Fractional real estate tokens are reshaping how individuals invest in property, offering a digital, accessible, and liquid alternative to traditional real estate. If you’re new to this space, you might be surprised at how straightforward blockchain property investment has become. In this guide, we’ll walk through the essential steps for beginners looking to diversify their portfolios with tokenized real estate, highlighting the latest platforms and practical considerations for 2025.

What Are Fractional Real Estate Tokens?

At its core, fractional real estate tokenization is about converting ownership of a property into digital tokens on a blockchain. Each token represents a fraction of the asset, and owning tokens means you own a proportional share of the property and its income streams. This innovation has lowered entry barriers, making it possible to invest in high-quality properties globally with as little as $0.01 or €1, depending on the platform. For a deeper dive into how this process democratizes access and unlocks global opportunities, explore our guide on fractional ownership and tokenization.

“Tokenization is the bridge between traditional real estate and the digital future. It’s about access, transparency, and liquidity for everyone. “

How to Get Started: A Step-by-Step Overview

Before you purchase your first property token, it’s crucial to understand the process and choose the right platform. Here’s how to begin:

- Understand the Asset: Know what you’re buying. Each token corresponds to a specific property with its own risk and return profile.

- Choose a Platform: Platforms like OwnProp, PropShare, and Proptee offer compliant, transparent investment opportunities with low minimums.

- Complete KYC/AML Verification: This step ensures regulatory compliance and protects your investment.

- Review Properties: Platforms provide detailed financials and projections for each property. Compare options based on location, type, and expected returns.

- Invest: Decide how much to allocate and purchase the corresponding number of tokens. Many platforms accept both fiat and crypto payments.

Key Advantages of Investing in Property Tokens

Key Benefits of Fractional Real Estate Tokens

-

Lower Investment Barriers: Fractional tokens allow you to invest in real estate with small amounts of capital, making property ownership accessible to more people than traditional methods.

-

Enhanced Liquidity: Unlike traditional real estate, tokenized shares can often be traded on secondary markets, giving investors the flexibility to buy or sell their holdings more easily.

-

Diversification Opportunities: Investors can spread their capital across multiple properties and markets, reducing risk and increasing potential returns.

-

Transparent Ownership and Income: Blockchain technology ensures transparent records of ownership and income distributions, so investors can track their holdings and returns with confidence.

The appeal of investing in property tokens goes beyond low entry costs. Here are some standout benefits:

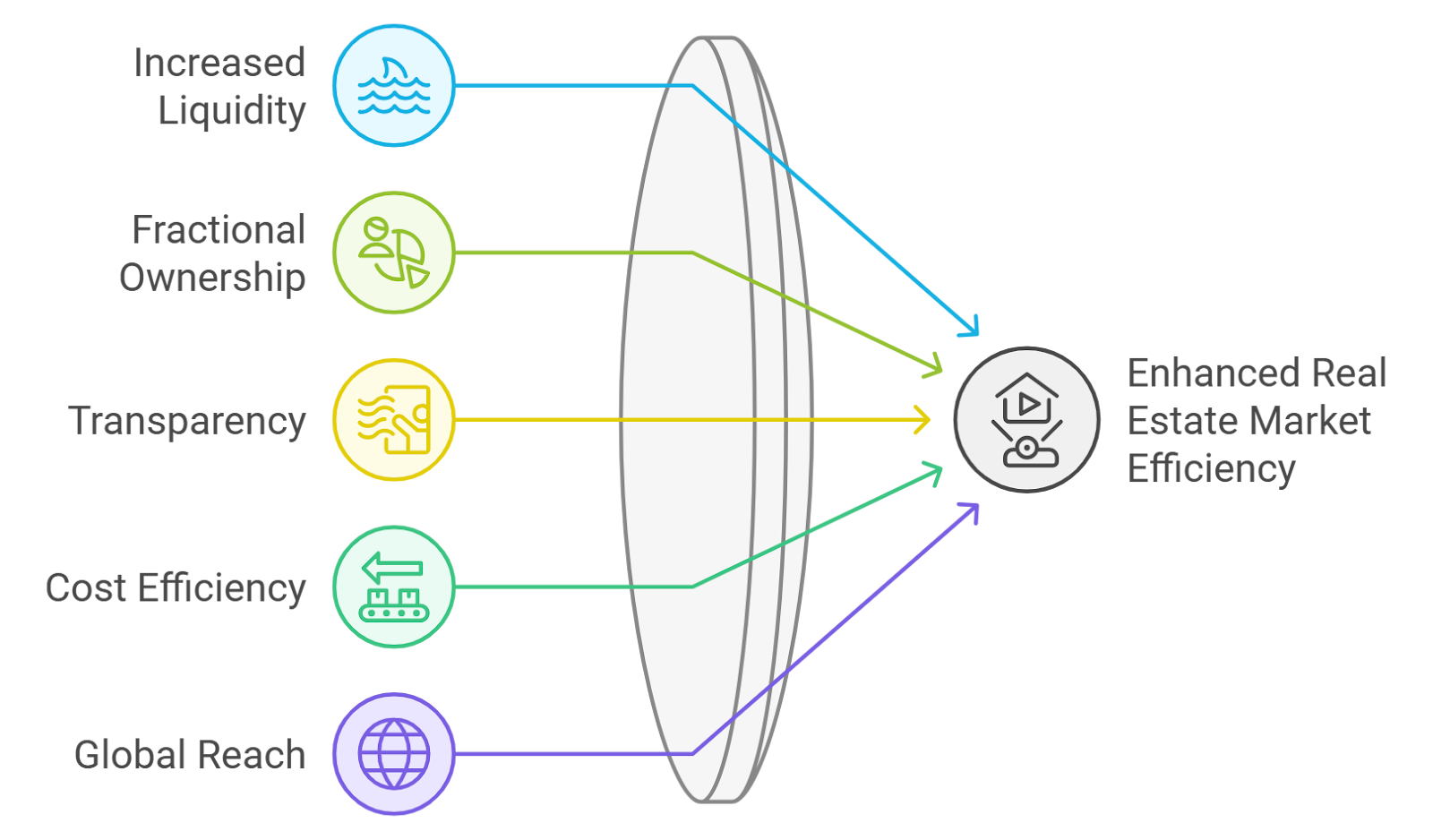

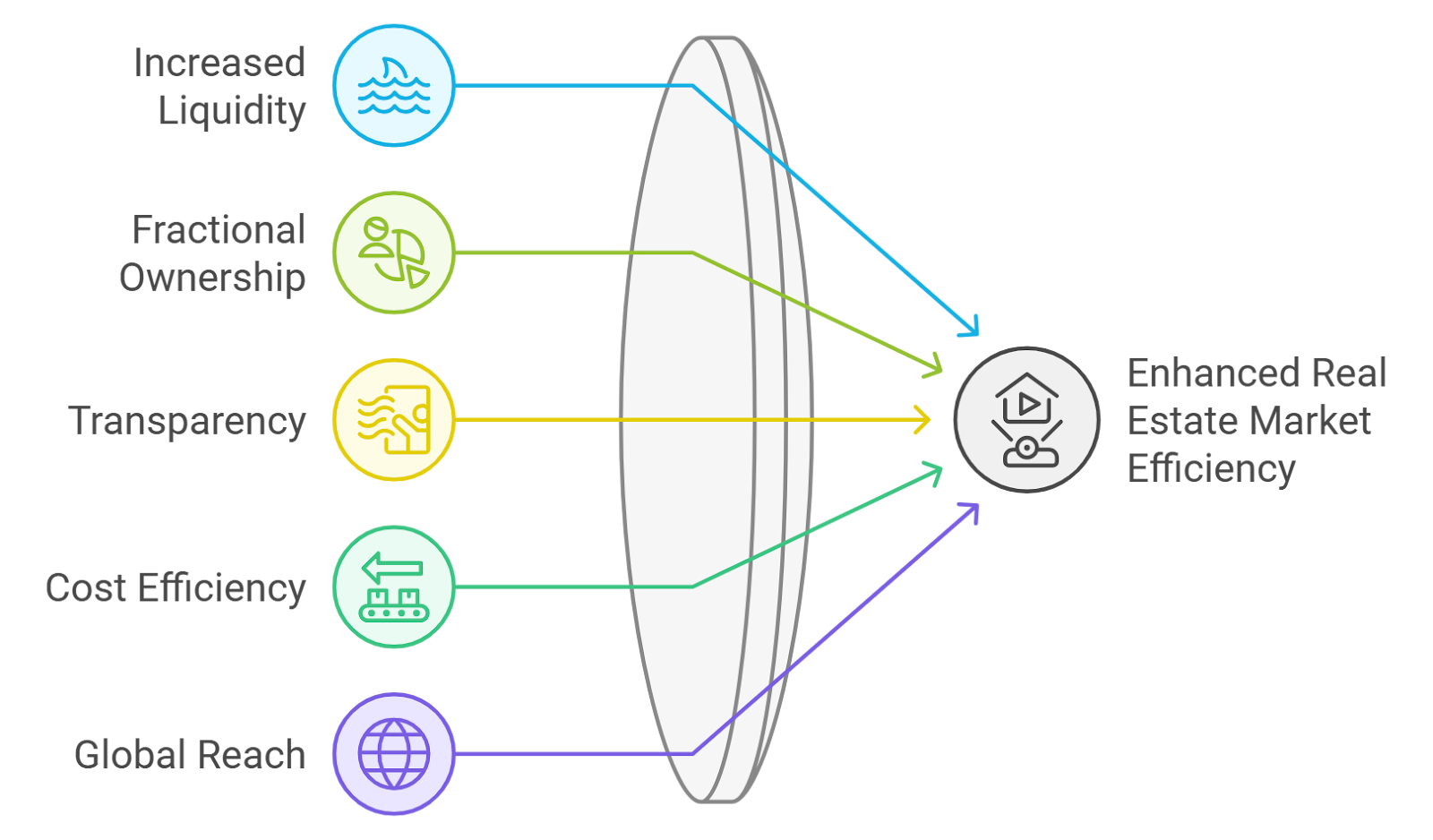

- Liquidity: Unlike traditional real estate, tokens can often be traded on secondary markets, providing faster access to cash if needed.

- Diversification: With small minimum investments, you can spread your capital across multiple properties and locations.

- Global Access: Blockchain platforms open up international markets that were previously out of reach for most retail investors. For more insights on how tokenization is making global property investment accessible, see our feature on tokenized global property investment.

- Transparency: Blockchain records all transactions immutably, reducing fraud and increasing trust in the process.

If you’re ready to take the next step, remember to assess each platform’s security measures and compliance standards. As with any investment, due diligence is your best protection against risk. Stay tuned for the second half of this guide, where we’ll cover monitoring your portfolio, receiving income, and using secondary markets for liquidity.

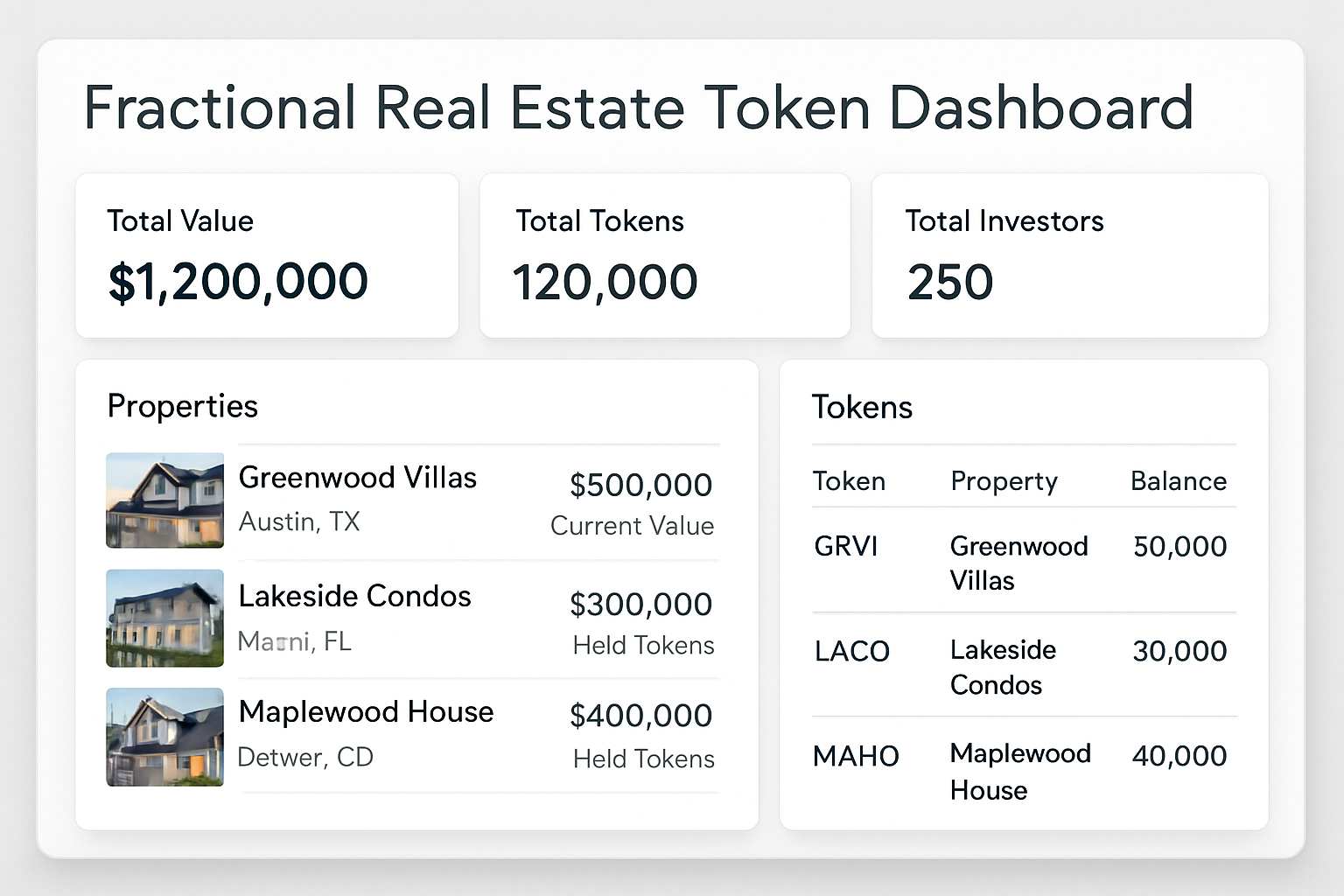

Managing Your Investment: Monitoring, Income, and Liquidity

Once you’ve invested in fractional real estate tokens, effective management is key to maximizing your returns and minimizing risk. Most reputable platforms provide a user-friendly dashboard where you can track your portfolio’s performance, view property updates, and monitor rental income distributions. Typically, income from rental properties is distributed on a regular basis, often monthly or weekly, directly to your account, proportional to your token holdings.

What sets tokenized real estate apart is the enhanced liquidity compared to traditional property investments. Instead of waiting months or years to sell an entire property, you can trade your tokens on secondary markets supported by platforms like Lofty. This means you can exit positions or rebalance your portfolio with much greater flexibility, responding to market trends or personal financial needs.

Tips to Monitor and Optimize Your Fractional Real Estate Tokens

-

Set up alerts for market updates and property news on your investment platforms. Enable notifications for important events, such as rental income payments, property value changes, or secondary market opportunities.

-

Reinvest rental income or profits to maximize compounding returns. Many platforms allow you to use earned income to purchase additional tokens, increasing your ownership stake over time.

-

Utilize secondary markets for liquidity management. Platforms like Lofty enable you to buy or sell fractional property shares, helping you rebalance your portfolio or access funds when needed.

-

Stay informed about regulatory and tax changes that may impact your investments. Follow updates from your platform and consult with a financial advisor to ensure compliance and optimize tax efficiency.

-

Periodically assess property fundamentals by reviewing updated financial reports, occupancy rates, and market trends provided by the platform. This helps you make informed decisions about holding, selling, or increasing your investment.

-

Diversify across properties and regions to reduce risk and optimize returns. Leading platforms like PropShare offer access to multiple property types and locations, enabling effective diversification.

Risks and Considerations for New Investors

While the advantages of investing in property tokens are compelling, it’s important to recognize the risks unique to this emerging asset class. Regulatory frameworks for tokenized real estate are evolving, so always confirm that your chosen platform operates within established legal guidelines. Market risks remain present, property values and rental yields can fluctuate, and digital assets are subject to cybersecurity threats.

Another consideration is platform solvency and operational risk. If a platform ceases operation or faces legal challenges, access to your tokens or income streams could be disrupted. To mitigate these risks, diversify across multiple platforms and properties where possible. For a deeper look at how fractional tokenization is making global real estate accessible while lowering entry barriers, visit this guide.

Best Practices for Beginner Real Estate Token Investors

Successful investors in blockchain property investment follow a few time-tested principles:

- Start small: Take advantage of low minimums to learn the ropes before scaling up your exposure.

- Diversify: Spread your investments over different properties, asset types, and geographic regions to reduce risk.

- Stay informed: Follow platform updates, market news, and regulatory developments to adapt your strategy as the landscape evolves.

- Review exit options: Understand how secondary market trading works on your platform so you’re prepared if you need liquidity.

The world of fractional real estate tokens is dynamic, with new platforms, regulations, and investment opportunities emerging rapidly. For those willing to learn and adapt, it offers a practical path to global real estate exposure with unprecedented flexibility.

As the sector matures, investor protections and platform standards are expected to strengthen, further enhancing the appeal of digital property shares. If you’re ready to take your first step, focus on education, due diligence, and gradual portfolio building, balance remains the key to lasting wealth.