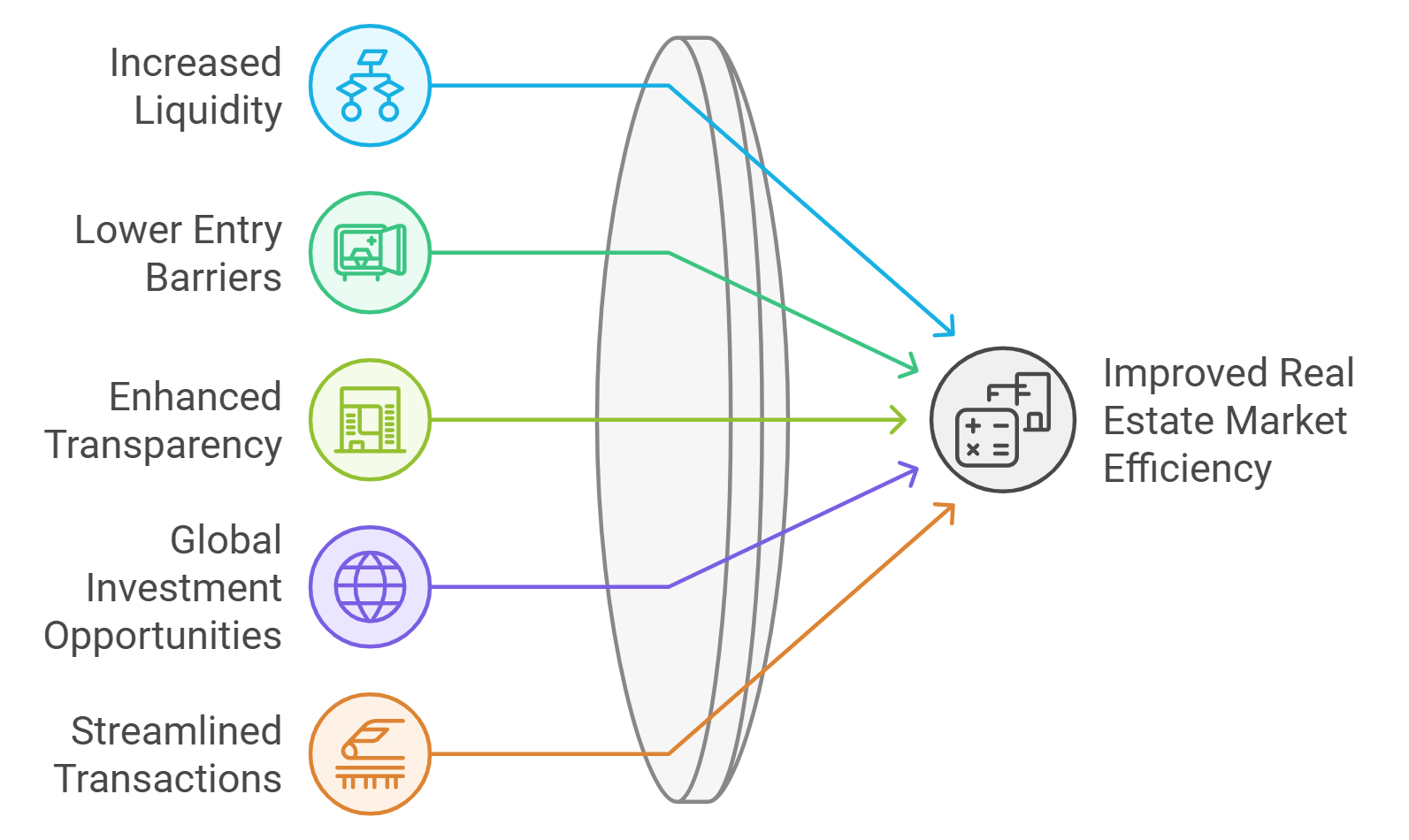

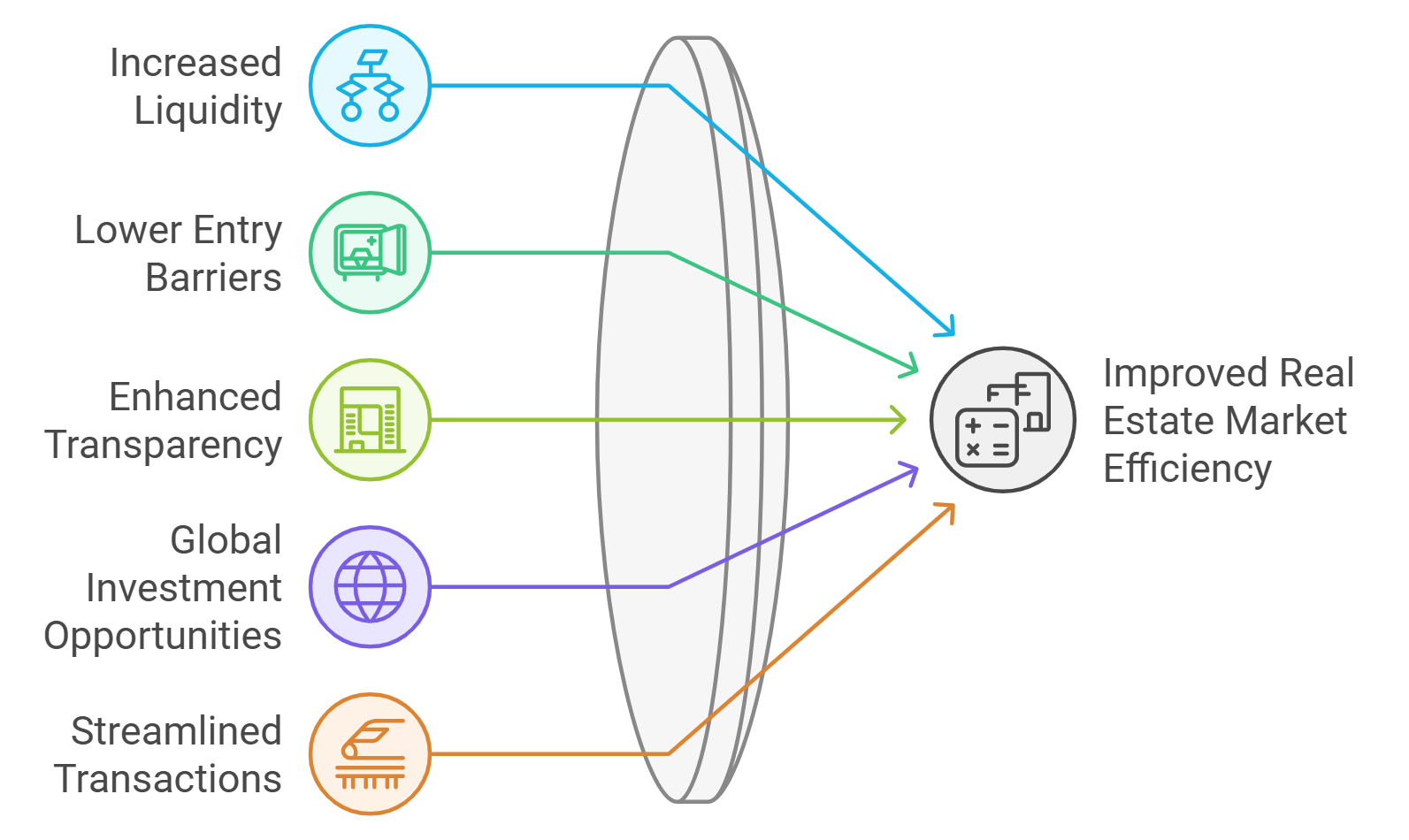

Fractional real estate ownership is rewriting the rulebook for property investment, and blockchain tokens are at the heart of this revolution. Gone are the days when only deep-pocketed investors could access prime real estate. Now, thanks to blockchain property tokens and advanced legal frameworks, anyone can own a slice of high-value assets. Let’s break down how this game-changing process works in 2024, step by step.

Legal Structuring and Regulatory Compliance: The Foundation

The journey begins with robust legal structuring. To fractionalize real estate while staying on the right side of the law, property sponsors typically establish a Special Purpose Vehicle (SPV) or a compliant Real Estate Investment Trust (REIT). This entity holds the deed to the property and is responsible for issuing blockchain tokens that represent fractional ownership.

Regulatory compliance is non-negotiable. Platforms are increasingly adopting standards like ERC-3643, which ensures that tokenized real estate aligns with existing securities laws and can adapt to evolving global regulations. This step is crucial for building investor trust and enabling cross-border participation in fractional property investment via blockchain.

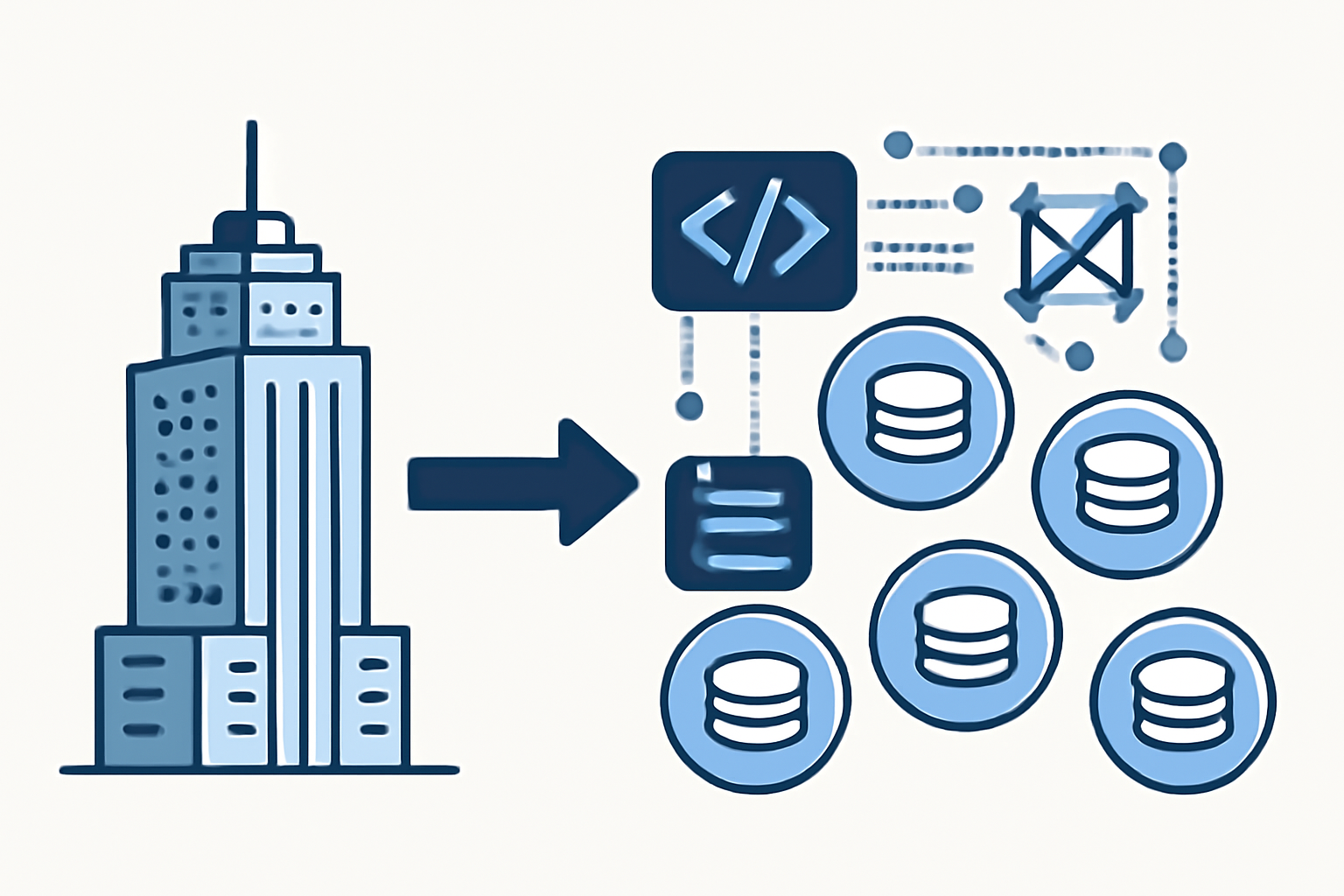

Property Tokenization and Smart Contract Deployment

Once the legal groundwork is set, it’s time to digitize ownership. The property is divided into a set number of blockchain-based tokens, each representing a specific share of the asset. These tokens are minted using secure smart contracts on platforms like Ethereum or Polygon.

Smart contracts automate everything from ownership transfers to income distributions. This not only slashes administrative overhead but also ensures transparency and security for all parties involved. Each token is traceable and tamper-proof on the blockchain ledger, making it easy for investors to verify their holdings at any time.

Investor Onboarding and KYC/AML Verification

Next up is investor onboarding – the gateway to democratized real estate investing. Tokenization platforms must perform rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This protects both the issuer and buyers by ensuring only verified participants can invest.

Today’s top platforms make onboarding seamless for global investors. With digital identity verification and compliance baked into the process, it’s possible to buy fractional shares of properties in New York, London, or Singapore from the comfort of your living room. This is where blockchain truly shines: breaking down geographic barriers and opening up new markets for fractional real estate ownership.

Step-by-Step: Blockchain Fractional Real Estate Ownership

-

Legal Structuring and Regulatory Compliance: Establish a Special Purpose Vehicle (SPV) or Real Estate Investment Trust (REIT) to hold the property, ensuring full compliance with local securities laws. Adopt established token standards like ERC-3643 for regulatory alignment and seamless integration with compliant platforms.

-

Investor Onboarding and KYC/AML Verification: Use compliant tokenization platforms such as Securitize or tZERO that perform Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, allowing global investors to participate securely in fractional ownership.

-

Secondary Trading and Liquidity Management: Enable instant trading of property tokens on licensed secondary exchanges or peer-to-peer platforms, such as OpenFinance or tZERO, providing ongoing liquidity and transparent price discovery for fractional owners.

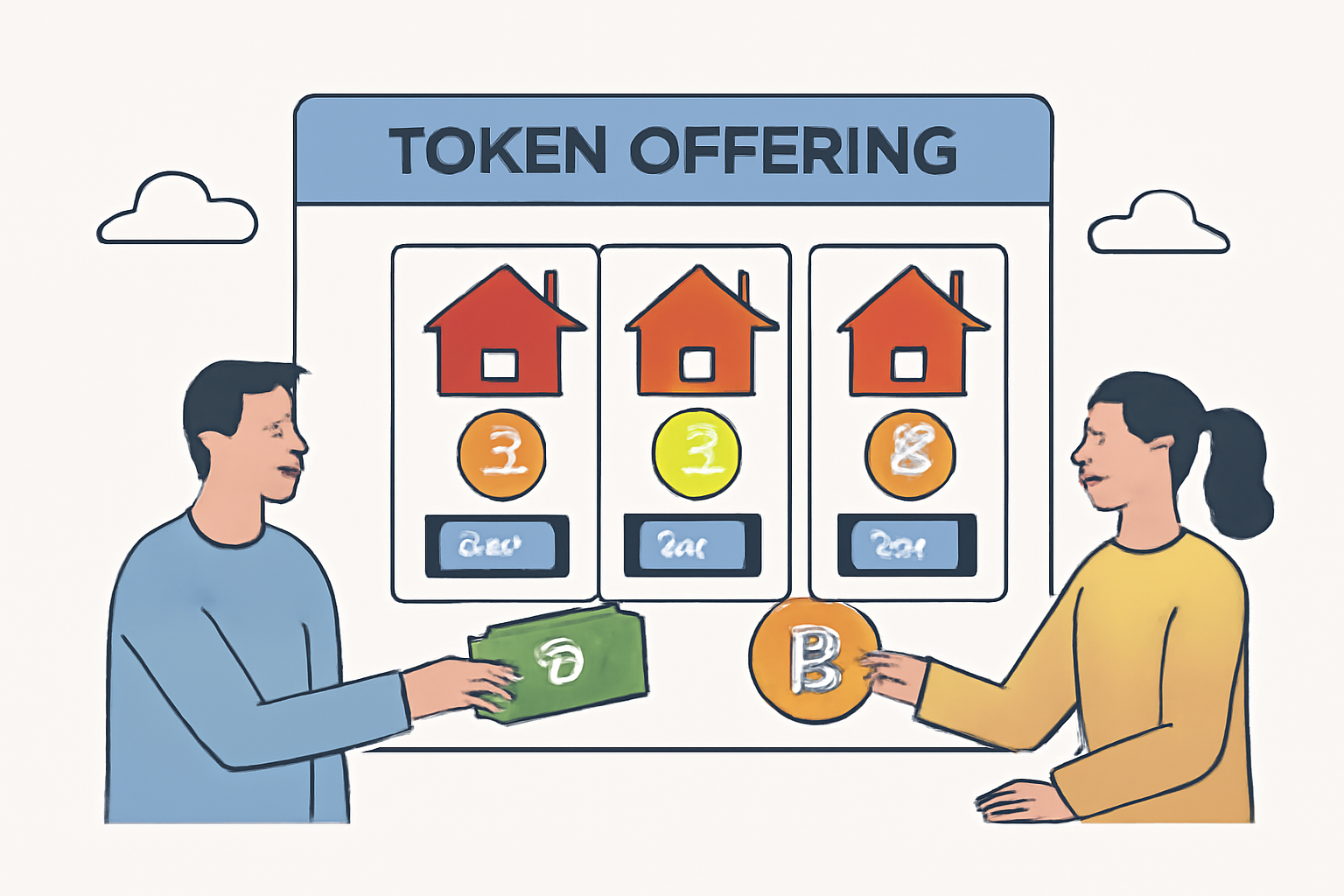

Token Offering and Distribution: Access for All

With verified investors ready to go, property tokens are launched via a Security Token Offering (STO) or similar regulated mechanism. Investors can purchase fractions using fiat or cryptocurrencies on licensed marketplaces, gaining exposure to assets that were once out of reach.

This step is all about accessibility and flexibility. Want to invest $500 instead of $500,000? No problem – fractional ownership via blockchain tokens makes it possible. Plus, STOs ensure that every transaction is logged on-chain, providing an immutable record for both issuers and buyers.

Stay tuned as we explore how secondary trading unlocks liquidity and transforms these digital shares into dynamic assets in the next section.

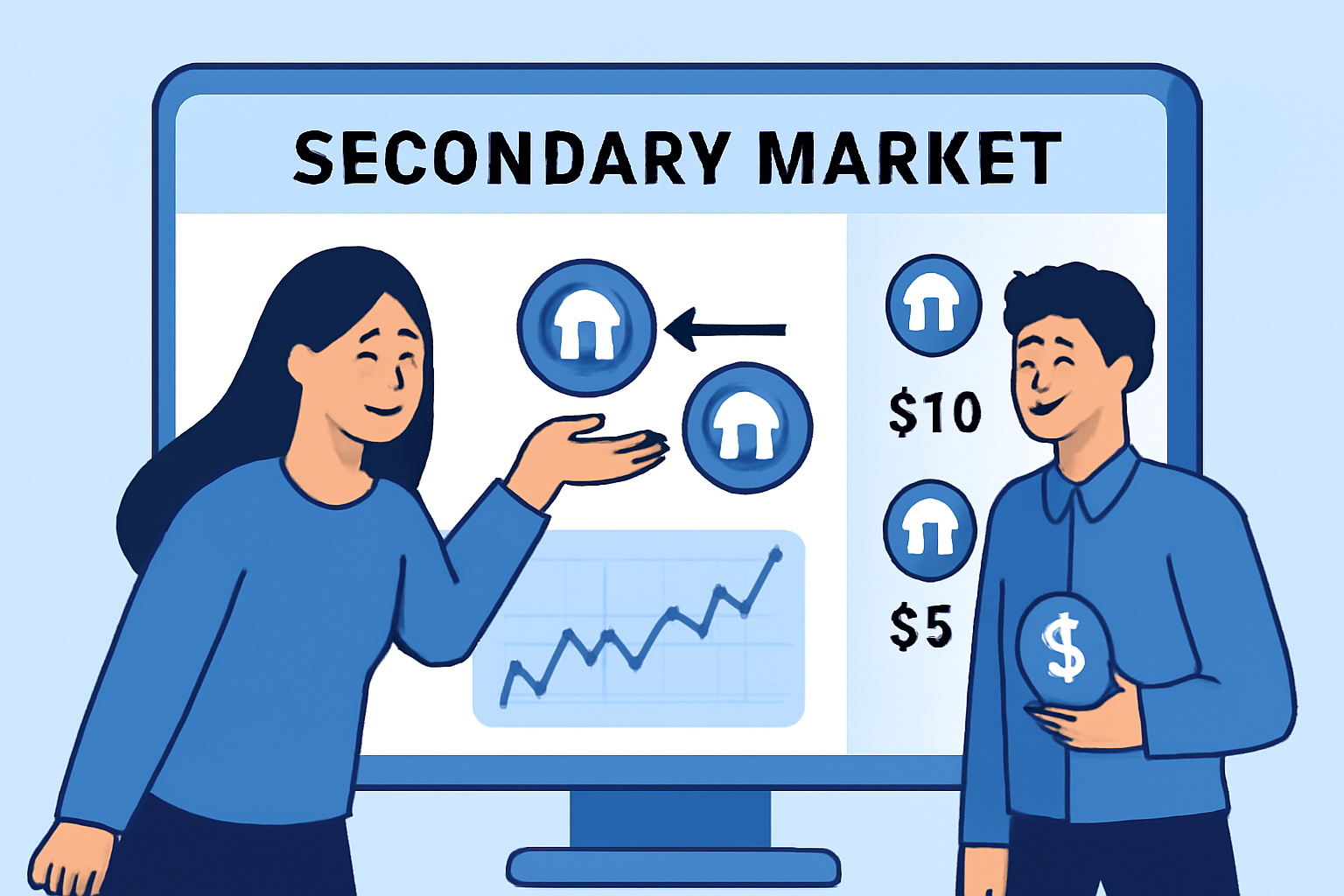

Secondary Trading and Liquidity Management

Once tokens are distributed, the real magic of fractional real estate ownership kicks in: liquidity. Unlike traditional property shares that can take months to sell, blockchain-based tokens can be traded instantly on licensed secondary exchanges or peer-to-peer platforms. This provides a fluid market for investors to buy or sell their fractions at any time, with transparent price discovery driven by real-time demand.

Liquidity management is critical. Platforms often partner with regulated exchanges that specialize in security tokens, ensuring compliance and safeguarding investor interests. Peer-to-peer trading also flourishes, thanks to blockchain’s trustless environment. No more waiting for escrow or mountains of paperwork, just seamless transfers of fractional property investment on blockchain rails.

Why Compliance and Standards Matter

All these steps hinge on robust compliance. Adopting frameworks like ERC-3643 isn’t just a technicality, it’s a necessity for legal interoperability and future-proofing your investment. ERC-3643 enables programmable compliance directly into the token, so only eligible investors can trade or hold certain assets. This keeps platforms aligned with evolving global standards for real estate token compliance, making cross-border trading viable and secure.

5 Essential Steps to Real Estate Tokenization

-

Legal Structuring and Regulatory Compliance: Establish a Special Purpose Vehicle (SPV) or Real Estate Investment Trust (REIT) to hold the property, ensuring full compliance with local securities laws. Adopt recognized standards like ERC-3643 for regulatory alignment and seamless integration with tokenization platforms.

-

Investor Onboarding and KYC/AML Verification: Use compliant tokenization platforms (such as Securitize or tZERO) that perform Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, allowing global investors to securely participate in fractional ownership.

-

Token Offering and Distribution: Launch the property tokens via a Security Token Offering (STO) or similar compliant mechanism, enabling investors to purchase fractions through fiat or cryptocurrencies on regulated marketplaces like tZERO or Securitize Markets.

-

Secondary Trading and Liquidity Management: Enable instant trading of property tokens on licensed secondary exchanges or peer-to-peer platforms, such as tZERO and Securitize Markets, providing ongoing liquidity and transparent price discovery for fractional owners.

The Investor Experience: Real-World Advantages

The end result? An entirely new paradigm for property investing:

- Accessibility: Invest with as little as $50, opening doors to premium properties worldwide.

- Diversification: Spread your risk by holding tokens from multiple assets across geographies and sectors.

- Transparency: Every transaction is recorded on-chain, providing an immutable audit trail for all participants.

- Speed and Flexibility: Enter or exit positions quickly without lengthy settlement periods or high fees.

- Global Reach: Participate in markets that were previously closed due to jurisdictional barriers or high entry costs.

If you can buy a share of Apple from anywhere in the world, why not a share of a Manhattan skyscraper? Blockchain property tokens make this vision a reality.

and mdash; Lila Monroe, Tokenized Real Estate

Looking Ahead: The Future of Fractional Property Investment Blockchain

The rise of blockchain-powered fractional ownership is already reshaping how we think about wealth creation through real estate. As regulatory clarity improves and platforms adopt best-in-class standards like ERC-3643, expect even greater participation from both retail and institutional investors. The days of illiquid, opaque property markets are numbered, the new era prioritizes transparency, liquidity, and inclusivity at every stage of the real estate tokenization process.

If you’re ready to chart your own course in property investing, understanding these five foundational steps will put you at the forefront of this dynamic transformation. The future is fractional, are you in?