For decades, direct real estate investment has been the domain of the wealthy and institutional players, largely due to steep capital requirements. Minimum buy-ins for traditional syndications or private real estate funds typically run from $50,000 to $300,000, creating an insurmountable barrier for most retail investors. However, the advent of tokenized real estate is rapidly transforming this landscape. By leveraging blockchain technology to fractionalize ownership into digital tokens, these platforms are slashing minimum investment thresholds and opening property markets to a much broader audience.

From $50,000 to $50: The New Reality of Property Investment

The shift is striking. Platforms like RealT and Lofty now let individuals invest in tokenized properties with as little as $50 per token. This is not a theoretical figure, these are current market offerings as of November 2025. Compare this with the legacy system’s entry point of tens or hundreds of thousands of dollars, and the democratizing effect becomes clear.

Fractional property ownership via blockchain does more than just lower entry costs; it allows retail investors to diversify across multiple assets and geographies with modest sums. For example, instead of committing $100,000 to a single apartment building, an investor can spread that same amount across 2,000 different property tokens at $50 each, potentially spanning residential units in Detroit, commercial offices in Miami, and vacation rentals in Arizona.

The Mechanics Behind Lower Minimums

How does tokenization make such low minimums possible? At its core, blockchain technology enables property rights or shares in real estate assets to be represented as digital tokens. Each token corresponds to a fractional interest in the underlying property or portfolio. The process typically involves:

- Legal structuring: Properties are placed into special purpose vehicles (SPVs) or trusts that issue digital tokens representing ownership.

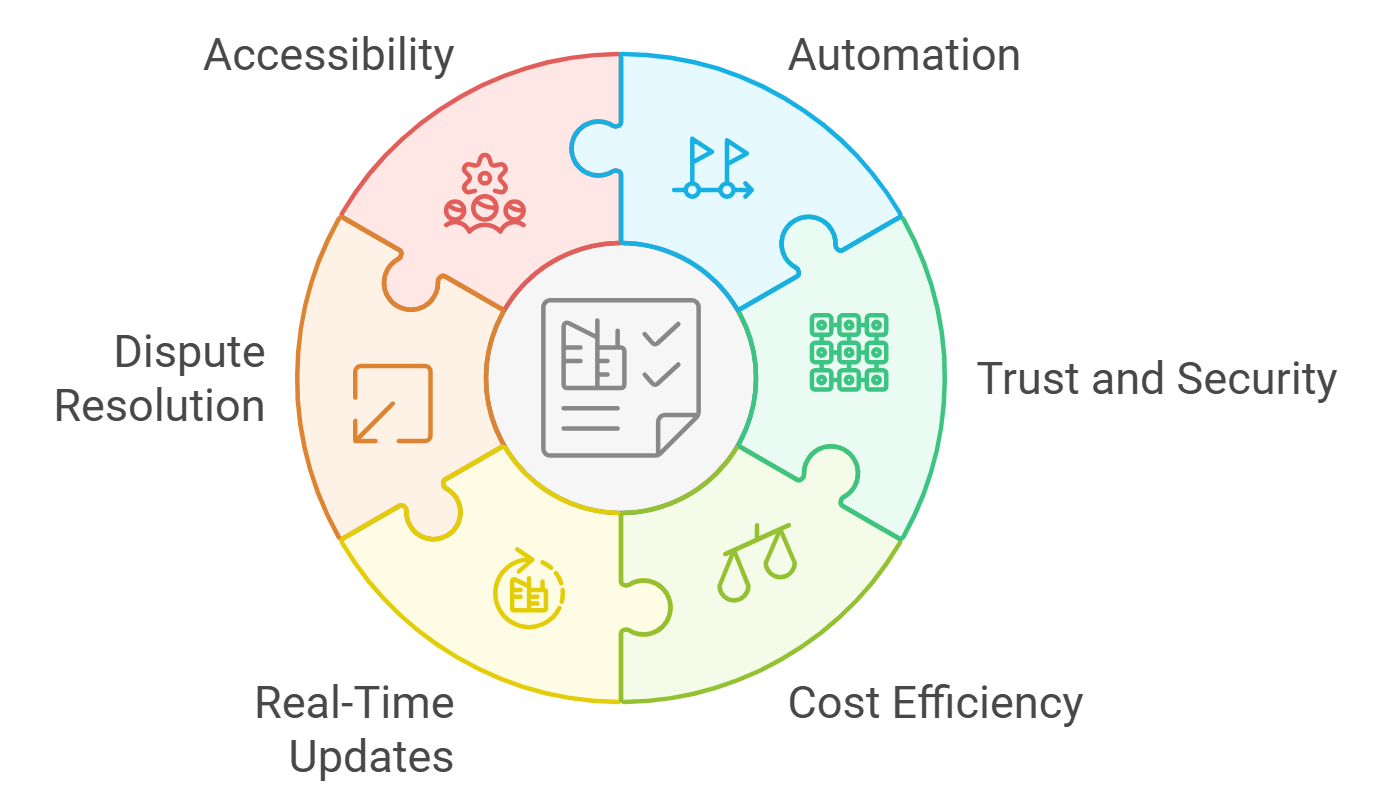

- Smart contracts: Automated agreements on blockchains handle transfers, distributions (such as rental income), and governance rights.

- Secondary markets: Investors can buy or sell tokens on compliant platforms without lengthy paperwork or broker fees.

This structure strips away much of the administrative overhead that traditionally made small investments uneconomical for sponsors and managers. As a result, platforms pass these efficiency gains directly to investors through lower minimums and lower fees.

The Impact on Retail Investor Access

The practical effect is profound: tokenized real estate minimum investments now rival those found in popular stock trading apps rather than exclusive private equity funds. According to EY’s latest research, some platforms have dropped their minimums even further, to just $100 or even less, enabling participation from virtually anyone with an internet connection and a digital wallet.

This accessibility is not limited by geography either. Platforms such as Lofty allow global investors to purchase U. S. -based property tokens for $50 each without cumbersome cross-border banking processes or legal hurdles. This trend aligns with data from Deloitte Insights and J. P. Morgan pointing toward a massive influx of new capital sources into previously inaccessible markets, a phenomenon often described as the “democratization” of real estate investing.

If you’re interested in exploring how these new models work across different jurisdictions and asset classes, including step-by-step guides for beginners, see our resource on fractional ownership and tokenized real estate.

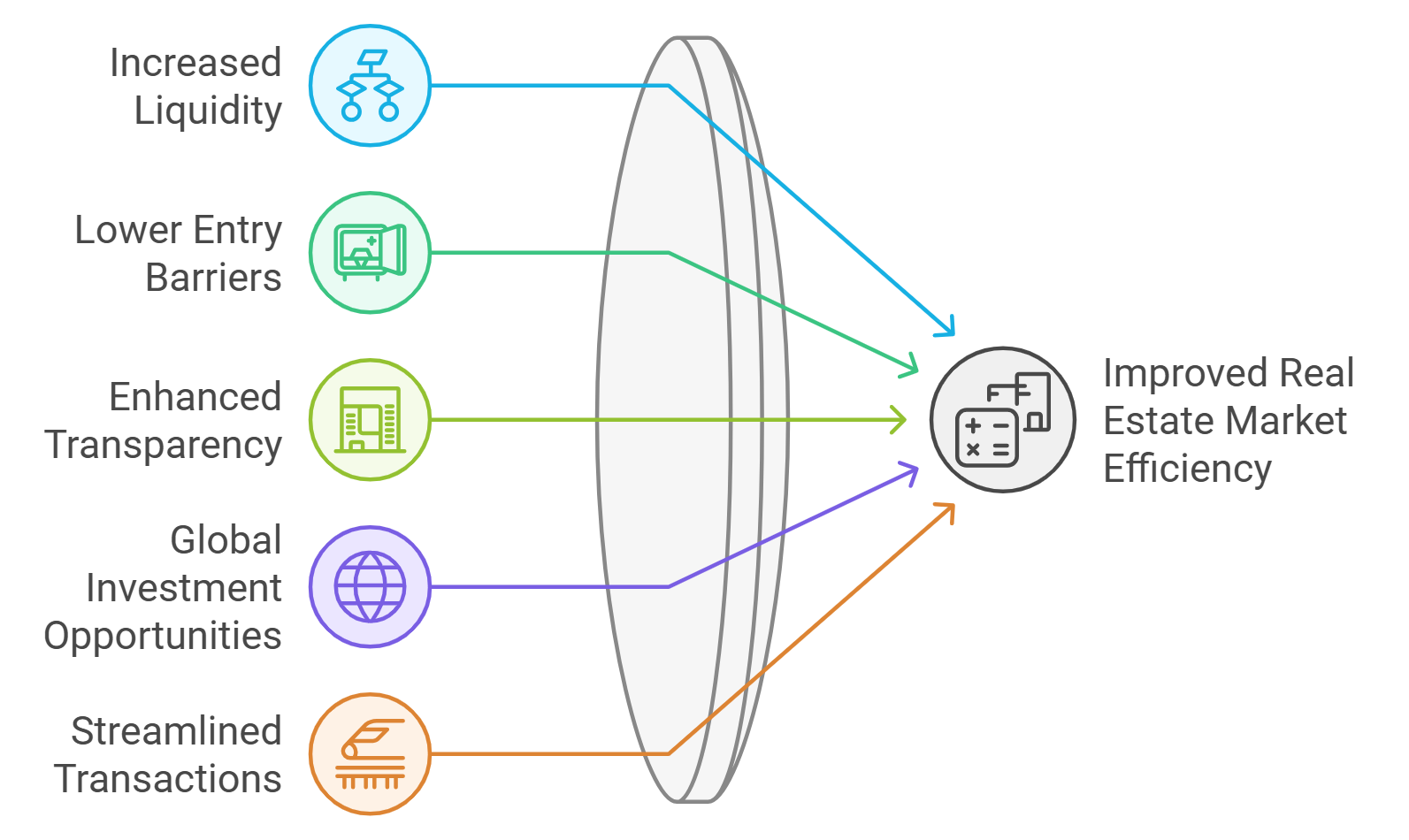

Liquidity is another key advantage unlocked by tokenization. Unlike traditional real estate holdings, which can take months or even years to sell, property tokens can often be traded on secondary markets, sometimes in a matter of minutes. This means retail investors are no longer locked into long holding periods and can adjust their exposure as market conditions or personal circumstances change. The ability to buy and sell tokens quickly also reduces the risk typically associated with illiquid assets and provides a level of flexibility previously unavailable to small-scale participants.

For many retail investors, this flexibility is further enhanced by the transparency of blockchain systems. Every transaction, ownership record, and distribution is logged on-chain, providing an auditable trail that increases trust and reduces the opportunity for fraud or mismanagement. As a result, platforms offering fractional property ownership on blockchain are becoming increasingly popular among those seeking both accessibility and accountability in their investments.

Top Tokenized Real Estate Platforms with $50 Minimums (2025)

-

RealT offers fractional ownership in U.S. real estate with token investments starting at $50. The platform has tokenized over 970 properties, allowing retail investors to diversify with ease.

-

Lofty enables investors to buy property tokens for as little as $50, providing access to income-generating real estate across the United States and a secondary marketplace for liquidity.

The Role of Real Estate Tokenization Platforms

The evolution of real estate tokenization platforms has been instrumental in lowering barriers for retail investors. Platforms like RealT and Lofty have pioneered models that combine regulatory compliance with user-friendly interfaces, making it simple for anyone to create an account, complete KYC verification, and start investing with just $50. These companies handle all legal structuring behind the scenes, so investors can focus on building diversified portfolios rather than navigating complex paperwork.

Moreover, many platforms now offer automated dividend distributions via smart contracts, rental income from properties flows directly to token holders’ wallets without manual intervention or delays. This not only improves efficiency but also ensures that even micro-investors receive their fair share of returns in real time.

Risks and Considerations for Retail Investors

Despite these advantages, it’s important to approach tokenized real estate with a research-driven mindset. While low minimums make entry easy, investors should carefully evaluate platform credibility, asset quality, regulatory frameworks in their jurisdiction, and secondary market liquidity before committing capital. Not every platform offers the same level of due diligence or investor protection; some may not be available to residents of certain countries due to local securities laws.

For those new to digital assets or fractional ownership models, reviewing comprehensive guides such as step-by-step instructions for investing in tokenized real estate can help demystify the process and reduce common mistakes.

Looking Ahead: The Ongoing Democratization of Real Estate Investment

The momentum behind accessible real estate investment is unlikely to slow down. As more properties are brought on-chain and regulatory clarity improves worldwide, we can expect further reductions in minimum investment thresholds, potentially below today’s $50 standard, and increased participation from non-traditional investor segments.

This trend does more than simply lower financial barriers; it redefines who gets to participate in wealth creation through property ownership. For retail investors historically sidelined by high minimums and opaque processes, tokenized real estate offers a transparent path into one of the world’s most resilient asset classes, with all the diversification benefits that brings.