Tokenized real estate is rapidly redefining the landscape of international property investment in 2025. By leveraging blockchain technology to digitize and fractionalize ownership of physical assets, tokenization offers unprecedented access, liquidity, and efficiency for investors across borders. As platforms like Binaryx expand globally and regulatory frameworks mature, the sector is on track to transform not only how properties are bought and sold but also who gets to participate in these markets.

Global Market Surge: From Billions to Trillions

The numbers tell a compelling story. According to Deloitte, the value of tokenized real estate worldwide could soar from less than $300 billion in 2024 to over $4 trillion by 2035, representing a compound annual growth rate exceeding 27%. As of October 2025, tokenized real-world assets (RWAs) have reached approximately $33 billion, with real estate tokens accounting for more than $10 billion in value. This explosive growth is not merely speculative – it reflects tangible shifts in investor behavior and market structure.

Platforms such as Binaryx have successfully tokenized properties in diverse markets including Bali, Turkey, and Montenegro. These platforms allow investors to purchase fractional shares of income-generating real estate with minimum investments often as low as $50 or $100. The result? A democratization of access that was previously unthinkable for cross-border property exposure.

How Tokenization Breaks Down Traditional Barriers

The traditional model of international real estate investment has long been plagued by high entry costs, illiquidity, complex legal requirements, and opaque markets. Tokenization addresses these pain points head-on:

- Fractional Ownership: Investors can buy small portions of high-value properties, enabling diversification across geographies and asset types without massive capital outlays.

- 24/7 Trading: Blockchain-based marketplaces facilitate round-the-clock trading of property tokens, vastly improving liquidity compared to legacy models.

- Lower Transaction Costs: Smart contracts automate many legal and administrative processes, reducing fees and settlement times.

- Increased Transparency: All transactions are recorded on-chain, providing immutable proof of ownership and transaction history.

This new paradigm is especially attractive for international investors seeking exposure to stable rental yields or capital appreciation in overseas markets. For more on how tokenization is solving liquidity challenges for global investors, see our deep dive at this link.

The Regulatory Landscape: Progress Amid Uncertainty

No revolution comes without its hurdles. While jurisdictions such as the European Union and Singapore are moving toward clearer guidelines for digital assets and property tokens, others remain cautious. For instance, China’s securities regulator recently advised some local brokerages to pause their real-world asset tokenization activities in Hong Kong due to concerns over rapid expansion. This highlights the ongoing need for standardized frameworks that protect investors while fostering innovation.

The trend line remains clear: institutional adoption is accelerating as regulatory clarity improves. The allocation of tokenized assets in global real estate portfolios is projected to grow from just 1.3% in 2023 to at least 6% by 2027 according to EY – a testament to both rising confidence and maturing infrastructure.

Yet, the path forward will not be uniform. Regulatory divergence between markets could create pockets of opportunity as well as friction. Platforms operating in jurisdictions with robust legal recognition of property tokens are likely to attract greater capital inflows, while those in less certain environments may face delays or additional compliance costs. Investors must remain vigilant, conducting due diligence not only on the underlying assets but also on the regulatory standing of tokenization platforms.

Security and investor protection are also top-of-mind concerns. As tokenized real estate matures, expect to see a rise in third-party custodianship, insurance products for digital assets, and enhanced KYC/AML protocols. These developments will be essential for institutional players and risk-averse investors considering entry into the space.

Unlocking New International Investment Strategies

The most profound impact of tokenized real estate is its ability to unlock new strategies for international property investment. By lowering barriers to entry, investors can now assemble diversified portfolios spanning continents, allocating capital across residential rentals in Southeast Asia, commercial properties in Europe, and vacation homes in Latin America with ease.

This shift is reshaping portfolio construction itself. Where once international real estate was reserved for the ultra-wealthy or large institutions, today’s digital platforms empower individuals and family offices to participate meaningfully. Liquidity is no longer an afterthought; secondary markets now enable rapid rebalancing or exit from positions that would have been illiquid for years under traditional models.

Top Cities Leading the Tokenized Real Estate Boom in 2025

-

Dubai, UAE: Dubai has rapidly become a global hub for tokenized real estate, with luxury developments and commercial properties now available as fractional blockchain-based assets. Regulatory clarity and a tech-forward investment climate have attracted both institutional and retail investors.

-

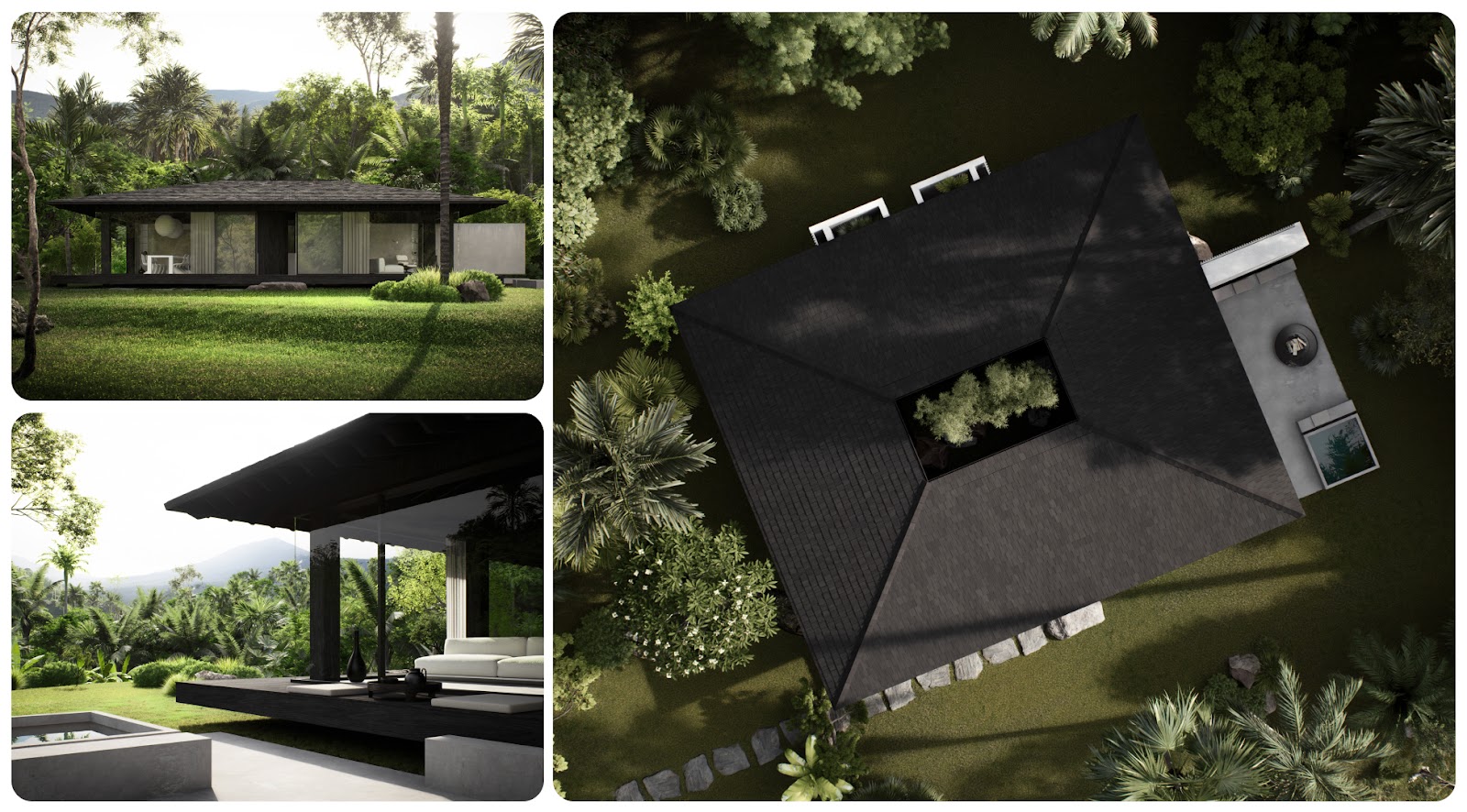

Bali, Indonesia: Bali’s thriving tourism sector and high rental yields have made it a hotspot for tokenized property investment. Platforms like Binaryx have enabled global investors to access villa and resort ownership through tokenization, driving a surge in international participation.

-

Istanbul, Turkey: Istanbul’s dynamic property market is seeing significant tokenization activity, particularly in residential and mixed-use developments. The city’s strategic location and growing fintech ecosystem have contributed to its prominence in this sector.

-

Montenegro: Montenegro has positioned itself as a pioneer in real estate tokenization, leveraging its investor-friendly regulations and scenic coastal properties. Tokenized offerings have made it easier for international buyers to access the country’s lucrative real estate market.

-

London, UK: London remains a leader in property innovation, with several commercial and residential buildings tokenized on blockchain platforms. The city’s robust legal framework and deep capital markets support continued growth in tokenized real estate.

-

New York City, USA: As one of the world’s premier real estate markets, New York City has embraced tokenization for both high-value commercial towers and multifamily residential properties, enhancing liquidity and accessibility for global investors.

Furthermore, cross-border investment is simplified by smart contracts that automate compliance checks and facilitate seamless dividend distribution across jurisdictions. This efficiency not only reduces operational overhead but also supports more transparent reporting, an increasingly important factor for ESG-conscious investors.

Challenges Ahead: Standardization and Global Trust

Despite remarkable progress, several challenges must be addressed before tokenized real estate can reach its projected $4 trillion scale by 2035:

- Lack of global standards: The absence of harmonized frameworks makes cross-jurisdictional investing complex.

- Technological interoperability: Different blockchains and token standards can hinder seamless transfers between platforms.

- User education: Many potential investors remain unfamiliar with blockchain-based asset management or wary of digital custody risks.

- Market depth: While liquidity is improving, thin order books on some secondary exchanges still pose challenges for larger transactions.

The industry’s response includes collaborative efforts among leading platforms to establish interoperability protocols and promote best practices. Education initiatives are targeting both retail and institutional audiences to demystify property tokens and showcase real-world use cases.

The Road Ahead: A More Inclusive Global Market

The trajectory for on-chain real estate global investment remains decidedly upward. As regulatory clarity spreads and technology matures, we will see even greater participation from pension funds, sovereign wealth funds, and retail investors alike. The democratization of access, once a rallying cry, has become reality as minimum investments drop below $100 and entire portfolios can be managed from a smartphone anywhere in the world.

The transformation underway is not merely technological but fundamentally structural: property ownership is being decoupled from geography, bureaucracy is giving way to programmable smart contracts, and liquidity, long the Achilles’ heel of real estate, is becoming a defining feature.

This evolution holds enormous promise for emerging markets as well as established ones. By lowering barriers and increasing transparency, tokenized real estate offers a practical solution to some of the most persistent challenges facing global investors today. As we look toward 2026 and beyond, those who embrace this new paradigm will find themselves at the forefront of a more open, and ultimately more resilient, international property market.