In 2025, real-time on-chain real estate data is not just a buzzword but a fundamental force reshaping how property markets operate, invest, and innovate. Blockchain technology has moved from proof-of-concept pilots to powering large-scale tokenized real estate platforms, enabling fractional ownership and seamless global trading of property tokens. According to Deloitte, over $4 trillion in real estate is projected to be tokenized by 2035, a massive leap from under $300 billion in 2024. This acceleration is driven by the integration of dynamic, transparent, and immutable data streams directly onto public blockchains.

Transparency and Trust: The On-Chain Advantage

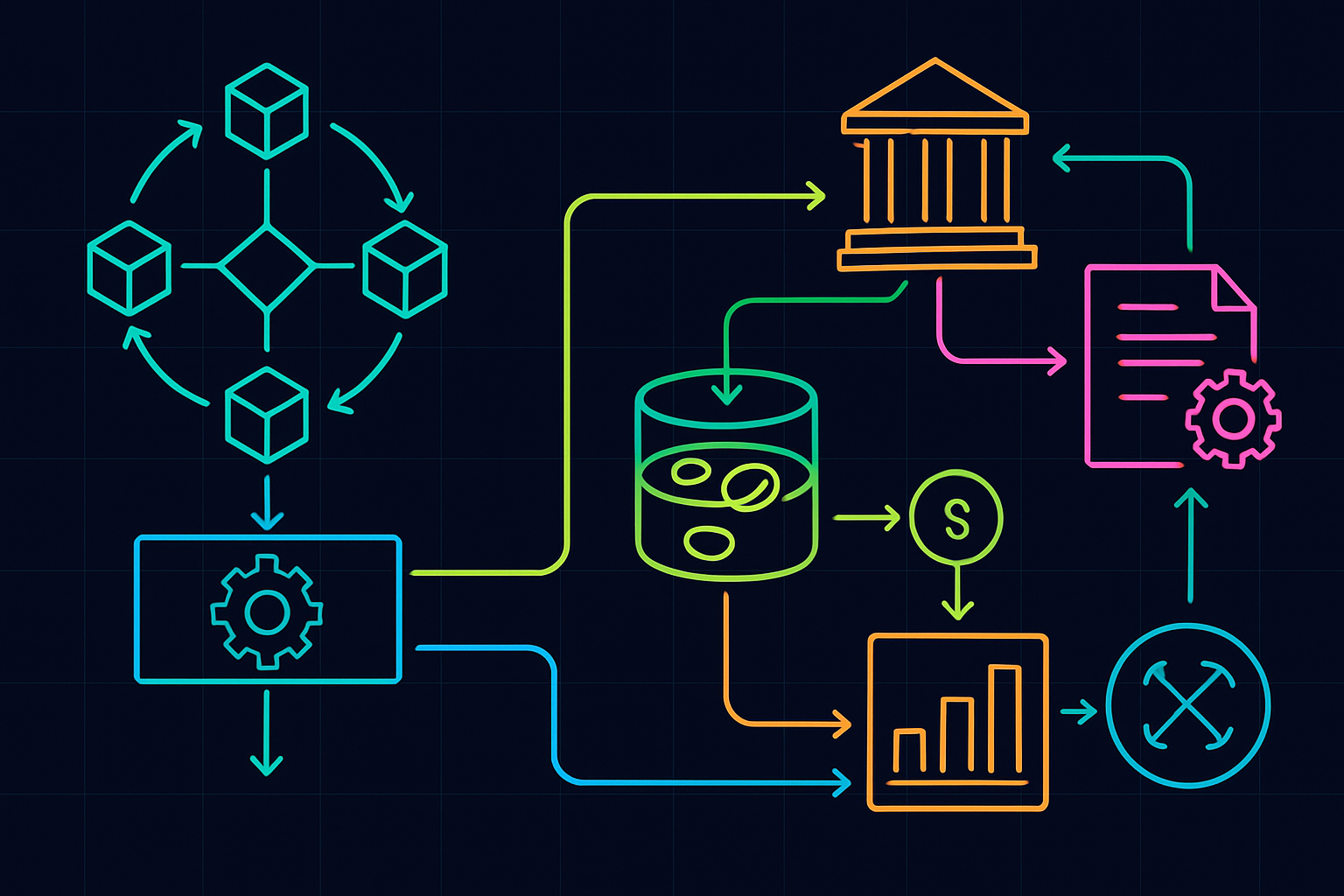

One of the most profound impacts of real-time on-chain data is radical transparency. Every transaction, whether it’s a fractional purchase, rental payment update, or change in legal ownership, is immutably recorded and instantly accessible to all stakeholders. This minimizes the opacity that has historically plagued traditional property investment and management.

For example, investors can now verify ownership status or rental yield performance directly on-chain without relying on intermediaries or opaque reporting. Platforms like RWA. xyz provide analytics dashboards that aggregate these live data streams across multiple chains. This enables both institutional and retail investors to make informed decisions based on verifiable facts rather than delayed quarterly reports or unverifiable claims.

“On-chain data is turning real estate into a truly digital asset class, one where trust is built algorithmically rather than by reputation. “

Liquidity Unlocked: Fractionalization Meets Real-Time Markets

The confluence of tokenization and instant data feeds has ushered in an era where liquidity is no longer an afterthought in real estate. By breaking down properties into thousands of digital tokens, investors can buy or sell fractions with unprecedented speed. Real-time price discovery, powered by protocols like Chainlink’s Data Streams, ensures that each trade reflects the latest market conditions.

This transformation is especially evident in secondary markets for dynamic property tokens. Instead of waiting weeks for title transfers or escrow settlements, trades settle instantly with automated compliance checks embedded in smart contracts. The result? A more efficient market where liquidity premiums are shrinking and access barriers are falling.

Broader Accessibility and Regulatory Evolution

Tokenized real estate in 2025 represents more than just technological progress, it signals a democratization of access to one of the world’s largest asset classes. Lower minimum investments mean that individuals from diverse geographies can participate alongside institutions. Automated compliance modules now scan transactions for regulatory adherence across jurisdictions in real time, reducing friction for cross-border investments.

This shift also brings new challenges: standardization across protocols remains an open question as platforms compete for interoperability; meanwhile, regulators are racing to keep pace with innovations such as real-time blockchain rental updates that merge settlement with legal enforceability (as highlighted by QuillAudits).

For traditional investors, these changes demand a rethinking of risk, due diligence, and portfolio allocation. The ability to monitor on-chain ownership verification and rental cash flows in real time is reducing information asymmetry. Market participants can now track vacancy rates, rent payments, and even maintenance events as they occur on-chain. This level of granularity was simply unattainable in the analog world of property investing.

The rise of dynamic property tokens is also blurring the lines between private and public markets. Properties that were once illiquid and opaque are now part of a global, 24/7 trading ecosystem, one where price signals respond to actual events rather than stale appraisals or delayed filings. As more jurisdictions adopt standardized frameworks for digital securities, expect further convergence between tokenized real estate and mainstream financial infrastructure.

Market Intelligence: Data-Driven Decision Making

The actionable intelligence provided by real-time data streams is transforming how asset managers, developers, and retail investors approach their strategies. Platforms like RWA. xyz aggregate live feeds from multiple blockchains, enabling comparative analysis across regions and property types. Investors can benchmark yields, identify emerging market trends, or react to regulatory shifts, sometimes within minutes rather than months.

This data-driven approach is not just about speed; it’s about precision. Automated analytics can flag anomalies such as unexpected drops in rental income or sudden spikes in transaction activity. These insights empower users to act defensively or opportunistically with a confidence rooted in verifiable facts.

What’s Next for Tokenized Real Estate?

Looking ahead to 2026 and beyond, several trends are set to define the next phase:

- Cross-chain interoperability: As tokenization spreads across multiple blockchains, seamless movement of assets will become critical for both liquidity and compliance.

- Automated regulatory reporting: Expect further integration of smart contracts that not only enforce legal requirements but also report compliance status directly to regulators in real time.

- Growth of secondary markets: With increasing standardization and transparency, secondary markets for property tokens will rival those for traditional REITs, offering both liquidity and price discovery.

The scale of transformation is hard to overstate: with over $4 trillion projected for tokenized assets by 2035 (Deloitte), the sector’s trajectory points toward a future where every major property deal leaves an indelible mark on the blockchain. For those willing to embrace this new paradigm, and leverage research-driven insights, the edge now lies in harnessing the power of real-time on-chain real estate data.