Imagine owning a piece of a luxury Miami condo, a bustling Chicago apartment building, or a Dubai skyscraper – all without the headaches of paperwork, huge upfront costs, or geographic barriers. That’s the reality fractional real estate ownership is unlocking in 2025, powered by blockchain property tokens. This isn’t just a buzzword revolution: it’s a practical, fast-growing investment model that’s reshaping how people across the globe access property markets.

The Mechanics of Fractional Ownership with Blockchain Tokens

At its core, fractional real estate ownership means splitting a property into smaller, tradable shares. Blockchain technology takes this concept further by representing each share as a digital token, recorded on a tamper-proof ledger. Here’s how it works in practice:

- A property is valued and divided into a set number of tokens. For example, a $1 million property might be split into 10,000 tokens at $100 each.

- Each token represents a direct, fractional ownership stake in the asset, including rights to rental income and appreciation.

- These tokens are issued and managed on a blockchain, ensuring transparent, immutable records of who owns what.

- Investors can buy, sell, or trade tokens on dedicated platforms, often with just a few clicks and minimal capital.

- Smart contracts automate processes like income distribution, voting on property management, and compliance checks.

This isn’t theory – it’s already happening. Platforms like RealT, Propy, Lofty AI, and MANTRA are leading the charge, each with their own twist on property tokens blockchain technology. For a detailed, step-by-step breakdown of this process, check out this illustrated guide.

Who’s Leading the Tokenized Real Estate Platforms in 2025?

The landscape of tokenized real estate platforms is more dynamic than ever, with several standout players:

Top Tokenized Real Estate Platforms in 2025

-

RealT specializes in U.S. residential properties, offering fractional ownership of over 700 tokenized assets valued at more than $130 million. Investors receive daily rental income in stablecoins, and tokens are easily traded on secondary markets for enhanced liquidity.

-

Propy bridges traditional real estate with blockchain, enabling global tokenization of both residential and commercial properties. Its platform integrates KYC, legal compliance, and smart contract-powered title transfers to streamline property transactions.

-

Lofty AI runs on the Algorand blockchain and lets users buy fractional shares of income-generating properties starting at just $50. The platform uses AI analytics to guide investment decisions and automates income distribution via smart contracts.

-

MANTRA partnered with Dubai’s DAMAC Group in 2025 for a $1 billion initiative to tokenize Middle Eastern real estate. This collaboration is positioning Dubai as a global hub for digital and crypto asset-backed property investment.

-

Seazen Digital Assets Institute, launched by China’s Seazen Group in Hong Kong, is pioneering the tokenization of real-world assets including property income streams and intellectual property, marking a major step for Asian real estate tokenization in 2025.

RealT has tokenized over 700 U. S. properties, valued at more than $130 million, letting investors earn daily rental income in stablecoins and trade tokens on secondary markets. Propy bridges traditional and blockchain real estate, streamlining everything from KYC to smart contract title transfers. Lofty AI lets you start with as little as $50, using AI insights to guide investment decisions. Meanwhile, MANTRA and Dubai’s DAMAC Group have launched a $1 billion initiative, positioning the Middle East as a new hub for digital property investing. And in Asia, China’s Seazen Digital Assets Institute is exploring tokenization of both real estate and income streams.

Why Investors Are Flocking to Fractional Property Investment

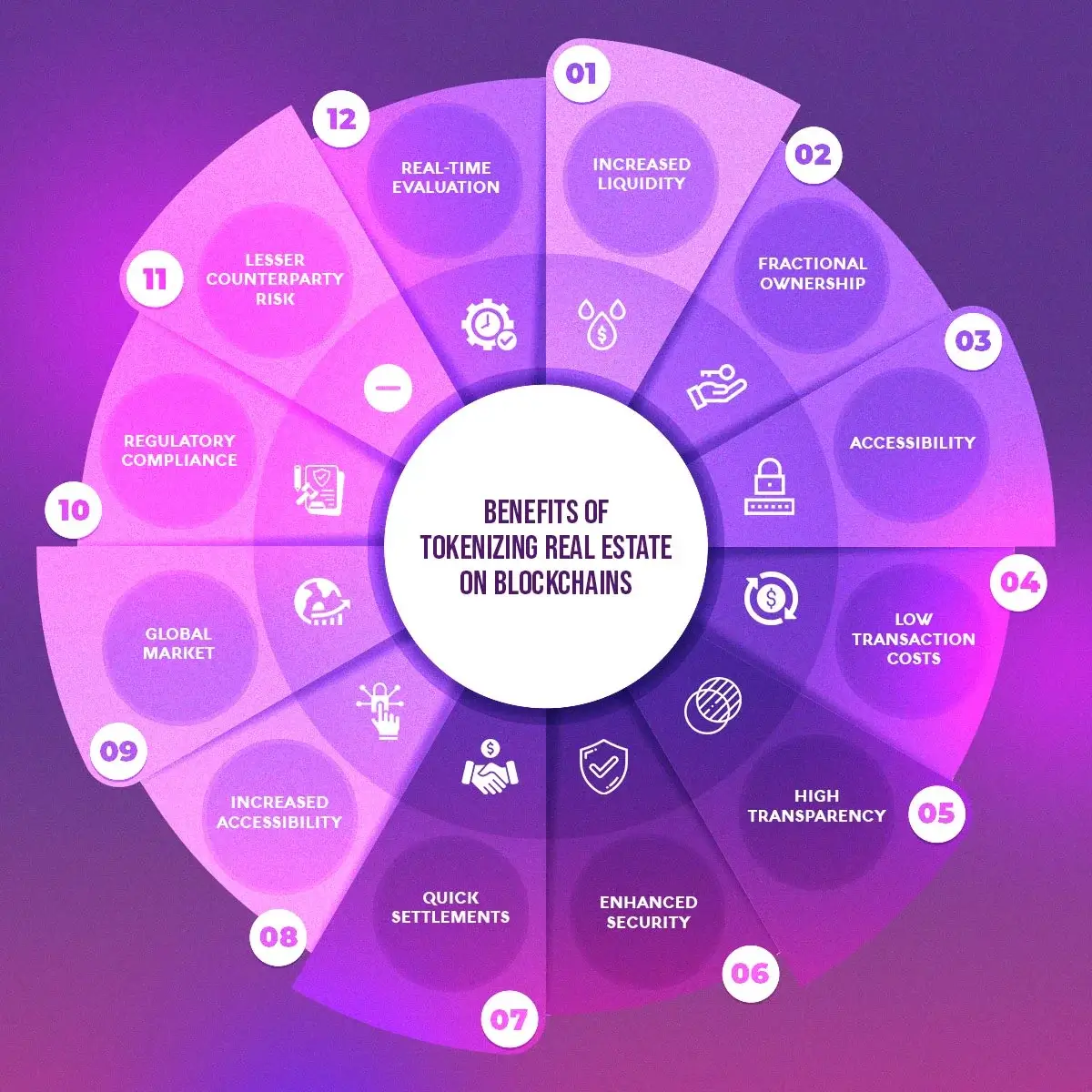

It’s not just about the tech – it’s about the benefits. Here’s why fractional property investment is gaining momentum:

- Lower Entry Barriers: With minimums as low as $50, real estate is now accessible to a wider range of investors.

- Enhanced Liquidity: Unlike traditional real estate, tokens can be traded on secondary markets, making it easier to cash out or diversify.

- Transparency and Security: Blockchain’s public ledger reduces fraud risk and ensures everyone can verify ownership and transactions.

- Automation: Smart contracts handle rental income distribution and compliance, reducing paperwork and delays.

Of course, it’s not all smooth sailing. The regulatory landscape is still evolving, and due diligence on platforms is essential. If you want a deeper dive into the mechanics and risks, see our comprehensive explainer.

As the dust settles from the initial hype, savvy investors are starting to treat on-chain real estate investing as a core portfolio strategy rather than a speculative bet. The combination of global access, real-time settlement, and programmable ownership rights is simply too compelling to ignore. Whether you’re looking to diversify beyond stocks and bonds or seeking stable, income-generating assets, property tokens offer a unique bridge between the physical and digital worlds.

Navigating the Evolving Regulatory Landscape

One of the most important considerations for anyone exploring fractional real estate ownership via blockchain is the regulatory environment. While some countries have embraced property tokens as securities, others remain cautious or lack clear guidelines entirely. This patchwork creates both opportunities and risks. For example, U. S. -based platforms like RealT operate under strict SEC compliance, while emerging hubs in Dubai and Hong Kong are experimenting with more progressive frameworks.

Investors should always check if their chosen platform adheres to local securities laws, implements robust KYC/AML processes, and provides transparent legal documentation for each tokenized asset. When in doubt, consult a legal advisor familiar with digital assets and cross-border property investment. For a detailed walk-through on regulatory best practices, visit this resource on compliance and due diligence.

What to Look for in a Tokenized Real Estate Platform

Not all tokenized real estate platforms are created equal. Here are a few key questions to ask before committing your capital:

Key Criteria for Choosing a Fractional Real Estate Platform in 2025

-

Regulatory Compliance & Legal Transparency: Ensure the platform operates within clear legal frameworks and complies with regional regulations. Look for robust KYC/AML procedures and transparent ownership structures.

-

Asset Quality & Due Diligence: Choose platforms that offer thoroughly vetted, high-quality properties and provide detailed due diligence reports. Leading platforms like RealT and Propy are known for their rigorous asset selection.

-

Liquidity & Secondary Market Access: Opt for platforms with active secondary markets so you can buy and sell property tokens easily. Platforms such as Lofty AI and RealT facilitate token trading, enhancing liquidity.

-

Minimum Investment & Accessibility: Consider the minimum entry amount—some platforms allow investments starting at just $50. This democratizes access for a broader range of investors.

-

Income Distribution & Smart Contract Automation: Look for platforms that automate rental income payouts and voting rights through smart contracts for efficiency and transparency. Lofty AI and RealT excel in this area.

-

Platform Reputation & Track Record: Prioritize platforms with a proven history, positive user reviews, and significant transaction volumes. Established names like RealT, Propy, and MANTRA are industry leaders in 2025.

-

Global Reach & Asset Diversity: Select platforms offering access to international properties and diverse asset types, such as residential, commercial, and income streams. Propy and Seazen Digital Assets Institute are expanding global options.

Look for platforms with a proven track record, clear fee structures, audited smart contracts, and accessible secondary markets. The most reputable operators also provide detailed property reports, regular income distributions, and responsive customer support.

Tip: Always verify that property tokens are backed by legally enforceable claims to the underlying asset, not just promises on a website.

The Future of Fractional Real Estate: Trends to Watch

The coming year promises even more innovation. Expect to see:

- Multi-asset portfolios: Platforms will allow investors to bundle various tokenized properties, residential, commercial, and even hospitality, into custom baskets.

- AI-powered analytics: Deeper insights into location trends, rental yields, and risk factors, helping users make smarter decisions.

- Integration with DeFi: Imagine using your property tokens as collateral for loans or yield farming directly on-chain.

- Global interoperability: Cross-border trading of property tokens will become more seamless as standards mature.

As these trends unfold, expect fractional real estate ownership to move from niche experiment to mainstream asset class, especially as traditional investors seek alternatives in a volatile global market.

If you’re ready to explore this space, start by researching reputable platforms and understanding the specific rights each token confers. For a step-by-step guide on getting started, check out our investor walkthrough.

Key Takeaways for Investors

- Accessibility: Tokenized real estate breaks down barriers for global investors with low minimums and digital onboarding.

- Liquidity: Secondary markets mean you’re not locked into decade-long holding periods.

- Transparency and security: Blockchain ledgers and smart contracts reduce fraud and automate payouts.

- Caution: Always perform due diligence, regulations and platform credibility matter more than ever in this fast-evolving space.

The bottom line? Fractional ownership through property tokens is no longer just an experiment, it’s the new reality of real estate investing in 2025. The winners will be those who stay informed, adapt quickly, and choose their platforms wisely. Ready to take your first step? The world of on-chain property investment has never been more open or more exciting.