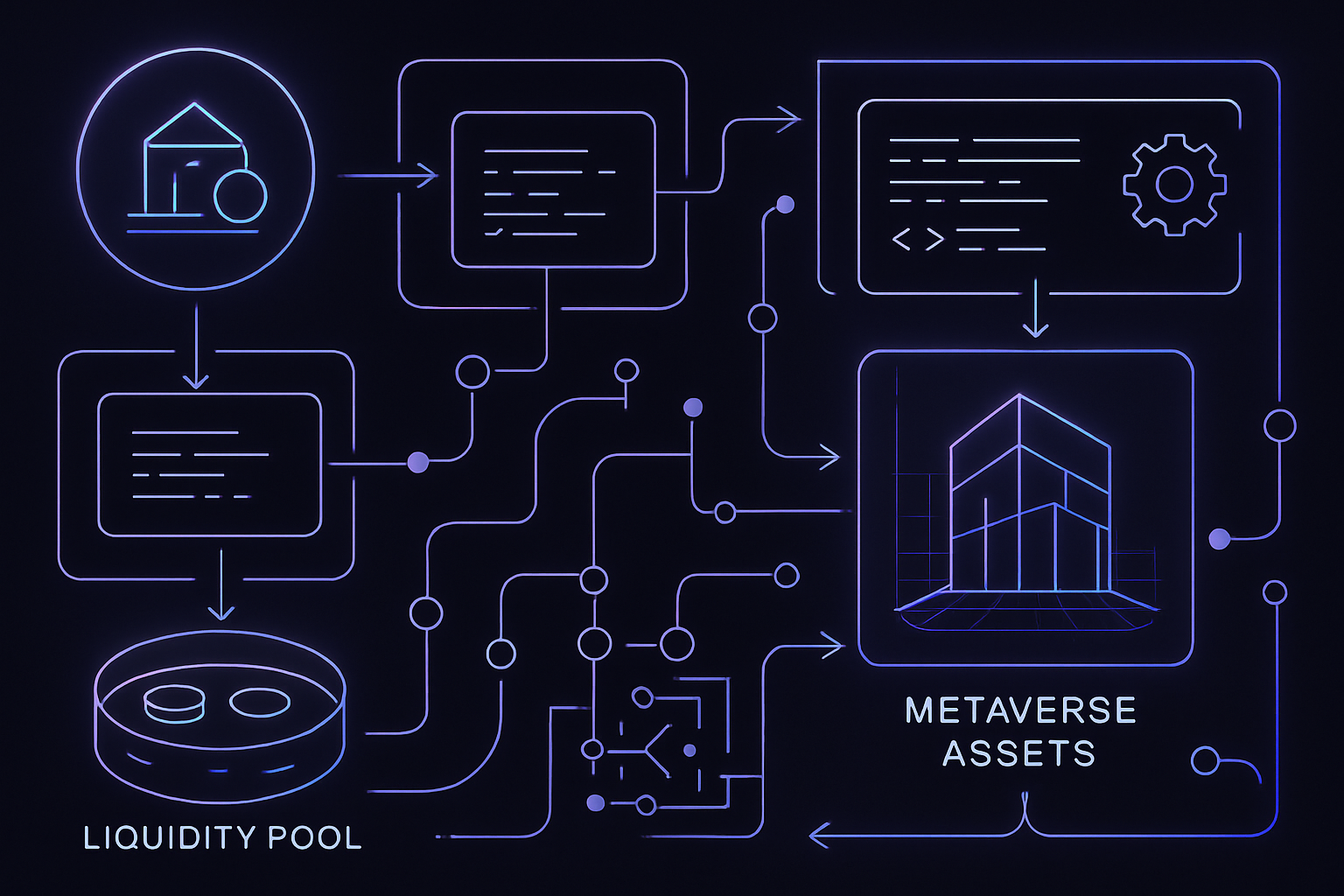

Property tokens are digital assets that represent fractional ownership in real estate, recorded on a blockchain for maximum transparency and security. With tokenization, the ownership rights of a commercial property, think office buildings, logistics centers, multi-family complexes, are split into hundreds or thousands of digital shares. Each token corresponds to a small slice of the asset’s value and income stream.

This structure brings several advantages over traditional real estate investing:

- Accessibility: Minimum investments can be as low as $50 on platforms like Lofty AI, opening doors for everyday investors.

- Liquidity: Unlike conventional real estate, property tokens can be traded on secondary markets, allowing you to exit or rebalance your position far more easily.

- Transparency: Blockchain ledgers record every transaction immutably, reducing fraud risk and providing clear proof of ownership.

The global market for tokenized real estate is projected to expand dramatically by 2035 (Deloitte Insights). But even in 2025, platforms are already making high-value assets accessible around the world.

The Leading Platforms for Fractional CRE Investing in 2025

The ecosystem is rapidly maturing. Here are some standout platforms that have made fractional commercial real estate investing mainstream:

- RealT: Specializing in U. S. residential and commercial properties, RealT lets you buy fractions and receive daily rental income in stablecoins. As of October 31,2025, they’ve tokenized over 700 properties worth more than $130 million.

- Propy: Known for global reach and robust compliance tools (KYC/AML), Propy streamlines everything from purchase to title transfer with smart contracts.

- Lofty AI: Built on Algorand blockchain with minimums starting at $50. Lofty leverages AI analytics so investors can make data-driven decisions about which properties to back.

- HoneyBricks: Geared toward accredited investors with minimums from $1,000. HoneyBricks enables crypto payouts (Bitcoin/Ethereum) from rental income streams.

- Binaryx: Focuses on luxury vacation/resort properties worldwide; minimum investment is just $500, ideal for those seeking exposure to global hospitality markets.

If you want more details about how these platforms work or how fractionalization plays out in practice, check out our guide: How Fractional Ownership Platforms Are Making Commercial Real Estate Accessible Through Tokenization.

Your Step-by-Step Guide: How To Invest Using Property Tokens

If you’re ready to take the plunge into tokenized commercial real estate, here’s what the process looks like in 2024-2025:

- Select Your Platform: Compare options based on asset type (office vs retail vs industrial), minimum buy-in amounts ($50 on Lofty AI; $500 on Binaryx), fees, geographic focus and reputation.

- KYC/Compliance Checks: Complete identity verification (KYC) and anti-money laundering (AML) steps required by your chosen platform.

- Add Funds: Deposit money via bank transfer or crypto wallet depending on platform support.

- Select Properties and Buy Tokens: Browse listings, look at projected yields/risk profiles, then purchase tokens representing your share.

This streamlined process brings institutional-grade assets within reach of retail investors globally. For a deeper breakdown of each step, including screenshots and tips, see our walkthrough: How To Invest In Fractional Real Estate Tokens: A Step-by-Step Guide For 2024.

Once you’ve acquired your property tokens, management is refreshingly hands-off. Most platforms automate the distribution of rental income directly to your account, often in stablecoins or even major cryptocurrencies like Bitcoin and Ethereum. You can monitor performance, receive updates about the property, and decide whether to hold or trade your tokens on a secondary marketplace.

What to Watch Out For: Risks and Realities

Despite the clear benefits, fractional commercial real estate investing via property tokens isn’t risk-free. Here’s what savvy investors keep in mind:

- Regulatory Landscape: Not all jurisdictions treat tokenized assets the same way. Make sure your chosen platform complies with local securities laws and provides robust KYC/AML checks.

- Market Volatility: Commercial property values can fluctuate due to macroeconomic shifts, changing tenant demand, or local real estate cycles. Token prices may not always reflect underlying asset value.

- Platform Security: Choose platforms with transparent security protocols and a proven track record, look for regular audits and insurance coverage where available.

- Liquidity Limitations: While tokenized assets are more liquid than traditional real estate, thinly traded properties may still be hard to exit quickly at your desired price.

If you want a more granular look at these risks (plus mitigation strategies), our deep dive on property tokenization risks and rewards is worth bookmarking.

Comparison of Top Fractional Commercial Real Estate Platforms (2025)

| Platform | Minimum Investment | Payout Frequency | Supported Regions |

|---|---|---|---|

| RealT | $50 | Daily | United States |

| Propy | Varies (typically $100+) | Varies by property | Global |

| Lofty AI | $50 | Daily | United States |

| HoneyBricks | $1,000 | Monthly | United States (Accredited Investors) |

| Binaryx | $500 | Monthly | Global (focus on luxury/vacation properties) |

What Returns Can You Expect?

The returns from tokenized commercial real estate typically mirror traditional income-producing properties: rental yields, appreciation potential, plus occasional liquidity events if a property is refinanced or sold. Some platforms advertise projected annual yields between 5%–10%, but actual results will vary depending on location, asset type, and market conditions.

The added bonus? Rental distributions are often automated via smart contracts, no chasing down payments or dealing with tenants yourself. And because you’re not locked into multi-year commitments (as with many private REITs), you can rebalance your portfolio as opportunities arise.

The Future of Blockchain Real Estate Investment

The shift toward blockchain-powered fractional ownership isn’t just a passing trend, it’s part of a larger movement toward democratizing access to high-value assets worldwide. Expect continued growth as regulatory clarity improves and more institutional players enter the space. By 2035, experts predict that trillions of dollars in global real estate could be tokenized (Deloitte Insights). For now, early adopters are enjoying first-mover advantages like lower minimums and access to previously off-limits markets.

If you’re curious how this fits into broader portfolio strategy, or want examples of how $50 can turn into global diversification, our explainer on how fractional real estate tokenization works (with a $1 million property example) offers actionable insights.

The bottom line? Property tokens are making it possible for anyone, from seasoned pros to first-time investors, to participate in the upside of commercial real estate without the legacy barriers. As always, do your homework before committing capital, but don’t sleep on this opportunity: blockchain is rewriting the rules of real estate investing for good.