Real-time rental payments are rapidly emerging as the linchpin of on-chain real estate innovation in 2025. As blockchain technology continues to mature, the ability to automate, verify, and instantly distribute rental income is fundamentally changing how investors, landlords, and tenants interact with property assets. No longer confined by the slow, opaque processes of traditional real estate management, tokenized real estate platforms now offer programmable income streams and unprecedented liquidity, ushering in a new era for property investment.

Programmable Cash Flows: The Engine of Tokenized Real Estate

At the core of this transformation is the automation of rent collection and distribution through smart contracts. In 2025, platforms like RealNOI have demonstrated the power of tokenizing substantial rental cash flows, recently facilitating the on-chain management of $570M in real estate income (source: Coindesk). These programmable cash flows eliminate human error and administrative lag, ensuring that rent is collected and distributed to investors with mathematical precision.

The impact is twofold: investors receive transparent, timely payouts, while property owners reduce overhead costs associated with manual reconciliation. This shift has enabled fractional ownership models where individual investors can access institutional-quality properties with minimal capital outlay. As a result, tokenized real estate in 2025 is no longer just about owning a digital deed, it’s about owning a share of live cash flow.

Lower Barriers and New Opportunities for Global Investors

The democratization of rental income is perhaps most visible in solutions like RentFi’s $RENT tokens. By abstracting away the complexities of property management and legal compliance, these tokens allow global investors to participate in real-time rental markets without high entry costs or operational burdens. Investors can buy tokens representing shares in diversified portfolios, residential or commercial, and receive their proportional share of rent as soon as it’s paid by tenants.

This model not only increases market liquidity but also makes real estate yield on blockchain accessible to a broader audience. For example, an investor in Singapore can now earn U. S. -dollar denominated rent from New York apartments at near-instant speed, no intermediaries required. Such innovations are reshaping expectations around property investment returns and risk management.

Tenant Experience: Flexibility Meets Accountability

The benefits aren’t limited to landlords or investors. For tenants, solutions like r3nt leverage decentralized protocols to enable flexible payment options, including weekly or milestone-based schedules, while providing landlords with upfront assurance via escrowed smart contracts. This creates a more equitable relationship between renters and owners; payments are verifiable on-chain, reducing disputes and increasing trust across all parties.

The integration of live blockchain property updates also means that both tenants and owners have access to real-time data regarding payment status, lease terms, and maintenance requests, all recorded immutably on-chain. This level of transparency was previously unthinkable in legacy systems.

The Data-Driven Future: Transparency at Every Layer

As adoption accelerates into late 2025, industry observers note that real-time on-chain data is now central to how tokenized properties are valued and traded. Automated reporting tools provide granular insight into occupancy rates, delinquency trends, yield fluctuations, and even predictive analytics for future performance, all accessible through open APIs or permissioned dashboards.

This surge in data transparency is not just a technical milestone, it’s transforming how investors, asset managers, and regulators approach risk and compliance. Smart contracts can be programmed to enforce regulatory checks, automate tax reporting, and flag anomalies in rental flows or property performance. For institutional participants, this means more robust due diligence and continuous monitoring without the cost and friction of third-party audits.

Moreover, platforms are leveraging propertynft rental verification to authenticate tenant histories and lease agreements on-chain. This allows for rapid onboarding of new tenants and reduces fraud risk for landlords. The cumulative effect is a self-reinforcing cycle: greater transparency attracts more capital, which in turn incentivizes higher standards of data integrity and operational efficiency across the entire market.

Challenges Ahead: Scaling Trustless Infrastructure

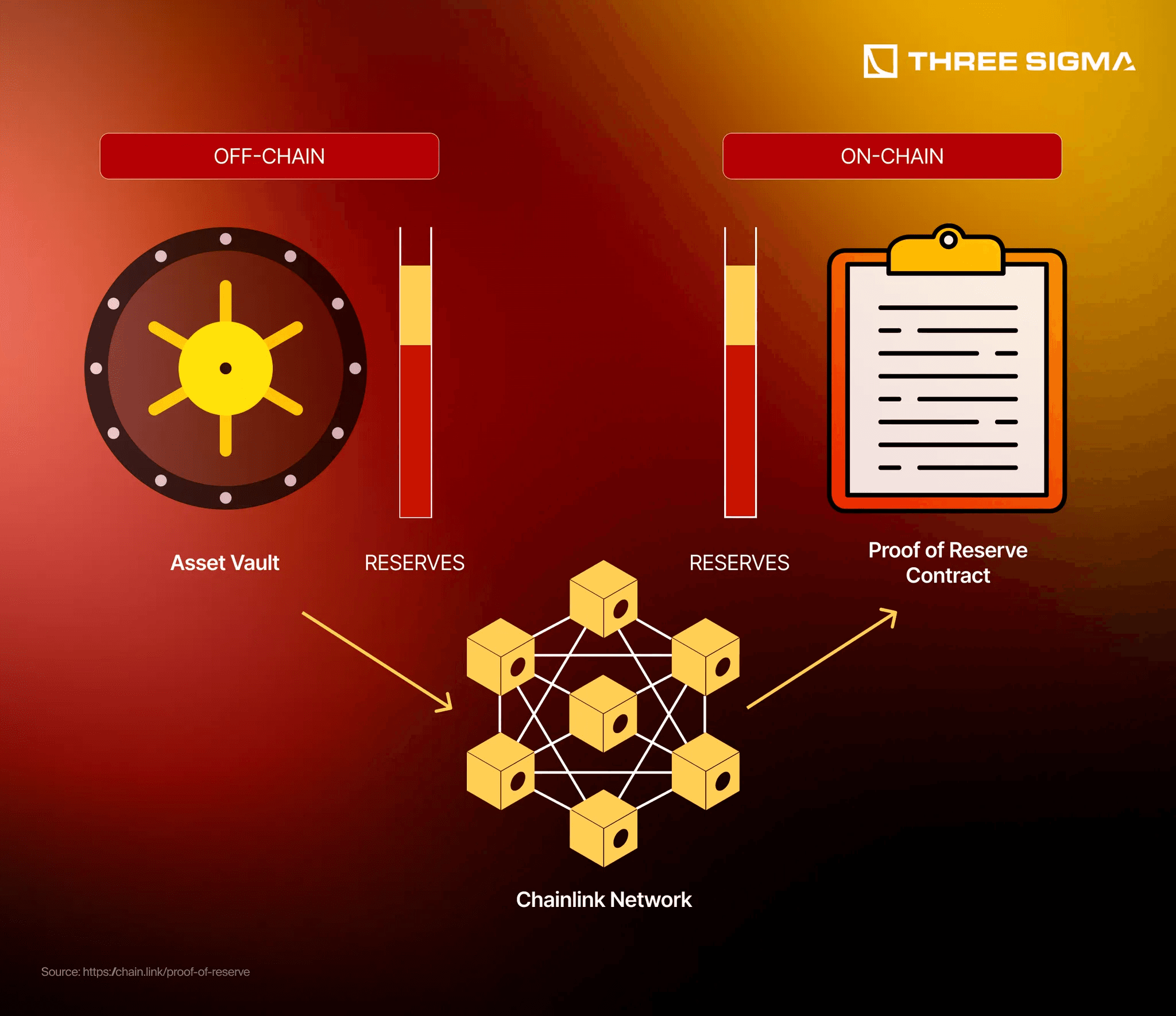

Despite these advances, scaling real-time rental payment systems across jurisdictions remains complex. Regulatory fragmentation, differing local tenancy laws, and the need for reliable oracles to bridge off-chain data with on-chain execution are ongoing hurdles. However, leading platforms are forming cross-border partnerships and investing heavily in compliance automation to address these gaps.

Security is another priority. As programmable property assets become more valuable, and visible, platforms must maintain rigorous smart contract audits and adopt best-in-class cybersecurity measures. The industry’s focus has shifted from simply proving concept viability to ensuring resilience at scale.

Top Real-Time Rental Payment Platforms in 2025

-

RealNOI: RealNOI stands out in 2025 for tokenizing substantial rental cash flows from real estate, letting investors access property income without traditional ownership hurdles. The platform leverages blockchain to automate rent collection and distribution, ensuring transparency and efficiency for all stakeholders.

-

RentFi: RentFi has introduced $RENT tokens, enabling global investors to earn rental income from tokenized properties. The platform removes high entry barriers and management complexities, using smart contracts to streamline real-time rental payments and profit distribution.

-

r3nt: r3nt is transforming on-chain rentals by offering flexible payment options for tenants and upfront assurance for landlords through decentralized mechanisms. Its smart contract-driven approach automates payments, enhances transparency, and simplifies rental management.

What Comes Next? Programmable Real Estate at Scale

The trajectory is clear: by late 2025, live blockchain property updates and automated rent distribution are setting a new baseline for what investors expect from tokenized real estate. We’re entering an era where programmable income streams can be traded as easily as digital assets, enabling everything from instant refinancing to secondary market liquidity events that were previously impossible in traditional real estate.

For forward-thinking investors seeking yield with transparency and minimal friction, the evolution of real-time rental payments marks a fundamental shift in both philosophy and practice. The winners will be those who adapt quickly, leverage live data, and prioritize trustless infrastructure as the foundation for tomorrow’s property markets.