Fractional property ownership, powered by blockchain tokens, is rapidly transforming how investors access real estate markets. Instead of requiring substantial capital to purchase an entire property, individuals can now buy digital tokens that represent a precise share of a real estate asset. This model not only lowers the barrier to entry but also introduces liquidity and transparency to a traditionally illiquid sector.

The Mechanics of Fractional Ownership with Blockchain Tokens

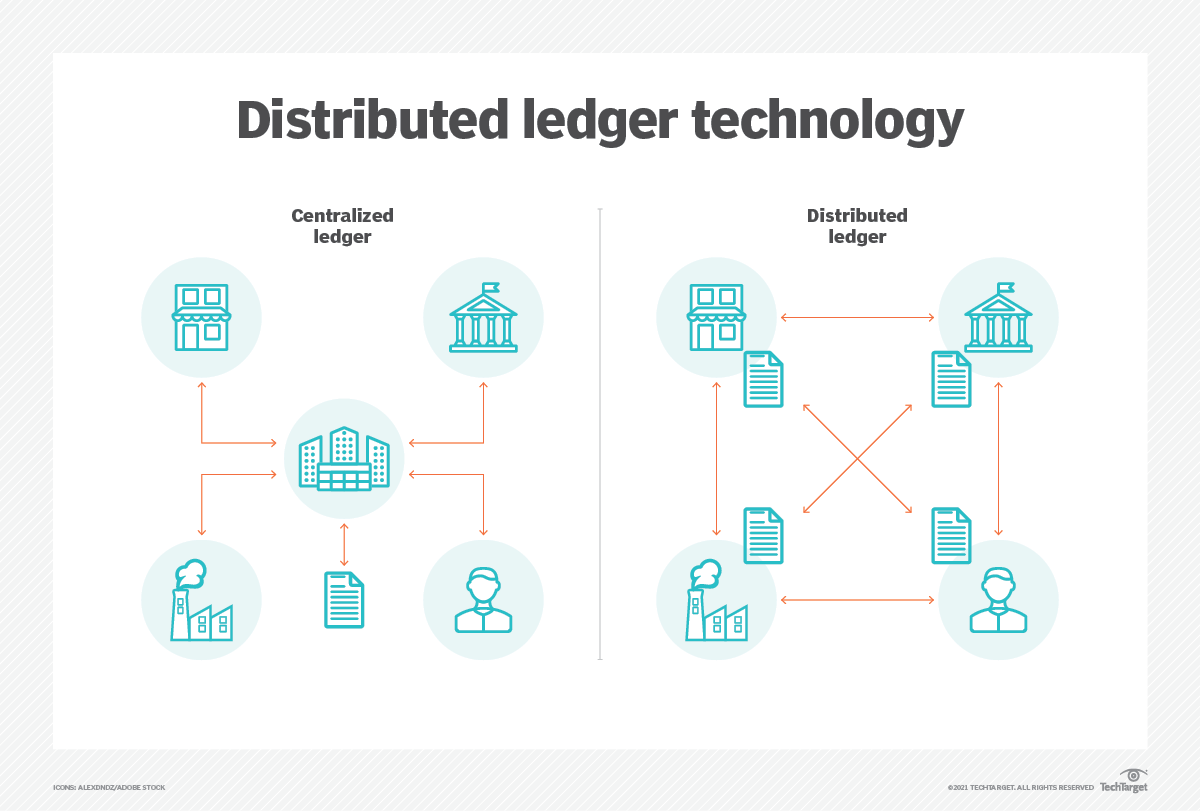

At its core, fractional property ownership relies on tokenization – the process of converting real-world assets into digital tokens recorded on a blockchain. Each token signifies a fractional stake in the asset or in an entity that owns the asset. Thanks to blockchain’s immutable ledger and automated smart contracts, these tokens can be bought, sold, or traded with unprecedented efficiency.

The process typically unfolds in three stages:

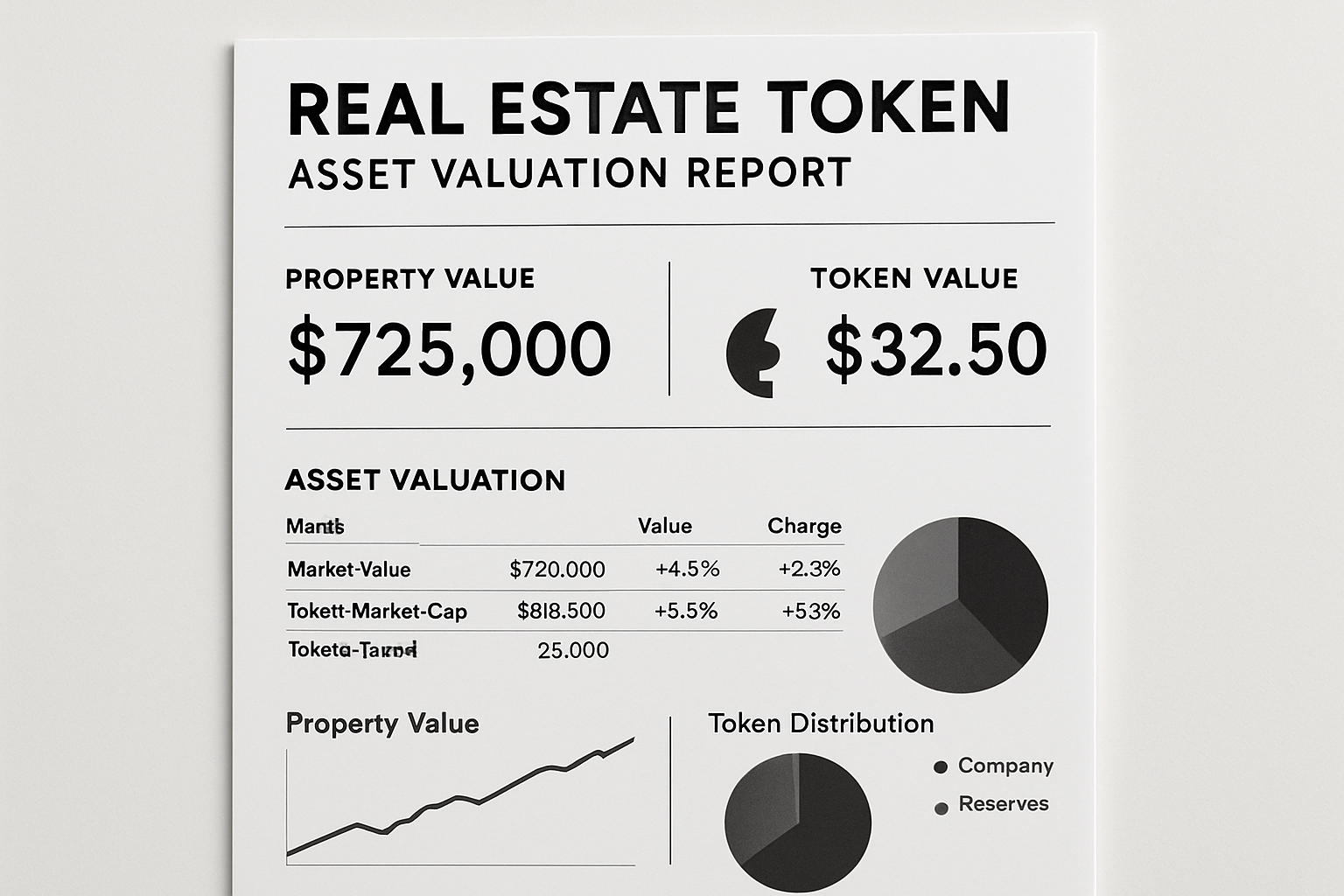

- Asset Tokenization: The property is valued and divided into a fixed number of tokens. For example, a $1 million apartment might be split into 10,000 tokens worth $100 each.

- Smart Contract Deployment: Smart contracts automate key functions such as rental income distribution and ownership transfers. This ensures transparency and reduces operational friction.

- Secondary Market Trading: Investors can trade their property tokens on compliant platforms, unlocking liquidity not seen in traditional real estate deals.

Real-World Platforms: From PropBlock to RealT

The rise of dedicated platforms has made blockchain real estate investments increasingly accessible. For instance, PropBlock offers institutions a turnkey solution for launching tokenized real estate offerings with full regulatory traceability. Meanwhile, RealT has already tokenized over 535 U. S. properties valued at more than $101 million, attracting more than 16,100 active investors worldwide.

Key Benefits and Risks of Blockchain-Based Fractional Property Ownership

-

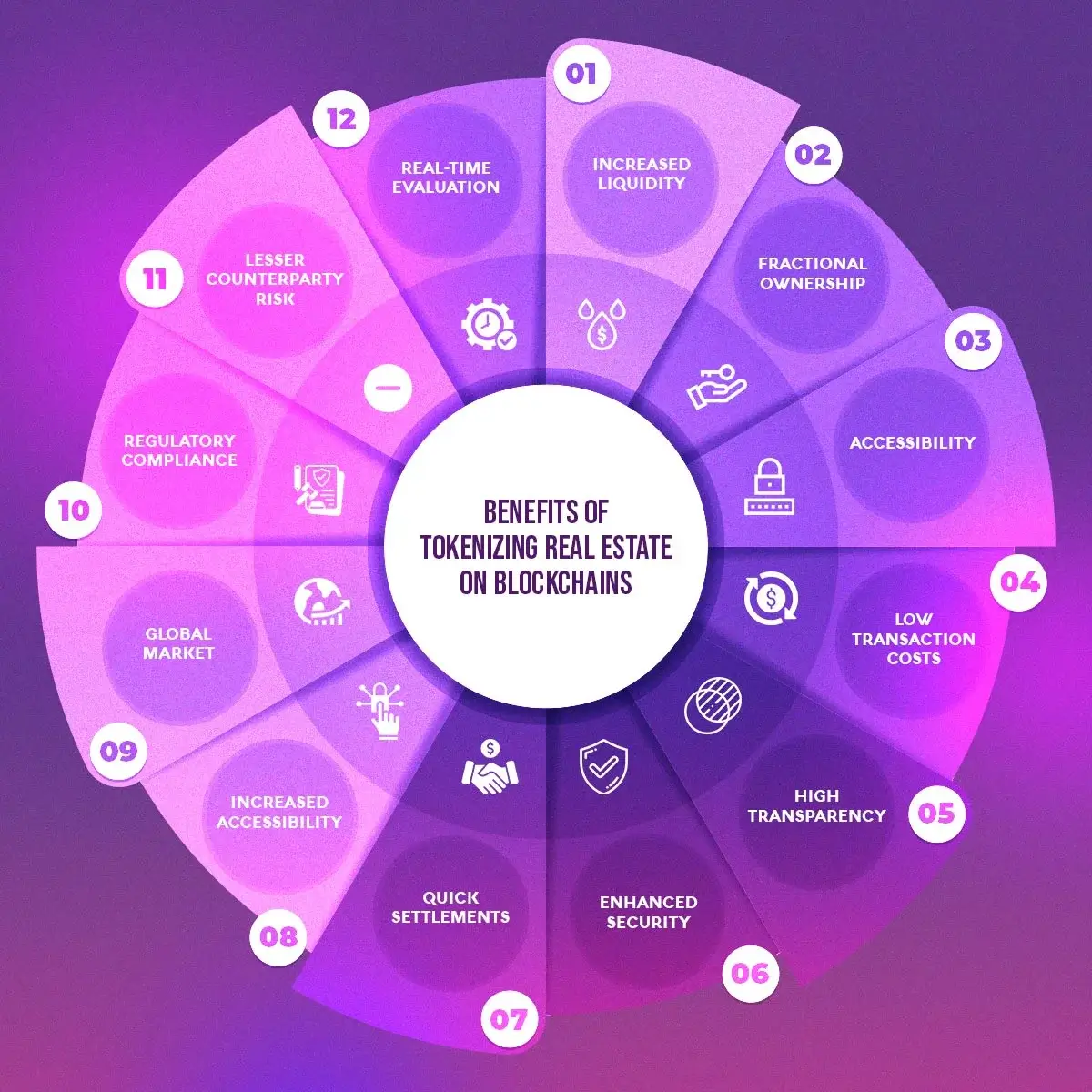

Increased Accessibility: Blockchain tokenization enables investors to purchase fractional shares of real estate, lowering the capital barrier and allowing broader participation in property markets.

-

Enhanced Liquidity: Tokenized property shares can be bought and sold on digital platforms more easily than traditional real estate, offering investors greater flexibility and faster exit options.

-

Automated Processes via Smart Contracts: Smart contracts handle tasks like rental income distribution and ownership transfers, reducing administrative overhead and increasing transparency.

-

Regulatory Uncertainty: The legal status of property tokens and investor rights can vary by jurisdiction, creating potential compliance and enforcement challenges.

-

Due Diligence and Legal Complexity: Investors must carefully assess tokenized offerings, as the rights and protections associated with tokens may differ from traditional real estate ownership.

This model also extends globally: Ekta is bridging physical assets and communities on-chain with over $5 million raised through seed funding and private sales (read more about Ekta here). These platforms are not just theoretical – they are actively reshaping how both retail and institutional investors approach property allocation.

The Role of Smart Contracts in Income Distribution

A defining advantage of blockchain-based property tokens is their use of income distribution smart contracts. Rental income generated by the underlying asset can be automatically distributed among token holders according to their proportional ownership. This automation reduces administrative overhead and minimizes delays or errors common in manual processes.

This approach also supports compliance with local regulations by embedding rules directly into the code – for example, restricting transfers to whitelisted addresses or enforcing holding periods as required by law.

Pioneering Moves: China’s Seazen Group Enters Tokenized Real Estate

The momentum isn’t limited to Western markets. In August 2025, Chinese developer Seazen Group announced its intention to explore converting intellectual property and asset income into tradeable digital tokens via its new Hong Kong-based Digital Assets Institute (see Reuters coverage here). This move responds directly to persistent liquidity challenges in China’s property sector and signals growing institutional interest worldwide.

As more developers and institutions embrace fractional property ownership through blockchain, the practical implications for investors are significant. Direct access to tokenized real estate means individuals can diversify across geographies, property types, and risk profiles, allocating capital in ways that were previously reserved for large funds or accredited buyers. With platforms like RealT demonstrating over $101 million in tokenized U. S. property value and a global investor base exceeding 16,100 participants, the model’s scalability is no longer hypothetical.

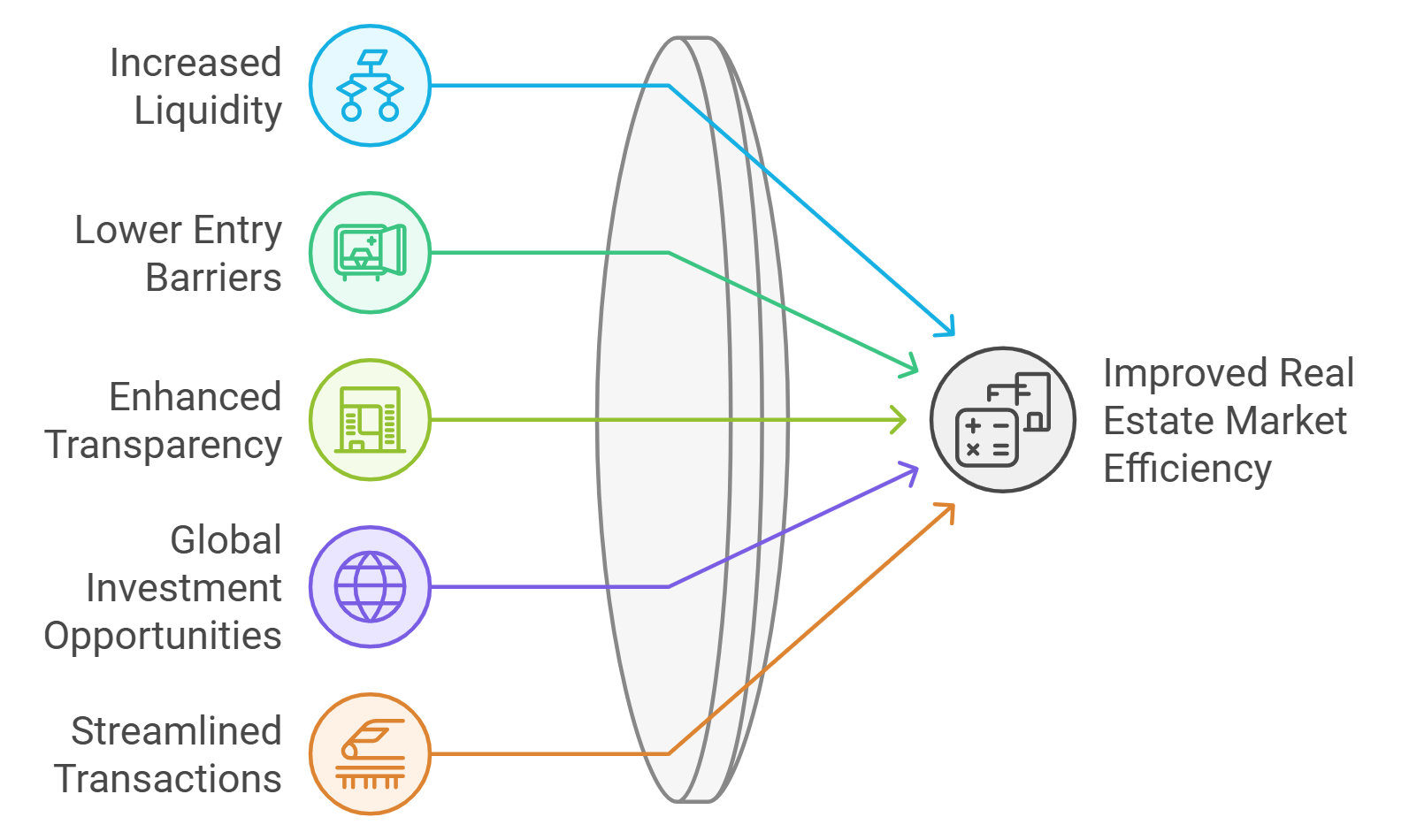

Liquidity, Transparency, and Market Access

Liquidity has long been real estate’s Achilles’ heel. Blockchain-based secondary markets are changing that equation by enabling peer-to-peer trading of property tokens without the friction of traditional escrow or title transfer processes. Investors benefit from near-instant settlement and transparent pricing mechanisms, features previously unheard of in direct property investment.

Transparency is further enhanced by the public ledger: every transaction, ownership change, and income distribution is recorded immutably on-chain. This not only builds trust but also streamlines audits and reporting for both individual investors and institutions.

Risks and Regulatory Considerations

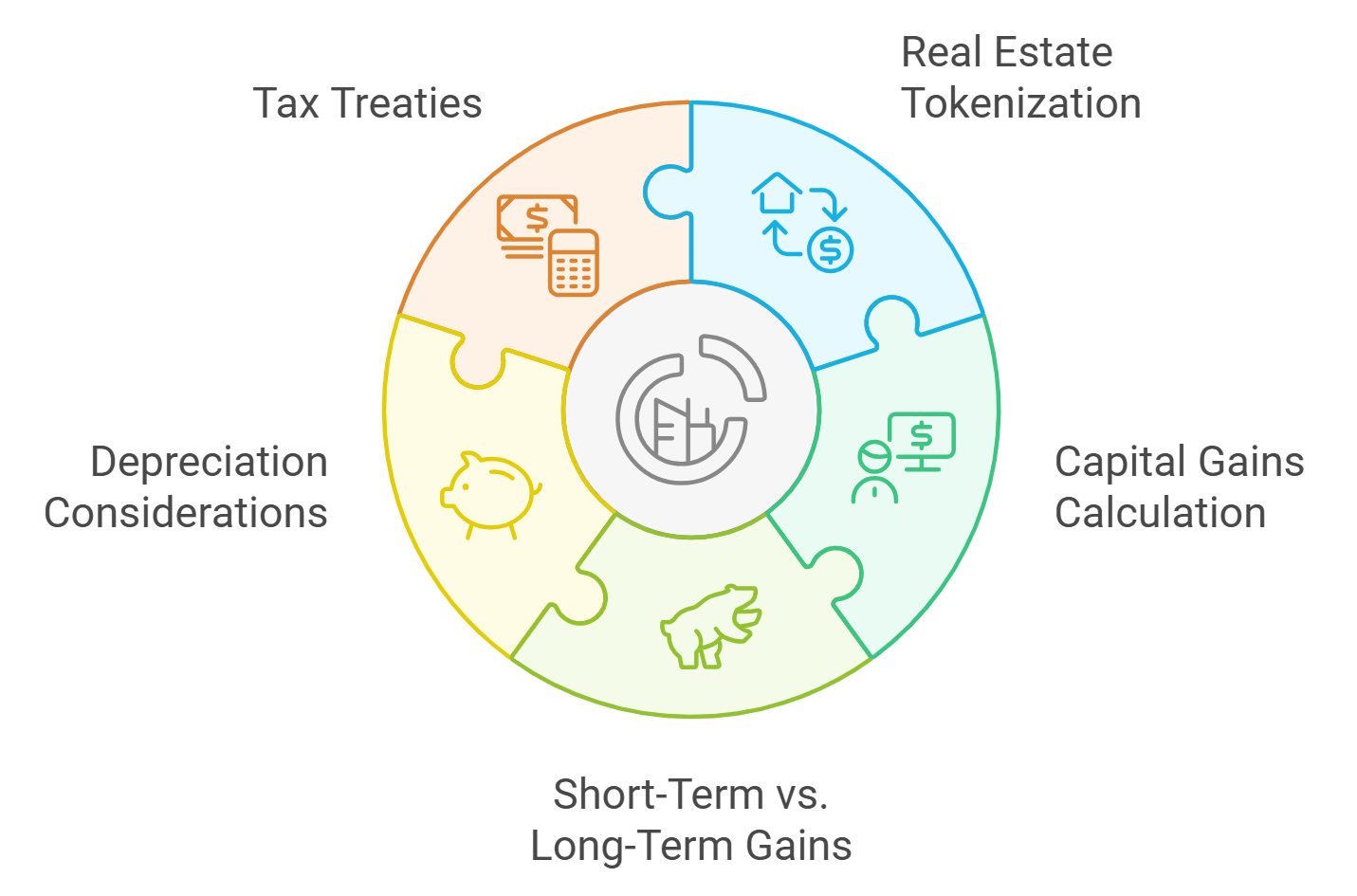

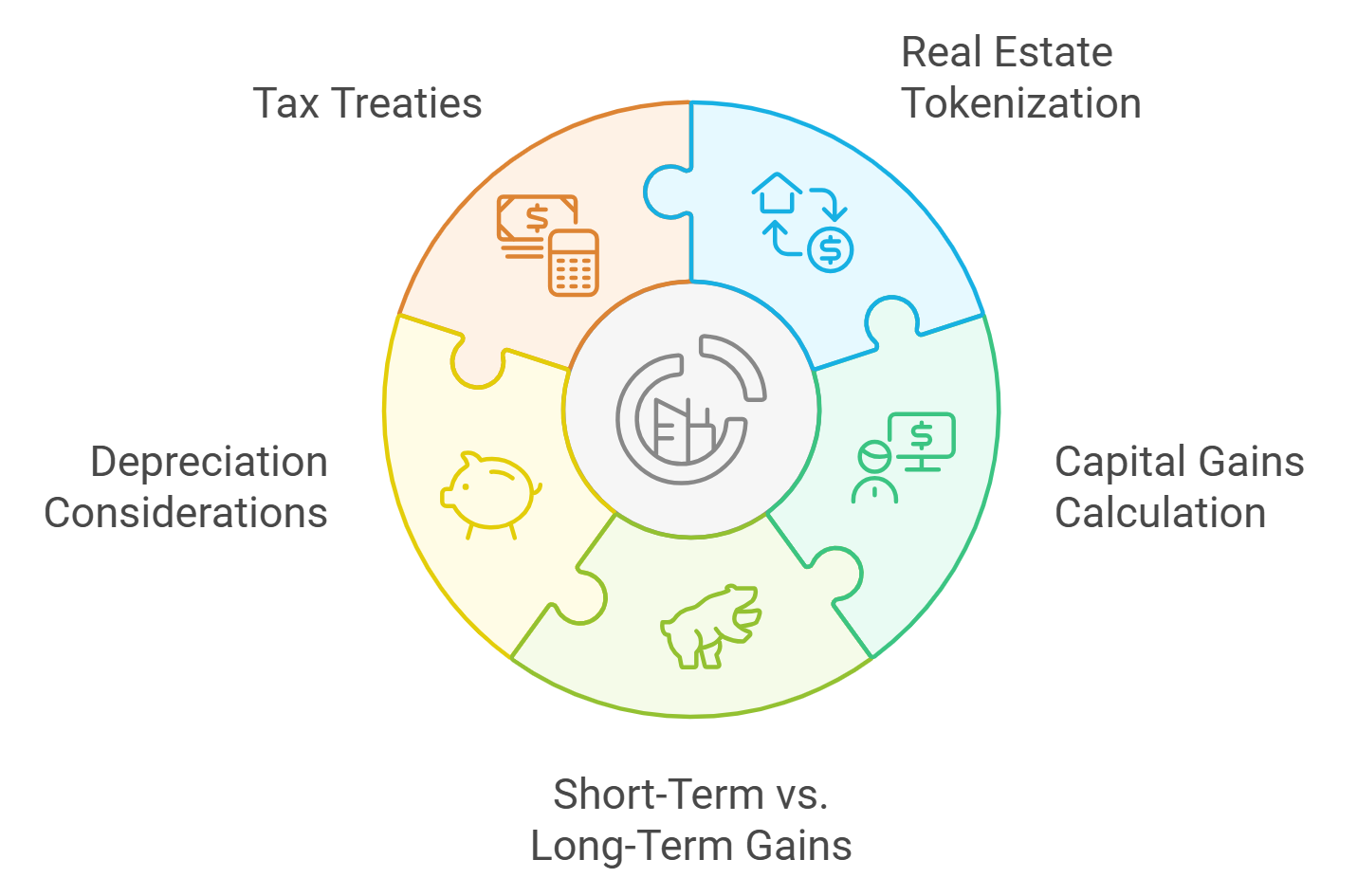

Despite these advances, fractional ownership via blockchain tokens is not without risks. Regulatory frameworks remain fragmented across jurisdictions; some countries treat property tokens as securities while others lack clear guidance entirely. The legal rights attached to each token can also vary, sometimes representing direct ownership in the asset, other times a share in a special purpose vehicle (SPV) that holds the property.

This complexity underscores the need for rigorous due diligence before investing. It’s essential to assess not only platform credibility but also underlying legal structures and compliance protocols. As highlighted by PropBlock, robust compliance engines are becoming standard practice for serious market participants.

Essential Questions Before Buying Property Tokens

-

What legal rights do the tokens confer? Understand whether your tokens represent direct property ownership, shares in a legal entity, or only rights to income streams. Legal structures and investor protections can vary significantly across platforms and jurisdictions.

-

What are the liquidity options and restrictions? Assess how easily you can buy or sell your tokens on secondary markets, and whether there are any lock-up periods, minimum holding requirements, or restrictions on transfers.

-

How are rental income and profits distributed? Verify if smart contracts automate income distribution, the frequency of payouts, and whether there are any platform or management fees deducted from your returns.

-

What are the risks and regulatory uncertainties? Investigate the current legal environment for tokenized real estate in your jurisdiction, including tax implications, potential for regulatory changes, and how investor protections are enforced.

-

Who manages the underlying property? Identify the property manager or operating company, their experience, and how maintenance, tenant relations, and other operational issues are handled.

-

How is asset valuation and reporting handled? Ensure there are transparent, regular third-party valuations and clear reporting on property performance, expenses, and token holder communications.

The Future Outlook

The recent moves by Seazen Group in China, establishing a Digital Assets Institute to convert IP and asset income into digital tokens (see Reuters coverage here): signal that institutional adoption is accelerating beyond early adopters in North America and Europe. As regulatory clarity improves and smart contract standards mature, expect broader acceptance among traditional investors seeking yield, diversification, or exposure to global real estate markets with lower minimums.

The convergence of blockchain technology with real estate’s stable cash flows is unlocking new opportunities for portfolio construction, and challenging conventional wisdom about what’s possible in property investment. For those willing to navigate evolving legal landscapes with discipline and due diligence, fractional ownership through blockchain tokens offers a compelling path forward.