In 2025, the intersection of blockchain and real-time data is fundamentally reshaping how investors, asset managers, and institutions interact with the real estate market. Tokenized real estate – where property ownership is digitized into blockchain-based tokens – is no longer a niche experiment. It has rapidly matured into a $10 to $15 billion global market, with the United States accounting for 60% of activity, Europe at 25%, and Asia at 10%. This transformation is underpinned by an unprecedented flow of real-time data that enhances transparency, liquidity, and accessibility for a new generation of property investors.

The Real-Time Data Revolution in Tokenized Real Estate

Historically, real estate markets have been hampered by opaque pricing, sluggish settlement cycles, and limited access to timely information. In contrast, tokenized property platforms now leverage blockchain’s immutable ledger to offer real-time transaction records, up-to-the-minute valuation metrics, and transparent cap tables. This shift is not just about speed; it’s about enabling smarter decisions through continuous access to structured data streams.

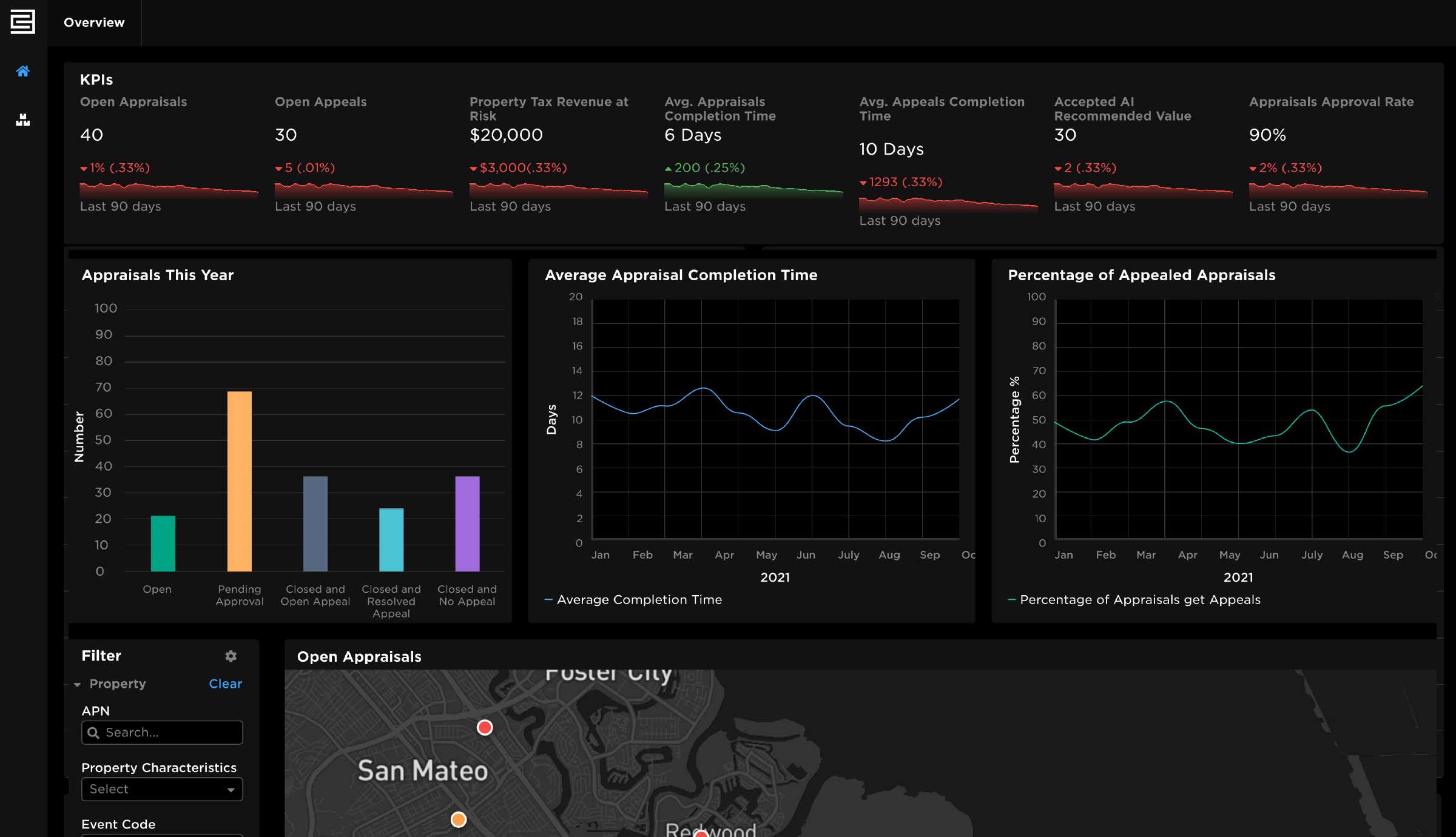

Consider the rollout of the Uniform Appraisal Dataset (UAD) 3.6 in 2026: residential property valuations will soon be delivered in machine-readable formats rather than traditional narrative reports. This structured approach allows AI-driven analytics to deliver dynamic price estimates and risk assessments directly into token trading interfaces. As a result, investors gain an edge with granular insights into everything from rental yields to maintenance schedules – all updated in real time.

Market Growth Driven by Data Transparency

The surge in tokenized property market liquidity owes much to this new era of transparency. As on-chain data becomes standard for verifying ownership and tracking performance metrics, barriers to entry are falling away. Fractional ownership models now allow retail investors to participate alongside institutions without waiting days or weeks for outdated paperwork or manual reconciliations.

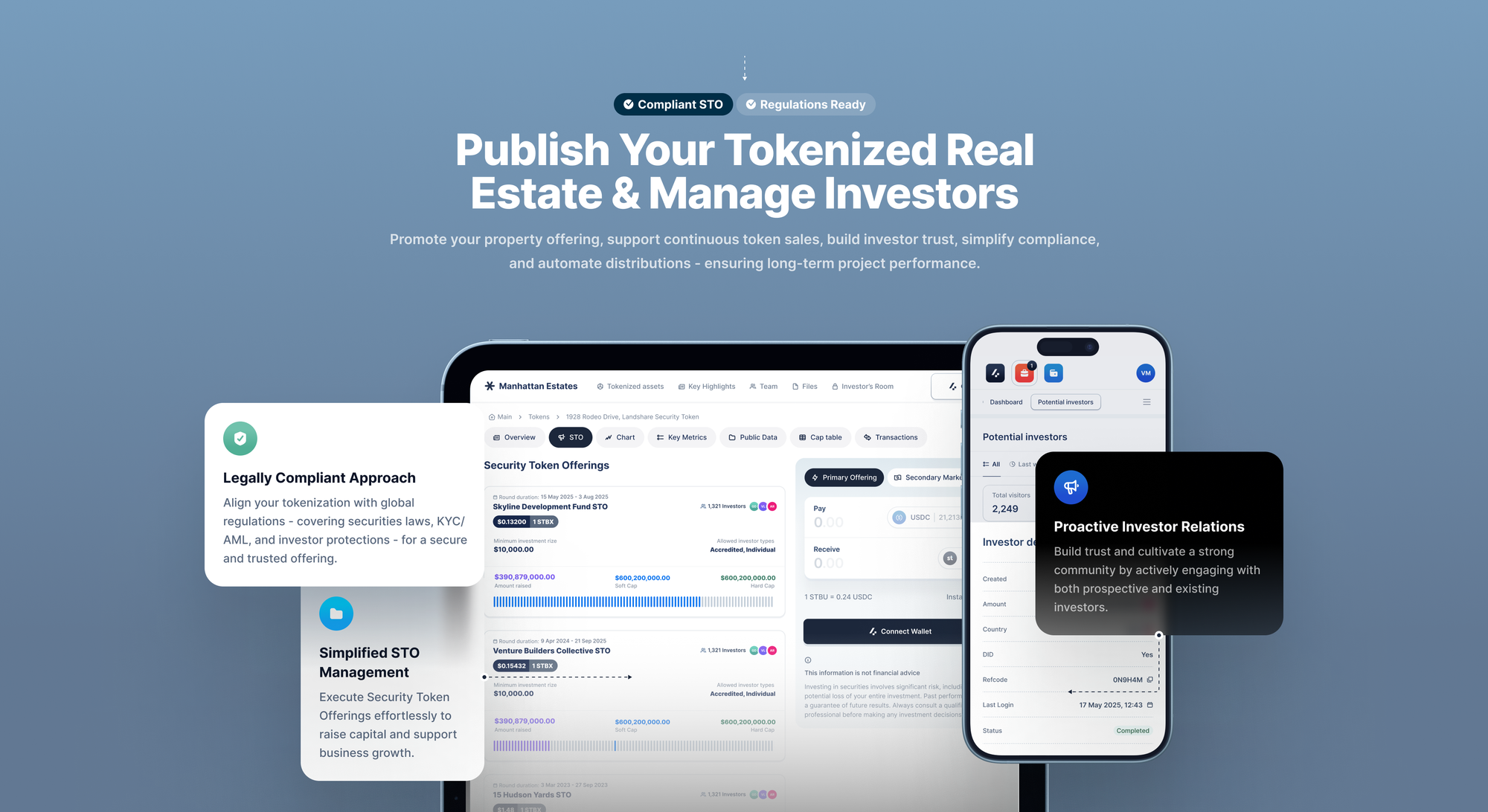

This democratization is further accelerated by major regulatory milestones: Nasdaq’s September 2025 SEC filing aims to make it the first major U. S. exchange to list tokenized securities on its main market. Meanwhile, Dubai’s DAMAC Group has partnered with MANTRA to tokenize $1 billion in Middle Eastern assets – a move aligning with Dubai’s ambition as a digital asset hub.

For more on how fractional ownership via tokenization is changing property investment dynamics globally, see this detailed guide.

The Technical Backbone: On-Chain Verification and Cross-Chain Interoperability

Modern tokenization platforms must marry robust on-chain logic with off-chain legal realities. Smart contracts now automate everything from dividend payouts to compliance checks while ensuring that every transaction is instantly recorded and auditable by all stakeholders. The emergence of cross-chain frameworks like xRWA addresses previous inefficiencies around repeated authentication and slow settlements between blockchains.

This technical progress means that token holders can verify their positions or trade assets across multiple networks without friction – all backed by live data feeds that reflect current market conditions rather than historical snapshots.

The implications for risk management are profound: programmable assets enable automated margin calls if valuations drop below certain thresholds; ESG metrics can be tracked transparently; and loan servicing can be executed based on verified real-time cash flows rather than static credit reports.

As tokenized real estate platforms become increasingly sophisticated, the integration of real-time data is also reshaping investor expectations around governance and sustainability. Blockchain’s transparency now enables live monitoring of environmental, social, and governance (ESG) performance at the property level. For example, investors can track energy usage, carbon emissions, or tenant satisfaction scores as they are updated on-chain, empowering a new class of ESG-conscious participants to allocate capital in line with their values.

In parallel, on-chain cap tables are providing unprecedented clarity into token holder composition. Unlike traditional private equity structures that obscure ownership layers, blockchain-based registries allow for instant verification of who holds what stake at any given moment. This is particularly important for institutional players seeking compliance with evolving know-your-customer (KYC) and anti-money laundering (AML) regulations. The result is a market environment where both retail and institutional investors operate on a level informational playing field.

Liquidity, Accessibility, and Automated Asset Management

The liquidity promise of tokenized real estate is finally being realized thanks to the continuous flow of accurate data. Automated market makers and secondary trading venues now function with near-instant settlement times, powered by smart contracts that execute trades as soon as price or risk parameters are met. This stands in stark contrast to legacy systems where property transactions could take weeks or even months to clear.

Lower minimum investment thresholds, enabled by fractionalization, mean that a broader demographic can access property markets previously reserved for high-net-worth individuals or institutions. The combination of real-time data, programmable assets, and seamless settlement protocols creates an ecosystem where global investors can enter or exit positions with confidence and agility.

Top 5 Benefits of Real-Time Data in Tokenized Real Estate (2025)

-

1. Enhanced Transparency for Investors: Real-time data streams provide up-to-the-minute insights into property performance, ownership records, and market trends, helping investors make informed decisions and reducing information asymmetry.

-

2. Improved Liquidity Through Fractional Ownership: With real-time data, fractional property tokens can be traded instantly, allowing investors to buy or sell shares more easily and increasing overall market liquidity.

-

3. Automated and Accurate Valuations: Integration of AI and structured datasets like Uniform Appraisal Dataset (UAD) 3.6 enables continuous, automated property valuations, ensuring pricing reflects current market conditions.

-

4. Streamlined Compliance and Reporting: Real-time monitoring supports on-chain regulatory compliance and instant reporting, simplifying audits and ensuring adherence to evolving legal standards.

-

5. ESG Monitoring and Sustainable Investment: Blockchain-based real-time data enables tracking of Environmental, Social, and Governance (ESG) metrics, empowering investors to support sustainable and socially responsible properties.

For those interested in how these innovations are dismantling traditional entry barriers for small investors, this resource offers a comprehensive overview.

Challenges Ahead: Data Integrity and Regulatory Harmonization

Despite these advances, challenges remain around ensuring the integrity and reliability of off-chain data inputs that feed blockchain systems. Oracles, systems that bridge external information into smart contracts, must be carefully audited to prevent manipulation or errors that could cascade through automated processes. Additionally, as jurisdictions race to update securities laws for digital assets, regulatory harmonization will be critical to sustaining cross-border liquidity and investor protections.

The next phase will likely see further convergence between AI-driven analytics and blockchain infrastructure. Machine learning models trained on structured datasets like UAD 3.6 will refine asset valuations in real time, offering predictive insights on everything from rental demand to maintenance cycles.

Looking Forward: A Data-Driven Market Redefines Real Estate Investment

By late 2025, tokenized real estate is no longer defined by its novelty but by its efficiency and inclusivity. As Deloitte projects market growth toward $4 trillion by 2035, with compound annual rates exceeding 27%: the sector’s momentum hinges on its ability to deliver trusted real-time information at scale. Investors who leverage this data edge will be best positioned to navigate volatility and capitalize on emerging opportunities across global markets.

For deeper analysis of how blockchain technology is accelerating liquidity for global property investors through these innovations, explore this feature article.