Fractional real estate tokens are redefining property investment in the US, turning what was once an exclusive asset class into an accessible, liquid, and tech-forward opportunity. With blockchain-based platforms offering stakes in income-generating properties for as little as $50, retail investors can now tap into a market that was historically reserved for the wealthy and institutional players.

What Are Fractional Real Estate Tokens?

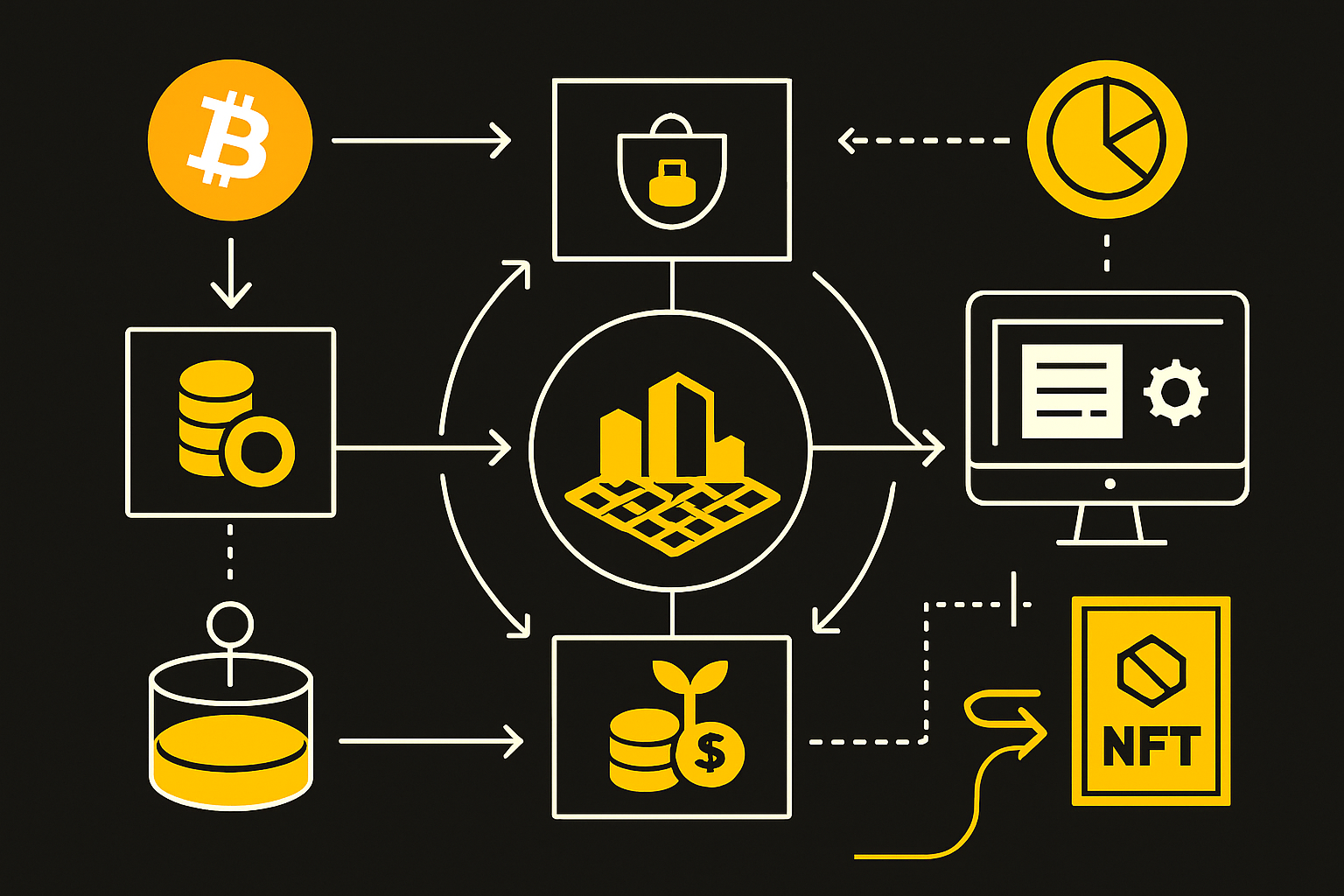

Fractional real estate tokens represent digital ownership shares in physical properties, recorded and managed on a blockchain. Each token corresponds to a fraction of the underlying real estate asset, entitling the holder to a proportional share of rental income and potential appreciation. This structure enables investors to diversify across multiple properties and markets without the hassle of direct management or the need for massive capital outlays.

Unlike traditional REITs or real estate crowdfunding, tokenized property investment offers enhanced transparency, near-instant settlement, and programmable income distribution via smart contracts. As Deloitte Insights notes, this technology empowers both individuals and institutions to create custom portfolios tailored to their risk profile and investment thesis.

Step-by-Step: How to Invest in Real Estate Tokens in the US

Getting started with fractional real estate tokens is straightforward, but success hinges on understanding the process and choosing the right platform. Here’s a strategic breakdown of the key steps:

- Understand Tokenization: Tokenization divides property ownership into blockchain-based tokens, each representing a claim on rental income and appreciation. This enables you to invest small amounts and still participate in high-value assets. For a deep dive on this foundational concept, see how tokenization lowers entry barriers.

- Choose a Platform: Leading US platforms include Lofty, RealT, OwnProp, and ProperFi. Each offers unique features, Lofty and RealT cater to both accredited and non-accredited investors with minimums as low as $50, while OwnProp focuses on iconic properties with SEC compliance.

- Verify Eligibility: Platforms may limit access based on accreditation status. For instance, OwnProp is currently for accredited investors only, while Lofty and RealT are open to all US residents.

- Create Your Account: Sign up and complete KYC (Know Your Customer) verification to comply with US regulations. This step is mandatory and helps ensure platform security.

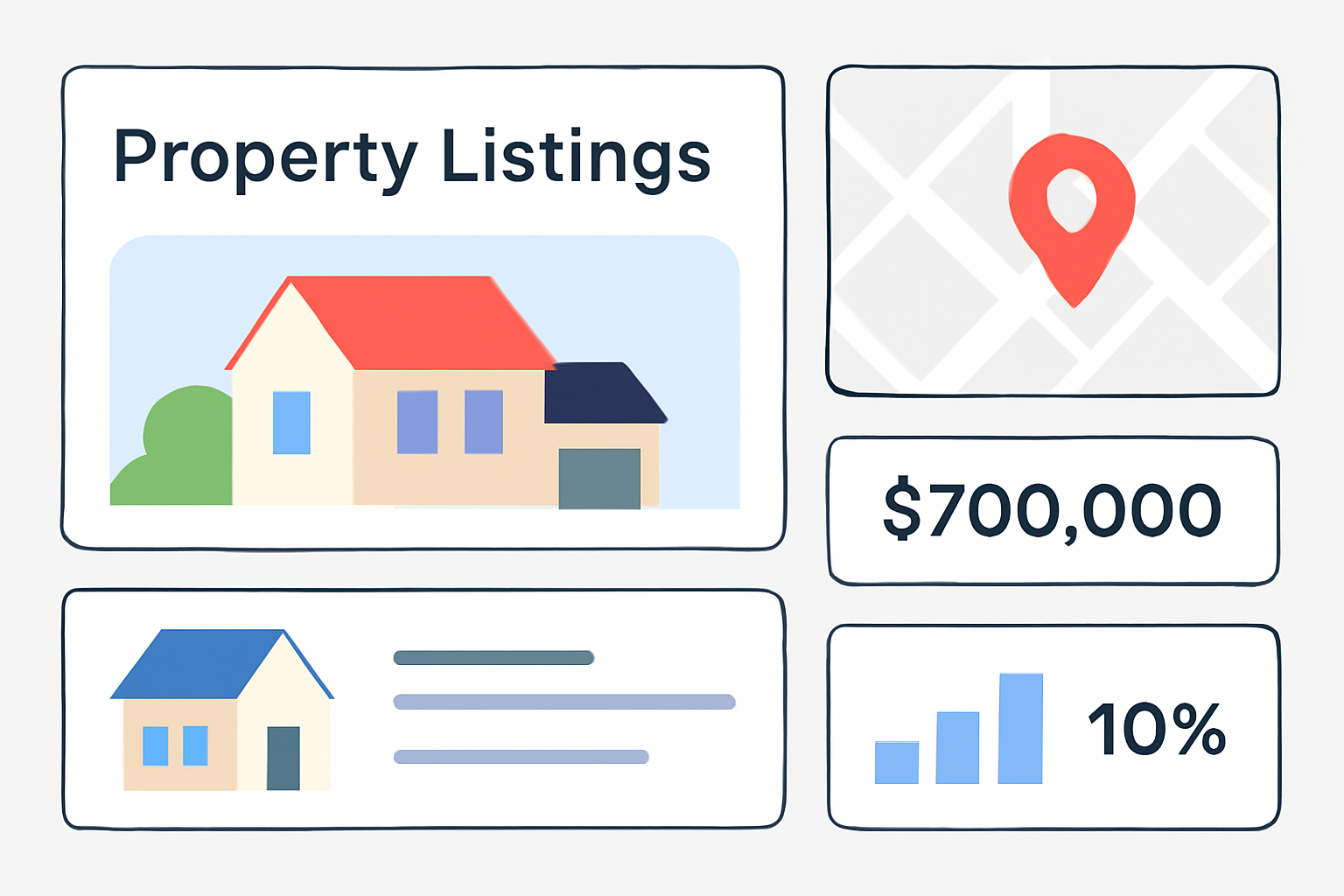

- Browse Properties: Review detailed listings with information on location, rental yield, historical performance, and risk profile. Many platforms provide projected returns and transparent fee structures.

Why Tokenized Property Investment Is Gaining Momentum

The appeal of fractional real estate tokens lies in their ability to democratize access to an asset class that is both inflation-resistant and income-generating. Investors can now build diversified portfolios across geographies and property types, all managed via intuitive dashboards. Liquidity is also improving, platforms like Lofty offer secondary marketplaces where tokens can be traded at current market prices, a major leap forward from traditional real estate’s illiquidity.

Importantly, platforms are prioritizing regulatory compliance. Both Lofty and RealT adhere to SEC guidelines, offering peace of mind for investors navigating this emerging space. As always, consider consulting a financial advisor to align your tokenized real estate strategy with your broader investment goals.

Key Platforms to Watch in 2024

- Lofty: Tokenized rental properties with daily rental payouts, minimum investment of $50, secondary market for liquidity.

- RealT: Fractional shares in US rental properties, daily income distribution, open to non-accredited investors.

- OwnProp: SEC-compliant offerings focused on landmark US properties; currently for accredited investors.

- ProperFi: Automated smart contract payouts, variable minimums, user-friendly interface.

By following these steps, you’re well-positioned to enter the world of blockchain real estate in the US, where property tokenization platforms are lowering barriers and bringing new liquidity to one of the world’s oldest asset classes.

For forward-thinking investors, the combination of fractional ownership and blockchain technology is not just a trend, it’s an evolution in how wealth is built and preserved. Tokenized property investment lets you sidestep the headaches of direct property management and unlocks diversification that was previously out of reach for most Americans. With platforms like Lofty and RealT, you can allocate as little as $50 per property, spreading risk across multiple markets and asset types.

Liquidity, Transparency, and Passive Income

One of the historic drawbacks of real estate has been its illiquidity. With fractional real estate tokens, this is changing rapidly. Secondary marketplaces on platforms such as Lofty allow investors to buy and sell property tokens at prevailing prices, offering a level of liquidity that rivals publicly traded REITs. Smart contracts ensure that rental income is distributed automatically and transparently, often daily, without manual intervention or hidden fees.

Comparison of Key Features: Lofty, RealT, OwnProp, and ProperFi (2024)

| Platform | Minimum Investment | Investor Eligibility | Rental Income Distribution | Secondary Market | SEC Compliance | Unique Features |

|---|---|---|---|---|---|---|

| Lofty | $50 | Accredited & Non-Accredited | Daily | Yes (Marketplace) | Yes | Low minimum, daily income, easy liquidity |

| RealT | $50 | Accredited & Non-Accredited | Daily | Limited (Some tokens tradable) | Yes | Wide US property selection, daily payouts |

| OwnProp | Low (varies by property) | Accredited Only | Varies (typically monthly) | Limited/No | Yes | Focus on iconic properties, SEC-registered |

| ProperFi | Varies by property | Accredited & Non-Accredited | Automated via Smart Contracts | Varies | Yes | Smart contract automation, flexible payouts |

Transparency is another major advantage. Blockchain ledgers provide immutable records of ownership, transaction history, and income distributions. This reduces the risk of disputes and increases trust between all parties. For a deeper look at how these innovations are lowering the entry barrier, visit this guide on entry barriers.

Risks and Considerations

While the upside potential is compelling, it’s essential to approach blockchain real estate US investments with a critical eye. Market volatility, regulatory changes, and platform solvency are real risks. Not all platforms offer secondary markets, and liquidity can vary depending on demand for specific property tokens. Always review a platform’s compliance credentials and fee structure, and never invest more than you can afford to lose.

“Tokenization is not just about access, it’s about control, flexibility, and transparency. But as with any innovation, due diligence remains your best defense. “

The Future of Property Tokenization Platforms

The regulatory environment is evolving, but momentum is unmistakable. As more platforms achieve SEC compliance and expand offerings, expect to see greater property variety, improved liquidity, and broader access for both accredited and non-accredited investors. This democratization is especially relevant for those seeking stable, inflation-resistant assets in uncertain markets.

Ultimately, the rise of fractional real estate tokens is a signal that the real estate market is entering a new era, one defined by digital access, transparency, and global reach. Whether you’re a seasoned investor or just starting, these platforms offer a powerful way to diversify, earn passive income, and stay ahead of the curve. For more practical tips and a beginner-friendly walkthrough, see our detailed step-by-step guide.